Although insurance companies that may have wanted more reinsurance coverage going into the 1/1 renewals elected to close their wallets in the face of rising rates, they will ultimately seek that additional cover, a reinsurance leader predicted Wednesday.

Speaking during an earnings conference call during which his company reported breakeven 2022 underwriting results for its property reinsurance business, RenaissanceRe Chief Executive Officer Kevin O’Donnell reviewed the dynamics of the Jan. 1 reinsurance renewals and what’s ahead for midyear.

“Going into the renewal, we expected significant supply and demand imbalance for property-cat reinsurance that would drive material rate increases in the range of 50-100 percent,” O’Donnell said, noting that when cedents recognized that the reinsurance market would remain disciplined on rate as the late renewal finally moved forward, the budget-conscious cedents responded by “increasing retentions, restricting coverage and restructuring programs.” They also kept limits flat (albeit, more remote given the higher retentions), he reported.

“These changes benefited us, in particular, as our underwriting expertise and flexible capital allowed us to execute in a structurally shifted market to increase profit, reduce risk and better diversify our portfolios,” O’Donnell asserted.

“The increased demand we anticipated was retained by insurers, as at the time they were unwilling to pay additional rate this marginal demand would require. Over time, we expect this risk to return to the reinsurance market as macroeconomic forces such as inflation and climate change continue to drive overall risk in the system.”

From RenRe’s perspective, O’Donnell foresees his company as a beneficiary of the increasing demand when it comes back to market. “We will always have the most efficient capital to assume property-cat risk, so it should ultimately sit with us,” he said referring to RenRe’s ability to place catastrophe risk on its rated balance sheet or into the capital markets through various joint ventures and special purpose vehicles (collectively, RenaissanceRe Capital Partners).

At 1/1, “buyers ultimately made a wallet decision as to how much they wanted to spend. [But] I don’t think their appetite for how much they want to buy has diminished. And I believe that what we’re experiencing is a bit of a delay in that limit coming to the market, which will add to the sustainability of the price hardness that we’re seeing,” O’Donnell said later, responding to an analyst’s question about 1/1 surprises. “I’m not concerned about it because I do think the capacity needs to come to the market and I think if it does come to the market, we’ve got the capital and the structuring capability to be able to service them,” he said.

Referring to Jan. 1, 2023 as the “most pivotal” and the “strongest renewal” in the company’s history at different points on the call, and also reporting that the goal he set out for investors and analysts at the end of last year’s third quarter—to put forward a “step change” in property-catastrophe reinsurance pricing—was accomplished, O’Donnell added that “the most dislocated part of the property market, U.S. risk, mostly renews at midyear.”

RenRe is ready. Among other actions, the company is reallocating capacity to its property-cat reinsurance book from its other property business as property-cat reinsurance conditions improve.

“We remain committed to being a global P/C reinsurance company at scale and a leading underwriter of property-catastrophe risk,” O’Donnell said during opening remarks as he reviewed an upward trajectory in operating earnings from 2021 to 2022—two years that had similar levels of industrywide catastrophe losses. “We have chosen to occupy this position because it is a critical link in the insurance value chain where we have a competitive advantage surveying the insurance landscape.”

“We have chosen this position because it is the most effective means for us to deliver superior profitability to shareholders over the long term,” he said.

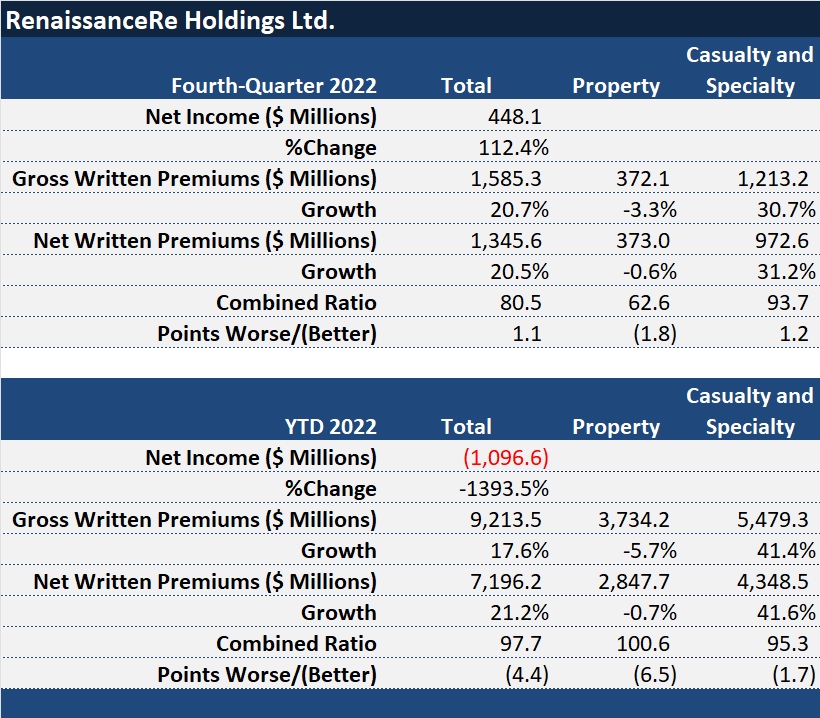

RenRe has also been diversifying its book. In fact, the growth engine for the business last year was casualty and specialty business, which represented 60 percent of the RenRe 2022 book compared to less than half in 2021. Diversified earnings streams, O’Donnell said, have “provided us the confidence to maintain our strategy and continue being a leading writer of property-cat reinsurance. That said, in 2022, we challenged our underwriters to optimize our property portfolio, and throughout the year we targeted improved profitability.”

In the end, while casualty and specialty net premiums grew 42 percent to $4.3 billion on a book with a mid-90s combined ratio, property remained flat at $2.8 billion with a 100.6 combined ratio—6.5 points better than the prior year.

Asked about rumors that capital would be coming into the market adding to the supply of property-cat capacity at midyear, O’Donnell speculated that it would come in the form of third-party capital rather than a “Class of 2023.”

Asked about the impact of Florida reforms, O’Donnell said that while he was pleased that steps are being taken to improve the health of that market, they would not change RenRe’s appetite, which shifted away from local Florida insurers toward larger national writers back in the early 2000s. Rate and appetite points will be more important drivers of how RenRe structures the portfolio, he said.

O’Donnell also gave his take on conditions for casualty and specialty during 1/1 renewals, noting that while rate increases are starting to slow in general liability lines and rates are reducing in directors and officers liability, the market was very dislocated in some specialty classes, including marine, energy and terror, where RenRe quoted significant lead lines in cyber and aviation.

As for 2022 results, in addition to the underwriting results shown on the accompanying charts, Chief Financial Officer Robert Qutub reported on higher levels of investment income for 2022—the result of rotating the portfolio into more current yields in recent quarters—and stable fee income from RenRe’s third-party capital management activities. During the year, RenRe raised $1.4 billion of third-party capital in the Capital Partners business and also raised just over $400 million more effective Jan. 1, 2023.

While operating income was $315.6 million for the year, net realized and unrealized losses on fixed maturity investments of $1.4 billion drove a net loss on the bottom line.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit