Following in the footsteps of groundhog Punxsutawney Phil, analysts from Fitch Ratings and Morningstar DBRS weighed in with these P/C insurance market forecasts in the past week:

- “Fitch Ratings expects the U.S. property/casualty market to continue softening in 2026, with increased competition, abundant capital and downward pricing pressure.

- “Despite the high number of litigations and escalating payouts, the U.S. casualty insurance market is still an attractive market because of its size, product and regional diversity, and pricing flexibility,” according to Morningstar DBRS.

- “We expect casualty insurance pricing to remain divergent from the rest of the P&C insurance market in the near term,” said Victor Adesanya, Morningstar DBRS Senior Vice President, Global Insurance & Pension Ratings.

- “Overall, we do not anticipate softening rates in the P/C market to pressure credit ratings, as most insurers benefit from diversification in their product mix and geographic footprint and can still increase their casualty insurance rates.”

- “Insurers will face slowing revenue growth given the easing rate environment amid macroeconomic uncertainty,” Fitch says.

- In property-catastrophe reinsurance, softening market conditions will “continue at the midyear 2026 renewals in April (Asia-focused) and June/July (Florida).”

Personal Lines: Shopping and Switching

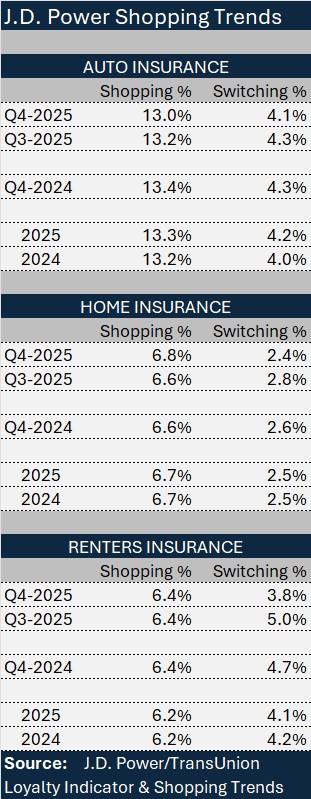

Separately, J.D. Power provided an early read on whether America’s drivers and homeowners will stay put with their insurers this year or switch to competitors for lower prices.

For the most part, shopping and switching rates were down slightly in the fourth quarter of 2025 except for residential property owners and renters, who are increasingly shopping but not switching carriers, according to latest Loyalty Indicator & Shopping Trends (LIST) report from J.D. Power, conducted in collaboration with TransUnion.

The most notable change evident from the figures in the report relates to policyholders shopping for new renters insurance. Those customers switched much less frequently in fourth-quarter 2025 than they did in prior time periods.

Averages compiled by Carrier Management from monthly shopping and switching percentages shown the LIST report reveals these findings:

Auto insurance: Both shopping and switching rates are down. The overall fourth-quarter 2025 shopping rate was 13.0%, down 0.2 points from third-quarter 2025 and 0.4 points from fourth-quarter 2024.

The fourth-quarter 2025 switching rate was 4.1%, also down from prior periods.

The fourth-quarter 2025 switching rate was 4.1%, also down from prior periods.

Home insurance: The average shopping rate in the fourth quarter was 6.8%, putting it above the 6.6% averages for third-quarter 2025 and fourth-quarter 2024. The fourth-quarter 2025 switching rate, 2.4%, however, was 0.4 percentage points lower than the third-quarter 2025 rate, and 0.2 points below fourth-quarter 2024.

Renters insurance: Both home insurance and renters insurance switching rates peaked in third-quarter 2025 last year but the switching rate for renters showed a sharper percentage decline. The fourth-quarter renters switching rate was 3.8%, down 1.2 points from third-quarter 2025 and 0.9 points year-over-year.

The report also provides insights on which customers are shopping and which insurers benefit and suffer from switching activity. In general, the analysis states that lower credit-based customers did more shopping for auto and home insurance last year, and Northeasterners led the shoppers for auto throughout most of the year—although those on the West coast started to look around for better deals late in the year.

The LIST report shows that Progressive was the biggest beneficiary of auto insurance shopping activity. On the flip side, the list of two dozen insurers ranked by policy inflows and outflows also shows that while Progressive had the highest percentage of new auto business last year, Progressive also experienced the highest rate of churn last year.

For home and renters insurance, State Farm garnered the highest percentage of shoppers but also saw the highest percentage of rental customers leaving the State Farm brand. Allstate had the highest percentage of home insurance defectors among the companies listed in the home insurance peer group.

How They’ll Buy: Accenture Weighs In

Consultant Accenture also offered five 2026 predictions for the insurance industry in a blog post this week. While some of the forecasts had life insurers in mind, the final one seems relevant to P/C insurers.

The prediction: “Embedded distribution will scale from ‘adjacent channel’ to a core growth engine.”

“By end-2026, the insurers growing fastest in new business will likely be those generating a meaningful share of new premium from embedded distribution through digital trading partners—not just from owned direct channels,” the blog items states.

According to Accenture, insurance “placement is shifting toward the moments where decisions are made: checkout, onboarding, renewal, and workflow completion. That’s where attention, intent, and data concentrate, and where insurance can be made simple enough to buy.”

Noting that “growth will concentrate in ecosystems where protection is easiest to bundle into a transaction or workflow,” they highlight the purchase of auto insurance via OEM and dealer ecosystems, noting that Accenture research reveals rising customer interest in purchasing insurance inside the auto buying journey.

The writeup also mentions “home and smart-building ecosystems”—utilities, IoT platforms, and smart-home services—in discussing embedded channels for home insurance, noting that risk mitigation and services can sit alongside insurance coverage.

“Execution won’t hinge on rhetoric. We think that winners will be the carriers that can offer API-first products, frictionless partner onboarding, and industrial yet flexible embedded offers, including service components where it strengthens the value proposition, not just the distribution pitch.”

10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Insurify Starts ChatGPT App Allowing Consumers to Shop for Insurance

Insurify Starts ChatGPT App Allowing Consumers to Shop for Insurance  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered