In their latest report on the U.S. auto insurance market, analysts from S&P Global Market Intelligence predict the strongest overall U.S. property/casualty insurance underwriting results in 18 years for 2025, driven by favorable private passenger auto outcomes.

Still, while their 2025 projected combined ratio across all lines is now 96.2, three points better than a midyear projection of 99.2 estimated for the year in August, “success is anticipated to be temporary due to various market dynamics and challenges,” S&P GMI said in a December media statement.

The media statement announced the publication of the firm’s 2025 U.S. Auto Insurance Market Report, which stresses the significant weight that auto insurance has on overall P/C insurance industry results.

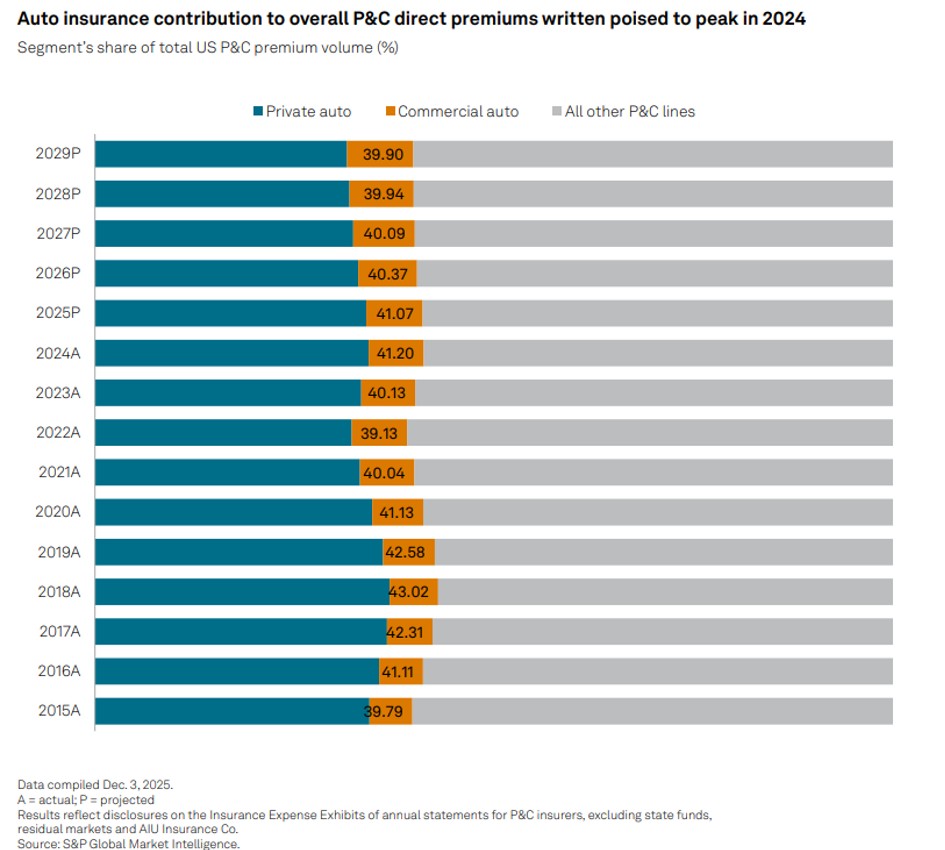

Together, S&P GMI estimates that private and commercial auto insurance will account for 41.1 percent of total U.S. P/C direct premiums written in 2025 when final results are tallied—slipping down slightly from a five-year high of 41.2 percent achieved in 2024, reflecting the impact of competition emerging in the private auto market.

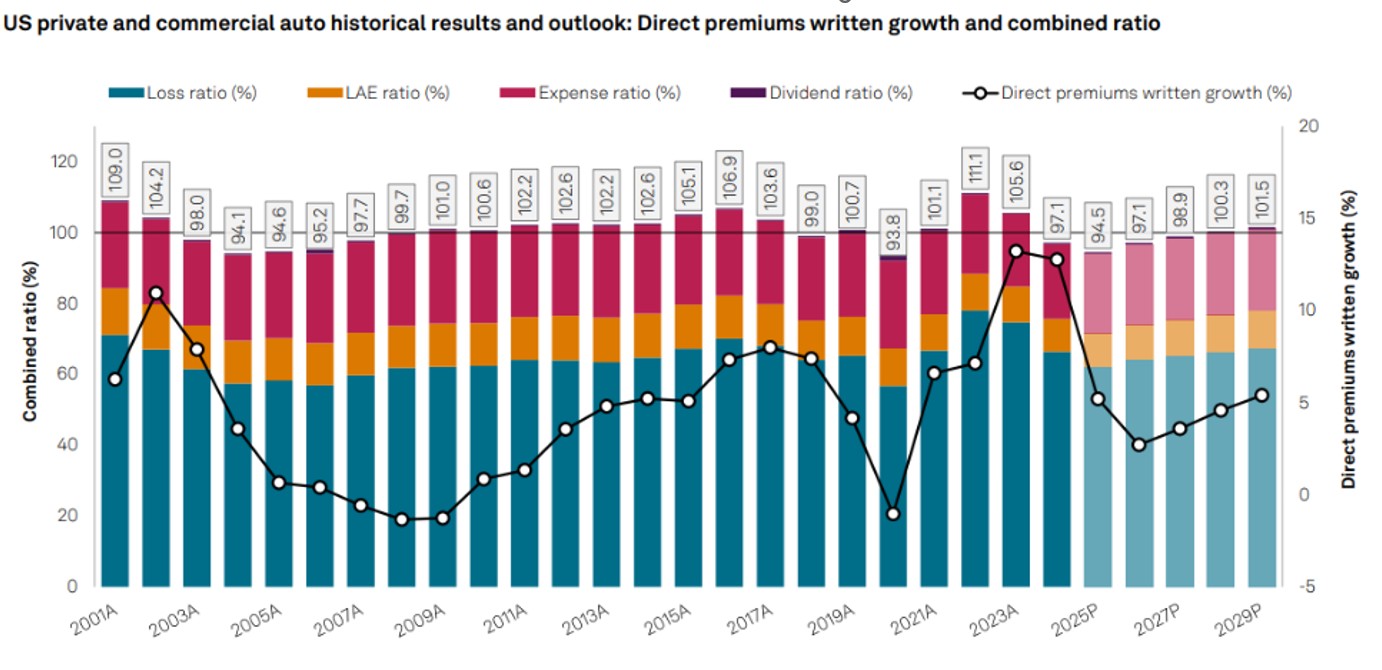

S&P GMI projects a 94.5 2025 combined ratio for auto insurance (personal and commercial together), driving the all-lines P/C combined ratio down to 96.2, compared to 96.5 in 2024. This marks the first sub-97 results in successive years since 2006-2007, according to the media statement.

Offering reasons for the industry’s success in 2025, S&P GMI noted the impact of “a generational hard market in personal lines,” as well as a benign year for natural catastrophes. “These factors are unlikely to recur, suggesting that the current level of success may be fleeting,” S&P GMI said.

In particular, the private auto business has seen accelerated competitive dynamics, “with rate decreases matching rate increases and increased advertising spending,” the media statement said.

Focusing on the 94.5 combined ratio projected for the combination of personal and commercial auto lines, the report notes that in the last two decades, the auto insurance business only produced a better result once—93.8 in 2020—when COVID-19 lockdowns fueled a precipitous drop in claims frequency. Even sub-100 combined ratios had been scarce from 2009 through 2023, with 2018 marking the only year other than 2020 with a result below breakeven.

Looking ahead, S&P GMI expects auto insurance combined ratios to breach the breakeven level again in 2028, edging up to 97.1 in 2026 (matching 2024’s auto combined ratio) and 98.9 in 2027, according to the full report made available to Carrier Management.

“Though we project that the combination of the private and commercial auto insurance businesses will post some of their strongest underwriting results on record in the near term, this is not to imply that the market is devoid of risks,” the report says. “Social inflation, or the escalation in claims severity due to adverse litigation trends, has vexed the commercial auto business for years, and recent results suggest that it is becoming a more significant threat to the private auto business—particularly among at-fault drivers with higher limits of liability under personal umbrella policies.”

“The political environment remains a wildcard as elected officials propose and/or implement policies with direct or indirect implications for auto insurance….[T]he generational hard market of the past several years in both private auto and homeowners has prompted calls for revisions to rate filing regimes that are likely to crescendo in 2026 to the extent our projections for continued historically favorable levels of profitability pan out.”

Also mentioned in the report is the tariff wildcard. Even though tariffs received a lot of attention earlier this year, they ultimately did not impact auto physical damage results. Still, future emergence cannot be entirely ruled out, S&P GMI suggests.

(Editor’s Note: Separately, S&P GMI projects a 92.7 combined ratio for personal auto in 2025, and 104.3 for commercial auto. If it actually lands at 92.7, the personal auto combined ratio result “would rival 2020 for the best private auto combined ratio [92.5] in at least 30 years,” without the material changes in driving behavior that accompanied a global pandemic.

Although S&P GMI doesn’t project that the personal auto combined ratio will rise above 100 until 2029, the text of the report suggests that a nearly 3-point improvement in the commercial auto combined ratio could be short-lived. The official forecast is for commercial auto combined ratios to move up slowly—from 104.4 in 2026 to 106.3 in 2029. But referring to historical results that could repeat, the text that a 3.5-point improvement in 2014, was followed by five years of pre-pandemic ratios ranging from roughly 109-111.)

Revised Projections

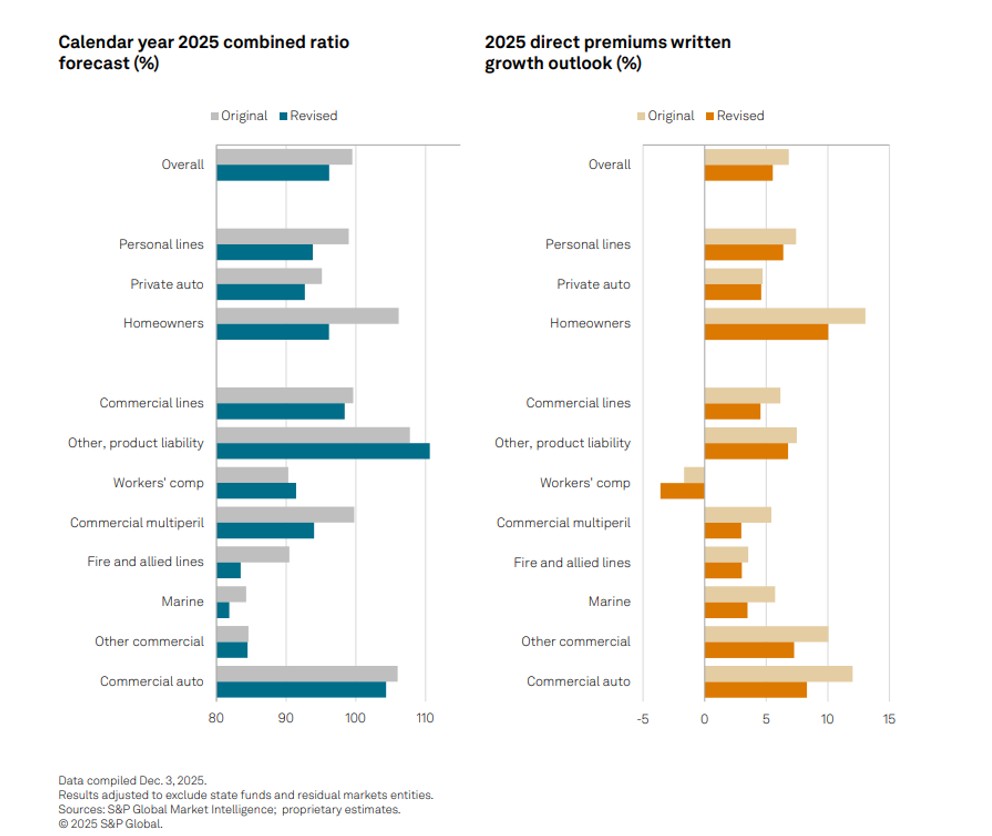

In addition to auto insurance, the 2025 U.S. Auto Insurance report, published in late December, includes full-year 2025 combined ratio projections for homeowners insurance in personal lines, and for several commercial lines, as well as projections of direct written premium growth for the same lines.

Comparisons to earlier projections delivered in S&P GMI’s 2025 U.S. Property and Casualty Insurance Market Report, published in August 2025, are shown graphically in the latest report on auto lines and set forth below.

The latest combined ratio projections are generally better than the August projections, with the homeowners line showing the greatest change—falling down from a forecast of 106.1 in August to below 100 (96.2) in December. The only line for which the forecasted full-year combined ratio moved in the opposite direction is commercial liability (other liability and product liability), which moved from 107.8 in the August report to over 110 in December.

Previously, the homeowners combined ratio projection had incorporated expectations for another active severe convective storm season in the second quarter and an average hurricane season in the third quarter—neither of which materialized.

“Meanwhile, adverse reserve development in certain casualty lines is running ahead of what we presumed to have been conservative projections,” the report says, commenting on the commercial liability lines. “This is particularly worrisome given that the fourth quarter, when companies occasionally implement ‘kitchen-sink’ reserve charges lies ahead.”

As for premium growth, S&P GMI hasn’t changed personal auto forecast of a jump of about 5 percent in 2025, compared with 2024, but analysts now project commercial auto insurance direct premiums “expanding at a more sluggish pace” than previously expected. In the August report, S&P GMI has put commercial auto premium growth at 12 percent, but the forecast now falls below 10 percent, according to the graphical comparison.

On the personal lines side, S&P GMI has also taken down its projected growth rate for homeowners insurance—to roughly 10 percent, according to the December auto insurance report, down from 13.1 percent in the August analysis.

What Else Is in the Auto Report

S&P GMI’s December auto insurance report also includes:

- A discussion of macroeconomic factors and their impact on the auto insurance business.

- Separate analyses of liability and physical damage combined ratios and growth rates for personal and commercial auto insurance segments.

- Lists of the top 20 personal and commercial auto insurers, showing five years of direct premiums and loss ratios for each insurer (2020-2024).

- Maps providing state-by-state loss ratio comparisons (five-year loss ratios for 2020-2024, presented separately for personal auto liability, personal auto physical damage, commercial auto liability and commercial auto physical damage).

- Maps indicating 2025 rate-change relativities for personal auto by state, and cumulative rate changes from 2021 through 2024.

- Discussion and analysis of advertising spending of major personal lines direct writers.

- Crash frequency statistics for commercial trucks and the analysis of E&S growth in the commercial auto market.

Throughout the report, S&P GMI also reminds auto insurers of long-term challenges on the horizon as the potential shift toward autonomous vehicles requires insurers to plan for a future with different risk profiles and coverage needs.

Conceding that “the promise of full autonomy within the private passenger fleet seemingly remains years away,” the report advises that “no matter how distant the transition, auto insurers have had no choice but to plan for a future that may look very different than the present and past.”

The Future of HR Is AI

The Future of HR Is AI  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly