The insurance industry has always operated in cycles. Natural disasters, seasonal weather patterns and unexpected catastrophic events create predictable surges and lulls in demand.

Executive Summary

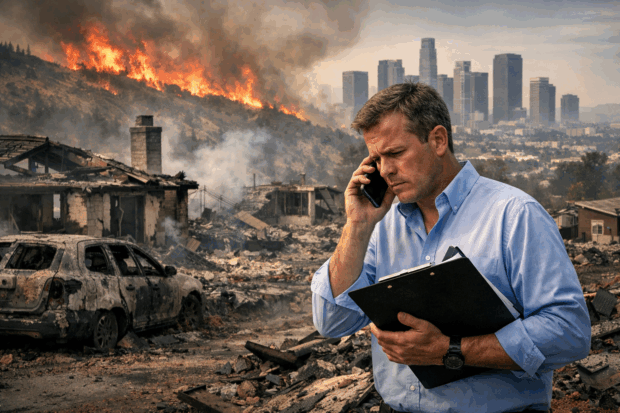

Referencing the dual challenges that California's insurer of last resort faced in the wake of last year's January wildfires, Peter Crowe and Nick Lamparelli revisit the idea of elastic staffing. They argue that insurers should adopt elastic models to maintain resilience, protect customer experience and avoid employee burnout during periods of extreme volatility.Related article: Adapting Insurance Talent Models for a More Volatile, Tech-Driven Market

What remains far less predictable is how severe those surges will be and how many operational fronts they will hit at once.

The anniversary of the 2025 Los Angeles wildfires highlights a particularly pressing issue: how insurers manage sudden, simultaneous spikes in claims and new business. This challenge is not unique to California but underscores a broader vulnerability within the insurance sector, one that demands innovative solutions to ensure operational resilience.

The 2025 LA Wildfires: A Dual-Spike Stress Test

The 2025 LA wildfires were a stark reminder of the destructive force of nature and the financial toll it exacts on individuals, communities and insurance organizations. For California-based insurers, the aftermath was particularly challenging. The California FAIR Plan, the state’s insurer of last resort, faced an unprecedented scenario: a simultaneous surge in claims from policyholders impacted by the fires and a dramatic increase in new business from homeowners seeking coverage after private carriers exited high-risk markets.