Insurers that earn jeers from their customers are falling further behind the ones that earn cheers.

Executive Summary

Watermark Consulting’s Jon Picoult demonstrates that the connection between the customer experience a company delivers and its financial performance within the insurance industry. Following up on a prior study in which he uses a stock performance analysis tied to J.D. Power’s insurance customer satisfaction ratings, Picoult shows that the competitive edge enjoyed by J.D. Power’s Insurance Customer Experience Leaders over Laggards is both real and strengthening in the auto and homeowners lines.That’s the key takeaway from Watermark Consulting’s 2018 Insurance Customer Experience ROI Study.

The study, which was last conducted two years ago, seeks to provide insurance executives with a macro understanding of the impact that customer experience has on a company’s fortunes. This is important information for an industry that publicly affirms the importance of customer experience, but privately struggles to quantify the benefits of such investments.

About the Study

Watermark’s analysis is based on data from what is arguably the most well-regarded source of insurance carrier customer experience rankings—J.D. Power and Associates’ annual Insurance Satisfaction Studies.

The study’s approach was simple: We calculated the cumulative total stock returns for two model portfolios, comprised of the Top 5 (“Leaders”) and Bottom 5 (“Laggards”) publicly traded companies in J.D. Power’s annual study. (A white paper about the study, referenced at the end of this article, includes a more detailed description of how the analysis was conducted.)

In both cases, our model portfolios tracked the stock performance of the carriers for the year-earlier period of their designation as a Leader or Laggard (so, for example, J.D. Power’s 2017 Leaders were used, retroactively, to build our 2016 stock portfolio).

This approach was consistent with our thesis that the market would already be rewarding/penalizing the Leaders/Laggards in the full-year period preceding the release of J.D. Power’s consumer survey (given the customer experience the carriers were already delivering). It also helped ensure that the model portfolios’ performance was not at all influenced by the publication of the J.D. Power study itself.

The Results

Yet again, the Insurance Customer Experience Leader portfolios far outperformed the Laggard portfolios—and the margin of victory widened considerably as compared to the 2016 study.

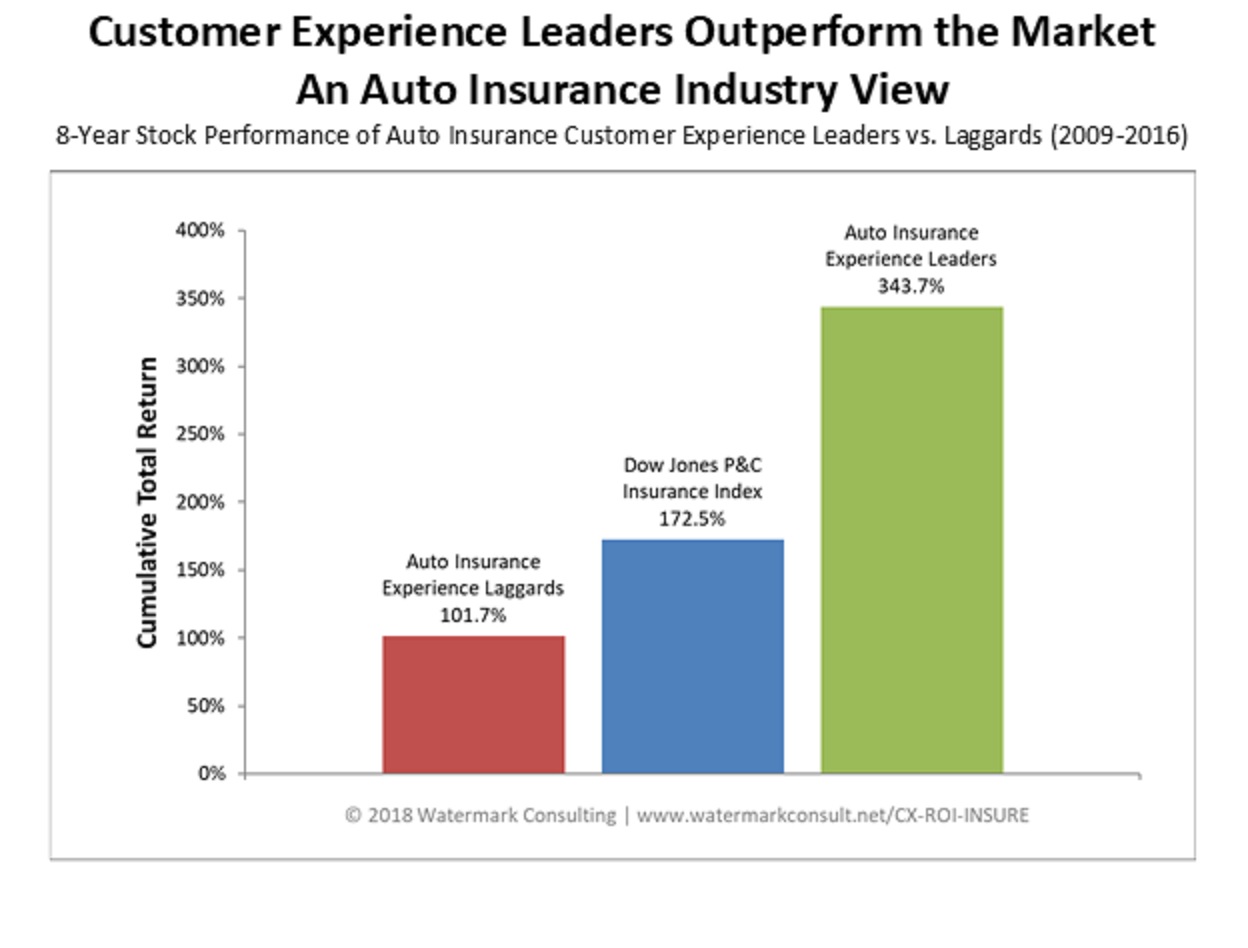

As the accompanying graphic shows, over the eight-year period studied, the portfolio of Auto Insurance Customer Experience Leaders far outperformed the industry, generating a total return that was nearly double—171 points higher—than that of the Dow Jones Property & Casualty Market Index.

While a few carriers made repeated appearances in the Leader category over the eight years examined, only one, Erie Insurance, earned that distinction for every year of the study.

What’s most striking is the growing chasm between the Auto Insurance Customer Experience Leaders and Laggards. The Laggard portfolio now trails the Leader portfolio by an astounding 242 points.

As with the Leaders, there was some year-to-year consistency in the Laggards list, with two firms— MAPFRE-Commerce Insurance and The Hanover—showing up in that category every year of the study.

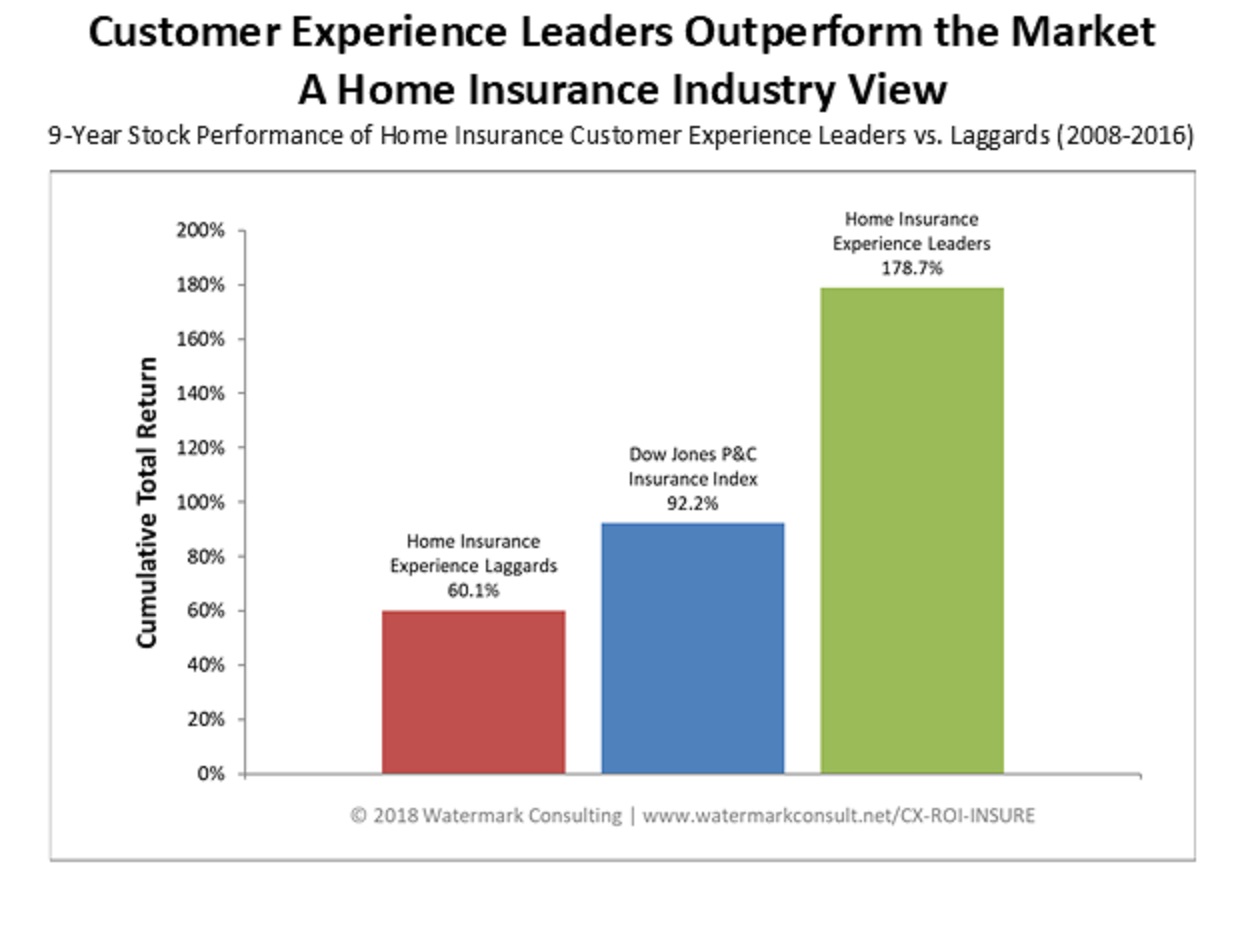

The graph below, which shows the analysis for home insurers, exhibits a similar pecking order as seen with the auto insurers.

The Home Insurance Customer Experience Leader portfolio outperformed the industry, generating a total return that was nearly double (87 points higher) than that of the Dow Jones Property & Casualty Market Index.

While several home insurance carriers made it into the Leader category multiple times, Erie Insurance was again the only one that achieved that distinction for each of the years covered by the study.

The Home Insurance Laggards in this latest study fell even further behind the Leaders, with the cumulative performance gap between the two portfolios reaching 119 points. (Editor’s Note: In the prior study, the gap was 57 points.)

Interpreting the Results

This study should give pause to anyone who is skeptical of the value that customer experience differentiation accords to an insurer.

That enhanced value is a function of the Leaders seeing a rise in revenue, thanks to happy, loyal customers who spend more with them, stick around longer, and refer others.

It’s also a function of a more competitive cost structure, as the Leaders can spend less on new business acquisition because of all the referrals they receive. In addition, because these firms’ happy customers complain less, there’s not as much stress on their operating infrastructure, which also helps keep expenses in check.

The Laggards, of course, are weighed down by just the opposite factors—depressed revenues, high customer churn, and profit-sapping, strained infrastructures.

What was notable in this year’s study was that the disparity in performance between the Leaders and the Laggards wasn’t just striking—it was also growing by double digits.

Those angling to break into the Leader category should be forewarned: There is no “silver bullet” for achieving customer experience excellence. Latching on to some buzzword– big data, InsurTech, AI, etc.—won’t get you there. Neither will advertising how great your customer experience is. The reality will always overshadow the marketing.

Those leading firms often rely on a handful of time-tested experience design principles. (See the white paper referenced below for examples). However, at their core, what makes the Leaders different is their unwavering commitment to always start with the customer—understanding their needs and wants, their frustrations and aspirations—and then working backwards to craft a distinctive, impressive end-to-end experience.

Fundamentally, it is this outside-in philosophy that gives these companies their competitive edge. And, as this study so clearly illustrates, the strength of that advantage should not be underestimated.

Note: A white paper describing Watermark Consulting’s 2018 Customer Experience ROI Study (Insurance Industry Edition) is available for complimentary download at http://bit.ly/CX-ROI-INSURE.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb