How far will they climb? How far can they fall?

Executive Summary

David vs. Goliath. Startup vs. Incumbent. The battle to win insurance customer wallets is heating up as VC-backed InsurTechs grow premiums incredibly fast but fail to show underwriting profits. Here, InsurTech watchers Matteo Carbone and Adrian Jones bring the profit vs. growth question into focus, noting that InsurTech growth has started to slow down a little and that underwriting losses are not always a natural startup phenomenon, as demonstrated by the superior profitability of insurer-backed startups.Will innovative InsurTech startups rocket past established players?

Those may be some of the unspoken questions beneath a series of articles written by two industry thought-leaders who have been compiling the statutory financial results of a trio of venture-backed InsurTech startups for several quarters.

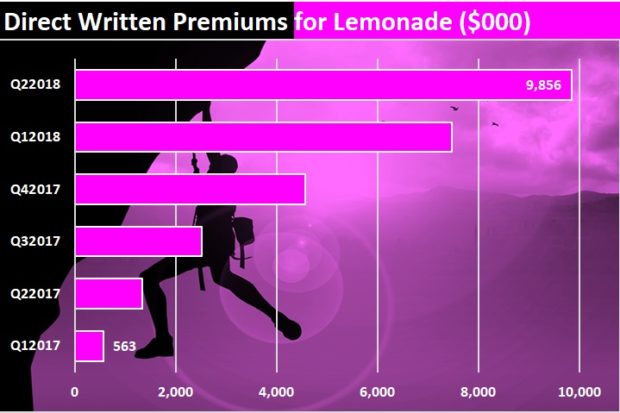

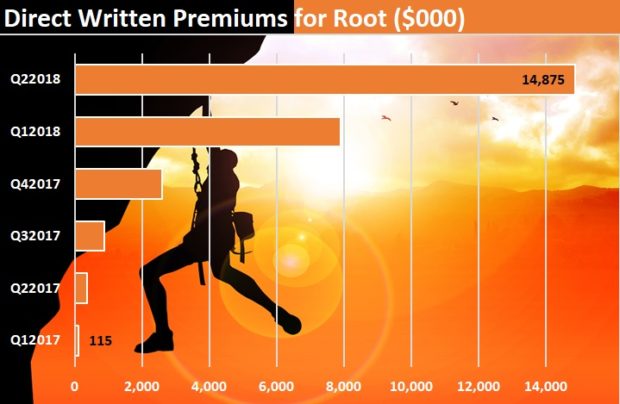

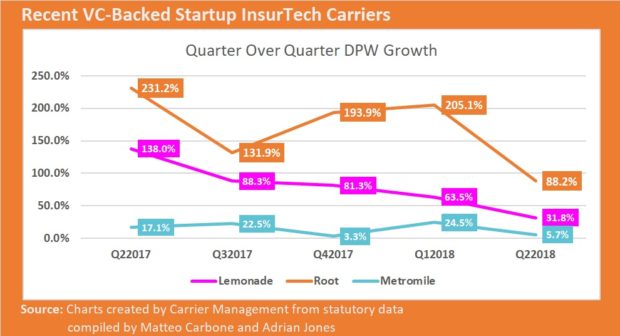

With off-the-charts jumps in gross premium growth like 205.1 percent for Root from fourth-quarter 2017 to first-quarter 2018, or Lemonade’s 81.3 percent leap between the third and fourth quarters of last year, InsurTech watchers Matteo Carbone and Adrian Jones note that the startups continue to gain ground on existing carriers in the growth department.

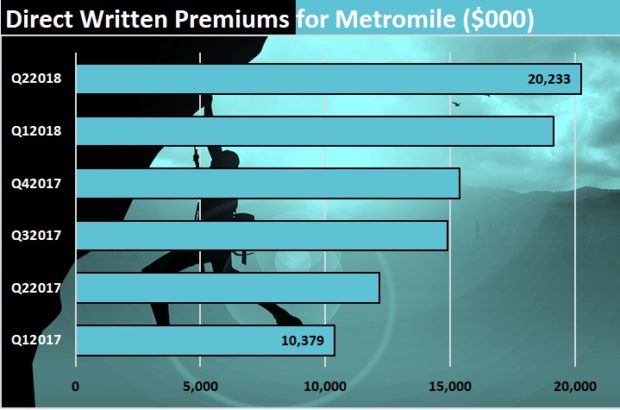

“While the lumbering incumbents in the insurance industry are powerful giants and have a head start on the climb, they are also carrying lots of weight,” they wrote in their latest article about second-quarter 2018 financial results, painting an image of the two groups—agile startups vs. overburdened incumbents—embarking on a steep climb up the “Cliffs of Insanity.” The startups are making progress that the slower giants might view as “inconceivable,” they suggest, even if the oldest and biggest—Metromile—had only written $39 million of premiums in the first half of this year. (See related textbox, “Inconceivable! ‘You Keep Using That Word.”)

“While the lumbering incumbents in the insurance industry are powerful giants and have a head start on the climb, they are also carrying lots of weight,” they wrote in their latest article about second-quarter 2018 financial results, painting an image of the two groups—agile startups vs. overburdened incumbents—embarking on a steep climb up the “Cliffs of Insanity.” The startups are making progress that the slower giants might view as “inconceivable,” they suggest, even if the oldest and biggest—Metromile—had only written $39 million of premiums in the first half of this year. (See related textbox, “Inconceivable! ‘You Keep Using That Word.”)

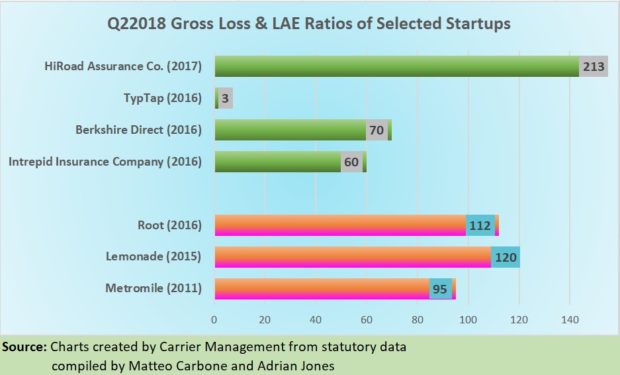

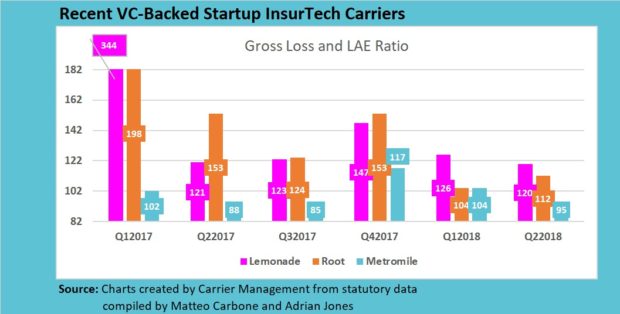

On the other hand, the newbies have seen scant improvement in their underwriting profit pictures, with only Metromile reporting any loss ratios under 100 in the past five quarters. Gross loss ratios are generally stable or improving slightly, but they are “still unsustainable,” they note in their article, first published on their LinkedIn pages in their personal capacity and later republished on Carrier Management’s website.

Growth vs. Profit

Poor loss ratios, however, are not always a natural startup phenomenon, Jones reveals.

“We want to avoid giving the impression through the articles that all insurers when they first start up produce poor underwriting results. It’s a matter of strategy—pursuing growth vs. profitability. Some venture-backed startups have done very well on underwriting profitability, even from Day 1, which is an extraordinary feat because they’re either underwriting or distributing in a different way, and oftentimes a different product,” he said.

“We’re speaking only our personal opinions and not those of the Observatory or SCOR, but it’s fair to say that we as individuals want these startups to succeed and think their numbers will get better, both revenue and profitability. They all have the management teams and the capital to be winners,” he said.

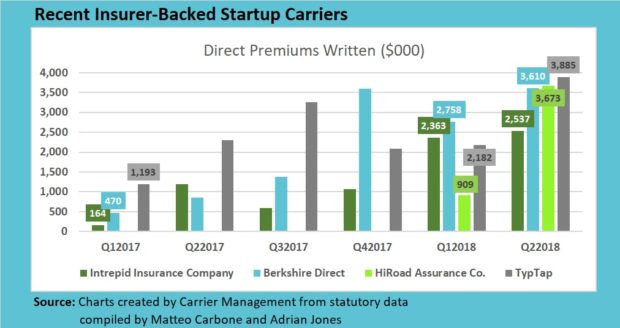

In the second-quarter article, he and Carbone were able to offer a comparison of the premium growth figures and loss ratios of the three VC-backed InsurTechs to the same metrics for four recent startups backed by traditional carriers that do report results publicly in statutory filings:

- Berkshire Direct, or biBerk, a Berkshire Hathaway company, which ultimately reports to Ajit Jain, writing small business insurance online. Launched in 2016 and writing $3.6 million of direct premiums in second-quarter 2018.

- Intrepid, a W.R. Berkley company, writing bundles of coverage for auto repair garages and franchise restaurants online within 10 minutes. Launched in 2016 and writing $2.5 million of direct premiums in the second quarter.

- TypTap, a wholly owned subsidiary of Homeowners Choice Property & Casualty Insurance in Florida, writing private market flood insurance. Launched in 2016, with second-quarter 2018 premiums of $3.9 million.

- HiRoad, State Farm’s app-based auto insurer using telematics and offering up to 50 percent savings. Currently writing in Rhode Island only. Launched in 2017 and already up to $3.7 million in premiums in the second quarter.

“I think that the biggest surprise to me was the degree to which the startups that are run by well-known underwriters have a very clear underwriting approach showing through in the numbers in terms of lower premiums but also much lower losses as compared to the venture-backed companies,” Jones told Carrier Management in an interview.

“I think that the biggest surprise to me was the degree to which the startups that are run by well-known underwriters have a very clear underwriting approach showing through in the numbers in terms of lower premiums but also much lower losses as compared to the venture-backed companies,” Jones told Carrier Management in an interview.

With the exception of the newest startup, HiRoad, the insurer-backed companies all reported loss ratios well below the VC-backed trio.

“Eventually, I think we’ll see a convergence in the strategies,” Jones said. “The venture companies have already said they’re becoming more focused on loss ratio, and the startups within big companies will need to drive greater premium, which could include bigger investments in advertising.”

“Eventually, I think we’ll see a convergence in the strategies,” Jones said. “The venture companies have already said they’re becoming more focused on loss ratio, and the startups within big companies will need to drive greater premium, which could include bigger investments in advertising.”

“The debate in the industry is which comes first: the premium or the profitability. And you see two very different approaches to that question right now. I do think that they will converge,” he said.

Already, growth rates have started to slow for auto insurers Root and Metromile and for home and apartment insurer Lemonade, with each turning in their slowest or second-slowest quarter-over-quarter premium growth in the last five during the second quarter of 2018. Is it because the carriers have a new focus on underwriting profitability, or is customer acquisition just becoming more difficult, Jones and Carbone ask readers in their article.

Carbone was surprised by the slower growth rates and says he is much less optimistic than Jones that these startups have been raising prices to improve their loss ratios. “I think it is normal that startups are aggressive on price. We have seen that for many years.”

Carbone was surprised by the slower growth rates and says he is much less optimistic than Jones that these startups have been raising prices to improve their loss ratios. “I think it is normal that startups are aggressive on price. We have seen that for many years.”

“The point is if you are paying more claims than you are raising as premium, then probably the gap between the current price and a sustainable price is so huge that when you raise the premium you will lose a large part of the volume that you have underwritten. So, I think that is way too aggressive of an approach.”

Jones, on the other hand, notes that executives of Root and Lemonade have recently responded to questions about sustainability and written about plans to improve their loss ratios in blog items posted on their websites. “Placing more importance on underwriting is a sign of a maturing and more sophisticated company,” he said.

At Root, CEO Alex Timm addressed questions from customers about the new company’s ability to pay claims in the future by noting the carrier’s use of reinsurance and conservative loss reserving practices in an Aug. 18 blog item. “We want to make the right long-term economic decisions, not optimize a quarterly P&L,” he said, reinforcing the reserving point earlier this year during an “Ask Me Anything” session on Reddit in July. Specifically responding to questions about the poor loss ratios of startups, Timm said, “Over the long term, prioritizing underwriting and pricing accuracy will lead to superior performance,” and added, “We also have no intention of underpricing insurance to gain market share, using boldface type to emphasize the point. (More details of the Reddit session available at carriermag.com/jt9m2.)

In a May 18 blog item posted by Team Root titled “Here’s why your car insurance rate changed,” the company made the same point.

“We’re dedicated to giving our good drivers the lowest rates possible. But to do that well—and in a way which keeps us healthy as a company—we have to keep a sharp eye on our data and how our models perform over time. Our actuaries…are knee-deep in the numbers every day, creating, checking and double-checking our actuarial tables.

“Once we create those tables,…we constantly monitor them to ensure that they’re accurate. If we see areas where a prediction doesn’t quite align with reality, we act. If it looks like we priced too high in certain areas, we lower prices. If it’s clear that we’re underpricing, we adjust prices upward. It’s as simple as that.”

Separately, in a blog item titled “We suck, sometimes,” Shai Wininger, the co-founder of Lemonade, revealed “a ludicrous 1,000 percent” jump in revenue for the last six months compared with the same period last year but unprofitable underwriting results along with a bigger business.

“One of the things we still didn’t get right is our loss ratio…It’s still in the red,” wrote Wininger, part of an executive team that famously set out to design an insurance company that doesn’t suck (in their words).

“The good news is, for the first time, we’ve reached the point where we have enough data to take action and bring it down. Fixing our loss ratio requires fine-tuning the machine, tweaking product, pricing and filings,” he wrote in his blog item, reporting that encouraging results have already started to emerge. (The rest of the Lemonade blog item is summarized at carriermag.com/a9xvp.)

Shiny New Cars; Probably Not Road Ready

Lemonade also announced the release of Policy 2.0 during the quarter—”a radically simplified, modernized and digitized insurance policy” that is also an “open source” policy. “We invite consumers, advocacy groups, regulators, insurance enthusiasts, data scientists, designers, competitors and techies to all jump in. We’re big believers in ‘wisdom of the crowd,’ and hope broad participation will make Policy 2.0 all it can be,” CEO Dan Schreiber wrote in an article explaining the reason for throwing out traditional insurance policies to create a new one.

But what will Policy 2.0 mean in terms of Lemonade’s profitability? Are the simplified terms restrictive, potentially helping to reduce loss ratios in the future? Or does opening up policy language for the masses to weigh in potentially set the company up for worse underwriting results?

Jones and Carbone think those questions are premature.

“Policy 2.0 quickly collides with the reality of laws that, for example, define the required coverage in a state,” Jones said, referencing some insight on regulation he and Carbone shared in their latest financial-results article. There, they cited language from a nine-page deficiency letter from Virginia outlining the ways in which Lemonade’s proposed policy wording didn’t comply with the state’s insurance code, including the definition of “hovercraft.” (carriermag.com/d2ngc)

Jones concluded: “There are really 50 different markets in the U.S., plus the territories. I’m glad that companies are innovating the policy form. But a total overhaul is like the concept cars that you see at car shows. They’re incredibly cool, but they won’t be on the street for many years, if ever.”

Carbone was more critical. “I am always curious to see these ideas, [but] I consider them too smart to think about using a tool like that to produce a new coverage,” he said, referring to executives of Lemonade. “Lemonade is one of the most interesting initiatives from a marketing and PR perspective that [should] be studied within the University within a marketing course,” he said.

Asked about a potential bump in the road to growth and profit for the two auto startups—driverless cars—Carbone doesn’t see such vehicles being a serious threat in the short term. “I don’t think autonomous cars will be an issue for decades,” he said. “It will be 30-35 years or more before you will see any Western or European market with more than 30 percent of the cars going around the street [and] insured—without a wheel, Level 5 autonomous cars,” he predicted, listing obstacles that include technology readiness, necessary infrastructure changes, cyber risk solutions being put in place and regulatory issues that will have to be solved.

“Then you have the customer effect. Customers have to start to buy the cars. And there are already surveys that are showing that not all customers are ready to buy. You need time to change the behavior of people.”

Last but not least, you need to change car parks, he said. “If you line up all those barriers, it’s pretty easy to see that we are talking about decades.”

Bottom line: “Auto insurers have a future that will be challenging. Their margins will be challenged for sure, but the day when consumer auto insurance is no longer relevant, and when telematics will not be relevant, is far away.”

Also far in the future is the prospect of Metromile or Root or Lemonade leaping up to the top of the leader board of insurance carriers based on premiums or market share. “Even for Progressive and GEICO, success has been decades in the making,” said Jones. “If you look at the history of the insurance business in the U.S., there has been a technological disruption every 20 years, dating back to the 1950s when mainframe technology first came out. And the impact of that disruption has not been that carriers have gone away. It’s that market shares have changed slowly over time, with less innovative carriers shriveling up and ultimately being acquired and the more innovative carriers gaining market share. But it’s a slow process.

“Out of each of the past disruptions, you have seen a handful of new companies emerge that have gone on to become highly successful—the multiliners in the 1950s, the specialists like W.R. Berkley in the ’70s, and the Bermuda reinsurers in the ’80s and the ’90s, only a handful of which are still independent. I think you’ll see the same thing with this wave of companies.

“Whether the companies that we think of in 20 years as being household names have been founded already or not, I don’t know. I think there’s a lot of room for continued innovation in this industry, and I think there will be some winners from the current crop of startups,” Jones said, noting that continued analysis of their financial results will give hints about which those will be. (Related articles: “Who’s Next: The Value of MGAs and Carriers,” “Wasted Opportunity for Reinsurers?“)

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit