Personal lines InsurTech Root reported its first-ever quarter of operating profit and first-ever gross combined ratio below 100 for first-quarter 2024 while more than doubling gross written premiums and policies-in-force.

Looking ahead, however, the company will tread carefully on growth in the coming months as its data science platforms monitor an increasingly competitive landscape in personal auto insurance, executives said during an earnings conference call.

Chief Executive Officer Alex Timm and Chief Financial Officer Megan Binkley credited Root’s continued use of data science and technology as a key determinant of the quarter’s results, but pointed to seasonality, in addition to increased competition, as another factor that would likely mean slower growth in the second quarter.

“These results are a testament to our strong product offering, disciplined execution and the power of our technology,” said Timm.

Financial highlights included:

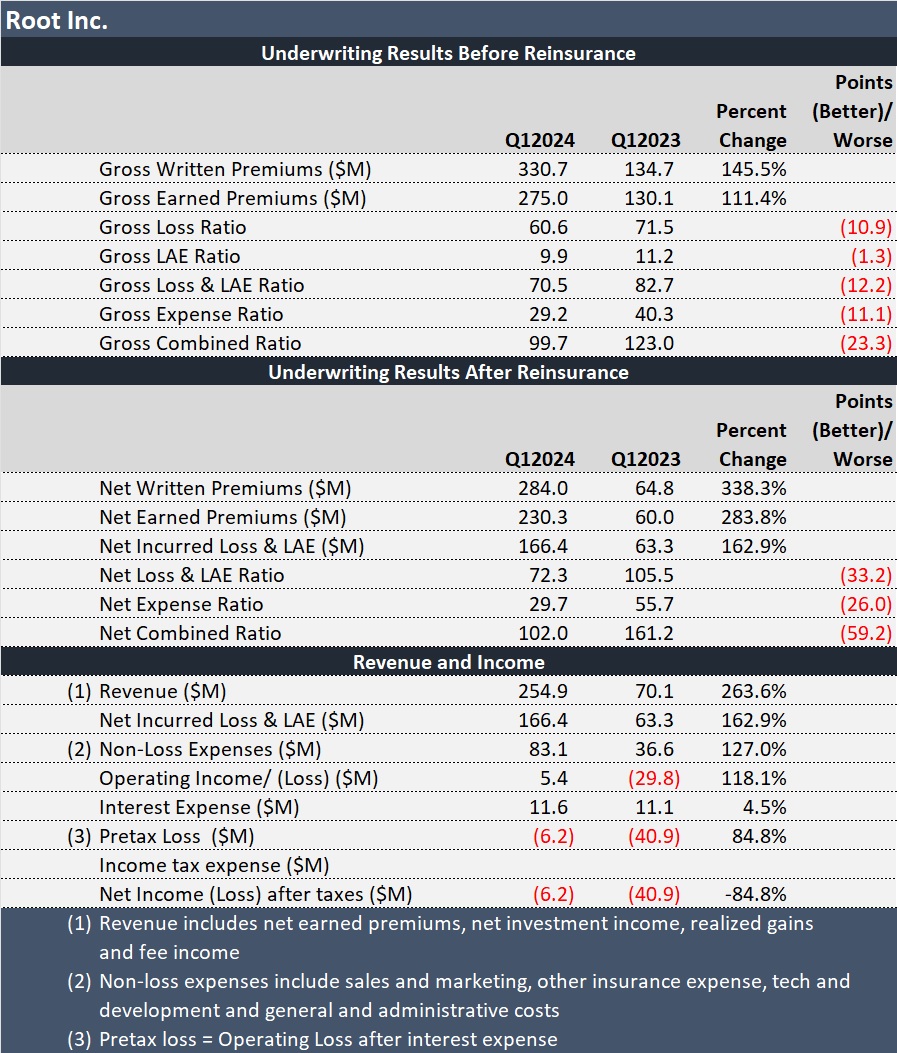

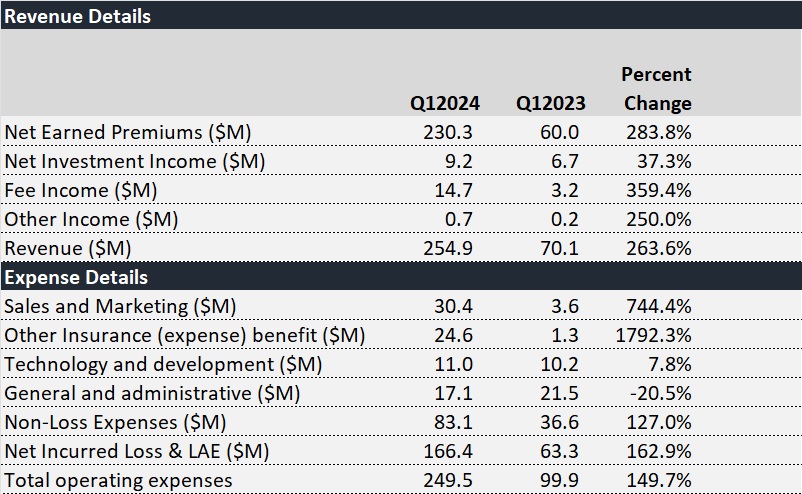

- Gross written premiums climbing nearly 150 percent to $330.7 million in the quarter.

- A 23-point drop in the gross combined ratio to 99.7. Just over half of the improvement (12.2 points) was attributable to a loss ratio improvement, and the other half came from an expense ratio improvement (11.1 points).

- Net written premiums more than tripling—a function of growth and a change in Root’s reinsurance program.

- A 59-point drop in the net combined ratio to just over breakeven (102.0), with the first-quarter loss and LAE ratio down 33.2 points compared to first-quarter 2023, and the first-quarter expense ratio improving 26 points.

- An operating profit of $5 million, and a bottom-line net loss just over $6 million.

“While pleased with this performance, we are far from achieving what we believe we can as a company over the long term,” Timm said. “We believe data science and technology will fundamentally change the way insurance is priced, and in the first quarter we continued to significantly improve the predictive accuracy of our pricing and underwriting models,” he stated. “As we grow, our dataset grows, which allows us to retrain our models and deliver better prices to customers. In turn, with better prices, we’re able to grow more efficiently leading to a virtuous cycle.”

While Root has aspirations to grow in both the direct-to-consumer and partnership (embedded) channels, Timm noted, “Our data science machine is constantly looking to see how the competitive environment is evolving. As such, [the direct] channel fluctuates due to the seasonality and competitive dynamics. And as anticipated, we saw competition increase in the direct channel,” he said, referring to a reduction in new writings that came at the end of the quarter.

Binkley also noted that first-quarter underwriting results generally benefit from a favorable seasonality trend during the first few months of each year, attributing this to fewer miles being driven in the winter months “and also higher purchasing power resulting from tax season refunds.”

Later, asked specifically how marketing spend would trend in the coming months in reaction to the intensifying competitive landscape, Timm noted that because there is a lot of auto insurance shopping in the first quarter, sales and marketing spending is typically higher in the first quarter relative to other quarters.

He added, “We also saw competition come back, and one of the things that we do at Root is we are always looking at profitability and making sure that we are optimizing for profitability. And so as you see competition return or enter or increase, you will see us pull back so that we’re constantly and diligently driving the company toward profitability.”

“Our data science marketing platform continues to systematically deploy our spend and optimize unit economics, as well as detect prevailing trends in the competitive landscape,” he wrote in a letter to shareholders accompanying the financial report online.

Binkley noted that the first-quarter figures were a “strong proof point” that Root’s various models (for pricing, underwriting and marketing) are working, increasing Root’s confidence that it can continued to grow. “But I want to make sure that it’s clear that the growth going forward will moderate if we’re not reaching our unit economic profitability returns.”

“Our growth will continue to be very prudent and disciplined. We’re not sacrificing our capital position for unprofitable growth,” she stated.

In response to several other analysts’ questions, Binkley repeatedly stated that Root will be opportunistic in the deployment of marketing spend. But “we’re laser-focused on profitability and protecting the business long term,” she said.

“We expect growth to be softer in Q2 versus Q1 due to seasonality and due to competitive landscape changes. So that means we are expecting sales and marketing expense to be lower in the second quarter,” she said.

Still, she also said, “We believe that we’ve got ample growth levers that we can pull,” noting that Root, now in 34 states, “would like to be national at some point.”

“And we’re continuing to invest in our differentiated distribution, so our partnership channel does continue to grow. It’s been growing. We’re continuing to onboard and launch new partners,” she said.

While Root named Carvana as one of these partners in 2021, and has mentioned that others have teamed up with Root since, Root has not specifically named the other partners.

Timm said that Root grew new writings in the partnership channel 68 percent in the first quarter compared to the same period last year.

On a net basis, first-quarter growth and profit also benefited from the impacts of an evolving reinsurance strategy, which Binkley announced in last year’s third quarter. With Root commuting existing quota share treaties and reducing cessions to third-party reinsurers on new treaties, net retention has increased and reinsurance costs have been reduced.

Comparisons of gross and net premium figures reveal that Root was ceding more than half of its premiums to reinsurers in last year’s first quarter. In first-quarter 2024, the figure is now only about 15 percent. The new reinsurance strategy, which still involves the purchase of per-risk and catastrophe covers to protect the business against volatility, has also brought gross and net loss and LAE ratios more in line. In first-quarter 2024, the net loss and LAE was only about 2 points higher than the gross ratio.

“As we look forward, if we see something opportunistic in the reinsurance markets, we’ll want to take advantage of that,” Binkley told an analyst who asked about the likely cession percentage going forward. “As we sit here today, we don’t intend to cede more than 25 percent of our GEP, but we want to make sure that we’re giving ourselves optionality….We are constantly looking to optimize our capital structure, and as a result have continued to improve,” she said.

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report