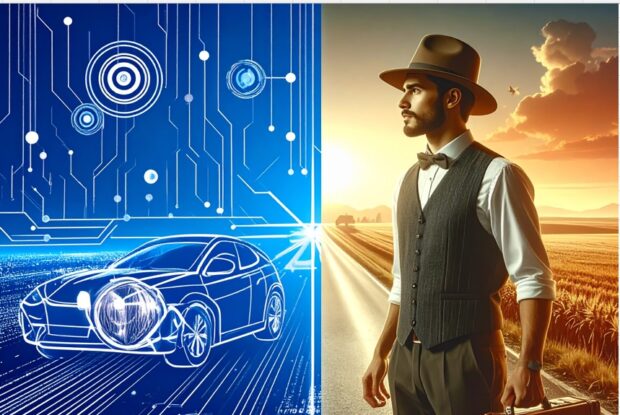

It is 1921 and the insurance industry looks quite different than it will in a century.

Executive Summary

G. J. Mecherle understood the basics of innovation in the insurance industry more than a century ago, creating a company that adapted coverage to the needs of the largest consumer constituency in America at the time—the nation's farmers.

But in the years since State Farm was launched, insurers have lagged behind tech, e-commerce, telecom and other industries, which, unlike insurers, deliver products that get smarter, more elegant, more predictive, more personalized, more adaptive and more intuitive every day.

Here, Haden Kirkpatrick, who has held innovation and strategy leader roles in both the insurance and telecom industries, offers his take on what has gone wrong in insurance and introduces ideas about risk-taking, user-centered design, product development and data usage that are central to innovation.

Kirkpatrick plans to expand on these ideas and share his learnings in a series of articles to motivate today's Mecherles, paving the path of the future of the industry.

Kirkpatrick previously co-authored the article "The State Farm Vision: Ecosystem Capabilities for the Insurer of the Future" with IoT Observatory Director Matteo Carbone.

Automobile policies are bound annually, and insurance risk is often spread across entire states as opposed to specific ZIP codes or census tracks. This model leaves many customers very dissatisfied, especially farmers, whose businesses—and risk profiles—are highly seasonal. These customers express, broadly, that the industry is no longer working for them.

Hearing their concerns, an entrepreneurial insurance salesman named G. J. Mecherle launches a small insurance company called State Farm in 1922 with a simple but powerful innovation: He will price and underwrite policies every six months, thereby providing coverage that adapts to the needs of the largest consumer constituency in America—farmers.

In the span of a mere 20 years, State Farm skyrockets to be the largest auto insurer in America, where it remains to this day.

Fast forward 100 years, and Americans are again expressing, broadly, that the insurance industry is no longer working for them. Every bit of research I’ve seen indicates that consumer dissatisfaction with insurance (all of it—from auto insurance to homeowners insurance to health insurance and everything in between) is high and continuing to rise.

It is easy to see why. Consumers look around to other industries and see elegantly designed products that practically read their minds. Across tech, e-commerce, media, automotive, mobile and numerous other industries, products are getting smarter, more elegant, more predictive, more personalized, more adaptive and more intuitive. But insurance seems to have not evolved at all since the inception of the Internet era, at least not in the minds of customers. They see other industries accelerating past the insurance industry and wonder, “What gives?!?!?” And they are not happy at all.

In this environment, as insurers continue to hike rates year over year, consumers are increasingly wondering what, exactly, they are getting for their money. And a “promise of protection” isn’t cutting it anymore, especially given how outdated the claims experience has become.