It is clear that traditional end-to-end business models are breaking down in every industry, including insurance. In the digital era, the standards of service are continually rising, making it increasingly more difficult for any single firm to deliver the seamless experience that customers expect. As customer demands for flexibility and integrated experiences grow, more insurers are recognizing and leveraging digital ecosystems to reinvent their products and services. With benefits such as better risk management, reduced claim cost and new sources of revenue, digital ecosystems can drive greater economic value and relevance for today’s insurance companies.

Executive Summary

With benefits such as better risk management, reduced claim cost and new sources of revenue, digital ecosystems can drive greater economic value and relevance for today’s insurance companies. Most insurers, however, are not yet ready and even lack the foundations to successfully execute insurance ecosystems. But that shouldn’t be an impediment, according to authors Matteo Carbone and Atanu Sarkar. Here, they explain how and why insurers should have a plan for incorporating ecosystems into their business models so they can better compete.However, most insurers are not yet ready and even lack the foundations to successfully execute insurance ecosystems. Rooted in legacy systems and siloed business structures, the majority of insurance organizations will likely struggle in transitioning from traditional insurance offerings to tailored, ecosystem-driven customer experiences. Nonetheless, insurers should have a plan for incorporating ecosystems into their business model to better compete in the growing digital landscape. It’s time for all insurers to become InsurTechs.

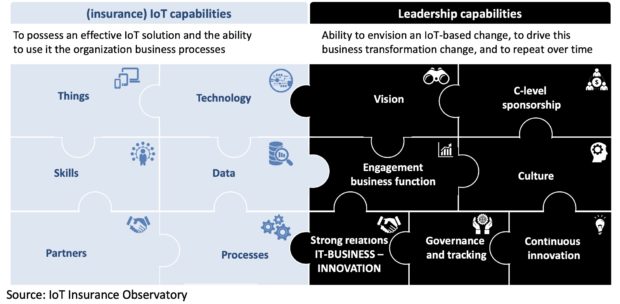

As opposed to the traditional business model where insurers create and distribute end-to-end products and services, an ecosystem model is characterized by unified/digital platforms that incorporate third-party products and services, as well as collaborate with segment-focused distribution partners. To deliver meaningful value, carriers must either bundle value from others with their products (e.g., providing IoT-based real-time risk mitigation services) or provide value to a bundle that someone else is creating (e.g., insuring the service performance delivered by an IoT service provider). Based on the IoT Insurance Observatory research—a think tank focused on North America and Europe with almost 60 members, including many of the largest insurance and reinsurance groups and prestigious tech players like ValueMomentum—the adoption of IoT is a business transformation that requires a robust and articulated set of capabilities as represented in the following figure.

Any insurance IoT program is a multiyear journey that requires overcoming functional silos, coordinating the different stakeholders and developing a collective intelligence to drive the IoT-based transformation of business processes. Partners can significantly contribute to insurers’ IoT journey. The adoption of IoT will enable insurers to achieve four different kinds of goals:

- Positively impacting core insurance activities (assessing, managing and transferring risks) by using IoT products and services for continuous underwriting, claims management and risk reduction. This goal was investigated in depth in our previous article, “Chloe and Insurance: A Love Affair.”

- Providing positive externalities to society, a topic more and more relevant due to the current focus on ESG investments(environment, social and governance).

- Generating new knowledge about policyholders and their risks. This knowledge has allowed carriers to insure current risks in a different way, enable up and cross-selling actions, as well as insure new risks.

- Improving customer experience by enhancing proximity and interaction frequency with them, therefore moving beyond the traditional risk transfer. Many players are selling additional services for a monthly fee; others have found new ways to sell insurance coverages thanks to IoT.

Even to enable new ways to sell insurance coverages, partnerships are a key differentiator. Some insurers recognize the importance of partnerships to expand their market reach and have recently announced bold initiatives to exploit this ecosystem opportunity. One such insurer is Nationwide, which recently disclosed its partnership portal that exposes its services and protection products—including UBI auto insurance and connected homeowner insurance—to partners.

With more than half of insurers delivering on their core systems modernization projects in recent years, it’s time that insurers leverage data coming from their core systems to grow their business. By integrating IoT devices data to the core system data and leveraging this data fusion, insurers will have the opportunity to build a more holistic view and understanding of their customers and their risks. This digital twin of the policyholder represents the enabler for exploiting the full potential of these data. Mastering digital twins not only will help insurers tailor their services and offerings and improve their customer experience, ultimately leading to better customer retention, but also to overcome the business line silos, enabling upsell and cross sell of their products and services.

Many senior insurance executives acknowledge that the world will be more and more hyperconnected and that they have to define their organizations’ role in this connected world. And although many insurers today have ecosystem as a topic in their agenda, the vision of how to exploit the usage of IoT in their business processes has not yet been realized and integrated in a meaningful way. To lead an IoT-based business transformation, a clear vision and a structured and well-communicated plan on how to achieve it are necessary.

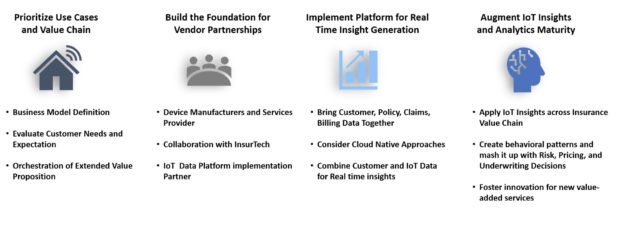

Technology is one of the key enablers of this transformation. However, insurers will have to carefully investigate, determine, prioritize and experiment with a range of IoT business use cases to develop an IoT-based business model that will orchestrate and extend their value proposition. Many insurers are exploring a range of scenarios beyond connected cars, including connected homes, health and lives, infrastructure, factories, and transportation. A comprehensive approach to help insurers build out the required capabilities for IoT is below. This InsurTech approach takes insurers from business model definition to vendor partner strategy, to platform implementation and finally to IoT insights across the insurance value chain.

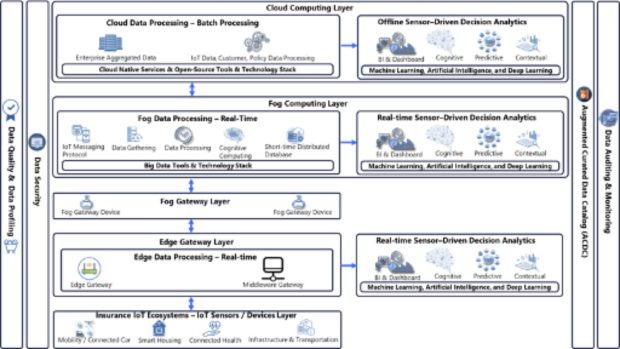

A main challenge for insurers when it comes to leveraging IoT is building the technology architecture to aggregate, normalize and analyze data to make it available for the IoT platform to draw data-driven insights. A big question for many is: How do I get started? An effective way to develop your architecture is by leveraging frameworks.

The framework below breaks down the broad portfolio of technology components, services and capabilities required to provide the computing need to arrive at real-time or offline sensor-driven insights for a multitude of insurance IoT use cases. The components are arranged in three layers—Edge, Fog and Cloud computing—addressing where data should be stored and processed for speed, cost and effectiveness, depending on the type of data and purpose of the data.

The collection of managed and platform services shown in the framework, across Edge and Cloud computing layers, connects, monitors and controls IoT assets and the processes that generate data for insights and analytics to integrate with the insurance value chain. These services work together across multiple layers that includes the IoT ecosystem—such as sensors, devices, industrial sensors—and connect to the computing infrastructure at Edge, Fog or Cloud persistently or intermittently.

Data collected by the IoT ecosystem is then processed and analyzed at the Cloud Computing layer, along with enterprise datasets such as customer, policy, claims and billing data. All of this data forms the inputs to the digital twin, which can then be turned into actionable outcomes using the latest computing techniques.

For insurers that are currently investing in IoT, and for many more that are considering doing so, this framework can help act as a guide to plan their approach as well as develop an ecosystem strategy that is grounded on a strong architectural foundation.

As new waves of technology or sudden social shifts bring disruptions or opportunities to the industry—similar to telematics or digitalization—an insurer’s ability to rapidly capture opportunities as they present themselves is critical. Today, success—and survival—are interdependent. Insurers that can reinvent themselves as key players in the digital era by leveraging data and forming ecosystems to bring additional and new value streams to their customers will be the ones who are successful.

After all, the digital economy is a “made for me” economy, and the digital twins allow insurers to better deliver a tailored insurance experience. Customers will continue to reward organizations that understand their needs and provide them personalized value.

There already are examples of successful insurers—in different business lines and different geographies—that have been able to effectively integrate IoT into their business strategy. Their stories are based on the usage of IoT data to improve insurance activities and demonstrate that mastering the usage of IoT is an achievable target for insurers without investing hundreds of millions, but instead by leveraging the right partnerships along their innovation journey.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford