There is little uncertainty that commercial auto is in a time of turbulence. Between the enormous claims payouts, increasing claim frequency and escalating issues with driving behavior, something needs to give. Adding to recent reports of problematic performance, the retired chair and CEO of CNA Financial, Thomas Motamed, boldly referred to it as the “black eye” of commercial lines on a third-quarter earnings call last year.

Executive Summary

The “black eye” of the commercial lines segment—the commercial auto line—is crying out for insurer investments in data and analytics, according to Valen Analytics CEO Dax Craig, who graphically illustrates the prospect of finding hidden pockets of profitability.Insurers need a new path forward, and traditional methods for gaining insight into policies aren’t cutting it. Similar to other lines, like workers compensation, which were historically unprofitable and troublesome to manage, commercial auto can begin to shift from volatile to profitable through the use of advanced analytics.

Current “Barriers to Success” for Commercial Auto

Commercial auto’s shaky position in property/casualty insurance is underscored by insurers making broad brush risk assessment decisions based on entire classes of business and feeling beholden to soft market cycles. There are ways to achieve price profitability, but many insurers are not equipping their underwriters with enough data to identify and price the risks appropriately at the individual policy level.

Investing in advanced data and analytics allows insurers to create their own market competition and achieve profitable pricing by simply knowing more about what they insure. If a competitor seems to be pricing too aggressively based on the market, are they making poor decisions, or do they know something other insurers don’t?

In prior articles published by Carrier Management, Craig and other representatives of Valen Analytics have repeatedly stressed that neither analytics nor underwriter judgment alone is the panacea for profitability that will help carriers break free of market cycle pricing. Combining both provides the best results for carriers.

See related articles:

When the competition has access to more granular data on policies than the incumbent insurer, it allows for a better risk assessment and leaves others susceptible to adverse selection, an insidious threat that is felt only after the damage is done. The insurer lacking the data to make well-informed decisions is unknowingly stacking its book with the high-risk policies left over from data-driven insurers.

An impending update to outdated ISO rates aims to deliver some relief to the current problem in commercial auto, providing a new baseline for all insurers to reference and improve upon. Regardless of how industrywide rates improve for commercial auto, achieving a competitive edge and protecting an organization from adverse selection requires individual improvement in risk selection and pricing.

Analytics Allow Carriers to Write Better Risks in Uncharted Territory

Underwriters are tasked to protect profitability in a very difficult commercial auto market and require the advanced tools to compete for the better risks effectively. Traditional rating factors like vehicle type, weights and driving radius can only go so far in helping underwriters select the best risks for their portfolios. It’s imperative to know more about the individual driver behavior to gain a holistic view of commercial auto risk and to be able to differentiate very similar risks like types of vehicles or vehicle classes. Without the granular level of insight provided by advanced analytics, underwriters are often forced to play it safer and price policies too similarly. This results in the better risks subsidizing the worse risks. Underwriters will do a decent job at separating good and bad risks from each other, but it won’t be significant or consistent enough to turn around this highly unprofitable line.

Using analytics provides a level of confidence that traditional pricing can’t because it offers a heightened level of precision into each risk assessment. However, that doesn’t negate the expertise of seasoned underwriters. Analytics combined with human expertise is the proven results winner. Insurers that rely on data-driven decision-making, guided by an experienced underwriting team, will know when to compete and when to walk away from a policy. Those that believe the soft market has the overriding control on pricing put their book in jeopardy when competing against analytics-driven insurers that are comfortable allowing an unknowing insurer to scoop the business at an inadequate price.

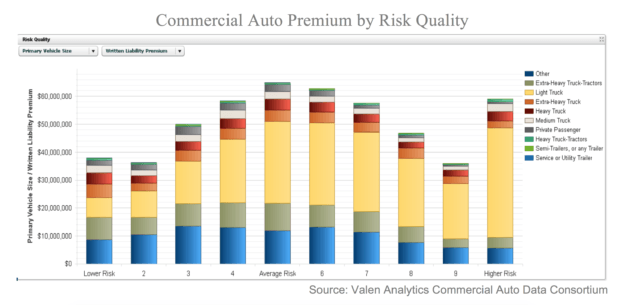

Despite a commonly held belief that there are types of vehicles inherently at higher risk, Valen research shows that each type has pockets of great business that insurers, without the advanced data insights, can’t identify consistently.

The chart below (click to expand) contains the distribution of risks from $510 million in premium within Valen’s commercial auto data consortium. These risks are separated into 10 bins, the left bin being the lowest-risk policies and the right being those with the highest risk. Each bin is separated by an equal range of the expected pricing credit or debit determined by the predictive model (e.g., bin 5 is 0-5 percent credit, bin 4 is 5-10 percent credit). The different colors on each bar represents a different vehicle type that makes up each bin. For example, light trucking (yellow) has a large amount of high-risk policies, but it also has risks dispersed across all the bins. This shows that writing business solely based on the type of vehicle is an imprecise means of evaluating risk, which can be rectified with analytics. Armed with greater knowledge, insurers can expand their scope and write profitable business in previously untouchable areas.

The Time Is Now

Over the last 10 years, underwriting analytics has been the catalyst for both personal and commercial lines to better understand risk quality. It’s no longer tenable for an entire line of business to accept poor underwriting performance—it introduces a tremendous amount of risk. Through smart use of analytics, commercial auto insurers can achieve both stability and profitability that few have today.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit