“Sustainable value creators” among the 100 largest property/casualty insurance carriers generated more than twice as much of their value through underwriting than through investment activities over a 20-year study period, according to a new analysis from ACORD.

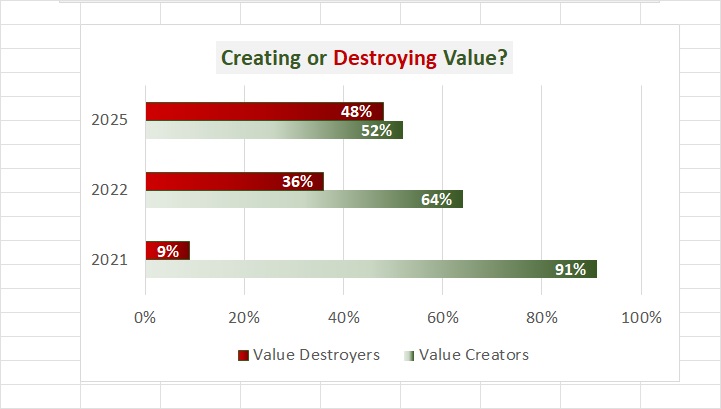

In addition, in a departure from similar ACORD studies that Carrier Management has previously reported on from past years, almost half (48) of the 100 insurers destroyed value, according to ACORD’s “2025 U.S. Property & Casualty Value Creation Study.”

Three years ago, ACORD found that just over one-third (36) of the 100 largest insurers destroyed value. And in a 2021 comparable study, only 9 of 100 were value destroyers.

As was the case in all the prior studies reviewed by Carrier Management, ACORD’s 2025 study, released in mid-December last year, identified value creators and value destroyers by determining whether 20-year returns exceeded a prescribed benchmark. Creators exceeded the benchmark over the study period; destroyers did not. (More precisely, the study examined cash flow in excess of an 8.2 percent cost of capital as the measure of value. Related textbox, “Defining Value Creation”)

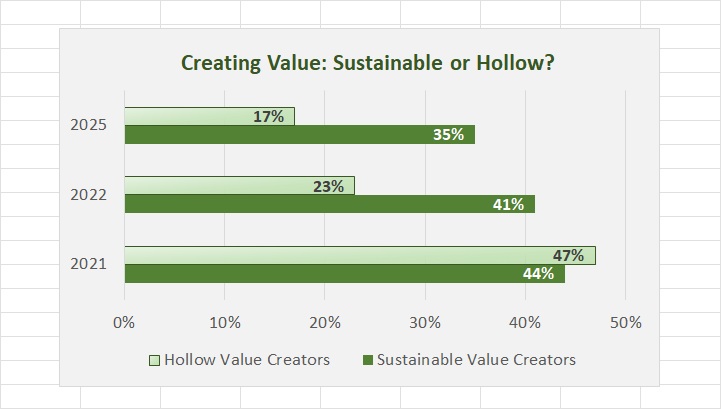

The ACORD analysis breaks the value creators into two categories: sustainable value creators that meet the required return threshold through underwriting and investment activities, and hollow value creators that do so through investment returns only while failing to generate value from underwriting.

Tallying the numbers, while 52 percent of companies were value creators, just 35 percent were sustainable value creators— achieving a 13.5 percent return on capital and generating $324 billion in value, according to the latest study. “Through their consistent disciplined focus on core insurance operations, these carriers created significant value through underwriting while simultaneously generating respectable investment gains”—$229 billion of value from underwriting and $95 billion from investments.

Analyzing 17 hollow value creators, ACORD said that their underwriting operations consumed $85 billion of the $121 billion created through investments—resulting in a net value created of $36 billion. “If not for their investment income, they would have fallen into the value destroyer category. Their dependence on investment income illustrates how precarious their position is and how much the industry continues to depend on a source of revenue other than its core competence of underwriting,” the report says.

In addition, ACORD’s research revealed:

• The largest carriers tended to generate more sustainable value in the U.S. P/C market, according to ACORD’s research. “More companies in the largest quartile [with net written premiums greater than $6 billion] achieved sustainable value creation, and fewer of them destroyed value, than any of the smaller quartiles.”

The report puts companies writing less than $2 billion as the lowest quartile. Other quartiles are $2-3 billion, $3-6 billion and over $6 billion.

A graphic in the report shows that 30 of the 52 value creators wrote premiums above $3 billion, and 28 of the 48 value destroyers wrote less than $3 billion.

“In past decades, larger scale was more frequently associated with value destruction in the P/C industry. The emergence of larger carriers achieving sustainable value creation suggests that a new advantage of scale is emerging—one that is not simply operational but informational,” the report says.

• Sustainable value creators have roughly half of their insurance portfolios in personal lines and half in commercial. The business mix of hollow value creators tilts more heavily toward commercial lines (56 percent commercial vs. 44 percent personal), while value destroyers emphasize personal lines (64 percent personal vs. 36 percent commercial).

Focusing on personal lines, ACORD noted that sustainable value creators showed greater discipline in writing homeowners compared to their less successful competitors, with 22 percent of their personal lines business devoted to the homeowners lines. For hollow creators and value destroyers, the homeowners shares of personal lines writings were 39 percent and 34 percent, respectively.

• There is roughly a 4-5 point difference between the all lines P/C loss and loss adjustment expense ratios of sustainable value creators (70.2) vs. either hollow value creators (73.9) or value destroyers (75.3).

• On the underwriting expense side, sustainable value creators’ expense ratios averaging 24.3 were nearly 7 points better than hollow creators (30.0) and over 3 points better than destroyers (27.4).

Breaking down underwriting expense categories, ACORD found little difference in commission ratios among the three value cohorts, but sustainable value creators spent significantly less on other acquisition expenses compared to other companies in the study. “Hollow value creators had higher levels of back-office expenses versus the other cohorts and the top 100 average”—9.3 for hollow creators vs. 5.9 for sustainable creators, the report says.

The ACORD report also identified “value levers” that keep the sustainable value creators ahead of the pack: underwriting, claims and customer lifetime value.

In underwriting, sustainable value creators “focus on profitable, intelligent growth, rather than simply expanding market share,” the report says. These carriers leverage data and advanced analytics, including AI, to precisely target the right customers for acquisition, retention and cross-selling.

In claims, they use technology “as a force multiplier” for human judgment to improve productivity and decision-making for claims teams. “These insurers strike a balance between loss payments and adjustment expenses while sustaining high levels of customer satisfaction.”

According to ACORD’s research, sustainable value creators also optimize customer lifetime value, with an average of two products per customers (and some, averaging five or more) vs. a 1.5 product per household average across the P/C personal lines industry.

Concluding the report with a section titled “The Path to Sustainable Value,” ACORD notes that a single path no longer works. “While insurers have historically focused on one of four strategic pillars–customer intimacy, product leadership, innovation or operational excellence—the ACORD U.S. P&C Value Creation Study has shown that in recent years, carriers must effectively execute across all four to remain competitive in the shifting market.”

For the first time, this year’s edition is available to both ACORD members and non-members throughout the industry. Visit www.acord.org/research to download the report.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage