“It’s too long to be considered a hot streak.”

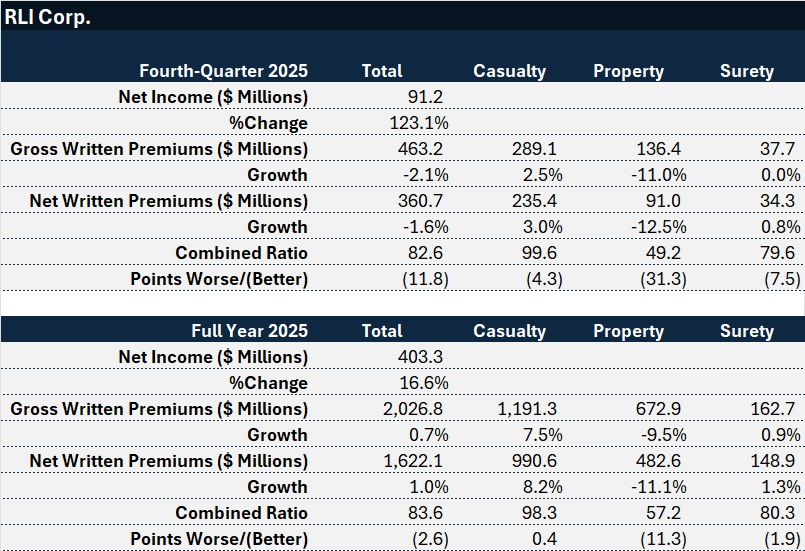

That’s how the chief executive officer of specialty insurer RLI delivered the news of his company’s unbroken 30-year record of underwriting profits on an earnings conference call Thursday. For 2025, underwriting income was $264.2 million, translating to a combined ratio of 83.6

In his opening remarks, Craig Kliethermes also noted that RLI’s premium growth for the year was “modest”—only 1% for the year on a net basis, and less than 1% gross.

“The environment remains competitive,” he explained. “But that’s exactly when our model tends to show its strength,” he added, referring to an ownership culture and a model of disciplined execution that rewards underwriters for long-term profit. “We don’t measure success by how fast we grow. We measure it by how well we grow and whether today’s decisions stand the test of time,” Kliethermes stated, going on to invoke the words of RLI Founder Gerald Stephens who reportedly said, “You don’t win the long game by swinging at every pitch. You win it by knowing which ones to let go by.”

Said Kliethermes: “We’re comfortable pulling back when the risk-reward equation doesn’t work, and we’re confident leaning in where we have the expertise and when the market supports it.”

“You don’t win the long game by swinging at every pitch. You win it by knowing which ones to let go by.”

Towards the end of the call, the CEO spent some time reflecting on the trajectory of RLI’s business over three decades of underwriting profit, noting that the company that wrote $2.1 billion in gross premiums in 2025, wrote $270 million 30 years ago, one-third of which was earthquake insurance. “We were still in the contact lens business” then, he said, referring to the fact that Stephens founded the company as an agency placing contact lens replacement coverage in 1961.

In 2025, most of the property business was E&S property and marine, rather than earthquake business, and more than half the book—$1.2 billion of gross premium—was casualty insurance, including primary and excess commercial liability, personal umbrella, transportation and executive products. Chief Operating Officer Jen Klobnak detailed market conditions and RLI activities in these lines between Kliethermes’ opening and closing remarks.

Referencing the biggest top-line drop across RLI’s segments—an 11 percent decline in fourth-quarter property premiums—Klobnak noted that a 49 combined ratio for the same segment, underscored the quality of the portfolio and the property team’s ability to execute in softer markets.

Although she noted that “intense competition” in E&S property, fueled an 18 percent dip in premiums in the quarter, she also remarked that carrier competitors in the E&S property market are slowly giving back terms and conditions, while MGAs are being more aggressive.

An analyst, focusing on rate decreases, asked Klobnak whether a $50 billion catastrophe could change the trajectory of pricing in the property market, also asking the COO whether market pricing is irrational or just a “normalization” after a period of strong rate hikes.

“What we need is a little bit less capacity, and whatever can cause that to happen would be beneficial to the market,” Klobnak said, suggesting that a shift in insurance underwriting opportunities to other lines, absent an outsized catastrophe, could beneficially reduce capacity in the property market.

“All we need is a stable market,” she added, noting that she believes the current catastrophe market “is well-priced with reasonable terms and conditions in a lot of places.”

“We could navigate this market easily if it would stay where it’s at,” she said, adding however that buyer-friendly 1/1 property reinsurance renewals could prompt some further softening of the property insurance market.

While she said it was difficult to characterize the reasonableness of competitors as RLI navigates the market on the daily basis, she did note that RLI has observed “business being stolen between producers.”

“There’s a lot of movement going on just because people have changed which wholesalers they work for,” she said.

RLI also comes up against responsible carriers that align interest with producers placing property accounts. “That’s a fair playground.” In contrast, “capital providers that don’t have aligned interests,” alter the market’s stability. “The MGAs in some cases have no downside. [They’re] not aligned with the carriers, who have to pay those claims at some point. That’s where there’s a disconnect and where the MGAs want to use up that capacity quickly because right now the market could be better than it [will be] a few months from now.”

Some producers, she said, “have received capacity for this year that [is] multiples and multiples of what they were able to provide last year….We can’t compete on some of that. So, we don’t spend a lot of time on those types of deals. We move into the spaces where we know we have a chance as a business.”

Earlier in the week, during the Travelers earnings conference call, Alan Schnitzer described national account property as the most competitive segment of the property market but also suggested that the overall market is not irrational.

“It’s a challenging year [but] the pricing dynamic is what the pricing dynamic is,” he said. “To a very large degree, that’s reflective of the profitability of that business,” he said, noting that rate gains achieved over a very long period of time have translated into strong profits.

Travelers is sometimes surprised at competitive pricing, and more so by terms and conditions being given away in the marketplace that Travelers is unwilling to match. “But writ large, we look at it and we say [the market] is not so crazy when you think about where the returns are.”

Klobnak also offered thoughts on various segments of the casualty and surety markets. Among her observations:

- While casualty segment premium grew just 2% in the fourth quarter, personal umbrella led the way with premium growth of 24%.

- Half of the premium growth figure for personal umbrella was attributable to rate increases, amounting to 12%, and RLI secured additional rate approvals that will add growth to the book in 2026.

- “The personal umbrella market continues to present opportunities as our competitors responded to deteriorating results by adjusting their appetite and terms and conditions.”

- Within the casualty segment, transportation premium fell 10% in the fourth quarter despite a 13% increase in rates. “We continue to prioritize profitability over volume in a highly competitive environment.”

- Klobnak also noted that severity trends and economic pressures have reshaped the transportation industry, “with heightened volatility and increased expenses forcing some transportation companies to consolidate or close, reducing the demand for insurance.”

- “At the same time, despite some insurance providers leaving this space due to poor financial performance, there always seem to be new markets entering and pushing for growth,” she said, noting that “acute pressure” on the largest account sizes has driven RLI to reduce the average account size in its transportation book over the last two years.

- The E&S Casualty team witnessed increased competition in the fourth quarter, “particularly on larger six-figure premium accounts due to competitors chasing top-line growth, presumably to meet year-end goals.”

- In E&S Casualty, where RLI’s book is heavily construction-related, Klobnak also said competition varied by region. Some markets exited while others leaned in. She also reported that while submissions increased by double-digits, construction projects are taking longer to bind. “We have many quotes outstanding waiting for permitting or funding.”

In spite of RLI’s decades-long record of underwriting profits, an analyst focusing on the casualty segment worried about two straight years of 98 combined ratios for the segment. Are the trucking headwinds of past years now in the rearview mirror, he asked.

Executives pointed to multiple years of rate increases as a good foundation for the business going forward, and Klobnak noted that the elevated combined ratios, in part, reflect the fact that RLI has been slow to release reserves for some casualty coverages. At one point, she noted a positive sign—a 24% drop in new transportation claims last year, later adding that RLI is not reacting to the trend by lowering initial loss picks. “We tend to be pessimists…. We tend to wait and make sure that we are seeing enough good news…. before we’re going to recognize it,” she said.

Kliethermes confirmed this. “I grew up in the Show-Me State of Missouri, so we’ve got to wait and see. On good news, we’re slower to usually recognize that. But if we see something go in the other direction, we…try to get that up as quickly as possible.”

Responding to another analyst who asked what levels of additional rate increases might be required beyond last year’s 13% to sustain rate adequacy on the transportation book, Kliethermes said RLI will continue to seek double-digit increases.

“We have seen elevated severity trends in pretty much all auto businesses since COVID, since the courts have opened back up. At some point, that has to subside,” he said reasoning that insureds can’t afford 10-15% insurance rate increases for much longer. “At some point, there’s going to be a breaking point,” he said, offering that a potential fix to moderate loss severity is more tort reform. “In the meantime, you can expect us—I can’t speak for other companies, but I can speak for us—we try to at least get the increase to cover trend….”

“We’re going to try to continue to get 10%-15% increases on auto business going forward until we see that loss cost trend subside.”

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  The Future of HR Is AI

The Future of HR Is AI  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard