In separate reports last week, AM Best and Morgan Stanley analyzed P/C insurance industry expense ratios, with one reporting a 2.4-point drop over the past decade and the other projecting another potential 2.0-point decline by 2030.

While both reports highlight the impact of AI and automation in driving down expenses, the AM Best report, which gives the historical take, also flags drops in rent expenses related to increased remote work as a factor.

Analyzing underwriting ratios of the 2014-2024 timeframe, AM Best noted that while the loss ratio declines, including a 5.4-point drop in the U.S. property/casualty insurance industry loss from 2023 to 2024, drove improved results in recent years, looking over the entire 11-year period, the expense ratio fell to 25.3 in 2024, compared to 27.7 in 2014.

The overall 2.4 percentage point decrease in the U.S. P/C insurance segment’s long-term underwriting expense ratio was primarily driven by a 1.9-point decrease in the other acquisition expenses ratio and a smaller, 0.5-point decrease in the general expense ratio, AM Best said in a Jan. 6, 2026, special report, “Lower P/C Insurer Expenses Boost Underwriting Results.”

(Editor’s Note: Neither the commission expense component nor the tax expense component of the expense ratio changed much over the study period. The AM Best report does not include 2025 results.)

The overall improvement is “reflective of the progress the P/C industry has made via increased digitalization, and the use of automation and advanced technologies,” the AM Best report states.

Addressing the biggest part of the drop—the 1.9-point decrease in other acquisition expenses—the report notes that the “shift from a five-day-a-week office commitment to hybrid or fully remote work policies has lowered the proportion of other acquisition expenses attributable to rent expense.”

The Morgan Stanley report is solely focused on go-forward impacts of AI on expense ratios and operating margins. Titled “AI (01000001 01001001): How the New Industrial Revolution Is Reinventing Insurance,” the Morgan Stanley report includes separate analyses of potential earnings growth driven mainly by the back-office implementation of artificial intelligence for the insurance broker, P/C insurance carrier and life insurer segments.

The Morgan Stanley analysis starts with a higher P/C insurance expense ratio than the AM Best report ends with—30.4 for 2026 vs. AM Best’s 25.3 for 2024—likely resulting from a different universe of carriers regularly followed by Morgan Stanley (mostly commercial, specialty and reinsurance companies). For the Morgan Stanley cohort, the Wall Street analysts project an expense ratio of 30.5 for 2030 if the carriers do not use AI, and 28.5 after using AI—2 points or 200 basis points lower.

There’s a similar impact on operating margins, the analysis shows.

For the year 2030, the Morgan Stanley report reveals a post-AI operating margin of 17.4 percent, compared to 15.6 percent, absent AI, across P/C insurance carriers—an improvement of nearly 180 basis points.

(Editor’s Note: More precisely, the analysts calculate 176 basis points of operating margin improvement from AI. Operating margins in the report are expressed as returns on total revenue rather than premiums or operating earnings per share.)

In dollars, the report shows a $9.3 billion jolt from AI use in 2030, with projected operating income rising from $82.7 billion without AI to $92.1 billion after AI. Morgan Stanley refers to the 11 percent jump as “operating income uplift.”

The uplifts in operating income dollars and operating margin basis points are comparisons of post-AI and pre-AI results for the year 2030. Morgan Stanley analysts calculated similar results for each year from 2026 through 2030. Looking across the years, things get worse initially for P/C insurers until they get better.

In 2026, post-AI margin for insurers covered by Morgan Stanley research is 14.7 percent, compared to a pre-AI margin of 15.2 percent. The post-AI margin lifts slowly to 15.4 percent in 2027, 15.6 percent in 2028, 16.2 percent in 2029 and finally up to 17.4 percent in 2030.

Assumptions about high AI implementation costs early on and delayed ramp-up of efficiency benefits weigh heavily on the 2026 projections. For that year, Morgan Stanley estimates over $6.0 billion in cost savings across the carriers analyzed, but with only 10 percent flowing through to operating earnings ($600 million) and $3.0 billion of implementation costs, the result is a $2.4 billion drop in operating income.

For 2030, Morgan Stanley assumes implementation costs are largely behind the carriers and that 100 percent of $9.3 billion in potential cost savings hit the books five years into the future.

Improved Carrier Operating Margins

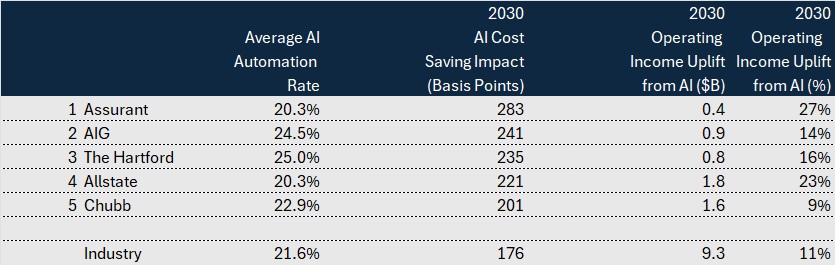

Analyzing carriers in the Morgan Stanley coverage universe individually, the report flags Assurant, AIG, The Hartford and Chubb among the carriers that analysts believe stand to gain the most points of operating margin from increased AI use over time.

Supporting the report narrative, charts and graphs in the report set forth summary information about each carrier’s workforce underlying the carrier projections.

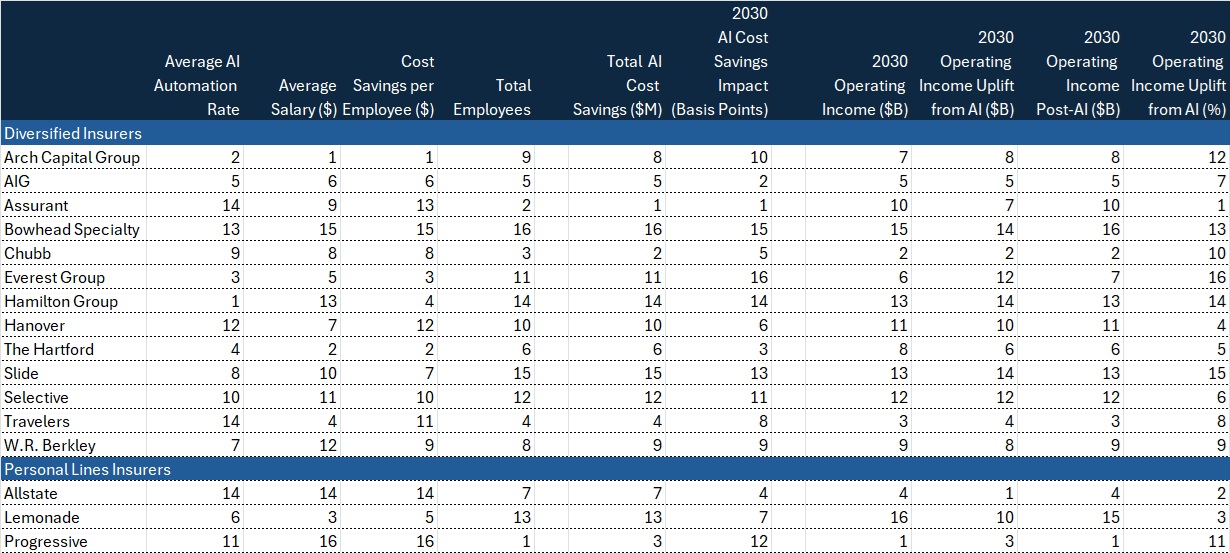

Included is the “average agentic AI automation rate” across each carrier’s workforce, ranging from a low of 20-21 percent for standard carriers like Travelers, Allstate and Progressive to highs of 25-27 percent for specialty providers like Arch Capital Group, Hamilton and Everest.

A methodology section of the report explains that the starting point of the analysis involves gathering task-level agentic AI automation rates and determining the tasks involved in various carrier jobs and the distribution of jobs across individual carrier workforces. (See “How Morgan Stanley Developed AI Impact Projections” section of this article for more information on sources of data used.)

Below, we have excerpted the average automation rates and financial projections for the five P/C carriers that have the highest 2030 operating margin income uplift measured in basis points.

In dollars, these five carriers account for nearly 60 percent of the $9 billion-plus projected industry boost in operating earnings from AI use in 2030, according to the Morgan Stanley projections. Potential AI benefits for Progressive and Travelers account for much of the remainder.

Where carriers wind up individually in terms of the percentage of operating margin uplift depends not only on starting assumptions about salaries, head count and estimated percentages of tasks that can be automated through agentic AI but also on relative levels of pre-AI operating earnings and revenues. Note, for example, that a relatively high level of pre-AI operating earnings for Chubb translates to a lower percentage jump in operating earnings from using AI than the percentage change that the Morgan Stanley analysts estimate for specialty carrier Assurant (9 percent for Chubb vs. 27 percent for Assurant).

Below, we have indicated the relative rankings of all 16 carriers in the report for each of the input assumptions, as well as for the final projected AI impacts on 2030 operating earnings (basis point change, dollar change and percentage change).

Focusing on personal lines insurers, Progressive has a relatively low assumed automation rate (20.7 percent), the lowest average salary (rank 16 of 16 carriers), the largest workforce and the highest level of pre-AI earnings (rank 1), all combining to pull its percentage uplift in 2030 earnings below the overall industry figure (8 percent for Progressive vs. 11 percent for the industry).

Among diversified insurers and reinsurers, Arch Capital Group has the highest average salary and the second-highest assumed agentic AI automation rate (25.7 percent). But with mid-range operating earnings and workforce counts, Morgan Stanley calculates a 2030 operating earnings uplift from AI for Arch at 6 percent.

What About the Brokers?

According to the Morgan Stanley report, the analysts expect two key stages of AI adoption for carriers and brokers: an initial stage of “back-office AI implementation aimed at boosting operational efficiency, primarily impacting expense ratios,” and a later stage to enhance underwriting capabilities, improving loss ratios, impacting pricing and driving sales growth. It is the first stage that is the focus of much of the research report.

The report includes assessments of AI impact for major P/C brokers like Aon, Marsh, WTW, Brown & Brown and Ryan Specialty. The analysts note that brokers, like carriers, will see notable benefits from AI adoption over time. Broker benefits will derive from the “human capital-intensive nature of the business model,” the report says. While Morgan Stanley analysts perceive brokers currently lagging P/C carriers in AI adoption, the predicted 2030 operating margin uplift from AI adoption for brokers is almost twice that of carriers—350 basis points for brokers vs. 180 basis points for carriers.

How Morgan Stanley Developed AI Impact Projections

Several pages of the report provide a step-by-step walkthrough of the methodology and sources of workforce information and assumptions that Morgan Stanley used for its analysis. For example, Morgan Stanley tapped into Anthropic’s Economic Index data to determine estimated percentages of specific insurance professionals’ tasks that can be automated through agentic AI.

Other sources of information were the Department of Labor’s O*NET database, which was used to map potentially automated tasks to specific insurance jobs, and LinkUp job posting data, used to develop a distribution of jobs across each carrier or broker workforce.

Putting all that together with annual salary data, Morgan Stanley researchers were able to estimate total potential annual cost savings from agentic AI implementation across each of the workforces they analyzed.

Offering some details of the calculations for Aon for illustrative purposes, the report notes that “the automation rate of insurance sales agents who sell insurance policies and may refer clients to independent brokers is 21 percent,” and the average salary of an insurance sales agent in the U.S. is roughly $82,000, suggesting a potential annual cost savings of $17,000 for each insurance sales agent. (Across Aon, the average annual salary for all types of professionals analyzed is over $105,000.)

For the brokers as a group, charts in the Morgan Stanley report reveal potential automation rates averaging 25.1 percent across their workforces. Carrier automation rates average out to 21.6 percent.

The analysts assumed that the first stage of AI adoption is a multiyear journey for both carriers and brokers, but that expense savings flow through carrier financials quicker than brokers.

For Aon, for example, Morgan Stanley assumes it will take five years to achieve 50 percent of AI-driven cost savings. Carrier projections assume 100 percent of AI-driven savings achieved in five years.

Morgan Stanley expects both groups to focus on building and experimenting with AI tools during the next two years, resulting in returns on AI investments that will be negative and then marginal before they can achieve meaningful cost savings and improved bottom lines.

Beyond the carrier and broker expense saving projections, the report includes sections describing the durability of profit gains insurers have historically achieved as a result of adopting new technologies, changes in the incidence of insurance executive discussions of AI use cases on earnings conference calls, historical timeframes for technology development and adoption across industries, along with other related research topics.

Featured image: AI-generated by Copilot

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers