Homeowners insurance is one of the most heavily regulated industries in the United States. Regulations aim to protect consumers from arbitrary rates and unfair practices and ensure that insurers can pay claims. Despite these common goals, the relationship between state regulators and consumer advocates is fraught with tension and disagreement.

Executive Summary

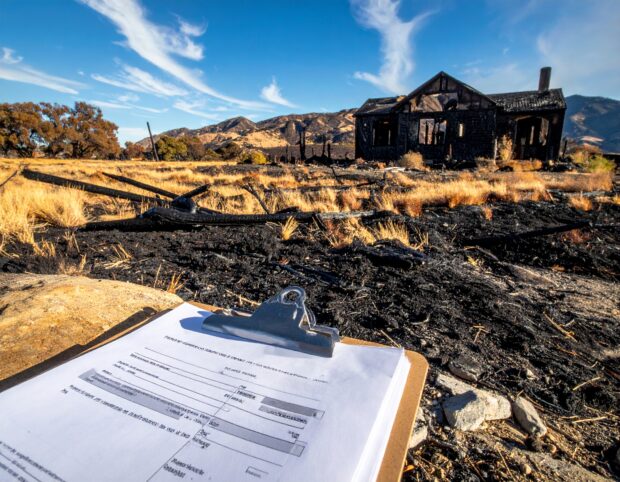

Industry experts and consumer advocates weigh in on former Disney and Amazon legal honcho Merritt Farren's regulatory proposal to assess a home insurer's claims practices in rate request proceedings. Insurance Journalist Russ Banham sought the opinions to compile this follow-up to an article titled, "The Good Neighbor," which we published in November. The prior article introduced Farren, who launched a months-long legal battle against insurer State Farm and the California Insurance Department as intervenor in a State Farm rate review hearing.Few people know this better than J. Robert Hunter.

From 1970 to 1980, Hunter served as the Federal Insurance Administrator under Presidents Ford and Carter, directing the National Flood Insurance Program. For a while, he was a Texas Insurance Commissioner. In 1980, with the encouragement and support of Ralph Nader, he founded the National Insurance Consumer Organization, which later merged its work with the Consumer Federation of America.

Although retired since 2022 and nearly 90 years old, Hunter, a Fellow of the Casualty Actuarial Society, continues to provide his actuarial expertise as an expert witness in consumer-related insurance cases. Having interviewed Bob innumerable times since the mid-1980s, an email from him regarding a recent article I wrote in Carrier Management involving the rare intervention of a single consumer in California’s rate setting process was unexpected: