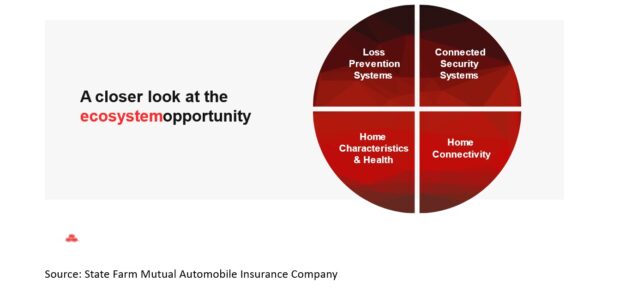

A century-old insurer is evolving to help people manage the risks of everyday life, recover from the unexpected and realize their dreams in an increasingly hyperconnected world. The State Farm innovation journey extends beyond insurance products and into the ecosystems of connected things surrounding them.

Executive Summary

Back in 2015, in the first viral insurance innovation article he wrote (“Will Fintech newcomers disrupt health and home insurance?“), IoT Insurance Observatory Founder Matteo Carbone provoked the insurance sector, urging stakeholders to delineate their levels of ambition and their roles in the home and car ecosystems, and to identify ways of cooperating with other ecosystem players having like aims of creating services around an integrated set of customer needs.At a recent conference, Haden Kirkpatrick, VP of Innovation at State Farm, described how the 101-year-old carrier has embraced a visionary outlook to sustain—and expand—its relevance to customers who, in Kirkpatrick’s words, “now expect their insurers to understand them as well as Google and to deliver products and services as efficiently and cost-effectively as Amazon, all in a curated Netflix-style queue.”

This article describes State Farm’s existing relationships with ADT and other home ecosystem players, and future ecosystem capabilities for the insurer of the future.

State Farm’s challenge lies in meeting customers where they are against evolving consumer expectations—expectations that have undergone profound transformations over the last two decades. Consumers expect an experience delivered in a fashion as seamless and elegant as an Apple product, that understands them as well as Google, and is delivered as efficiently and cost-effectively as Amazon, all in a curated Netflix-style queue. (Guest Editor’s Note: Kirkpatrick spoke about this at the Future of Insurance USA 2023 conference. His presentation conveyed a palpable sense of urgency regarding the imperative evolution of the industry to the hundreds of insurance executives in attendance.)

The insurer of the future should adopt a mindset, approach and positioning more akin to that of a big tech company than a traditional insurance provider. Consequently, even in the realm of insurance, technology will emerge as the predominant catalyst for the realization of insurers’ strategic objectives (as prophesied in co-author Carbone’s 2017 book, “All the Insurance Players Will Be Insurtech.”)

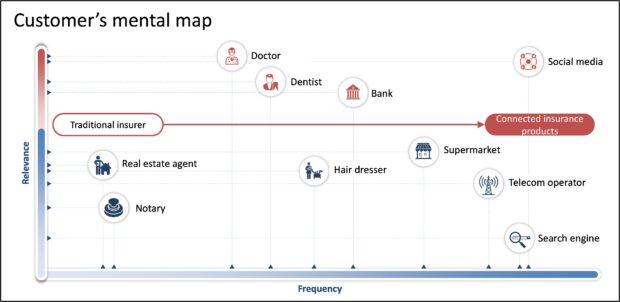

The insurer of the future is expected to sustain its historical relevance with customers, as it has for many years in the past. As the IoT and its corresponding data expands, adopting a platform-level approach will be critical to putting insurers in a position to become a more integral and frequent presence in daily lives, providing value beyond the insurance policy alone.

By actively engaging with the interconnected ecosystem of assets surrounding the risks covered by an insurance policy, the industry may gain a better understanding of customers’ holistic needs and provide tailored experiences to help fulfill them. Forward-looking entities can then actively participate in the collaborative development of solutions within these ecosystems, allowing for elegant and seamless integration into the IoT space.

Connected cars, connected homes and connected self are at the heart of this vision for the future. State Farm is committed to progressing in these spaces as it looks toward the next hundred years of industry leadership. In preparation, it has worked to develop one of the largest usage-based insurance (UBI) initiatives in the industry. Its innovation endeavors are concentrated on fortifying its competencies within these realms, especially leaning into smart homes. State Farm is keen on the smart home and what it means for the carrier’s business.

A Deeper Dive Into Smart Homes

Homes are rapidly evolving into sensor-rich environments. This overarching trend is not transient; rather, it is a fixture of the future. Insurers must adapt to this reality and determine how to navigate an environment where a substantial portion of the properties in their insurance portfolios will be connected.

Nevertheless, the majority of gadgets are not necessarily developed with insurance integration in mind. To be effective, insurers require adequate insight for understanding—and potentially mitigating—risks and effectively engaging policyholders.

To truly transform their business operations, insurers must formulate a vision and strategy for the implementation of IoT, along with a practical path to data utilization. A smart home strategy is imperative to systematically identify customers, craft value propositions tailored to the unique requirements of each segment, establish IoT use cases to support these value propositions and execute effective go-to-market plans.

Customer benefits may include fewer disruptive claims and access to solutions that aim to mitigate losses from things like fire, water damage or intrusions. These innovations can serve as the next stride into the future of home insurance by improving the value proposition for homeowners.

Over the past seven editions of the IoT Insurance Observatory, peer-to-peer discussions between members such as State Farm have highlighted the results obtained using IoT data in both personal and commercial lines.

IoT can be harnessed at various stages of the homeowner insurance value chain, bolstering the insurer’s capacity to evaluate, mitigate and transfer risks. It also can play a pivotal role in fostering customer engagement and retention. Moreover, it helps to provide more comprehensive insights into risks.

Enhance Customer Experience

Smart home technology has the potential to forge novel homeownership experiences and strengthen customer relations. This constitutes a relevant motivation for embracing IoT in the realm of home insurance. Meaningful interactions with customers have been demonstrated as an effective means to cultivate greater loyalty and differentiate from competitors.

These concepts are highlighted by State Farm’s relationship with ADT. In September 2022, the insurer unveiled a $1.2 billion equity investment in ADT Inc., along with the creation of a $300 million opportunity fund. Their strategic collaboration provides a glimpse of what the future of the smart home ecosystem may look like for insurers.

In March of this year, an exclusive offer was launched for State Farm customers, where new and existing eligible homeowner customers in participating states are able to buy an ADT home security system, including professional installation, for no upfront cost—and with significant savings on monthly monitoring costs. Program integration also allows customers without an existing security system discount to receive a discount on their home insurance premiums. A strong belief in the opportunity paired with positive customer sentiment has led to rapid program expansion, reaching 13 states by the end of the summer with more on the way.

Impact the Core Insurance Processes

In addition to its work with ADT, State Farm has partnered with Whisker Labs to help prevent fire losses. Whisker Labs’ Ting smart plug monitors a home’s electrical wiring to detect common electrical issues that can lead to fires. When a risk is detected, Whisker Labs notifies the customer, helps them locate the potential hazard and—when necessary—coordinates with a licensed electrician to get the issue resolved.

Central to the State Farm vision for smart homes is the aspiration to transition from recovery to the ability to help predict, intercept and prevent losses, relying upon products like ADT and Ting. This vision about evolution of the insurance promise, which was explored in the 2021 Carrier Management special feature, “Insurance is Getting Connected,” has garnered the embrace of an increasing number of carriers worldwide with each passing year.

Ting is currently being offered to State Farm customers with a current, non-tenant homeowner policy in 44 states and the District of Columbia, entirely free of charge. This offer includes three years of monitoring services, a lifetime warranty on sensors and a $1,000 credit to cover needed repairs by a licensed electrician if a hazard is detected.

More than 460,000 homes insured by State Farm are now monitored by a Ting sensor. Since the program’s inception in 2020, Ting sensors have detected over 5,700 hazards inside homes or their incoming utility grids. Customers have shared numerous “success stories,” with many citing instances of imminent electrical fire loss prevention.

The successful scaling of the relationship with Ting represents a critical step toward what State Farm believes to be the future of insurance. These “predict and prevent” efforts are ripe for exploration, especially when it comes to covered water-related losses. Potential solutions are currently being tested to gain a better understanding of consumer sentiment and determine the viability of future offerings, home telematics integration and policyholder education.

Smart home capabilities and assets can empower insurers to deliver near-real-time alerts to their policyholders and engage them in proactive steps to mitigate or prevent significant claim events. Through loss mitigation smart home vendors, State Farm harbors the ambition of preventing 20 percent of losses related to fire, water and theft (which account for approximately two-thirds of all homeowner insurance losses).

Insurers have the unique opportunity to leverage an extensive reservoir of data generated by smart home devices. State Farm is working to apply this data to consumer education through the creation of the “home health score,” which is intended to develop a deeper understanding of long-term risks while providing customers with proactive advice to help them improve their score.

With the right plan, this data could also be used to establish benefits like a reimagined claims management process. In the spring of 2023, State Farm obtained a patent for an IoT-driven claim process. This innovative approach may create efficiencies for policyholders and may also provide insights to the claim handler to support them in better serving the customer.

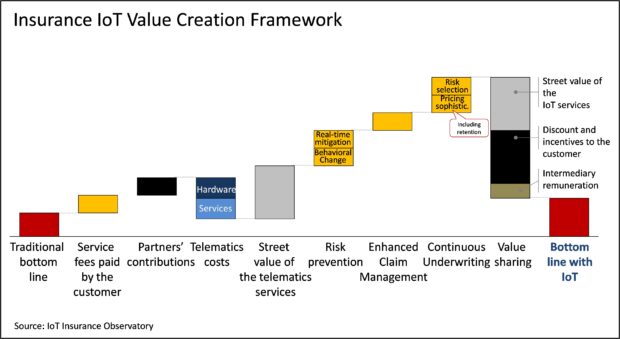

The effects of IoT on the fundamental insurance processes can enable the creation of additional economic value within the insurer’s portfolio. This incremental value can then be shared with policyholders, as elucidated by the IoT Insurance Observatory’s iconic value creation framework.

Additional opportunities include the positive externalities that benefit society, stemming from the wrapping of prevention services into traditional risk transfer contracts. Moreover, there is potential to develop new insurance products inspired by the insights derived from the extensive data generated by smart home sensors. In this scenario, the execution of a thoughtful smart home strategy may not be a nice-to-have goal. Rather, it may be essential to remain competitive going forward.

Execute a Platform; Play and Develop Capabilities Along the Journey

State Farm envisions a future where virtually everything within the sector is interconnected based on the belief that a platform-based approach to insurance is the best way to capitalize on the availability of data and create a seamless customer experience. In essence, State Farm is looking to reinvent the insurance industry once again, by leaning into a model that doesn’t just price, protect and recover. State Farm is proactively seeking ways to integrate experiences and predict and prevent loss.

Insurers with the ambition to remain relevant must possess the capability to master connected platforms, specifically those related to IoT. This knowledge should be democratized throughout the organization via advanced digital assets like digital twins, serving as the foundation for delivering and overseeing an interconnected suite of services within a unified customer experience. Moreover, this knowledge will be fundamental to orchestrate an ecosystem of alliances and to be capable of defining a platform strategy, whether open or more restricted, that fits best with a carrier’s corporate goals.

We need to be aware that there are barriers and blockers to achieve this ambition, including legacy technology stacks, risk aversion, tight regulations, slim margins. It is up to us as innovators to find ways past these challenges and develop the necessary capabilities for the insurer of the future.

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes