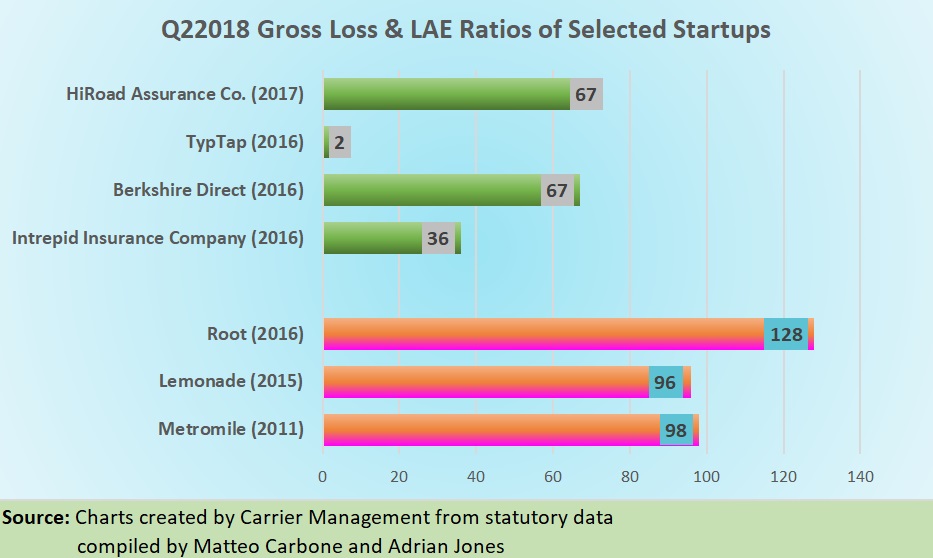

We first pointed out in a second quarter analysis of VC-backed startups Root, Lemonade and Metromile that companies run or led by well-known underwriters were growing slowly but far more profitable than those with venture capital backing. That hasn’t changed in third-quarter 2018.

Executive Summary

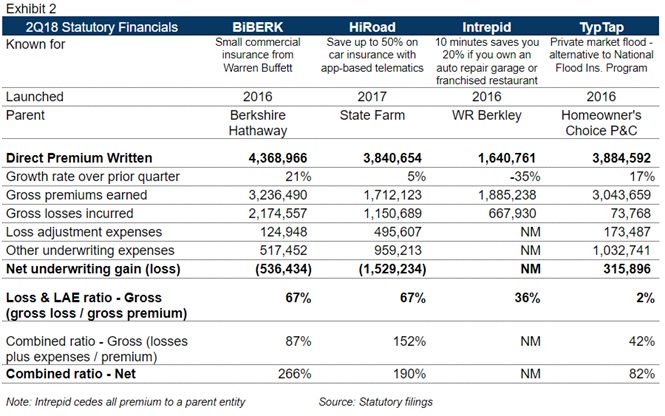

Carrier Management is republishing this analysis of the statutory financials of three InsurTech carriers as a four-part series. For the complete original article, visit the LinkedIn pages of Matteo Carbone or Adrian Jones.Here are the four subsidiaries of big companies that are selling direct or have a claim on being an InsurTech. These companies often depend on parents for reinsurance and infrastructure, so we show mainly the gross figures.

Here’s how they compare to the trio of VC-backed InsurTech carriers we have been tracking:

Related Articles

In Part 1, the authors present overall loss ratio, expense ratio and combined ratio results from statutory filings of the three insurers. “Between An Ant and A Grasshopper, Lemonade’s Results ‘Most Improved’ for Q32018“

In Part 2, “Getting to the Root of the Problem: Why One InsurTech’s Loss Ratios Still Disappoint,” the authors take an in-depth look at results for one of the three carriers.

In Part 3, they answer the question, “Can an InsurTech Startup Compete With Progressive and GEICO?”

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best