Looking for clues about property/casualty insurance carrier profit potential and market conditions for 2026, Carrier Management listened to earnings conference calls for six publicly traded insurers in January, gathering executive explanations about 2025 results and their expectations for the year ahead.

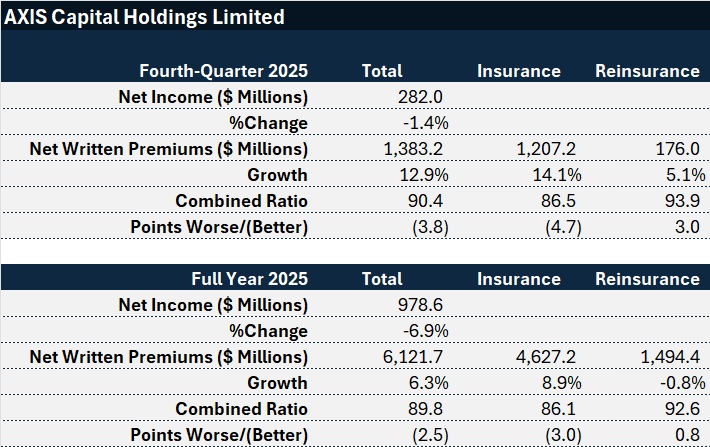

The highest growth figure reported by any of the carriers in their fourth-quarter and full-year 2025 wrap-ups was a nearly 13% jump in fourth-quarter net written premiums for AXIS Capital. The Bermuda-based insurer and reinsurer also reported 6% growth for the full year.

See related article, “Insurance Groundhogs Warming Up to Market Changes” for charts summarizing the fourth-quarter and full-year 2025 financial results of seven insurance companies that published financial results in January.

With roughly three-quarters of the book in insurance rather than reinsurance, CEO Vincent Tizzio attributed the growth to mainly to “new and expanded classes of business” during an earnings conference call. In fact, Tizzio said that nearly $150 million of added premiums in the fourth quarter came from these classes alone. (Gross insurance premiums grew by nearly $200 million in the quarter.)

“We leaned into attractive specialty markets, drove increased profitable growth that was largely propelled by our new and expanded business classes, and further enhanced our operating efficiency,” Tizzio said, summing up some contributors to 2025’s 18% operating return on equity and a combined ratio of 89.8—the lowest recorded for the company since 2010.

“Our growth has been bolstered by our highly premium-adequate, lower middle market units, both in the U.S. and U.K.”

Vincent Tizzio, AXIS Capital

Looking ahead, retiring Chief Financial Officer Peter Vogt said AXIS expects mid‑ to high‑single‑digit insurance growth in 2026. On the other hand, “our overall reinsurance gross premiums could be down in 2026, even up to double digits,” he said, referring to forecasts for a liability and specialty-focused reinsurance business in a competitive market.

“We maintain a cautious and highly selective stance in professional and liability, and our caution has only escalated, reflecting our view of a misalignment of risk and reward,” Tizzio said, referring to increasingly challenging reinsurance market conditions for bottom-line focused company.

While stressing the underwriting discipline being maintained in the insurance businesses, the executives explained insurance growth with reference to contributions from units of the company dedicated to lower middle market accounts—in particular, property insurance growth for middle market business—and the launch of AXIS Capacity Solutions, a third-party capital unit, last year. The ACS unit is “dedicated to developing and supporting structured and multi-line portfolio capacity deals on both a facilitated and delegated basis,” according to an announcement last year.

A culture of “strong cycle management” continues, Tizzio said, referencing actions to cut back on some primary casualty, cyber and public D&O writings at AXIS in recent years.

He reported varying market conditions across the lines of business in which AXIS participates today.

- Liability rates were up 10% in the fourth quarter, and AXIS grew liability premiums 6%.

- In U.S. excess casualty, AXIS generated a 13% rate increase and 4% growth.

- AXIS grew its property book by 12% across eight underwriting units worldwide, experiencing different degrees of competitive pressure. “Our growth has been bolstered by our highly premium-adequate lower middle market units, both in the U.S. and U.K., as well as by taking advantage of the innovation we’ve brought to the market through ACS,” Tizzio said.

- In professional lines, AXIS grew 19% although rates were flat, Tizzio said, explaining that the high rate of growth was attributable to transactional liability and new and expanded E&O lines, including allied health, miscellaneous E&O, and enhancements to a design professionals offering.

- Without revealing a number, Tizzio reported “solid growth” in the private D&O business.

- “We… do not see cyber as a growth area for the foreseeable future unless a better risk-reward outcome is realized,” he said. Increasing ransomware attacks and an environment that is being “made worse by the potential of AI enabling more effective and sophisticated ransomware threats,” as well as “increasing competition from MGAs [that are] placing downward pressure on [cyber] price adequacy,” are other factors driving caution.

Another talking point during this quarter’s early conference calls was the impact of technology on insurance companies and how investments in technology would impact expense ratios and growth. At AXIS, Tizzio referenced a “How We Work” transformation program in his opening remarks, along with increased investments earmarked for scaling new and expanded lines and “integrating a new AI-enabled front end.”

Vogt said that investments in technology and operations, as well as in hiring teams, increased in the fourth quarter and that “variable compensation for a very successful year in insurance” pushed the company expense ratio up a point (to 33.4). “Our investments in operations have significantly reduced submission, quoting, and ingestion times, particularly as we employ AI tools, and we are still at the early days of implementation,” he said.

Tizzio suggested that more investments in talent will be part of AXIS’s 2026 story, responding to an analyst’s question about the prospect of “opportunistic hiring.”

“We want to reserve the right to remain very strategic in how we go about hiring teams. We have some scheduled for the 2026 year. I don’t really want to reveal how many or in what lines of business. But suffice to say, my business leaders are certainly active,” he said.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict  Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says

Hackers Used AI to Breach 600 Firewalls in Weeks, Amazon Says