When consumers decide what to buy, they want companies to treat them as individuals: “Do you know my unique needs?” and “Will you be there for me when I need you?”

Executive Summary

“Do you need to call 911?”To give customers peace of mind, Allstate launched Crash Detection in 2020, free for customers enrolled in Drivewise telematics program, giving those customers quick access to emergency help through the Allstate mobile app.

That’s just one example of how Allstate leverages the dynamic, expanding capability of telematics to deliver personalized value for customers, according to Allstate’s Susanna Su and the IoT Insurance Observatory’s Matteo Carbone.

Telematics helps Allstate customers get the best rates based on their driving, but price isn’t all customers care about. An Observatory survey conducted with Swiss Re found that automatic emergency assistance and anti-theft support ranks close behind safe-driving rewards.

For insurers, the answer to these questions lies in offering increased value. Carriers need to deliver experiences that go beyond premiums and claims to exceed customer expectations and gain their trust.

Technological evolution further amplifies this interest, as customers’ protection needs become more complex. Insuring connected cars, electric and autonomous vehicles, and ridesharing prompts questions for carriers:

- “How much is this protection designed on customers’ unique needs and risks?”

- “Will customers feel more control in the face of more choices?”

- “What more value can be delivered to gain higher engagement and trust from customers?”

Telematics makes it possible to understand customers’ individual needs and provide personalized solutions and value as those needs evolve.

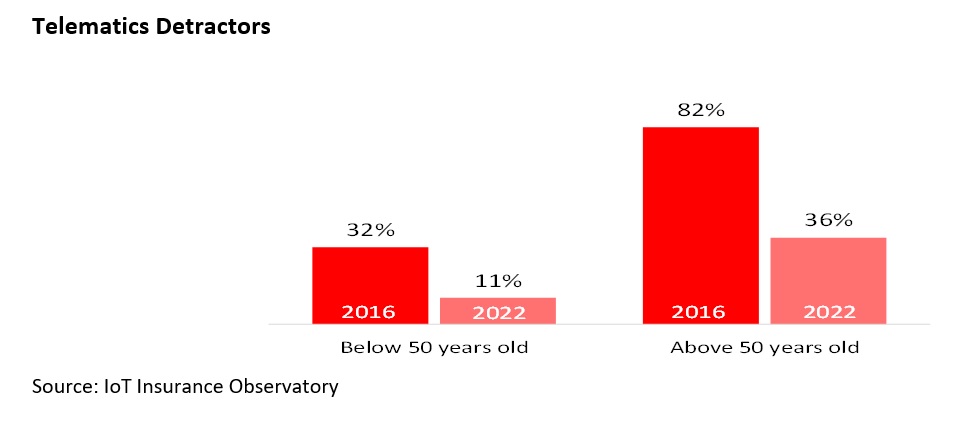

When presented with an app-based telematics program that monitors driving behaviors and provides rewards for safe driving, crash assistance and other services, more than 50 percent of U.S. respondents in the 2022 Swiss Re and IoT Observatory survey (10,000 worldwide/2,000 U.S.-based) said they would recommend it to a friend. A mere 23 percent were reluctant, saying “no” or “definitely no.” This resistance has markedly diminished among customers: The primary detractors (above 50 years old) are now at 36 percent, compared to 82 percent in a similar survey in 2016.

Allstate was the first major U.S. insurer with a continuously connected mobile telematics product. Over the past decade, the company has built a remarkable success story, as Allstate and the IoT Insurance Observatory shared with Carrier Management in 2022. (“Telematics Has Kept the Promise: Allstate’s Journey Continues” by David MacInnis and Matteo Carbone, June 28, 2022)

The foundation of telematics is simple: Customers share data to obtain benefits for safe driving. Nearly one-third of Allstate brand auto customers opt into telematics when they purchase a policy, and Allstate’s usage-based insurance portfolio has grown at over a 15 percent compound annual growth rate since 2020.

For Allstate, telematics is a dynamic, expanding capability that makes it possible to deliver personalized value for customers while accelerating the company’s transformation to provide affordable, simple and connected solutions:

- Affordable: Customers have access to high-quality protection at a low cost that meets their needs.

- Simple: Customers have easy, hassle-free experiences, no matter how they interact with their insurer.

- Connected: Customers are connected digitally and feel like we know them, their situation and how to best meet their needs.

Looking at the UBI story worldwide, saving on insurance premiums has been the primary reason for a customer to choose telematics. With the cost of seemingly everything on the rise, customers are looking for ways to save on auto insurance. That’s why telematics has expanded in the U.S.

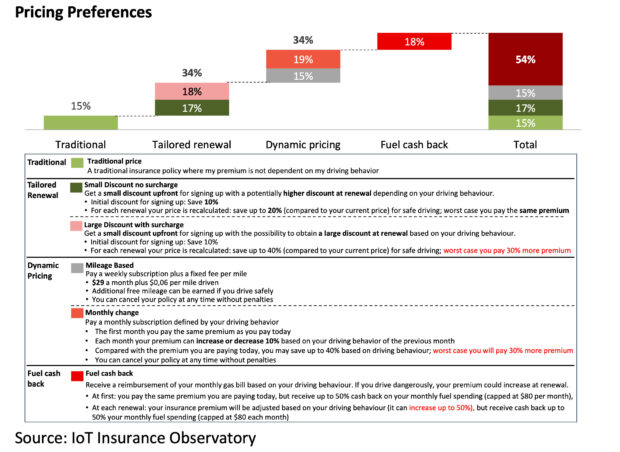

But remember: Customers don’t all have the same needs. Even when it comes to saving money, their preferences vary. The IoT Insurance Observatory and Swiss Re asked drivers their preferred pricing methods. Two significant takeaways emerge from the survey:

- Diverse saving preferences: There is a wide spectrum of preferences, ranging from a proclivity of traditional rate plans to benefits through fuel cash back based on driving behaviors. There is a significant opportunity for insurers to tailor their UBI offers based on customers’ distinct preferences.

- Benefit-driven interest: Customers are more attracted to offers with the highest possible benefits by using their driving behavior data, even with potentially higher premiums. The three most preferred propositions (shown with varying shades of red in the chart below) show that the respondents are not fazed by the prospect of surcharges related to poor driving behavior when presented with the higher possible benefits.

Allstate satisfies these customer preferences. With individual driving data, the insurer shows each policyholder what influences their price changes and how they can control them.

Allstate has two telematics programs to help customers save: Drivewise and Milewise.

- Drivewise personalizes the auto experience. It gives customers insights into their behavior to promote and reward safe driving. This data is also used to adjust the premium at each renewal.

- Milewise is a pay-per-mile product that invites drivers to “Drive Less, Save More.” Most Milewise customers drive less than 6,000 miles a year.

The appeal is improved pricing accuracy: Telematics helps Allstate customers get the best rates based on their driving. Individual driving and vehicle variables can more closely predict individual customers’ risks. Evolving to discount for good risks and surcharge for poor ones, Allstate has continued to see noticeable higher retention for good risks, with strong overall retention, and no noticeable difference in telematics adoption.

And now many new Allstate customers don’t have to wait until their policy renews to get the benefits of being a great driver. With their consent, the company can use driving and vehicle data from elsewhere, like family safety apps, when giving them a quote.

Yes, price is key when customers are looking for value, but it’s not all they care about. The more benefits an insurer can provide, the higher the engagement, loyalty and trust among their policyholders.

These benefits include a sense of safety and convenience, thanks to an ever-expanding range of features and services accompanied by Allstate’s hard work protecting customers’ personal information. IoT can help insurers build a new relationship with customers by enhancing simplicity, connectivity and personalization, and making their lives easier.

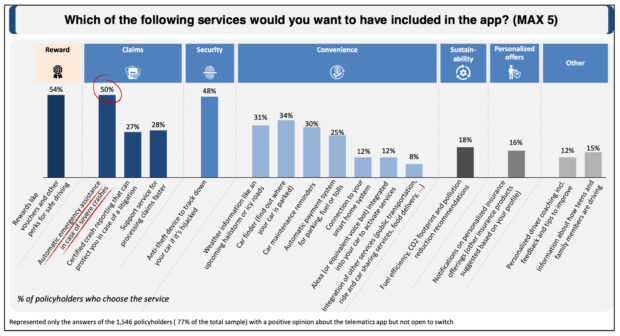

For insights, the IoT Insurance Observatory and Swiss Re asked drivers to pick their preferred app features. Among U.S. customers, the top three are rewards, automatic emergency assistance in case of an accident and anti-theft support. Conveniences like weather info, car location finder, maintenance reminders and claims support are also popular.

To give customers peace of mind, Allstate launched Crash Detection in 2020, free for Drivewise customers. It gives them quick access to emergency help through the Allstate mobile app. When the telematics system detects an accident, the customer is asked whether they need to call 911, start a claim or request roadside assistance.

If the app detects a serious crash, customers will receive a push notification from the Allstate mobile app to offer help. Customers can press and hold the notification or tap on it to see the help options:

- Call 911, using the customer’s prefilled phone number in the app.

- Request 24-hour roadside assistance or file a claim.

- Indicate if the crash is a false alarm (which is not required).

About 80 percent of Allstate telematics customers enable the notification function.

The Allstate mobile app has a long history of using innovation to make it easy for customers to connect with their protection and provide a seamless mobile experience that provides day-to-day value. Having telematics programs like Drivewise and Milewise integrated into the company’s flagship app means that customers can find everything they need in one place. Allstate telematics customers engage with the Allstate mobile app three times more than other Allstate (non-telematics) customers who use it, leading to higher satisfaction and retention.

The type of telematics utilization outlined in this article enables insurers to gain higher trust and loyalty by increasing benefits for customers.

Allstate will continue its transformation to meet evolving customers’ needs by leveraging telematics capability to unlock value through affordable, simple and connected solutions.

***

This article is featured in Carrier Management’s fourth-quarter magazine

Related articles include:

- The Tipping Point for Insurance IoT: How HSB and Its Partners Are Creating a Playbook for the Future

- Real-Time Data and Mitigation: How Tokio Marine Is Changing Risky Behaviors

- Repeat, Repeat and Repeat Again: How The Hartford is Embedding IoT Capabilities in Commercial Insurance Businesses

All of the articles in the magazine are available on the magazine page of our website.

Click the “Download Magazine” button for a free PDF of the entire magazine.

To be able to read and share individual articles more easily, consider becoming a Carrier Management member to unlock everything.

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs