In our ever more interconnected world—from vehicles to manufacturers to health care to the power grid—solutions to avoid risk are becoming more common.

Our automobiles have evolved into veritable iPads on wheels, maintaining constant connectivity with their manufacturers. In the realm of business, access and building management have transitioned to sensor-driven automation systems.

Executive Summary

Risk prevention has been a key pillar of Tokio Marine Group’s global strategy for years, with many of its local insurance entities around the world marrying real-time risk mitigation solutions and behavioral change programs to their insurance products. Just one example is TMNF’s Drive Agent service, providing in-vehicle alerts to over one million drivers who are distracted, sleepy or in danger of crashing and resulting in a 13 percent drop in claims frequency.Here, TMNA EVP Robert Pick and CM Guest Editor Matteo Carbone also review the claims management benefits of Drive Agent, and other IoT-based services developed by Tokio Marine operations like Philadelphia Insurance and PURE in the U.S., targeting risk prevention for commercial and personal property policyholders in addition to drivers of individual cars and fleets.

Solutions are structured around sensors gathering data and wireless connectivity transmitting this information to the cloud. Here, automated systems process and add enriched data and intelligence, driving real-time informed decision-making and subsequently triggering actions. These actions can be executed by physical devices or, alternately, by humans alerted by the systems.

We may not even realize how much the Internet of Things (IoT) paradigm has changed our lives in the past few decades. The insurance industry has also significantly invested in this paradigm. Let’s think about using connected data for pricing in personal auto (the well-known UBI insurance) or creating parametric flood insurance coverage based on a device measuring the water level in a location. However, one of the most relevant opportunities for our sector has been using IoT-based solutions to prevent and mitigate risks.

In the past two years, from the publication the Geneva Association’s paper “From Risk Transfer to Risk Prevention: How the Internet of Things is reshaping business models in insurance” and the Carrier Management’s special “Insurance Is Getting Connected,” more and more insurance carriers have invested in this opportunity, experimenting with solutions and subsequently scaling select initiatives, yielding concrete results in keeping bad things from happening to their policyholders. In doing so, they have generated positive externalities benefiting society at large.

Insurers have wrapped prevention services around their traditional risk transfer solutions. Based on the research of the IoT Insurance Observatory, the initiatives have been focused on reducing the consequences of three different situations:

- An incident (insured event) already happened, such as detecting water leakage or an injured employee. Here, the insurer’s goal is to act as quickly as possible to mitigate the event’s consequences.

- A risky situation, such as a forklift operator speeding in a warehouse or anomalies in an electrical control panel. The insurer’s goal is to act in real time to avoid the risky situation from escalating into an accident and generating a loss. A complementary insurance approach is to introduce programs that promote less risky behaviors and practices, as a way to reduce the frequency of occurrence of these risky situations.

- Missed safety tasks—such as scheduled inspection or maintenance, bald tires—and out-of-order (or absent) risk mitigation systems—such as low pressure in the sprinkler system or a smoke alarm out of battery power. The insurer’s goal is to act proactively to restore the prevention capabilities. Even in this scenario, a complementary insurance approach is introducing programs that promote compliance with the safety task and the presence or correct use of risk mitigation tools.

Risk prevention has been a key pillar of Tokio Marine’s strategy. The group globally views risk management as a key part of the insurance ecosystem, benefitting policyholders, the carrier and even society. Many of its local entities around the globe have include dreal-time risk mitigation solutions and behavioral change programs in their insurance product.

In the U.S., Philadelphia Insurance Companies has led the way in telematics for Tokio Marine Group and the industry for commercial lines with PHLYTRAC (auto telematics) and PHLYSENSE (property telematics) over the last 10-plus years. In concert with broader groupwide InsurTech and digital initiatives, Philadelphia Insurance has included risk mitigation services and benefits in offerings for different personal and commercial lines, from auto to property to cyber.

In 2021, Tokio Marine launched Tokio Marine dR, a new data company, centralizing the group’s data and advanced analytics capabilities and managing a specialized risk data platform. This company is developing data-driven insurance products, creating IoT-based risk prevention services both for corporate and retail clients.

Real-Time Risk Mitigation

A real-time mitigation approach is the perfect archetype of IoT-based service: sensors monitor the insured asset, and data is constantly sent to the insurer. In the cloud, algorithms autonomously infer the emergence of situations necessitating intervention, proactively facilitating smart actions to address and resolve such circumstances.

The actions can be executed automatically by an IoT device, such as an automatic shutoff valve on a water line, or by human intervention, such as a frontline employee alerted through a text message sent by the system.

Over the past few years, Tokio Marine has experimented with a broad set of use cases and technologies for real-time risk mitigation to its policyholders. Tokio Marine’s U.S. high-net-worth personal lines subsidiary, PURE Insurance, has ongoing activities in place to recommend, and in some cases require, IoT-enabled water shut-off valves and, less frequently, water sensors. The insurer is currently running pilots, offered at no cost to their insured homeowners, a prevention solution addressing risky situations that can escalate to fire—the Ting solution (illustrated in the article “Creating the Tipping Point for Insurance IoT” in this Carrier Management special report)—and a water escape mitigation solution, the Ondo service (“LeakBot”), which is able to provide early detection of leaks. Both of these approaches are centrally monitored and generate alerts to the user and the monitoring organization, and ultimately rely on human intervention to solve the situation.

The same human-based, real-time risk mitigation approach is the foundation of the PHLYSENSE program. The service is based on small battery-powered devices that constantly monitor the temperature and detect the presence of water on the floor of commercial properties. The data, captured through the cellular network, is sent to the cloud, where algorithms detect anomalies (such as low or high temperature, or water detection), and a 24/7 support center monitors the anomalies detected, dispatching alerts (emails, SMS and phone calls). These alerts allow policyholders’ frontline employees to intervene, limiting the damage that can occur. Since 2020, Philadelphia Insurance has offered this solution at no cost to policyholders with commercial property coverages. Growth has been substantial, especially in the SMB space, where building management systems are less common.

In Japan, Tokio Marine & Nichido Fire Insurance Co. Ltd. (TMNF) has been offering automatic real-time risk mitigation for personal auto. Since 2017, the company has sold the Drive Agent service—based on a constantly connected camera with AI at the edge—to its current auto policyholders. For a monthly fee of $4 to $6, this multi-award-winning service, provides:

- A record of crash events, protecting drivers against third-party actions.

- The dispatch of proactive assistance, such as an ambulance, for severe impacts, which can mitigate the consequences of an incident that has happened.

- Alerts to mitigate risky situations in real time.

Using a speaker and a display near the rear mirror, these automatic alerts warn the driver of risky situations, such as distraction or signs of falling asleep, lane departure, risk of forward collision, and proximity to risky areas. This connected portfolio already has reached one million users, allowing TMNF to measure robust actuarial evidence about the risk mitigation results: a 13 percent reduction in the claim frequency emerges comparing the claims of this group of policyholders before and after using the service.

The recorded videos and telematics data are also used for claim management. AI is used to reconstruct the accident situation, providing valuable assistance to claim handlers. This methodology has enabled the carrier to curtail the time required for accident resolution by 15 percent, enhancing the client experience while concurrently affecting cost savings for the company.

Behavior Change

Human behaviors—exhibited by both personal lines policyholders and frontline employees in commercial lines—influence the risk exposure of many P/C perils. Consequently, expected losses can be modified by human behaviors during the life cycle of a risk. This has motivated numerous insurers to integrate behavioral modification initiatives within their policies, with IoT data as the cornerstone of these programs.

These approaches have been discussed at many of the IoT Insurance Observatory’s peer discussions, including the last one in Las Vegas on Oct. 31, by the over 100 carriers participating in this think tank’s seventh edition. Key ideas shared revolve around:

- Creating awareness about the level of risk and critical areas detected. In personal auto, numerous examples of telematics apps provide a detailed analysis of the driving behavior to policyholders. Similarly, in commercial auto, structured reports are systematically shared with fleet managers.

- Suggesting actionable changes to reduce the risks. The same personal auto telematics apps provide, acting on the rational angle, suggestions to improve the critical areas and gamification mechanisms to engage policyholders in a journey to change. In commercial lines, insights inferred from the IoT data are provided to loss control teams to support their risk advisory services to enterprise clients and more accurately suggest changes to reduce the incidents. Some workers compensation approaches deliver suggestions directly to frontline employees between shifts.

- Rewarding compliance with the suggested actions. Based on the IoT Insurance Observatory research, awareness and suggested behaviors are necessary but not sufficient to keep engagement and change habits. Rewards appear as a fundamental aspect in maximizing the effectiveness of behavioral change programs. For example, recent Federal Highway Administration research on driver distraction mitigation demonstrated the superior results obtained with weekly rewards. In commercial lines, the incentives should be designed at both enterprise and employee levels. There are examples in cyber insurance where the policy has a dynamic deductible: It is reduced when the level of compliance with the prevention tasks is above a defined threshold.

Tokio Marine’s subsidiary E.Design Insurance Co. Ltd. (EDSP) introduced an app and tag telematics auto insurance product focused on improving driving behaviors consistent with the carrier’s goal to create accident-free cities in Japan. The product uses the constant flow of driving data to provide trip reports to the policyholder, create awareness about the risky situations, and reward safe driving habits with perks such as coffee, ice cream, etc., at Starbucks and other affiliated stores.

EDSP picks up frequently occurring accident patterns and factors from its accident data and provides users with “driving themes.” Users are challenged on these themes and can get points by demonstrating an improvement. “Driving themes” include behaviors such as:

- Engaging in safety checks even on roads where the driver’s own car has priority.

- Considerate driving (e.g., driving at slow speed in residential areas, around schools, etc.)

- Being alert to changing conditions (e.g., whether the driver did not miss signs of fatigue, such as increased yawning and blinking).

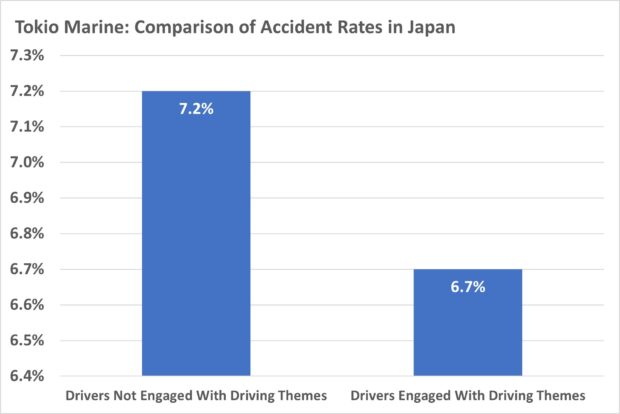

Data analysis by EDSP showed that the accident rate for drivers who engaged in the “driving themes” was lower than that for drivers who did not (6.7 percent for engaged vs. 7.2 percent not engaged).

Accumulated points in the range of 100 to 500 can be redeemed for rewards (e.g., 100 points for coffee, 350 points for Haagen-Dazs ice cream, 500 points for digital gift cards, etc.)

In the U.S., Philadelphia Insurance’s PHLYTRAC commercial auto program represents the recognized telematics best practice for safety. The carrier has offered, at no cost, a layer of protection to the fleets in its commercial auto portfolio since 2016. The fleets receive an OBD dongle for each vehicle. The data is used to provide periodic reports about driving behaviors, allowing policyholders’ operational managers to follow up with the drivers and implement changes to reduce the risks. More than 20 percent of Philadelphia’s insured commercial auto vehicles have adopted the solution, representing more than 1.8 billion miles protected. The company has measured double-digit reductions in claim frequency among these fleets.

The Future of Insurance

The insurer of the future will manage risk prevention, creating new revenue streams while improving the profile of risks written and the happiness of the insureds. This risk avoidance effort represents a societal benefit, as well.

To concretize this potential, carriers must have the vision to embrace new (and often changing) technology and develop peoples’ skills and operative processes to create and manage at-scale prevention services. Further, carriers must govern and integrate this additional IoT data into their data architecture.

Carriers must also work to both understand and overcome some longstanding barriers to adoption among personal and small business users. These barriers—namely concerns over data privacy and use—as well as difficulty in setup and installation, cost, and false alerts, remain challenges for adoption.

Data privacy and use are best addressed with clear, plain-language explanations as to what is collected, how it will be used and by whom. Setup and installation is naturally becoming easier and simpler as tech and devices improve. Similarly, as tech improves, costs come down, making the business case more sustainable for all stakeholders.

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers