Lower levels of catastrophe losses more than offset impacts of prior-year reserve boosts to Selective Insurance’s third-quarter and nine-month combined ratios. But behind improved underwriting metrics, the carrier flagged problematic auto insurance trends in its home state.

“Unfavorable prior-year development in [auto] lines is attributed to the 2024 accident year, and is primarily driven by the state of New Jersey,” said John Marchioni, Selective’s president and chief executive officer during an earnings conference call yesterday, referring to $35 million of prior-year reserve development for the commercial auto line and $5 million for personal auto. Together, the $40 million prior-year development (PYD) added 3.3 points to the Branchville, N.J.-based insurer’s third-quarter combined ratio.

“New Jersey has always been a higher severity state across all casualty lines of business, but we’ve seen that really impact the last couple of quarters. We didn’t point it out last quarter, but it was also the primary driver of our commercial auto emergence that we saw last quarter as well,” Marchioni reported.

“What we’ve seen in the last two quarters is a re-acceleration of severity trend,” he said, noting that roughly 15 percent of Selective’s countrywide commercial auto premium comes from the Garden state.

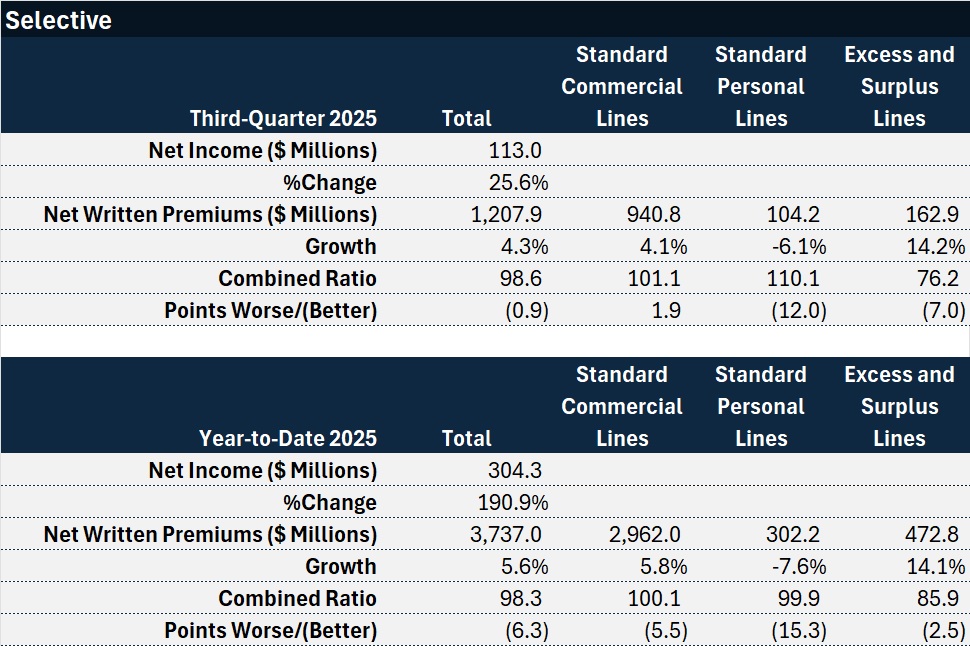

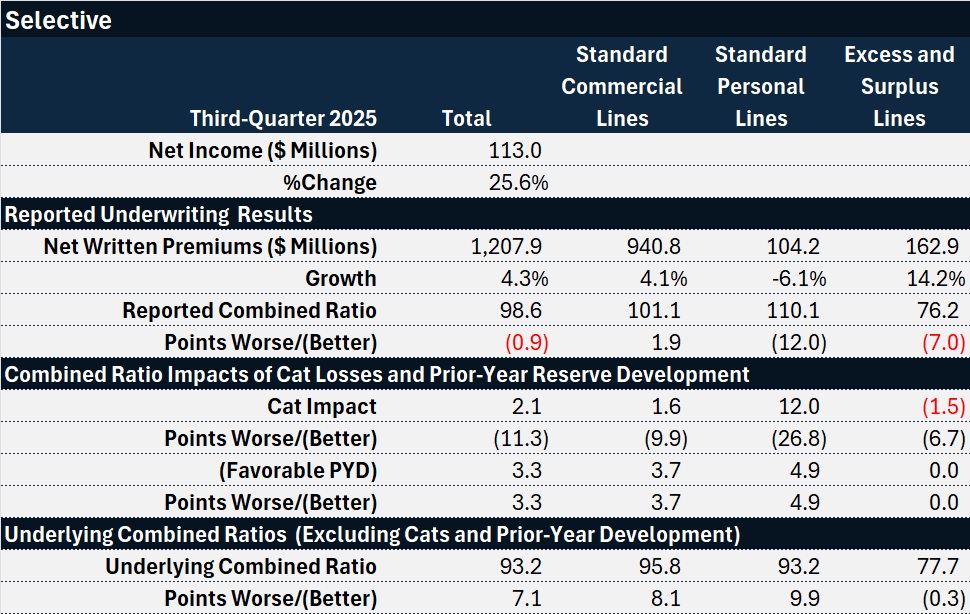

Besides the PYD impact, Selective’s underwriting results also reflected the benefit of markedly lower catastrophe losses, which added just 2.1 points to the third-quarter 2025 combined ratio vs. 13.4 points in third-quarter 2024. In spite of that 11 point improvement, Selective’s overall reported combined ratio improved less than 1 point—to 98.6 from 99.5 for the same quarter last year.

While slower premium growth in the quarter may partially explain a 6.3 point deterioration in the underlying (ex-cat, ex-PYD) combined ratio, further discussion from Marchioni offered a better explanation. He said that said that the increasing loss cost trends in recent prior accident years prompted Selective to refine its view of the current accident year, 2025, for commercial auto.

“This adjustment added just under 5 points to the current-year casualty loss costs for the line’s year-to-date combined ratio.”

Going a step further, as Marchioni and Chief Financial Officer Patrick Brennan reviewed the details behind a 13 percent return-on-operating-equity for the quarter, as well as considerations that put the carrier’s full-year combined ratio guidance above a targeted 95, Marchioni seemed to signal the possibility that there’s more loss reserving pain ahead for the industry as a whole in coming quarters.

Marchioni did not specifically state that there will be industrywide challenges with commercial auto or other casualty loss reserves going forward. In fact, he deliberately said he would “stop short of that” in responding to an analyst who questioned him on the point. But he did confirm what the analyst alluded to in dissecting introductory remarks from the CEO about the findings of multiple third-party reviews of the company’s reserve position, methodology and claims processes. According to Marchioni, not only were central estimates of a third-party opining on the appropriate loss reserve levels for Selective lower than the company’s booked numbers, but the external review also “confirmed that our approach was somewhat more responsive to recent elevated trends they are seeing industrywide,” Marchioni said.

The analyst took note of the canary in a coal mine. “It sounded like [there are] warning signs for some pockets of deficiency for the industry that just hasn’t been recognized yet,” the analyst said during the question-and-answer part of the conference call.

“What I will say—and reinforce—is the validation from more than one external actuarial expert that has a broader view of the industry, that the elevated trends we’re responding to in the more recent accident years are evident across the industry,” responded Marchioni. “That is clearly a statement that we’ve gotten from them….”

“While it doesn’t change the results that we’re delivering, I think it does suggest that in fact this is something that’s more widespread,” Marchioni said, noting that the same messaging came from Selective’s reinsurance partners at the recent CIAB meeting.

The commercial auto liability and general liability lines, he said, are “under continued pressure from elevated social inflationary trends. But we’re reacting, and we’re reacting in a way that we think is timely and appropriate. And I’m highly confident that when we look back at these more recent accident years post-pandemic, as they age for us and everybody else, that our track record and our reputation of being a strong underwriting company–history will show that that’s continued to be the case,” he said.

“I understand that it might not feel that way right now. But that’s how we manage our business and that’s how we’ll continue to manage our business,” he said.

A look at underlying and reported combined ratios for standard commercial lines, which include commercial auto, give some sense of how much Selective has reacted.

As shown above, a nearly 10-point downward swing in the impact of catastrophe losses and a 3.7-point upward move in the PYD impacts did not add up to a 6-plus point improvement in the commercial lines reported combined ratio in the quarter. Instead, the reported combined ratio worsened by almost 2 points (1.9 points) to 101.1.

The underlying combined ratio—excluding the impacts of catastrophe losses and PYD— rose 8.1 points, with the commercial auto loss cost adjustments to the current accident year driving much of the result. In fact, Brennan said 6.2 points of higher current-year casualty loss costs figured into the reported combined ratio deterioration.

Brennan also reported that Selective’s New Jersey personal auto reserving actions added 4.9 points of unfavorable prior-year casualty development from the 2024 accident year to the reported result for the standard personal lines segment—a 110.1 combined ratio. New Jersey’s unfavorable picture also drove a 7.2 point increase in current-year casualty loss costs in the quarter, the CFO said.

For the commercial auto line alone, the reported third-quarter combined ratio of 117.6 was more than 15 points higher than a 102.2 recorded for third-quarter 2024, with roughly 8 points of the deterioration explained by unfavorable loss development for recent prior years. The underlying combined ratio deterioration worsened by 7.6 points to 105.2.

Through the first nine months, the underlying combined ratio across all lines was 91.6. Marchioni said an underlying ratio of 91-92 is built into Selective’s guidance of a 97-98 combined ratio for the full year. Brennan indicated that this guidance includes 4 points of catastrophe losses—lowered from a previous 6-point estimate, reflecting favorable results through the first nine months of the year. The guidance also include 2 points of PYD. “It also assumes no additional prior year casualty reserve development and no further change in loss cost estimates,” Brennan said.

At several points during the call, Marchioni presented lists of actions that Selective is taking to get its companywide combined ratio down to 95—a target figure for the insurer.

“We are prioritizing profit improvement and moderating premium growth,” he said. “Risk selection, granular and accurate risk pricing and prompt fair claims adjudication are foundational capabilities we have built over many decades,” he said, adding that continuing to strengthen these core competencies will be a priority. Selective is also continuing to diversify revenue and income within and across three broad insurance segments—standard commercial, standard personal and E&S business.

Specific to commercial insurance, Marchioni said the carrier has a goal of expanding to a near-national footprint, reporting that Selective has strategically added 14 states since 2017, with two more—Montana and Wyoming—planned in 2026.

Specific to the commercial auto line, renewal price changes are around 10 percent and rate increases will continue, he said. Early last month, Selective also “deployed an updated rating plan and predictive modeling to provide more granular pricing segmentation.” According to Marchioni, this plan incorporated enhanced rating variables, including additional vehicle- and driver-specific criteria.

“We’ve implemented tighter underwriting guidelines on fleet exposures, supported by state-level tactics and analytics to better identify and target risks,” he said, also noting that the carrier is looking to increase the take-up of its telematics solution in certain auto segments and states and actively engaging with fleet customers to promote increased use of risk management tools, such as commercial auto self-assessments providing online guidance.

Asked about the dual impact of corrective actions and a competitive insurance market impacting Selective’s customer retention levels, or more specifically, its “share of wallet” with its agency partners, Marchioni highlighted the benefits of deep relationships in facilitating good communication back and forth during renewal negotiations.

“It is important in an environment like this that you execute your pricing and underwriting strategies in as granular a fashion as possible—by account, by class, by state, by line of business,” he added, noting that the ability to do this can mitigate any downward impact on retention overall.

“We are willing to make that trade if push comes to shove. But the granularity of our execution will ultimately determine how agents respond,” he said.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End