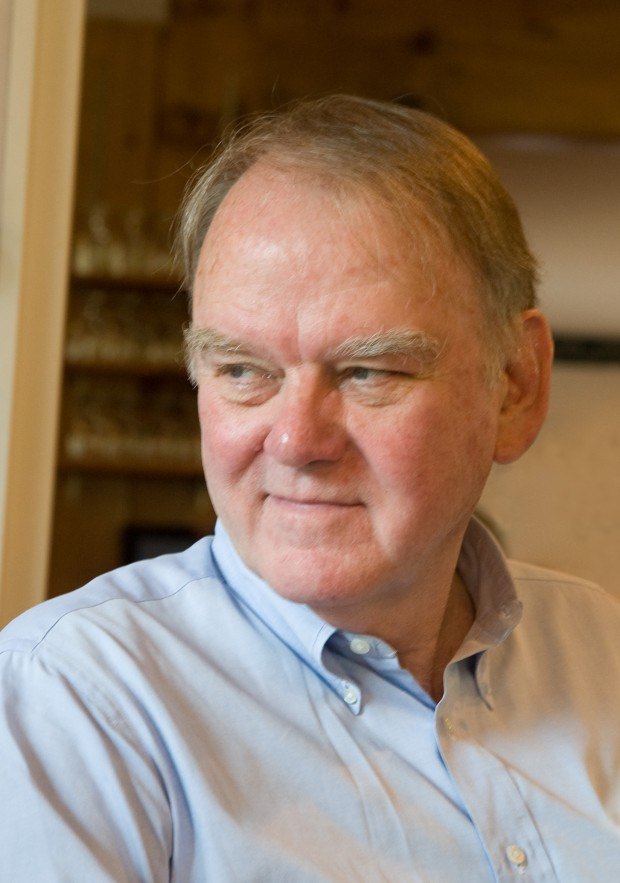

The man who served as the conscience of the property/casualty insurance industry for nearly three decades is retiring from a long-held post as director of insurance for the Consumer Federation of America.

The official statement from the CFA describes J. Robert “Bob” Hunter as the “father of insurance consumer advocacy,” announcing Hunter is retiring as the organization’s director of insurance after 27 years in the position, effective immediately. While Hunter will continue to serve in an advisory role as CFA’s insurance director emeritus, CFA’s insurance advocate, Doug Heller, moves into Hunter’s former role as director of insurance.

“For the past 40 years, the insurance industry has always had to ask themselves ‘what’s Bob going to say?’ whenever a consumer issue was on the table,” said Heller in a media statement. “It is impossible to quantify fully the impact Bob Hunter has had on the insurance market, its regulation, and its public policy,” he said.

The description of Hunter at the beginning of this article as the conscience of the industry is my own, but Heller, who worked with Hunter for 13 years, seems to be conveying the same idea. Hunter is a Fellow of the Casualty Actuarial Society, a designation we share. While my background in actuarial science informs some of what I write about today, Hunter has used the principles of actuarial science to ground every one of his analyses—analyses that he pulls together regularly to do good for society and to make industry participants think.

His work has been so inspiring to me that on occasions when I have thought about the possibility of embarking on a third career, I imagined following in his footsteps to do similar work on behalf of consumers.

There’s no third career in my future. It turns out that I don’t have the stamina that Hunter had. Here’s just a short summary (courtesy of CFA) of what he accomplished after working for 10 years as an insurance actuary in the private sector:

- Was hired by the United States Department of Housing and Urban Development in 1971 as Chief Actuary of the Federal Insurance Administration, an agency he would lead under Presidents Gerald Ford and Jimmy Carter.

- Was instrumental in achieving the flood insurance program’s early goals, creating the Liability Risk Retention Act and making insurance available in the inner cities through the implementation of the Riot Reinsurance Program and the Federal Crime Insurance Program.

- Served as Texas Insurance Commissioner.

- In 1980, founded and led the National Insurance Consumer Organization for 13 years.

- In the 1980s, pushed for a significant change to insurance ratemaking—getting insurers to include their projected investment income in ratemaking.

- In 1986, under contract with the California Legislature, wrote a seminal paper on California’s insurance market, which served as the basis for 1988’s historic “Voter Revolt” that enacted Proposition 103.

- In 1992, when Hurricane Andrew devastated Florida, proposed the moratorium on cancellations and rate hikes.

- In the early 2010s, uncovered the practice of price optimization, which bases premiums on the maximum amount that a consumer is expected to be willing to pay rather than calculating premiums based on projected costs, such as claims, overhead and profit.

- During the pandemic, called for insurance refunds to auto insurance customers who weren’t driving during COVID lockdowns.

Personally, I first worked with Hunter in late 2002, when I asked him to write an article for my previous publication supporting his view that an explosion in lawsuits was not to blame for spikes in medical malpractice premiums at the time. He complied with my request, providing chart after chart after chart confirming his view that an insurance cycle, and in particular, “an explosion in premiums charged by mismanaged insurers,” was at the root of the problem.

Representatives of industry trade groups have too often responded to Hunter’s deep data dives into industry practices with remarks like “Bob Hunter is at it again,” accusing him of “trying to make the data fit what he believes.” And that is literally the opening sentence of a Letter to the Editor that I received in response to Hunter’s article.

How did he respond? With a reasoned analysis of alternative data provided by the critic, carefully pointing out gaps in the data base and flaws in the alternate analysis.

Hunter’s work on price optimization in the 2010s prompted me to reach out to him to write another article when I started my role as editor of this publication. This topic struck a chord as he dove into what he views as the actuarial root of the problem with price optimization.

“Price optimization must be recognized for what it is: the rejection of actuarial standards for the sake of increased profits at the expense of unwitting policyholders,” he wrote. “Buying insurance is not like buying first-class plane tickets or jewelry, where willingness to pay may reasonably be used in price setting,” he continued, finally challenging his colleagues in the actuarial community with a question: “Will actuaries defend the unique role of the profession in setting prices, or will they cede that authority to the marketing departments?”

As the CFA pointed out in its media statement, Hunter, over the course of his career has been at the forefront of efforts to eliminate unfair and discriminatory pricing in the insurance markets, especially where those practices punish lower-income consumers. And his vocal opposition to price optimization is no exception. In short, he believes the practice discriminates against poor people and people of color, who tend to shop around less frequently than wealthier consumers, due to potentially fewer market options.

With the same problem in mind, Hunter pulled me into the fray to report on an event that provoked one of his recent crusades last year. This one involved what at least one of my readers referred to as an “arcane development” in the world of actuarial science. But to me, it demonstrated Hunter’s lifelong commitment to shedding the light on bad decisions in the P/C insurance industry. In this case, it was a decision by the board of directors of the Casualty Actuarial Society to rescind its “Statement of Principles regarding Property and Casualty Insurance Ratemaking“—the very foundation of the pricing methods that Hunter and I grew up with.

OK, maybe that does sound esoteric, but this is the document that says, “A rate is reasonable and not excessive, inadequate, or unfairly discriminatory if it is an actuarially sound estimate of the expected value of all future costs associated with individual risk transfer.”

In Hunter’s view, the board action to rescind that particular principle—and removing the required linkage between final rates and future costs—could open a back door for actuaries to label rates set using price optimization tools as “actuarially sound.”

Hunter didn’t just take the cause to the media (with articles showing up in the Auto Insurance Report and Reuters, in addition to Carrier Management) but he brought it to the attention of a task force of the National Association of Insurance Commissioners, which in turned reached out to the CAS to reinstate the principles.

I listened to that last meeting of regulatory actuaries on the topic, during which a CAS representative confirmed that the principles were back. The members of the NAIC task force repeatedly highlighted Hunter’s dogged determination in bringing the rescission to the attention of the committee in the first place—an effort that lasted more than two months judging from the back-and-forth correspondences I saw.

Hunter, for his part, told the group, “Regulators standing up strong together are quite powerful…A lot of times regulators are diffuse in their positions…But when they’re together, they have quite a bit of strength. And the insurance industry pays attention.”

The retiring consumer advocate and former regulator sometimes seemed like a lone voice fighting for justice when he felt consumers were being harmed by industry practices. He had his critics, but the industry paid attention. He made us think. He made us act. And he encouraged and connected with other consumer advocates to command that attention.

An article published in the Auto Insurance Report referred to Hunter as the “world’s most obstreperous actuary”—a description that Hunter really liked.

I’m partial to my own description as I reflect on Hunter’s career. “Conscience of the industry” seems equally fitting.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation