What if your car insurance reflected how you actually drive, not just who you are?

That question is no longer hypothetical.

In 2024, more than 21 million U.S. policyholders shared telematics data with their insurer, according to IoT Insurance Observatory research. That’s a 28% compound annual growth rate since 2018. Usage-based insurance (UBI) is no longer a niche; it’s a mainstream strategy reshaping our industry.

For years, competitive pricing drove adoption. But today, something deeper is at play: trust and perceived value are fueling the next wave of growth. This isn’t just about saving money; it’s about believing the insurer will use sensitive driving data responsibly and deliver tangible benefits in return.

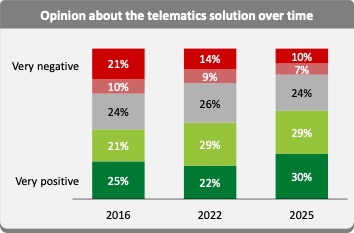

According to a recent consumer survey by Arity and the IoT Insurance Observatory, sampling 2,059 personal auto policyholders representative of the U.S. market, 82% of policyholders would recommend a telematics app that rewards safe driving, offers feedback, provides crash assistance and delivers other valued services. Among drivers under the age of 53, that number exceeds 90%. Positive sentiment toward telematics has steadily increased over the past decade, as shown in the chart above.

Related article: Consumer Acceptance of Telematics Widens, Says Survey

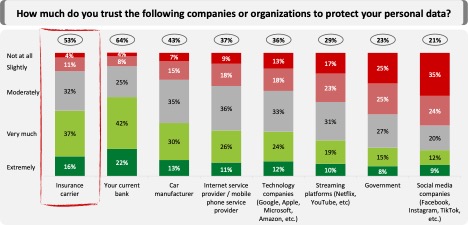

Trust isn’t a buzzword here. It’s the foundation of adoption. Consumers share data only when they believe insurers will protect it and use it to create real value. In fact, 53% of respondents expressed high trust in insurers’ handling of personal data, ranking insurers second only to banks. That trust translates into action: willingness to switch plans, share driving scores and pay for connected services.

The willingness to adopt UBI is strong: 60% of policyholders are open to switching, rising to 72% among younger drivers. This level is consistent with the evidence from recent TransUnion surveys showing that 60% of people reported being offered telematics opted-in.

When consumers see clear benefits, privacy concerns fade. They want pricing that reflects lifestyle, rewards for safe driving and features like automatic crash assistance. Three-fourths are open to sharing their driving score for a personalized quote. More than half of those willing to switch prefer pricing models that offer bigger potential savings, even if it means some risk a surcharge.

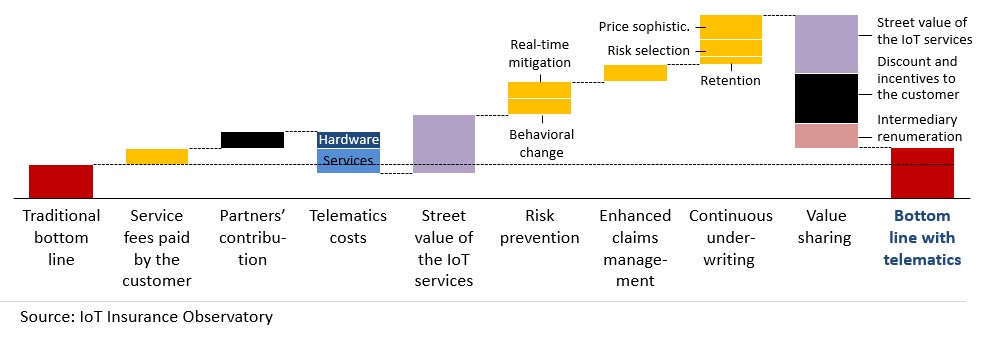

This is where telematics shines. Insurers can deliver compelling offers because telematics unlocks incremental economic value by sensing events; transmitting data in real time; and applying AI-driven analytics to understand, decide and act. This enables smarter underwriting, faster claims processing and more proactive risk management. By sharing part of this value with policyholders, insurers create a win-win scenario that makes UBI not just viable but mainstream.

Over the past decade, insurers have proven the power of telematics data to transform core functions:

- Continuous Underwriting. Telematics data enables more accurate risk assessments and selection, allowing insurers to better match rates to actual risks. This leads to more sophisticated pricing, improved retention and effective acquisition of good risks, and reduced premium leakage from riskier drivers. Insurers can also use telematics-based data to make portfolio-level decisions regarding risk appetite and reinsurance.

- Enhanced Claims Management. Real-time crash detection is a game changer for claims management. Insurers can trigger proactive responses, notify emergency services and initiate the claims process. Insights about crash events support timely claim handling and help minimize potential fraudulent or inflated requests.

- Connect and Protect. International telematics-based experiences demonstrate effectiveness in mitigating risks by identifying risky situations in real time and intervening before accidents occur. Behavioral change programs promote safer driving, leading to fewer accidents and lower loss ratios.

Policyholders are willing to reconsider their insurer when pricing reflects how they actually drive and live—more than half of policyholders would switch for a product with the premium defined by telematics data.

Consumers aren’t just looking for lower premiums; they want features that matter. Rewards for safe driving and automatic emergency assistance in severe crashes rank among the top preferences across all generations—from Gen Z to Traditionalists. And the appetite for innovation doesn’t stop there. More than half of policyholders would pay $4.99 per month for a connected dashcam service that offers emergency assistance, video recording for protection against unfair complaints and real-time safety feedback.

The impact goes beyond individual policies. When the usage of telematics data is holistically adopted across the entire insurance organization, this improves pricing accuracy, reduces losses and makes insurance more affordable, all while promoting safer roads. Fewer accidents mean fewer injuries and lives saved. That’s why telematics is more than a business strategy. It’s a social good.

The time to invest in telematics mastery is now. Insurers who fully embrace the connected paradigm in all their core processes and responsibly use data with customer consent can unlock greater value—delivering fairer pricing, personalized experiences and safer roads. This broader usage of data enables higher value creation and sharing, benefiting policyholders and society as a whole.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance  Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?