W.R Berkley reported a “flattish” top line but nearly 15% growth in underwriting income for fourth-quarter 2025 this week. The chief executive also signaled a change in the level of rate increases going forward.

Providing commentary on market conditions and company results during an earnings conference call, President and CEO W. Robert Berkley, Jr. said that while it may be early to make a definitive call, some recent prior years seem to be “developing out” favorably. In reaction to this, the company is not reducing prior-year loss picks, he said. But he also said, “We are not feeling, across the board, the same level of pressure to keep pushing on rate.”

Although the leader of the specialty insurer and reinsurer opened the call with some intriguing comments about the use of AI, about distributors competing with carriers, and about evolving customer priorities, most analysts questioning Berkley later in the call focused on that one particular utterance about rate need.

Responding to the analysts, Berkley called out areas where his company has continued to reduce exposures, such as commercial auto. Still, the analysts did not get a lot of clarification about which lines have returns that are adequate enough to warrant less aggressive 2026 pricing in Berkley’s view, although at some points Berkley did suggest that other liability business and small-account property where areas of opportunity for the company.

What Berkley Said About Rate Need

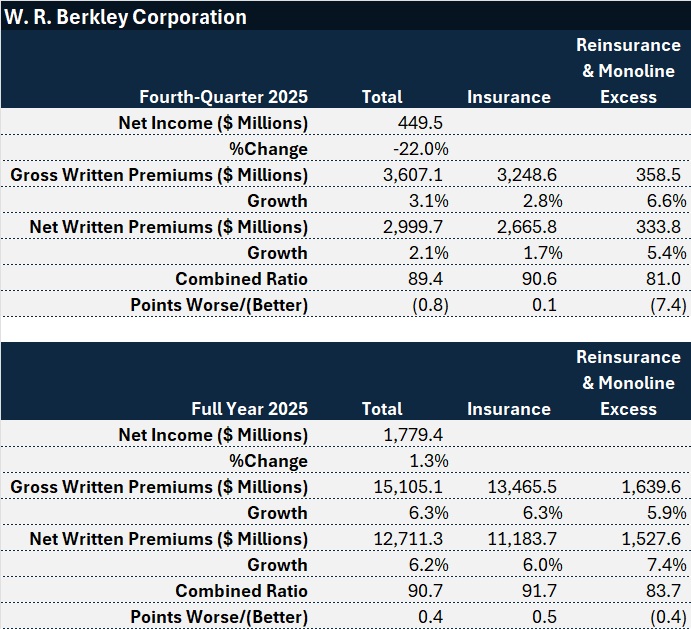

Berkley teed up the conversation about rate need by first suggesting that analysts shouldn’t read too much into the fact that his company’s fourth-quarter 2025 gross written premiums only grew 3% over fourth-quarter 2024, and net premiums only 2 %.

While he said that October and November growth figures “were particularly disappointing—I would call it flattish,” he reported that gross premiums for December rose 7%, without giving a segment or line of business breakdown for the month.

“I would caution people not to leap to the conclusion that what you saw for the [entire] quarter is the new reality. I think it’s quite the contrary in all likelihood,” he said, noting that midway through January, the company is “seeing some encouraging signs as relates to the top line.”

Turning to rate-specific comments, Berkley said rate growth for line other than the workers compensation line was just over 7%.

“Given what we’re seeing in some of the more recent years, granted it’s early, but how they seem to be developing out, we are not feeling, across the board, the same level of pressure to keep pushing on rate,” he said, stressing, however, that underwriters will “continue to be diligent….”

“We will continue to stay on top of it. We are not interested in our margins eroding, but we think that we’re in a pretty good place,” he said.

Why not read too much into October and November numbers? Is competition less now than in those two months? Or does W.R. Berkley just have a bigger appetite to go after more premiums, one analyst asked.

Berkley reiterated that two months don’t provide a clear picture, and that the four months through January reveal more top-line growth. In addition, he said, “There are certain pockets of our portfolio, certain parts of the market where given the early returns on the [loss] reserves, we are thinking that [this] is a more comfortable place than we appreciated,” he added.

Another analyst asked whether full-year premium growth, which came in at 6 percent for 2025, could move higher or to double-digits in 2026. While Berkley declined to offer forward-looking projections, he said, “I think the insurance business, both excess and primary, should have an opportunity to grow more than what you saw us do in the quarter.” In contrast, in reinsurance, “while we remain optimistic, we are even more so disciplined. And we can’t control the market, [which] seems to be becoming more challenging more quickly.”

Posing another question about Berkley’s rate need remark, an analyst asked if loss trend is starting to moderate, reasoning that this could explain how the insurer could back off on rate hikes but maintain profit margins.

“It’s premature to reach any conclusions with confidence, but some of the activity that we are seeing—or lack of activity in some of the more recent years—would suggest that we’re in a comfortable place,” Berkley responded. “Trend is a moving target. So, I don’t think it’s that we take our foot off the pedal, but maybe the foot doesn’t have to be stepping down on the pedal quite as hard, selectively….”

“We are looking to preserve our margins to the best of our ability as long as the market will allow us to. And right now, we think we can do that—certainly, more easily in the insurance business. I think the reinsurance marketplace is probably going to become more challenged more quickly, generally.”

“I don’t think it’s that we take our foot off the pedal, but maybe the foot doesn’t have to be stepping down on the pedal quite as hard, selectively….” — W. Robert Berkley Jr.

Responding to another analyst who asked about lines where Berkley plans to cut exposures, Berkley called out auto liability as an area where the company is shrinking business. He added that the company has concerns about some professional liability lines—D&O and architects and engineers—but that W.R. Berkley doesn’t write enough of that to move the needle on growth.

A big trouble spot in the market is large account shared-and-layered business, he said, at one point calling on the Lloyd’s market as a hot spot for a “feeding frenzy” on this business.

Related article: Rotting Apple: Berkley Explains Property Market, Company Appetite

Overall, he said, that “different product lines are in different places, and you need to use a pretty fine brush” to separate those with a green light—where “it would be advisable to try and lean in more”—from those flashing amber or red. Judgment calls are made every day, he said, adding that characteristics, such as length of incurred tail that can make the process much more complicated.

Related article: RLI Inks 30th Straight Full-Year Underwriting Profit

Restating his point about rate need differently to an analyst asking about loss reserve analysis, he said, “”[T]here are certain early indications that in some of the more recent years, that even the lines that have some tail to it, it would seem as though the underwriting actions and [prior] rate actions are having the impact-plus that we had hoped for.”

A final questioner, who asked specifically whether pricing for other liability accelerated in the fourth quarter, got a gentle pushback from Berkley who said he doesn’t generally provide that kind of detail by product line. “But as we suggested earlier, on the liability side, we are feeling comfortable about where things are and how we see the market opportunity at least at this moment.”

As for property, he said, large-account business is not a big part of what the company writes. “On the smaller property accounts, quite frankly, we’re still seeing opportunity there,” the CEO said.

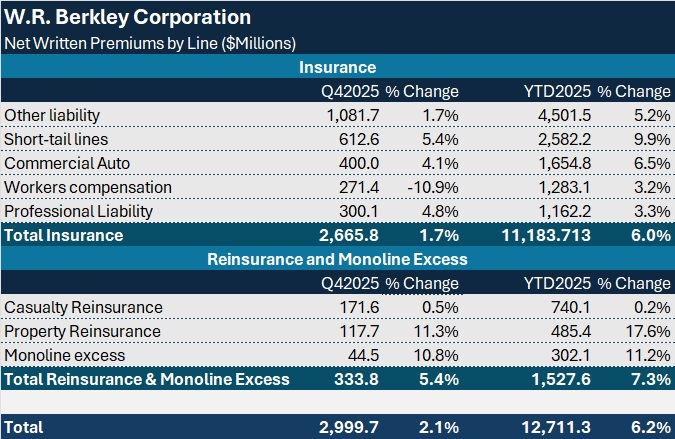

The W.R. Berkley earnings announcement included a line-by-line breakdown of the fourth-quarter and full-year 2025 net written premiums, summarized below.

Only one line showed a fourth-quarter drop in premiums, workers compensation, which executives attributed a timing issue.

Only one line showed a fourth-quarter drop in premiums, workers compensation, which executives attributed a timing issue.

Casualty reinsurance and primary other liability had little fourth-quarter growth, while property reinsurance and monoline excess grew by double digits.

Berkley attributed the 5 percent growth in short-tail insurance lines to accident and health business and the carrier’s BerkleyOne private-client operation.

During the earnings call, Berkley noted that from a reinsurance buyer’s perspective, his company’s property reinsurance treaty renewed with a risk-adjusted rate decrease of 19%, giving an indication of the competitiveness of the reinsurance market and adding that there are early signs of spillover into casualty reinsurance. He suggested that reinsurers who are struggling to achieve property premium targets “are trying to lean into the casualty to hit their top lines.”

“The big difference is the property-cat market had a bounce a couple of years ago. So, they are starting from a different altitude. Casualty never really had that bounce,” he observed.

AI, Distributors and Customers

Berkley opened the call with observations about artificial intelligence, insurance distributors and customers.

On AI, he commented that while there is a lot of current discussion around how the industry will adopt AI tools and what it will mean from an operational perspective, insurers should also be grappling with underwriting questions: “How do we think about these new technologies and the impact they’re having on society, the impact that they’re having on our insureds, what it means for risk and our ability to fully understand that risk so we can control it, select it and price for it.”

He went on to the other topics, noting that customer priorities are changing and that “the relationship between traditional distribution and carriers is without a doubt evolving.”

“Once upon a time, it was a very simple, straightforward relationship. One was the factory. The other was the distributor. But today, traditional distribution oftentimes is not just a partner, but is actually a competitor,” Berkley commented.

As for customers, they “are much more comfortable with a self-serve model. And it is becoming increasingly clear that convenience is more important to many customers than price,” he stated.

“Please do not misunderstand my comments. We are very committed to our partners. At the same time, it is not lost on us that the customer is queen or king and that we, as an organization, are going to do what we need to do to meet them where, when, and how they wish to be met.”

Setting aside Berkley’s bigger questions about underwriting in a world impacted by AI, analysts asked about the insurance company’s technology and AI investments, the expense ratio impacts and projected returns on investments in the next two years.

“We are going to be making meaningful investments in ’26, and I expect we will continue to make meaningful investments in ’27 ….It’s not a one and done,” he said.

“I would like to think that we’re going to start to see benefits certainly in ’27. And I think it will scale from there,” he said, tackling the ROI question. “But it’s certainly does take some time,” he said.

Related article: 20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

Asked to identify the specific capabilities that AI can tackle in the near term, Berkley said that “what is here and now and happening” on the underwriting side is the use of technology to dramatically increase intake efficiency. “We are able to get to more business, [and] prioritize. Said differently, people’s time is utilized much more effectively.”

As for the distribution commentary, Berkley said that an interpretation offered by one analyst—that the specialty insurer might now lean into using or buying managing general agents—was incorrect. “We have a real caution around delegated authority,” he said, referencing comments he has made on prior earnings calls.

We’re pleased to continue to partner with traditional distribution. But I think the point is it’s not lost on us that some of the traditional distribution is looking to have the pen or, in some ways, have a different relationship with capital. We’re aware of that. We are responding to it. And it also means that we’re thinking about distribution maybe a little bit in a way that we wouldn’t have thought about it five years ago,” he said, without elaborating.

What about doing more direct-to-consumer or direct-to-business online distribution? Is that in the cards, asked an analyst, who referenced the leader’s comment about meeting customers where they are.

Related article: Introducing Berkley Embedded

“The point that we were trying to make is that the sacredness of the relationship between carrier and distribution is not universally sacred anymore. There’s been a lot of change that has occurred, whether it be the nature of the ownership of the distribution, whether it be consolidation, whether it be distribution getting into the underwriting business. It has evolved.”

“The sacredness of the relationship between carrier and distribution is not universally sacred anymore.”

“Simultaneously, you have a meaningful shift in customer behavior. And while perhaps it’s not particularly pronounced among large accounts, …the small part of town…is much more akin to personal lines,” he said, repeating the intention of meeting customers as they desire.

“We certainly have businesses that are solely dedicated to wholesale. We certainly have businesses that are solely dedicated to retail. We also have businesses in the group that are going direct-to-customer.

“We have a new venture that is going to start to get its sea legs during ’26 called Berkley Embedded, where it’s point of sale.”

“There’s a whole host of different things that we’re doing—not looking to undermine partners but making sure that we are there to meet the customer….”

“They care about price. Almost every consumer does, but customers are more preoccupied with convenience, and they are more open to a self-serve model. We need to be conscious of that and responsive to that.”

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report