Though nearly half of U.S. homeowners are considering a move, this year is expected to bring greater market stability, according to an inaugural report on homeownership trends by Kin.

The direct-to-consumer digital home insurance provider found that climate-related concerns and insurance costs were now core factors in homeownership decisions.

The survey of 1,000 American homeowners across all age groups, along with additional internal and external research and data, found that homeowners are experiencing extreme weather anxiety.

More than ninety percent of homeowners worry about sustaining climate-related damage to their home within the next 2-3 years, and 68 percent expect extreme weather events to increase in their area in 2026.

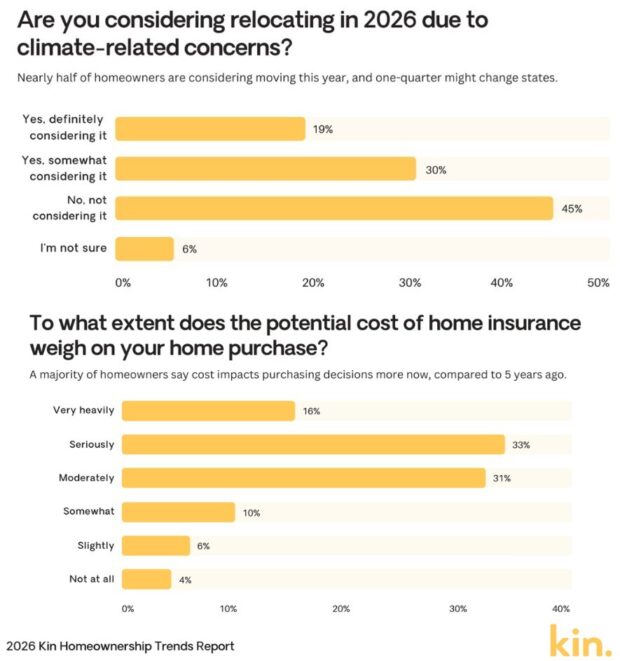

This concern has increased the pressure to migrate to areas with less extreme conditions.

Among those considering a climate-driven move, 25 percent are looking to leave their state entirely.

Florida (58 percent) and California (52 percent) top the list of states homeowners would avoid due to extreme weather risk, followed by Hawaii (24 percent), Louisiana (22 percent), Texas (21 percent), and Alaska (21 percent).

The expected rising costs related to homeownership, maintenance, and insurance add to their worry, with 80 percent expecting cost increases this year.

Additionally, 82 percent expect their insurance premiums to increase, with most (72 percent) expecting increases between 1 and 10 percent.

More concerning is that 31 percent of survey respondents aren’t confident they’ll be able to maintain adequate coverage, and 49 percent say insurance costs weigh heavily on homebuying decisions.

Another 19 percent plan to switch home insurance providers this year.

Purchasing a home is out of the question for most, with 74 percent indicating mortgage rates would need to fall to 5 percent or less for them to consider purchasing another home.

Just 32 percent of homeowners believe interest rates will “meaningfully drop” in 2026.

Kin Founder and CEO Sean Harper predicts more stability in 2026.

“We went through a period of economic instability, but it was driven by macroeconomic factors like inflation and interest rates that have since been absorbed,” Harper said. “Elevated inflation was one of the big drivers of premium increases last year, but inflation is now occurring at a more predictable pace. Substantial premium increases were the story in 2024, but they weren’t the story in 2025, except for some places like California. And, they won’t be the story in 2026.”

Homeowners should focus on customer service when evaluating insurance options, he added.

“Since prices won’t be fluctuating as much in 2026, shopping behavior will be driven by customer service,” said Harper. “You’ll have more choices, so you should use this year as an opportunity to improve your position as a consumer.”

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Markel Group Announces Leadership Changes

Markel Group Announces Leadership Changes  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard