Will property/casualty insurers be profitable in 2026? Will market conditions soften?

Looking for clues to answer these questions, Carrier Management listened to fourth-quarter 2025 earnings conference calls for a half-dozen publicly traded insurers that took place in January 2026, gathering executive explanations about 2025 results and their expectations for the year ahead.

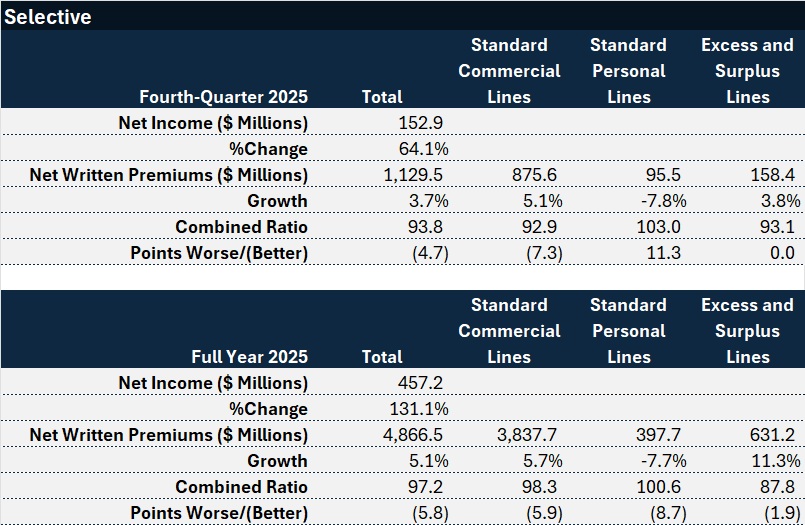

At the only regional insurer on the list, Selective Insurance, executives provided an expected range of combined ratios for 2026—falling between 96.5 and 97.5—which is similar to the recorded full-year 2025 combined ratio of 97.2. Excluding an assumed catastrophe load of 6 points, the underlying combined ratio is expected to come in around 90, they said.

Net premiums written growth was 5% last year. CEO John Marchioni reported that this level of growth reflected “deliberate actions to improve underwriting profitability.”

“This remains our primary focus. However, we are also executing strategies to support future growth opportunities, including expanding our geographic footprint and broadening E&S distribution capabilities with retail access,” he said. “We believe we have the capabilities and strategy to further diversify our premium and outpace industry growth in coming years.”

See related article, “Insurance Groundhogs Warming Up to Market Changes,” for charts summarizing the fourth-quarter and full-year 2025 financial results of all seven publicly traded P/C insurance companies that reported year-end financial results in the month of January.

Among seven U.S. P/C insurers that reported 2025 financial results publicly in January, Selective had the most improved full-year combined ratio, 5.8 points, and nearly 5 points of improvement in its fourth-quarter combined ratio as well. The favorable comparisons were largely attributable to meaningful amounts of unfavorable prior-year loss development that added 7.1 points to the full-year combined ratio and 8.8 points to Selective’s fourth-quarter combined ratio in 2024.

Selective continued to boost prior-year reserves during 2025, with the commercial and personal auto lines driving additions for recent prior accident years—mainly to react to problematic loss trends in the carrier’s home state of New Jersey. (In fourth-quarter 2025, favorable development for workers comp offset additions.)

Related articles: Recent Years’ Commercial Auto Loss Costs Dog Selective Insurance in NJ; The Year So Far: Liberty Improves Most Among Nationals; Discipline Tested

During the insurer’s earnings conference call, Marchioni spoke about expanding to other states and emphasized ongoing, meaningful investments in technology, including AI, that are improving underwriting, pricing accuracy and claims outcomes.

“We expect our 2026 expense ratio to increase by about half a point as we make strategic technology investments to support scale, enhance decision-making and improve operational efficiency,” he said.

“We are also executing strategies to support future growth opportunities, including expanding our geographic footprint and broadening E&S distribution capabilities with retail access.”

John Marchioni, Selective

In spite of the expense ratio impacts, Marchioni highlighted the benefits of tools to improve risk selection and overall underwriting profits. Referring to standard commercial lines—”our earnings engine”—the CEO said, “We have the sophisticated pricing and risk selection tools in the hands of our talented underwriters that are necessary for taking granular action across the portfolio. We are improving mix by achieving stronger rate and retention differentiation based on expected profitability while continuing to focus on overall rate adequacy. This is not new, but we expect the amount of differentiation to increase.”

He added that the company is leveraging these tools to drive higher renewal retention on its best-performing business while meaningfully lowering retention on poorer performing business through appropriate rating actions.

“While overall rate increases could moderate in the short term, we expect these mix improvement actions will deliver improved profitability,” he said.

Giving specifics on fourth-quarter 2025 pricing, CFO Patrick Brennan said:

- The average renewal pure price increase for standard commercial lines was 7.5%, or 8.5% excluding workers compensation, driving premium growth of 5% in the fourth quarter of 2025.

- General liability pricing increased by 9.8%, and commercial auto pricing increased by 8.6%.

- While there was some deceleration in commercial auto pricing for physical damage, commercial auto liability price increases continued to exceed 10%.

- For property, renewal premium change was 12.2%, including 4 points of exposure growth.

- For excess and surplus lines, average renewal pure price increased 7.8% for the quarter.

- For personal lines, renewal pure price for the quarter was 15.1% but net premiums written declined 8%. Still, target business in the mass affluent market was up 5%.

Asked to discuss the long-term impact of technology investments on Selective’s results by an analyst who noted that some carrier executives are touting future expense ratio improvements, Marchioni said, “Clearly, we’re in the camp that our investment in technology has continued to ramp up as a percentage of premium over the last several years, and we expect that to continue.”

Related articles: Expense Ratio Analysis: AI, Remote Work Drive Better P/C Insurer Results; 20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

He added, “When you look at it at the highest level, we expect the investment in technology to continue to rise as a percentage of premium and the cost of labor—the percentage of premium that goes to labor—will be coming down over time as a result of gaining the benefit of these technology investments.”

“We’re not setting aggressive targets, but we think there are real opportunities here, not just to drive operational efficiency but to improve decision-making and improve outcomes—across underwriting, pricing [decisions] and claims outcomes,” he said.

Related article: What Analysts are Saying About the 2026 P/C Insurance Market

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Binding System Reviewed After Vonn’s Skis Didn’t Come Off During Olympic Crash

Binding System Reviewed After Vonn’s Skis Didn’t Come Off During Olympic Crash  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers