The three U.S. venture-backed InsurTech carriers we have been tracking for several quarters have more money, more premium and more losses as we head into the last quarter of the year.

Executive Summary

With permission of the authors, Carrier Management is republishing this analysis of the statutory financials of InsurTech insurers Lemonade, Metromile and Root, originally published on LinkedIn. Originally published as a single article, we present it as a four-part series.- In Part 1, the authors present overall loss ratio, expense ratio and combined ratio results from statutory filings of the three insurers.

- In Part 2, “Getting to the Root of the Problem: Why One InsurTech’s Loss Ratios Still Disappoint,” the authors take an in-depth look at results for one of the three carriers.

- In Part 3, they answer the question, “Can an InsurTech Startup Compete With Progressive and GEICO?”

- In Part 4, they revisit a comparison of results for VC-backed startups and startups backed by traditional incumbent carriers. “Startups vs. Incumbents Revisited: Q32018“

For the complete original article, visit the LinkedIn pages of Matteo Carbone or Adrian Jones.

It’s still early. No meltdown is imminent as the startups have tons of cash. It’s still InsurTechs against the world.

Context

This is the fourth installment of our review of U.S. InsurTech startup financials. Here are the 2017 edition, the first quarter 2018 edition, which generated many social media discussions, and the second quarter 2018 edition. For more information on where our data come from and important disclaimers and limitations, see the 2017 edition. As we have said since the start, we think all three companies have solid management teams who will figure out a solid business, but it will take time.

Premium and losses grow at venture-backed startups

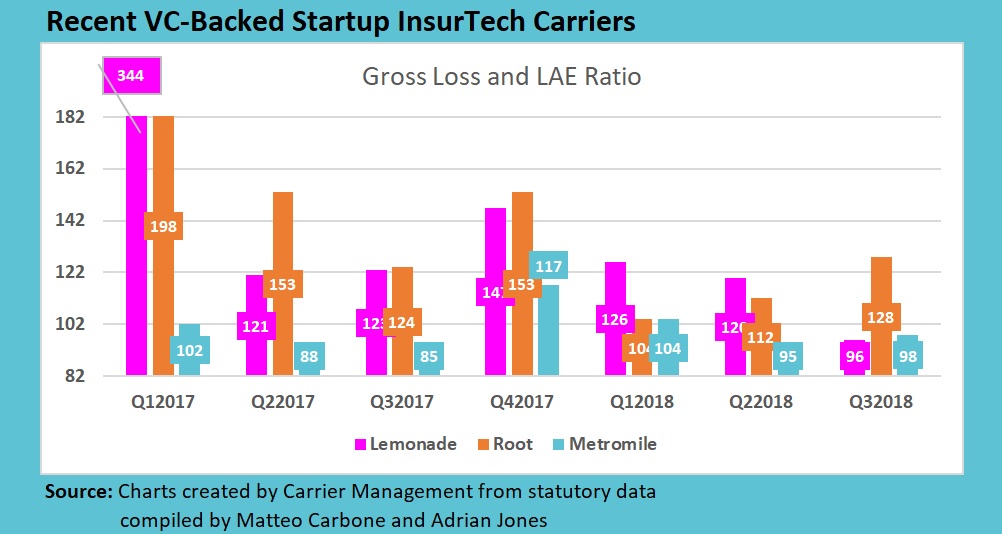

As we have said before, it’s early days. Growth is rapid. But all three startup carriers are a long way from profitability and need either to continue to raise prices substantially (and thus potentially churn customers), tighten underwriting (which could also materially affect growth), or improve operational aspects that drive losses such as claims performance.

In insurance, product-market fit is only demonstrated when selling a product that makes money.

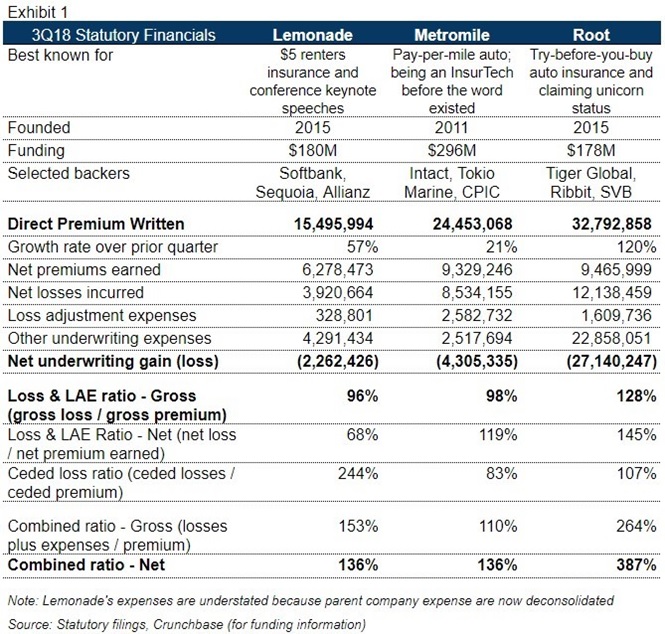

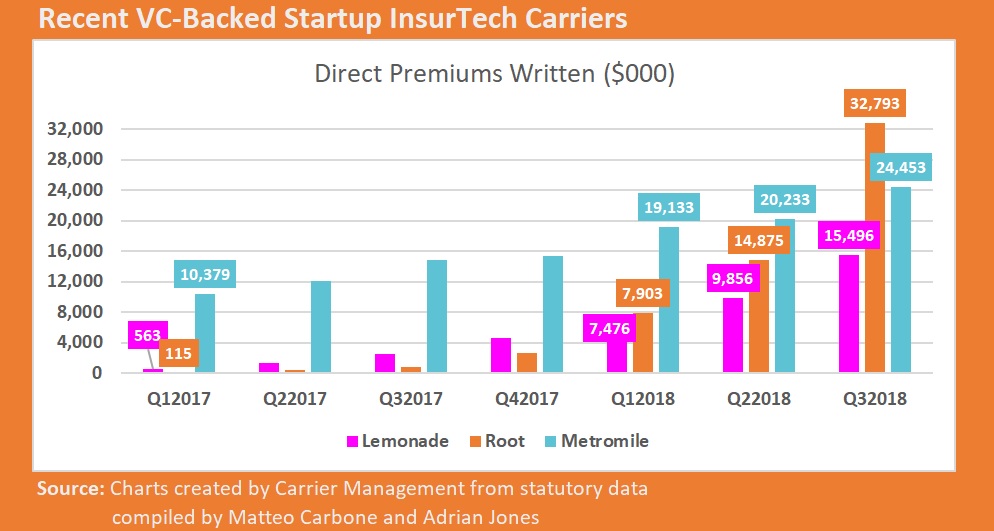

Here is the summary of the 3Q18 details of the three venture-backed US insurers that we’ve been tracking. The fourth venture-backed insurer, Next Insurance, did not write premium in third-quarter 3Q18.

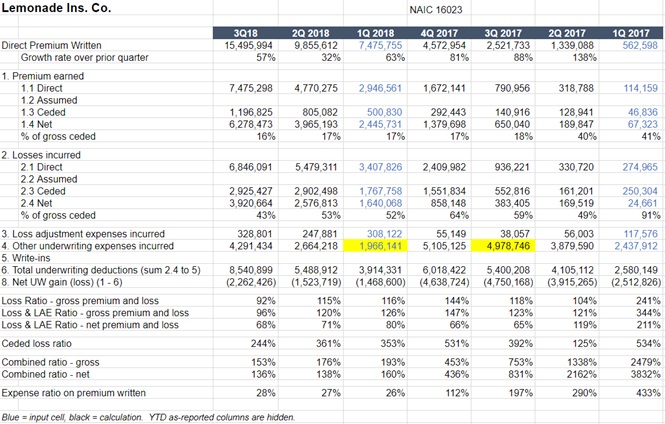

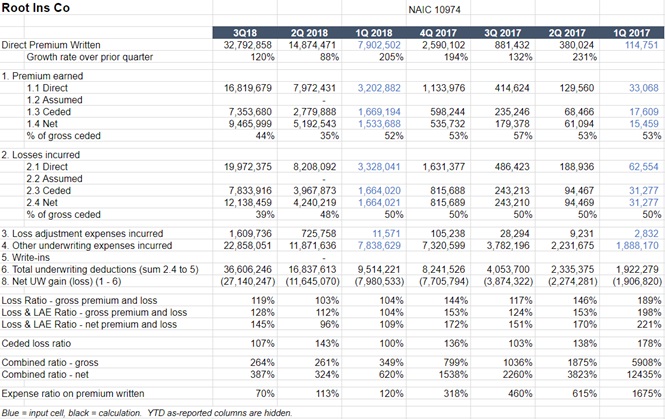

On expenses, it is important to note that Lemonade received permission from New York State to hide some expenses in an affiliated entity effective at the start of this year, so Lemonade’s expenses aren’t comparable to the others. (Lemonade’s CEO told us that the State of New York requested them to do so.) Root has followed suit and will now start to hide expenses in an affiliated agency, effective October 1, 2018.

Unfortunately, with less transparency, it is harder to verify whether the overall business model actually adds up. Lemonade, for example, makes a big deal about the power of an insurer built on a “digital substrate.” We’re inclined to agree, and we hope they’re right, but we won’t know from their statutory results whether a better expense ratio is really possible.

The third quarter’s “most improved” award goes to Lemonade, which grew premium by 57 percent over the prior quarter to $15.5 million (perhaps helped by seasonal effects in the rental market) AND turned in a 96 gross loss and loss adjustment expense ratio, its best ever. The company’s reserves developed slightly adversely in the quarter, with YTD unfavorable development standing at $254,000, modestly worse from $245,000 the prior quarter.

Lemonade has a way to go. Their reinsurers continue to subsidize their loss ratio (but now paying “only” $2.44 of losses per dollar of premium), the average net loss and LAE ratio is still well above the 40 percent at which charities receive a giveback, and they are far from profitability. But reunderwriting and higher rates, which we discussed in our last post, may be paying off. There are other explanations too—shifting to cat-exposed risk, for example, lowers the loss ratio but raises the cost of capital.

The company has written $33 million in the first nine months of 2018, which is well behind some exponential expectations published last year. Management also says that they will take out 60 loss ratio points: “A similar progression in the year ahead will get us to where we need to be”. Good luck. (Despite the good quarter.) Taking out loss ratio points gets harder for every point you get closer to the industry average. The breeziness of management’s comments makes us wonder how much focus will be placed on the hard spadework of loss ratio improvement vs. embarking on a glamorous European Grand Tour.

We have long taken issue with Lemonade’s definition of “transparency,” which (like many startups) is transparent only insofar as the company wishes to tell a story, which is just another form of marketing. (We are working on a longer article about ways startups bend numbers and welcome your ideas). We also agree with other commentators that the company’s promised Giveback to policyholders’ charities of 1.6 percent of premium for the latest year seems cynical. Middle-class insurance agents are some of the biggest charitable donors and sponsors in many towns, and it’s hard to see the social benefit in Lemonade’s spending the advertising budget enriching amoral tech bros at GAFA rather than sponsoring the town’s Little League uniforms as an agent might do. Even insurance veterans don’t seem to realize that all of Lemonade’s entities are for-profit. Don’t be fooled: B-Corps are still for-profit corporations. And railing against gun violence is easy, but social consciousness is messy in reality.

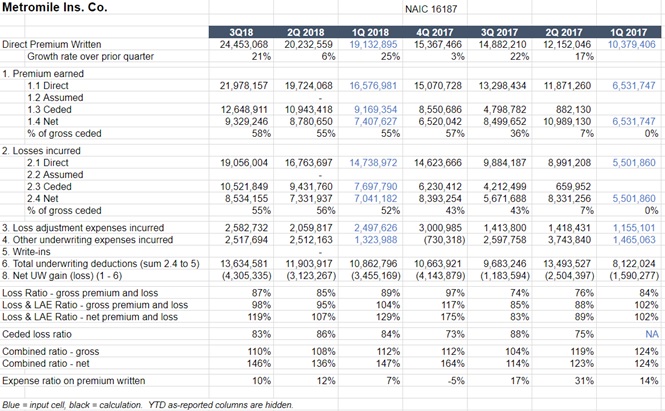

Metromile grew at a steady and respectable 21 percent from the prior quarter to $24.5 million of gross premium but ran a 98 gross loss and LAE ratio (not improved from 2017). Among the three players, it has been the ant: slower growth and rather steady results. After seven years in business, the company is barely generating an underwriting profit and is showing little improvement. The company has been taking rate, but not enough as the actuaries say is needed. The company’s latest California indication, for example, is rates up 38 percent, but the company only took 15 points of rate, effective 7/1/2018, which will work through its book over the next couple of months.

Matteo recently published a discussion of why its PAYD (the pay-as-you-drive) approach confirms its niche nature.

If Metromile is an ant, Root is a grasshopper. Root again grew extremely rapidly through its TBYB (Try-Before-You-Buy) mobile approach, as one probably would expect of a company with a $1 billion valuation (as we discussed in our previous article). Root doubled the volumes underwritten by Lemonade. But Root continues to struggle with rookie mistakes that drove losses—discussed more in a related article (“Getting to the Root of the Problem”). Root grew premium by 120 percent vs. the prior quarter to $33 million for the third quarter but turned in 128 gross loss and LAE ratio—its worst of the year and the worst of the three U.S. InsurTech carriers.

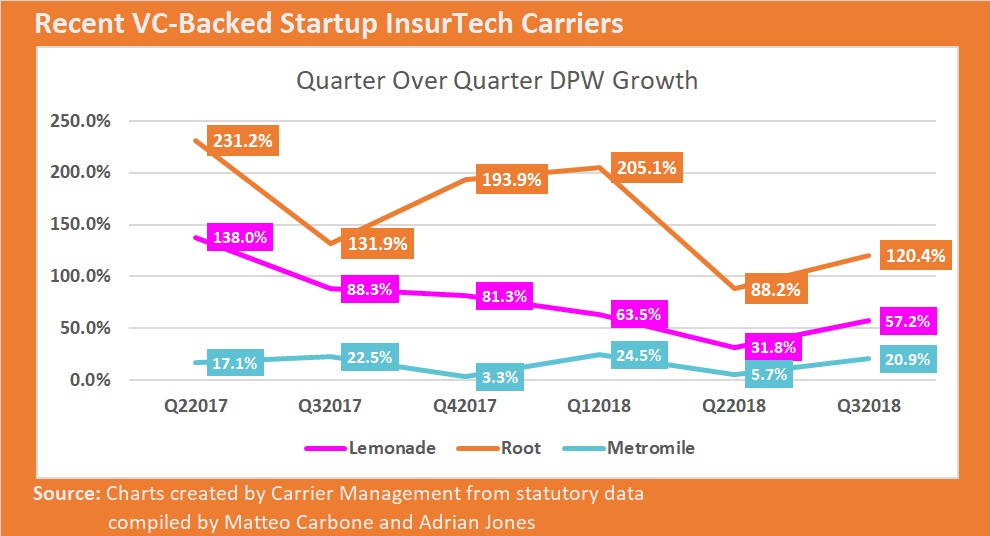

With the three carriers resuming rapid growth after a slow second quarter, the second-quarter slowdown that we observed in our prior article may have been seasonal or a one-time coincidental slowdown.

Gross or Net: Which One Matters?

One well-regarded venture capitalist challenged us on why gross premiums and loss ratio matter when net is what actually sticks to current investors. The difference between gross and net is reinsured premium and loss.

The gross loss ratio is provides an unbiased view of the profitability of the book of business, while the net loss ratio may benefit from savvy reinsurance buying, as in the case of Lemonade.

What matters most is for startups probably the higher of the two loss ratios. If reinsurance reduces the loss ratio, this is only sustainable over time if reinsurers make an adequate return. Reinsurers, like all businesses, tend to demand higher prices when customers lose them money, which in time makes the net loss ratio look more like the gross.

In the case of the two auto startups, they are paying reinsurers to take away their biggest losses, so this “cost of reinsurance” needs to be reflected, and the net numbers matter more.

Related Articles

More discussion of the third-quarter 2018 results is available in Parts 2, 3 and 4 of this four-part article:

- Getting to the Root of the Problem: Why One InsurTech’s Loss Ratios Still Disappoint

- Can an InsurTech Startup Compete With Progressive and GEICO?

- Startups vs. Incumbents Revisited: Q32018

The annual figures that are published in March contain a wealth of additional information. To be notified when these numbers are available, please follow the authors on LinkedIn.

We’ve been busy publishing other articles, in particular by guest-editing the November/December edition of Carrier Management. Here is what we published in that edition.

- The Value of Innovation

- Are You Tapping the Positive Innovation Energy in Your Company?

- So You Wanna Be an Innovator in a Big Company?

- Changing the Conversation About InsurTech—With Numbers

- Startup vs. Incumbent: The Battle Rages as InsurTechs Grow Fast But Fail to Show Profits

- Who’s Next? The Value of MGAs vs. Carriers

- Wasted Opportunity for Reinsurers?

- UBI Insurance Is Not Usage-Based. Sorry, Not Sorry!

- Chloe and Insurance: A Love Affair

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?