Days after announcing a deal to equip 10,000 engineers and data scientists at Travelers with AI assistants, the insurance company’s leader detailed “differentiating domain expertise” around data and technology, which fuel long-term profit growth for the insurer.

Travelers Chief Executive Officer Alan Schnitzer told investment analysts that more than 20,000 Travelers professionals already “use AI tools on a regular basis” during a fourth-quarter 2025 earnings conference call. He also said that the company’s claims call centers are getting leaner with automation tools providing an efficiency boost.

After he summarized drivers of 20% growth in fourth-quarter net income and 26% jump for the full year, and before referencing the new partnership with Anthropic to bring 10,000 personalized AI agents onboard to expand the carrier’s AI-enabled engineering and analytics capabilities, Schnitzer offered an overview of a decade of profit gains fueled by a technology and innovation strategy.

Among other things, Schnitzer said that net written premiums grew nearly 7 percent per year, on average, between 2016 and 2025, while the underlying combined ratio (excluding catastrophe losses and prior-year development) dropped nearly 8 points to 83.9.

“Notwithstanding a significant increase in our technology spending, that improvement in underlying profitability includes a 3-point or 10% improvement in our expense ratio,” he said, later revealing that actual investment dollars for AI and other tech initiatives totaling $1.5 billion. A slide displayed as he spoke indicated that the expense ratio dropped three points—to 28.5 in 2025, compared to 31.5 in 2016—in spite of the investments.

“As a consequence of all that, compared to 10 years ago, our underlying underwriting income is more than 4-times what it had been,” he stated.

“Over the decade, we developed the competitive advantage of an innovation skill set. Now we’re bringing all that Part 1 know-how to Innovation 2.0 at Travelers, powered by AI—and not too far off quantum computing.”

Alan Schnitzer

Offering a particular example of efficiencies gained through automation, Schnitzer said that Travelers “claim call center population is down by a third,” adding that the company will also be consolidating four claim call centers down to two this year.

“It’s worth pointing out that the efficiency gains in our claim organization come through loss adjustment expense, benefiting the loss ratio,” he stated, noting that the Travelers claims organization has benefited from investments in automation, straight-through processing and analytics that “refine indemnity payouts and drive operational efficiencies.”

Schnitzer reported that more than half of all claims to Travelers are now eligible for straight-through processing, and that customers actually adopt straight-through processing about two-thirds of the time.

“Another 15% of all claims are processed with advanced digital tools. All of those percentages are growing,” he said.

The Travelers CEO did note, however, that there are customers who still want to call Travelers to report their claims. To accommodate them, Travelers launched a natural language generative AI voice agent that takes first notice of loss by phone just last week. “Early customer adoption is exceeding our expectation,” he stated.

At one point, Schnitzer noted that Travelers handled 1.5 million claims in 2025—”about one every 20 seconds”—making claim payments of more than $23 billion while meeting a goal of closing 90% of catastrophe claims within 30 days.

Schnitzer stressed that potential automation and AI benefits extend beyond claims call centers. “Other use cases enhance underwriting decision quality and efficiency and improve the experience for customers, agents, brokers and employees,” he said.

Individually, Greg Toczydlowski, Jeffrey Klenk, and Michael Klein, the presidents of Travelers Business Insurance, Bond & Specialty Insurance and Personal Insurance gave examples related to their businesses later on the call.

Toczydlowski talked about gen AI agents that were recently rolled out “to efficiently mine” data sources—internal and external—to ensure appropriate business classifications are assigned to risks and “to better understand and synthesize the risk characteristics.” He said that this accelerates the underwriting process and results in improved segmented pricing.

In personal insurance, Klein said AI is leveraged to make renewal underwriting “more effective and efficient.”

“We start with a proprietary AI-enabled predictive model that scores every account in the property portfolio. Based on this score, accounts with the highest probable risk of loss are presented to underwriters for review. From there, our renewal underwriting platform leverages generative AI to consolidate data into summaries of relevant actionable information for our underwriters to evaluate.”

According to Klein, there’s a 30% reduction “in average handle time,” based on early results.

“The net result is that our underwriters focus their efforts on decisions most likely to improve profitability and do so more efficiently,” he said.

For specialty insurance, Klenk talked about AI investments for automating new business intake, suggesting that AI reduced time to ingest submissions “from hours to just minutes,” and stating that the AI capabilities were recently extended to renewals.

Innovation 2.0

Toczydlowski said commercial underwriters’ “execution excellence” is complemented by decision-support tools they have at their disposal at point of sale—models of risk characteristics, and tools that refine technical pricing and summarize historical modeled loss experience results, resulting in better risk selection, pricing and terms.

“They’re not only executing with excellence in the market today, but they’re also helping to shape the transformation of our industry,” he said.

During the question-and-answer session of the call, an analyst asked Schnitzer to estimate how much the Travelers workforce might grow or shrink as AI initiatives move forward.

“We gave you an example of narrow view of that in our claim organization in our call centers. We’re not going to get into projecting headcount beyond that,” Schnitzer replied. “But what I would say is that premium per employee is up, thanks to some productivity and efficiency initiatives, and we expect premium per employee to continue to go up.”

Related article: Expense Ratio Analysis: AI, Remote Work Drive Better P/C Insurer Results

During his discussion of the 10-year profit strides, Schnitzer attributed the gains to an “Innovation 1.0” strategy.

Summing up the strategy, he said Travelers did “three difficult things very well,

- Identifying initiatives that really matter, while passing on the merely good ideas that don’t

- Executing effectively

- And capturing the value of what we built.

“Over the decade, we developed the competitive advantage of an innovation skill set. Now we’re bringing all that Part 1 know-how to Innovation 2.0 at Travelers, powered by AI—and not too far off quantum computing.”

He said that the P/C industry as a whole stands to benefit from AI—pointing to the fact that the latest generation of AI tools can “understand and execute on the complex stakeholder interactions, well-defined processes, data-intensive workflows and massive amounts of unstructured data”—all of which characterize the industry.

But Travelers, he said, “is particularly well positioned.”

“As an industry leader, we bring differentiating domain expertise. Because AI amplifies existing strength, leaders in the domain are best positioned to use it to drive improvement,” he said, also highlighting Traveler “high-quality data” amassed over decades, and Travelers scale advantage, allowing the company to make significant investments in AI and technology, as both continue to segment the market.

“As an industry leader, we bring differentiating domain expertise. Because AI amplifies existing strength, leaders in the domain are best positioned to use it to drive improvement,” Schnitzer said.

“We have thousands of engineers, data scientists and analysts building AI and other sophisticated technology solutions. Dozens of scaled generative AI tools are already in production. Millions of transactions are now automated….And agentic AI isn’t a future aspiration. It’s embedded in our business operations today,” he stated, going on to talk about last week’s joint announcement with Anthropic.

“In extensive testing, we achieved significantly improved engineering output and meaningful productivity gains,” he said, discussing the Anthropic partnership.” We expect that this will result in faster and more cost-effective delivery of new capabilities across Travelers—everything from product development to new business prospecting to underwriting speed and quality, agent and customer service and more—benefiting our business, our customers and our distribution partners.”

Property Drags Down Growth

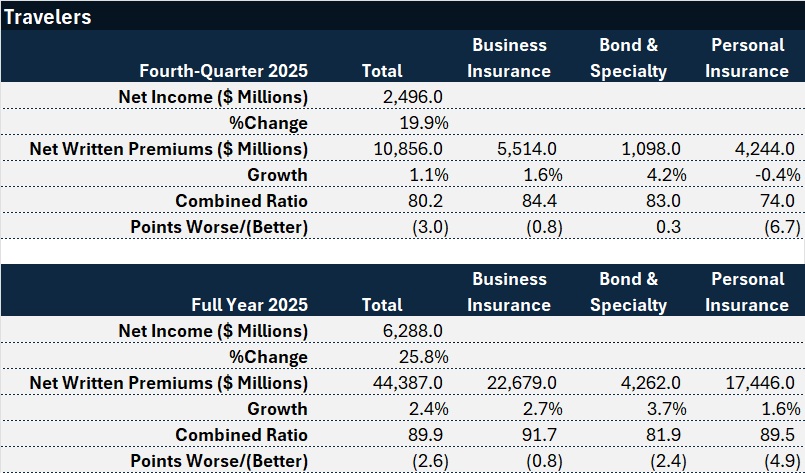

The main focus of the call was discussing Travelers performance in the fourth quarter and for all of last year. Executives pointed to the contributions of increased underlying underwriting income, higher favorable prior year reserve development and a lower level of catastrophe losses for the fourth quarter, along with growth in net investment income to the bottom line.

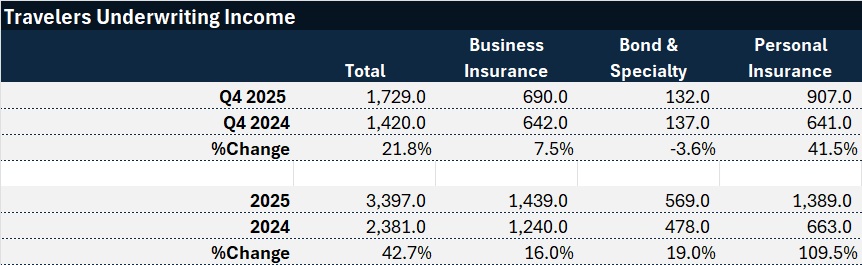

- After-tax underwriting income jumped 22% in the fourth quarter to $1.7 billion and more than 40% for the year to $3.4 billion. Personal insurance was a major contributor, with underwriting profit more than doubling in the segment last year.

- Favorable prior-year development across all segments was $815 million for year, shaving 2.4 points off the reported full-year 2025 combined ratio of 80.2.

- Catastrophe losses were lower in the fourth-quarter of 2025 than in fourth-quarter 2024 but rose for the full year compared to the prior year.

- Net investment income grew 10% for both the last quarter and the full year.

In each of the underwriting segments, the top-line grew by single-digits in year over year comparisons for the fourth-quarter and the full-year, with personal insurance actually showing a slight net premium decline in the fourth quarter. (Premium growth by segment is displayed on the top chart of this article.)

Still, Schnitzer noted that the $4.2 billion of personal insurance net written premiums booked in the quarter reflected continued strong renewal premium change in homeowners and higher new business in auto.

Presentation slides that accompanied the earnings webinar showed that renewal premium change was 16.7 percent for homeowners in the fourth quarter, while the comparable figure for personal auto was 2.2 percent. While Travelers booked $310 million of new business premium for auto, inforce policy counts at the end of the fourth quarter were down 3 percent for auto and 6 percent for homeowners, year-over-year.

The personal auto combined ratio dropped nearly 5 points in fourth-quarter 2025 to 89.4, compared to 94.2 in fourth-quarter 2024. A homeowners combined ratio of 60.0 for fourth-quarter 2025, brought the overall personal lines combined ratio to 74.0.

For the year, Travelers personal auto combined ratio showed 9.3 points of improvement, landing at 85.7. Homeowners improved 6.0 points to 67.6.

Klein said the personal lines results reflect the benefits of having a diversified book of business and a disciplined approach on pricing and risk selection. Referring to the drops in quarterly new business premium and policies in force for homeowners, he said Travelers made “deliberate choices” to improve profitability and manage volatility in property.

“Over the past few years, we’ve executed a granular strategy to reposition our portfolio to optimize our risk-return profile. The results have been meaningful,” he said, pointing to a double-digit drop in policies in force in recent years—mostly in high-catastrophe geographies. “While these actions impacted auto policies in force, the impact was muted as we grew auto in many of the markets less affected by our property actions,” he stated.

Klein went on to say that in 2026, Travelers will wind down many prior restrictive homeowners actions and focus on maintaining progress made to date “by deploying property capacity in support of writing package business.”

Asked by an analyst to clarify whether this meant that Travelers will now grow in cat-prone states to support personal lines growth overall, Klein said “maintaining the progress that we’ve made implies that certainly, at most, we would grow cat prone states in line with the rest of the portfolio. But we do still have some spots where we’ll be constrained.” As a result, in force policy growth in property will continue to lag auto policy growth, he said. “But the growth trajectories of both lines should improve.”

Another analyst asked about the regulatory landscape, and potential pushback on actions intended to fuel continued profits for insurers.

“We certainly understand the affordability issue, and I think it’s an important one for all of us to be focused on. And we are focused on it,” Schnitzer said, going on to note that the underwriting profits that Travelers booked in 2024 and 2025 were preceded by two years of combined ratios over 100. “And if you look at the last 5 years, it was 98, I think. So that would be below our target returns,” he said.

“This really is a business that you need to look at and manage over a period of time,” he said, stressing that Travelers has not be “over-earning” in the personal insurance business over longer periods. “We are trying to get the right price on the risk and earn a fair return,” he said.

Another talking point on the call was the impact of property price softening on the Business Insurance segment, which showed 1.6% premium growth for fourth-quarter 2025, compared to the same quarter in 2024. Excluding the property line, commercial insurance premiums grew 4%, Schnitzer reported.

“Declining property premium is a large- account dynamic,” he said, reiterating an observation he shared on the third-quarter earnings call. A presentation slide accompanying his commentary showed commercial insurance premiums for national accounts declining 2% overall, while Select (small) and Middle Market account premiums grew 4% and 3%, respectively.

Excluding National Accounts, Travelers said renewal premium change for Business Insurance was up 6.1%, with auto, commercial multiple peril and umbrella in double-digits territory.

Another notable development reported by management during the earnings call was the renewal of its property-catastrophe excess-of-loss reinsurance program at Jan. 1, with a lower attachment point—$3 billion vs. $4 billion previously.

During the Q&A, Chief Financial Officer Dan Frey responded to a question about loss reserves for casualty business, confirming that IBNR for the 2025 accident year includes a provision for uncertainty, something he believes will be continued later this year for accident-year 2026.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End  AI-Generated Job Ads Discriminated Against U.S. Workers, Says Civil Rights Unit

AI-Generated Job Ads Discriminated Against U.S. Workers, Says Civil Rights Unit  Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict

Jury Orders PacifiCorp to Pay $305M in Latest Oregon Wildfire Class Action Verdict