The three independent U.S. InsurTech startups whose 2017 full-year results we profiled in April continue to grow rapidly in early 2018. But so far that has meant more red ink.

Executive Summary

In April, Matteo Carbone and Adrian Jones presented overall loss ratio, expense ratio and combined ratio results from statutory filings of the three InsurTech carriers, Lemonade, Root and Metromile, finding poor underwriting results for the trio in 2017. In this two-part article, the authors take a look at the insurers’ first-quarter 2018 numbers—Lemonade, here, and the others in Part 2 (“Q1 Loss Ratios Unsustainably High for InsurTech Carriers Root and Metromile“)The carriers are bigger on the top line, but underwriting results aren’t any better, they find. In the end, Carbone and Jones address key questions about whether loss ratios decline with scale. Along the way, they comment on a key part of Lemonade’s business model—the Giveback to policyholders’ selected charities, drawing a response from representatives of the behavioral science and AI company.

[The originally published version of this article was edited by authors on June 27 to remove a line about Root’s paid losses based on loss-related payments on Page 5 of the statutory blank rather than the paid loss exhibit in Part 2 of the blank.]

We’ve again analyzed publicly available financial results from statutory statements. The same caveats from our 2017 full year analysis remain, and again we use only public data to write this post, which reflects only our personal opinions. If you haven’t read our 2017 analysis, please check it out first.

Our prior statements regarding the three companies also remain:

- We think highly of their management teams and long-term potential.

- All three have a lot of runway and time to perfect their business models. We think they will.

- We produce this analysis not to critique their management. We want to help investors, entrepreneurs, and traditional industry insurers to understand what is happening in InsurTech through a lens of insurance fundamentals and facts rather than dogmatic opinion-mongering.

Overall observations

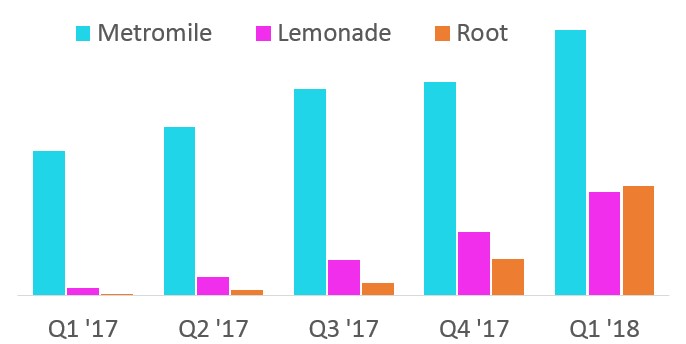

Top lines bigger. All three companies are growing at rates associated with successful early-stage startups. For a time, these rapid growth rates may sustain their impressive rumored valuations. State expansion is driving much of the growth currently. Root nearly tripled its top line in the last quarter, apparently without spending too much on customer acquisition, and now has closed the size gap on Lemonade. We suspect that this may surprise a few people considering the differences in the two companies’ “share of voice.” (Admittedly, we also give Lemonade a lot more attention, in part because its business model is less straightforward.)

Bottom lines redder. Underwriting results have continued to be consistently poor, even excluding expenses, which are influenced by scale and intercompany agreements. This is true even considering paid losses relative to premiums earned.

It has been suggested that some of the poor underwriting results are explained by exceptionally prudent or cautious reserving, but we find little evidence that reserving practices explain high loss ratios observed. Auto and renters are well-modeled, short-tail lines of business where large absolute differences in estimates are less common than in lines where losses take longer to become known.

It has been suggested that some of the poor underwriting results are explained by exceptionally prudent or cautious reserving, but we find little evidence that reserving practices explain high loss ratios observed. Auto and renters are well-modeled, short-tail lines of business where large absolute differences in estimates are less common than in lines where losses take longer to become known.

In between. A quarter doesn’t make much difference in insurance. Detailed breakouts of spending are only published annually.

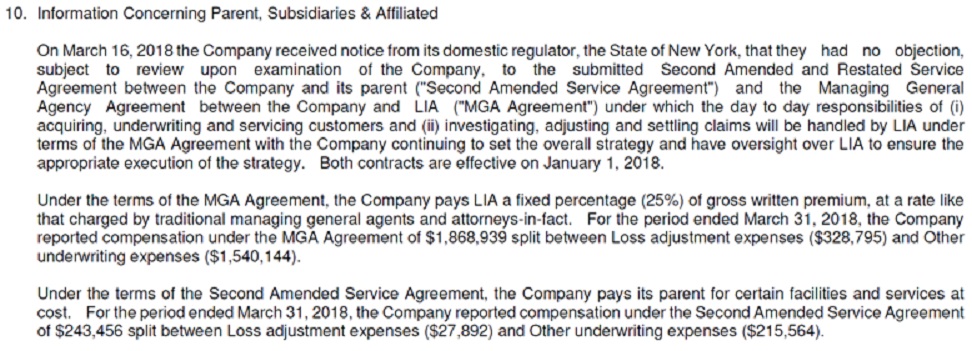

The most notable change: Lemonade materially reduced the potential Giveback and made an accounting change that reduces the expenses reported by their insurance company. Lemonade Insurance Company used to pay its parent a flat fee of 20 percent for various services rendered by the parent and affiliated companies. In March, this was raised to 25 percent, retroactive to 1/1/2018. The higher fee increases the slice going to Lemonade’s non-regulated entities by a quarter. Furthermore, Lemonade Ins. Co. no longer reports the true cost of the services provided by the parent, meaning that its expenses for 2018 will appear lower than they actually are. (We explain this later.)

Below, we review the first-quarter statutory results of Lemonade in detail. In Part 2 of this article, we provide more details for Root and Metromile. (See related article, “Q1 Loss Ratios Unsustainably High for InsurTech Carriers Root and Metromile“)

Lemonade Ins. Co.

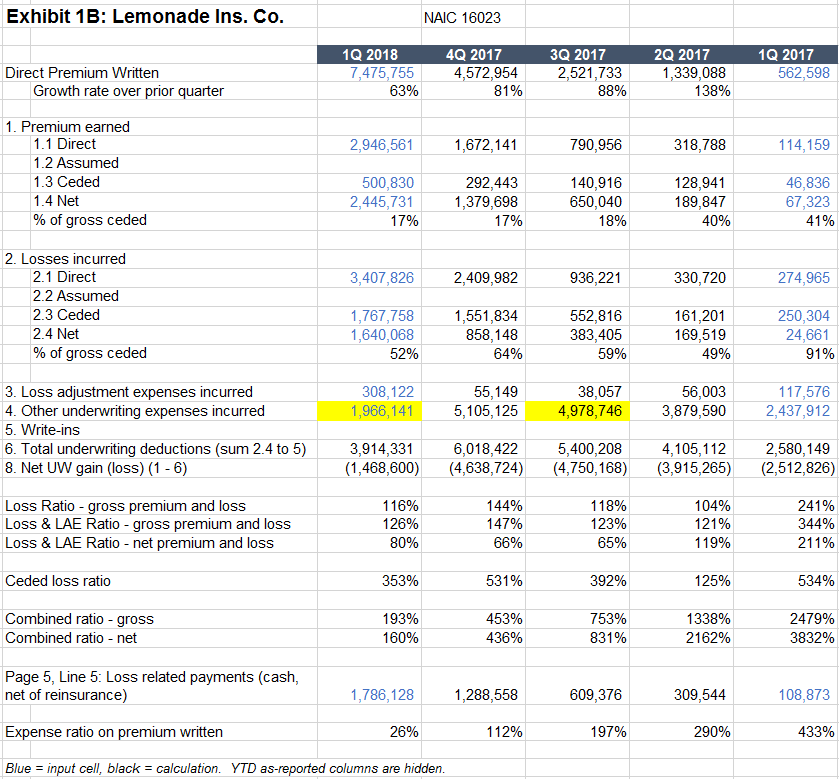

Love ’em or hate ’em, there’s something for you in Lemonade’s first-quarter results. The gross loss ratio (excluding loss adjustment expense) of 116 is still almost double what it should be to have a sustainable business, but it is within the last year’s quarterly range (from 104 to 144). A quarterly loss ratio with a small book like Lemonade’s ($2.9 million gross earned premium) is still quite sensitive to individual losses and reserve assumptions. The company reported $207,000 of gross adverse development in the quarter, which added 7 points to the gross loss ratio.

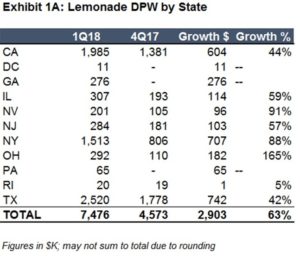

Premiums earned continue to grow rapidly. (Exhibit 1A below.) Texas is actually Lemonade’s largest state, followed by California and then New York. Lemonade’s other eight states combined produced less premium than New York in the first quarter of 2018. In the latest quarter, direct written premiums have almost doubled in New York, but the growth in California and Texas has slowed to around 40 percent, quarter-to-quarter. This is extraordinary growth even if it is slowing. Lemonade has pointed out that they look at different measures that aren’t published in yellow books, which we suspect include indicators of the sustainable long-term growth rate in the major states as well as seasonality factors in their renters’ insurance book.

Reinsurers continue to subsidize the company’s losses. Reinsurers incurred $3.53 for every $1 in premium they received in the most recent quarter. The aggregate XOL reinsurance contract normally runs another two years (through 6/30/2020), illustrating why reinsurers who back startups also consider having equity participation.

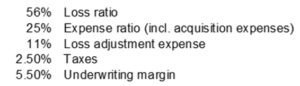

A homeowners company would typically aim for numbers something like the following (which are from a leading homeowners insurer), plus or minus a few points:

Compare to Lemonade’s numbers:

The Giveback

Lemonade’s Giveback is one of the company’s most intriguing features. Customers join cohorts, and if any premium remains after paying the cohort’s claims, fees, and reinsurance, that money goes to a designated charity. Lemonade says that this “Giveback” was 10 percent of “revenues Lemonade recognized” from its launch in 2016 till mid-2017. Another is coming in mid-2018.

Lemonade has hinted at “an exponentially larger Giveback in years to come.” We’re not so sure.

There are two big headwinds. First, Lemonade raised the fee paid from its cohorts to the parent company from 20 percent to 25 percent, effective 1/1/2018. Such arrangements are common in the insurance industry and are approved by regulators, but not always gladly. Sometimes profit is moved to an affiliated agency which doesn’t have to pay claims, while losses remain in the regulated insurer.

The second headwind against the giveback is that Lemonade’s cohorts have to pay for reinsurance, the cost of which is almost certain to rise in 2020 if the company continues ceding several times more losses than premiums. The Giveback will probably remain—someone’s cohort will have very low losses—but the combined effects of a bigger fee to the parent and more expensive reinsurance could greatly reduce the giveback “in years to come.”

This matters because the Giveback is the crux of Lemonade’s business model for both its investors and customers. As CEO Daniel Schreiber has explained:

“If there is underwriting profit it is donated to nonprofit. If it isn’t and there are insufficient funds the reinsurers have a bad day, not Lemonade.

“The 20 percent is insulated. We take 20 percent in good years and in bad and that is not really impacted by loss ratios. So, we are indifferent to the level of claims.”

Source: “Lemonade CEO: P2P moniker ’caused a lot of confusion,'” Insurance Insider, Sept. 19. 2017

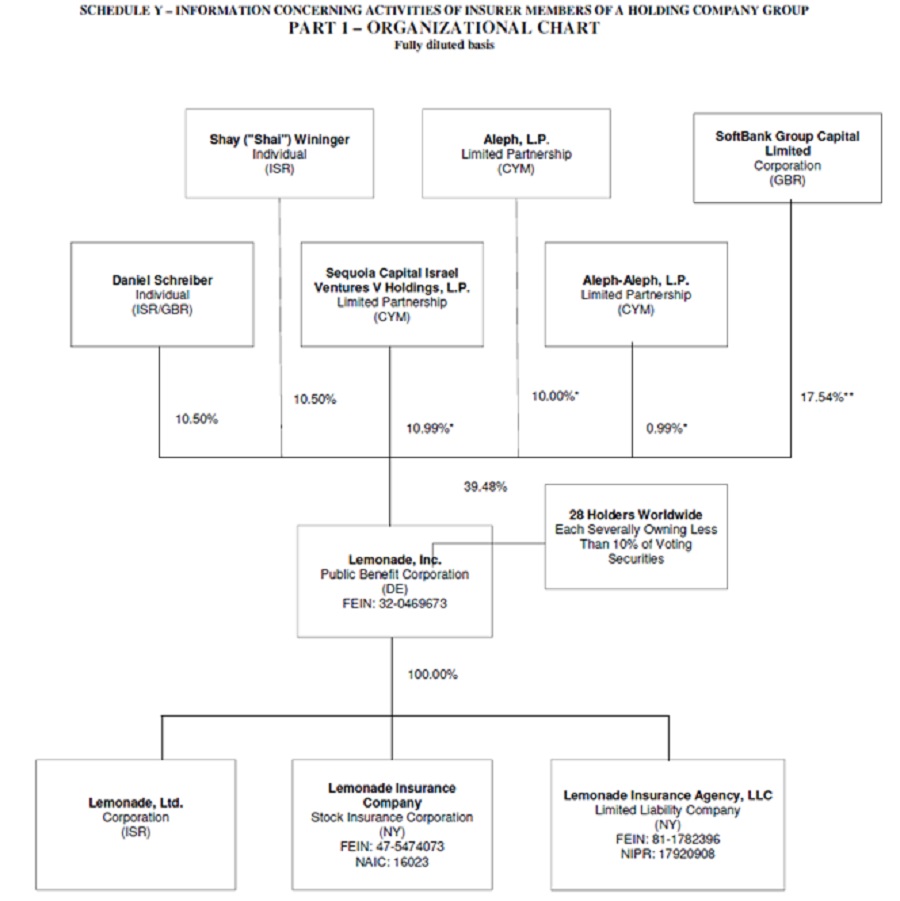

Lemonade has the cash to weather a lot of bad days and maybe even a pivot or two. The company confirmed its shareholding structure in the first quarter, and the figures support (but do not precisely confirm) the rumored $600 million valuation when Softbank and other investors put in $120 million.

Some favorable views of Lemonade’s Policy 2.0 initiative are presented in these two articles: J.D. Power: Why Lemonade’s Policy 2.0 Matters and I Kind of Like Policy 2.0.

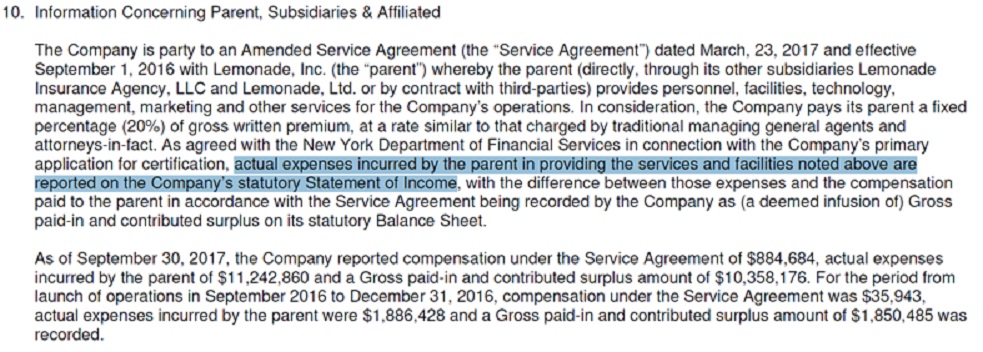

Lastly, we comment on a quiet but meaningful accounting change. The 20 percent fee paid by Lemonade Ins Co (now 25 percent) was far less than the actual cost of the services received. Lemonade Ins Co used to report consolidated figures that gave a true representation of the cost of running their operation. No longer. Effective in 2018, the consolidation is gone, and perhaps $3 million of expenses seem to be missing in 1Q18—highlighted in yellow above. In terms of disclosure, throughout 2017, Lemonade used the language shown below. The highlighted language is the key bit that is missing in 2018.

Now in 2018:

Transparency….

The authors’ opinions are solely their own, and only public data was used to create this article.

The Future of HR Is AI

The Future of HR Is AI  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best