Spring is not around the corner. It’s more than a month away, Punxsutawney Phil predicted on Monday.

But what is going to happen to conditions in the property/casualty insurance market?

What lines will experience more softening in 2026? Are insurance prices high enough? Where will combined ratios land? Where are the best opportunities for top-line growth? Will insurers compete away personal auto insurance profits? How will insurers use AI, and how will it impact jobs in the industry?

Executives of property/casualty commercial insurance and reinsurance companies offered their prognostications to answer some of the questions during earnings conference calls in January, indicating that even though premium growth looked weaker in the fourth quarter last year, they’re taking market changes in stride. Diversified portfolios offer promise for 2026, and technology will make them more efficient, fueling more growth, they say.

Below, we share a snapshot of key financial results for P/C insurers and reinsurers that reported fourth-quarter and full-year 2025 in January to gather some more clues about what lies ahead. Separately, we have summarized the executive commentary on the most recent January conference calls—AXIS Capital, The Hartford and Selective—in these articles:

- AXIS Capital: Expanding Insurance Business, Shrinking Re Book

- The Hartford: With an AI-First Mindset, ‘Sky is the Limit’

- Selective Insurance Group: Expanding Geographies. But First, Underwriting Profit

For commentary from executives of other insurers that hosted earlier January conference calls, refer to these previously published articles:

The Early Returns

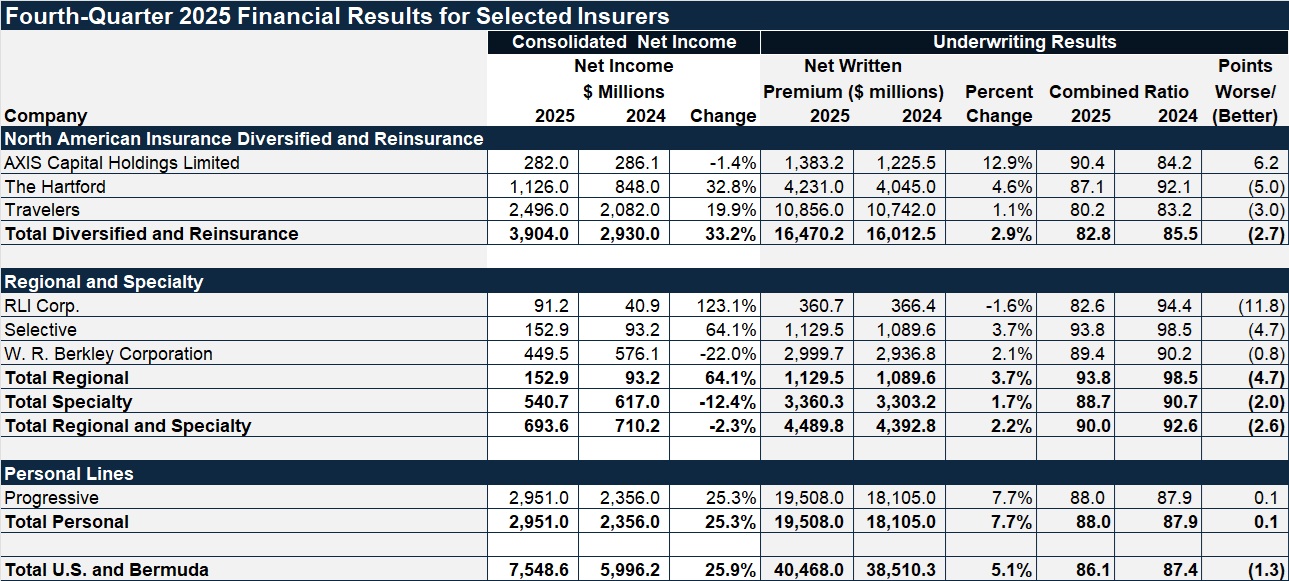

On average, the collection of seven publicly traded North American insurers that reported on last year’s earnings in January recorded 5% growth in fourth-quarter 2025 net premiums over the level reported in fourth-quarter 2024, together with just over one point of improvement in the fourth-quarter combined ratio.

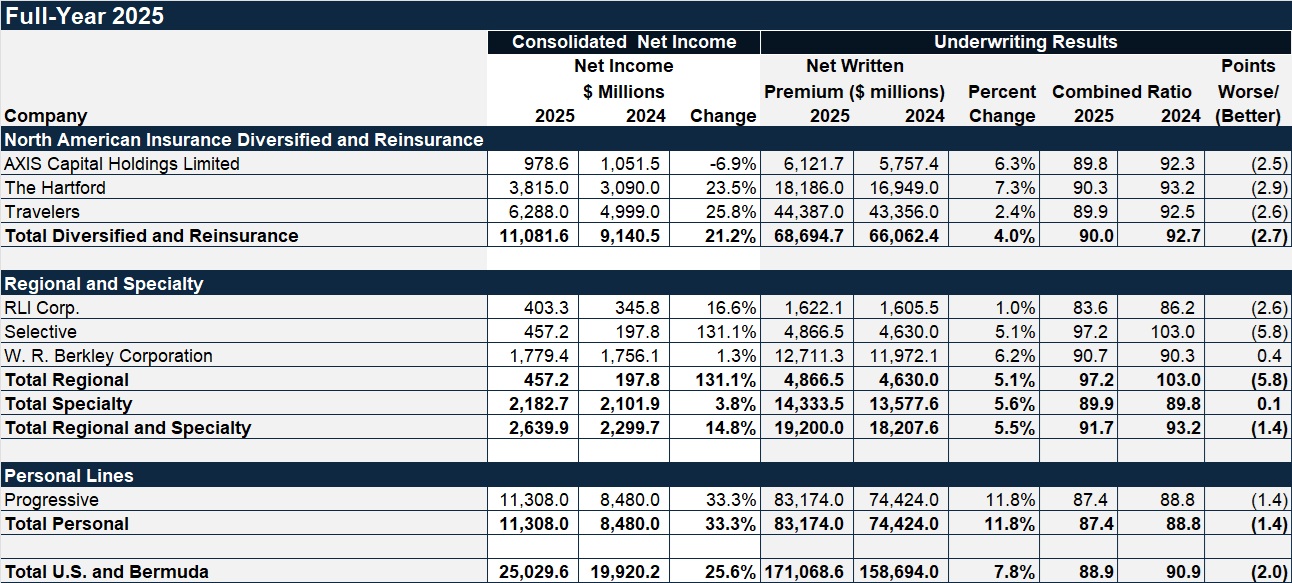

The figures for the fourth quarter were weaker than full-year results. For the year, average growth for the cohort neared 8%, and combined ratios improved two points.

In both the fourth-quarter and full-year periods, these companies all reported combined ratios below breakeven, with most below 90. The average 2025 combined ratio was roughly 89 for the seven insurers, compared to nearly 91 in 2024.

In 2024, the U.S. P/C insurance industry as a whole recorded net written premium growth of 8.7 percent and an overall average combined ratio of about 96.5, according to AM Best and Verisk.

The only carrier of the seven early reporters to record double-digit growth for the full year last year was Progressive, with the 11.8% jump in premiums coming mainly from 15% increase for personal auto rates. Progressive’s fourth-quarter 2025 premiums growth dropped to single-digits, rising 7.7% above fourth-quarter 2024 levels, and the combined ratio stayed flat about 88.0. While Progressive’s business is mainly personal lines and heavily weighted toward personal auto, other carriers with more balanced personal and commercial lines books of business and greater proportions of their personal lines books in property (Travelers and The Hartford, for example) reported slower personal lines growth than Progressive for the full year and dips in personal lines premiums for the fourth-quarter.

On the commercial lines side, year-over-year changes in fourth-quarter net premiums ranged from a 1.6% drop for specialty insurer RLI to a jump of 12.8% for AXIS Capital.

“We don’t measure success by how fast we grow,” said RLI’s Chief Executive Officer Craig Kliethermes on an earnings conference call. “We measure it by how well we grow and whether today’s decisions stand the test of time,” Kliethermes stated, noting that market conditions remain competitive in specialty insurance.

Related article: RLI Inks 30th Straight Full-Year Underwriting Profit

Speaking specifically about rate changes on renewing policies, Travelers CEO Alan Schnitzer said renewal premium change for business insurance was up 6.1% (excluding national accounts), with auto, commercial multiple peril and umbrella in double-digit territory. Separately, W. Robert Berkley Jr., CEO of W.R. Berkley, said fourth-quarter rate growth for the specialty lines his company writes (excluding workers compensation) were up just over 7% on average.

(Related articles: 20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut; We’re No Longer Pressured to Push for Rate ‘Across the Board,’ Berkley Says)

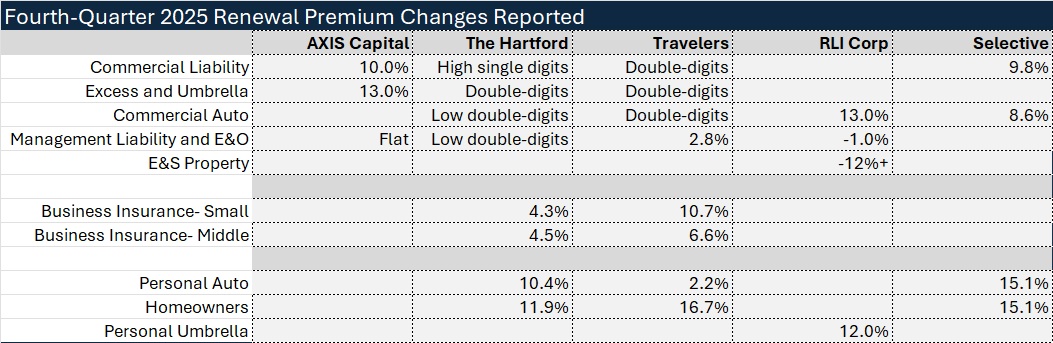

The table below captures specific renewal premium and rate changes reported by executives for individual lines and account sizes.

Reports of specific rate changes for property lines was sparse, with executives using words like “moderating” and “varied,” and generally calling out shared-and-layered large accounts as the most competitive area of the market. Only one insurer, The Hartford, was specifically asked to address the impact of Winter Storm Fern losses so far. The insurer reported less early claims activity compared to winter storms of recent years, before Verisk and KCC issued industrywide estimates of $4 billion and $6.7 billion.

Related articles: What Analysts are Saying About the 2026 P/C Insurance Market; Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Gender Balance as a Business Strategy

Gender Balance as a Business Strategy  Binding System Reviewed After Vonn’s Skis Didn’t Come Off During Olympic Crash

Binding System Reviewed After Vonn’s Skis Didn’t Come Off During Olympic Crash  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?