Over the past several years, the property/casualty insurance industry’s use of Internet of Things (IoT) has significantly accelerated. Beyond auto telematics, P/C insurers—from major carriers to risk pools—have been implementing sensor programs to address property and equipment risks.

Executive Summary

Munich Re’s HSB has been at the forefront of the industry’s paradigm shift toward IoT.Here, Gordon Hui, SVP of HSB’s Applied Technology Solutions, and Matteo Carbone, founder of the IoT Insurance Observatory, describe the multiyear journey of HSB and its partners in using IoT to reduce non-cat property risks, enhance customer experience, improve sustainability and to innovate protection products—the four main drivers of IoT adoption outlined by IoT Insurance Observatory for the insurance sector. Continuing innovation includes using sensor data to trigger coverage of existing risks and developing performance guarantees for sensors tracking electrical hazards, potential water damage and the condition of machinery.

Overall, the philosophy of predicting and preventing loss has been well-established as the general trajectory of the industry, as highlighted in the Geneva Association-IoT Insurance Observatory report “From Risk Transfer to Risk Prevention.”

HSB (part of Munich Re), however, has been at the forefront of the industry’s paradigm shift toward IoT. The company develops and distributes specialty insurance products and services through independent agents and brokers, and through reinsurance arrangements with multiline insurance companies. One of those services is Sensor Solutions by HSB, which allows insurers to harness the potential of IoT through leading-edge technology, insurance expertise and programmatic support. Current clients include Nationwide, Liberty Mutual, Philadelphia Insurance, New York School Insurance Reciprocal (NYSIR), Insurance Board and The Hanover Insurance Group Inc.

Over the past five years, HSB sensors, powered by its IoT development arm and wholly owned subsidiary, Meshify, have been implemented in over 20 different business classes, including apartments and condos, schools, office buildings, and houses of worship, and have generated over 57 billion sensor readings. Currently, HSB has active sensor deployments in all 50 states, and the total number of sensor devices deployed has doubled every year for the past four years. (Related sidebar, “HSB: The Original InsurTech”)

Together, HSB and the IoT Insurance Observatory have supported the growth of IoT adoption in the insurance industry, and we see the industry at an important inflection point. While great progress has been made, the tipping point of insurance IoT has not happened despite its proven impact and diverse value propositions. HSB’s evolution in risk prevention toward IoT—and the insurance industry’s continued transition—highlights where the industry has been and where it needs to go to fulfill its IoT potential.

Transformation of Insurance: Analog vs. Connected

At its core, insurance has always been about assessing, managing and transferring risks. Insurance professionals have traditionally relied upon collecting and analyzing historical data: past claims and exposure data, traditional data loggers, and more recently, thermography or aerial imagery. Historical data and underwriting questionnaires play vital roles in the risk pricing process, and detailed reports are essential for sound decision-making in claims management and loss control measures.

Risk mitigation (loss control) has always been in the DNA of the insurance industry, but it was (or still is, depending on the insurer) a human-driven activity. The prototypical insurance risk management expert is “The Clipboard Guy”—an individual who carries a clipboard, such as an inspector, risk engineering consultant or a coach. In addition, tools such as surveys, checklists and video-based training are core to the experience. This traditional approach provides, at times, personalized and contextual risk management to the policyholder.

However, this traditional approach poses scalability challenges due to a pronounced reliance on specialized personnel, especially in the wake of rising labor costs and impending retirements. Consequently, these services are typically offered only with commercial and high-net-worth homeowners policies. Equally important, the lack of continuous data significantly impedes the insurer’s ability to proactively address potential risks or tailor coverages to reflect the true underlying risk evolution.

The new connected insurance paradigm is based upon smart sensors continuously transmitting real-time data to a platform where they can be analyzed and transformed into meaningful insights about a location’s environment, equipment or activity-related risks. This is the foundation to act: sometimes there is an IoT-enabled response, and sometimes human intervention is necessary.

The resulting impact on the insurance value chain is transformative. By integrating IoT sensors into insured assets, valuable sensing capabilities and algorithmic data are seamlessly incorporated into:

- Traditional risk assessment, which hitherto relied on proxies or inspector observations, and is now undergoing a momentous improvement in precision through IoT-derived insights.

- Claims adjudication, which was reliant upon manual processing and onsite evaluations, and can now be supported by objective evidence derived from sensor data.

Henceforth, IoT solutions, functioning as the conduit that links insurers with associated risks, will empower insurers to implement innovative approaches beyond the limitations of the conventional analog paradigm.

Toward a Connect and Protect Future

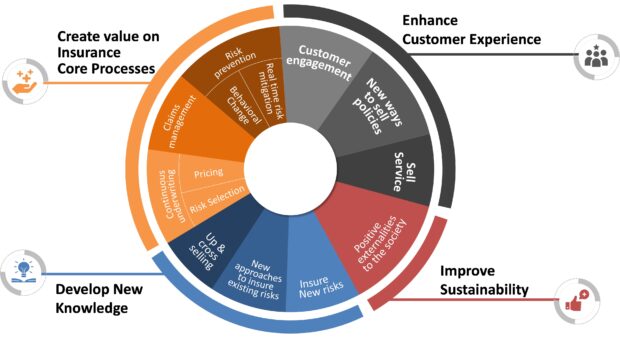

One of the core frameworks developed by the IoT Insurance Observatory highlights the four main drivers for IoT adoption in the insurance sector.

- Create value on insurance core processes

Insurers across different business lines and geographies have demonstrated the impact of IoT for risk reduction, claims management and continuous underwriting. Notably, IoT solutions unlock an entirely new model of risk reduction of expected losses through:

- Real-time risk management solutions designed to address specific insurance perils.

- Promotion of preventative risk management and behavior change by policyholders.

With this perspective in mind, HSB is focused on helping insurers and their policyholders migrate to a “Connect and Protect” future, where ubiquitous sensor technology and insights from insured locations create an unprecedented ability to proactively manage potential risks and mitigate peril situations from escalating in damage. By building customized programs that attack key insurance perils—notably non-weather water, fire and equipment failure—HSB helps IoT insurance clients reduce losses within their risk retention, thereby augmenting traditional risk transfer through InsurTech innovation.

A key differentiator of IoT is its unique ability to empower the policyholder to be an active player in their own risk reduction. By alerting the policyholder about potential or existing perils, HSB IoT solutions enable the user to take action to potentially prevent and ultimately protect their property and equipment. Advancing the state-of-the-art, HSB combines its 167 years of risk management experience and Meshify’s deep hardware and software capabilities to create IoT solutions designed specifically for the insurance industry. The recent launch of the Meshify Defender water shutoff continues HSB’s focus on enabling action, not just alerting, to further reduce risk.

Overall, the results of HSB and its forward-thinking insurance clients highlight the real-time risk management and behavior change that can occur through IoT. When using Meshify technologies, clients who scale their Sensor Solutions by HSB programs have achieved a return-on-investment (ROI) of 639 percent over the past five years.

Some HSB insurance company clients indicate that incorporating IoT programs into their offerings has improved policyholder acquisition and retention, even as premiums have meaningfully increased. In addition to providing more value, IoT highlights the insurance entity’s focus on innovation and differentiation.

- Improve sustainability

An additional positive impact of these approaches is sustainability. Through continuous remote monitoring of environments and equipment, IoT solutions enable action to reduce wasted resources and optimize costs. Expanding upon this value proposition, HSB develops IoT and technology-related coverages that guarantee a solution’s ability to reduce energy consumption or provide solar output, while addressing traditional insurance risks.

PACE AI, an HSB insurance partner, provides an innovative machine learning and smart edge solution that can reduce energy usage for a wide range of heating, cooling and refrigeration units, and is eligible for utility incentives across North America. One application is packaged rooftop HVAC units, which serve the air conditioning needs for over 50 percent of the U.S. commercial building market. PACE AI’s AI/ML technology optimizes the existing HVACR equipment’s operation in response to heating or cooling commands and provides real-time energy and equipment data for ESG reporting and smart grid features (e.g., demand response and microgrid control). Combined with HSB’s Energy Efficiency Insurance product, PACE AI’s solution provides guaranteed energy savings to commercial and industrial clients, reducing their energy costs and assisting in their decarbonization strategies.

3. Enhance customer experience

For policyholders, insurance is very important but often remains inconspicuous in their daily lives. By facilitating a new prevention-focused connection between the insurer and insured assets, the IoT paradigm enables an enhanced relationship with policyholders by fostering more frequent digital engagement and meaningfully differentiated touchpoints, even when there is no claim.

Whisker Labs’ Ting, an HSB-distributed IoT solution, highlights the ability to wrap services around IoT. With a simple plug-in sensor, Ting employs machine learning to detect and mitigate electrical fire hazards, such as electrical arcing concealed behind walls or poor utility power entering the home. If an anomaly is detected, Ting notifies the homeowner and a Ting Fire Safety engineer engages to verify the potential electrical fire concern. The service ensures each hazard is mitigated, which might require a licensed electrician, in which case Whisker Labs commits to contributing $1,000 toward labor. According to published data, Ting prevents about 80 percent of electrically-generated fires, and according to Whisker Labs, also provides an average of eight touchpoints a month with policyholders.

- Develop new business opportunities

HSB and its parent Munich Re’s deep experience over the years in connecting assets and using IoT solutions for risk mitigation has allowed the companies to unlock new growth opportunities and enable new business models.

One of their recent initiatives has been to provide underwriting capacity to FloodFlash, a managing general agent and Munich Re venture capital investment. FloodFlash’s IoT solution creates an entirely new approach for insuring an age-old risk. Unlike traditional flood insurance, the company offers parametric coverage for commercial risks. An ultrasonic flood sensor that measures water depth is installed at the insured location, and the claims process is initiated automatically when an agreed-upon depth has been reached. The payout chosen by the policyholder at purchase is settled quickly and without the costly and often frustrating loss adjustment process.

HSB has gone beyond innovation on current risks by addressing new risks, including the AI performance of IoT solutions. One of the most prominent examples is its collaboration with WINT Water Intelligence. Through an AI-based water management solution, WINT continuously monitors locations for water use and leaks, and can shut off water at the source to mitigate damage. For construction job sites, an HSB-backed warranty on WINT’s performance is offered for the service; in the event that a WINT-monitored pipe has a preventable water damage event, policyholders, such as general contractors and developers, are compensated up to $250,000.

HSB also backs warranties for risk solution partner Schneider Electric, a global leader in the digital transformation of energy management and automation, and Augury, a company that provides manufacturers and other industrial sectors with insights into the health of machines, processes and operations.

Carrier Partner’s Perspective

“The Hanover strongly believes in IoT’s transformative impact on the future of risk management and insurance. We see the value this technology brings to loss control and mitigation across a variety of business classes, and we are pleased with the results of our IoT collaboration with partners like HSB.”

Christina Villena

Vice-President, Risk Solutions

The Hanover Insurance Group Inc.

As highlighted earlier, certain successful risk mitigation initiatives have been implemented by primary U.S. carriers. In particular, HSB has cultivated a business that is truly at the intersection of technology, data and insurance, leveraging the capabilities honed within its own business to aid other insurance carriers in their prevention journeys. And with over a decade of experience, HSB has become a standard bearer in insurance IoT, and constantly staying on the innovation frontier, with Meshify’s recent partnership with Amazon on the Big Tech company’s Sidewalk network as just the latest example. (Editor’s Note: Amazon Sidewalk is a shared network that helps connected devices work better.)

Creating the IoT Tipping Point

HSB’s IoT experience and successes are an example of the path forward. The specialty reinsurer’s work with the industry on IoT and seven editions of IoT Insurance Observatory research highlight several recommended best practices:

- Commit to IoT for the long term.

IoT is a strategic choice. Toe-dipping behaviors, such as half-hearted pilots and sensor giveaways, do not lead to long-term progress. Focus on achieving early wins to build organizational momentum, recognizing that there will be highlight moments and learning opportunities along the way.

- Consider the full spectrum of potential IoT applications.

As HSB’s example highlights, leveraging a series of use cases creates mutual reinforcement and boosts IoT’s impact on your business. Focusing simply on loss control can lead to underinvestment or weak business cases.

- Create near-term and long-term IoT value to all the stakeholders involved.

Because avoiding losses that may never occur is somewhat intangible, creating near-term, tangible value, such as cost savings or compliance support, helps create additional motivation for policyholders to enroll and engage in IoT. For internal stakeholders and intermediaries, communicating—and even overcommunicating—the IoT vision and value propositions are essential to long-term success.

- Enable personalization at scale.

When correctly applied, IoT amplifies in-person touchpoints while providing the unique value of digital engagement. The resulting personalization extends your customer experience and boosts retention.

- Explore different go-to-market strategies.

More so than ever, IoT is enabling entirely new approaches to drive growth, improve loss ratios and expand risk appetite. Forward-thinking insurers are leveraging IoT to enable embedded insurance and, for specific risks, even requiring IoT as a condition of coverage.

IoT-integrated insurance policies, where the underlying IoT is inseparable from the risk transfer mechanism, is a clear next step for the industry at large.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Six Forces That Will Reshape Insurance in 2026

Six Forces That Will Reshape Insurance in 2026  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages