Much of life happens at work. Even if employees are more transient than ever, swapping jobs for greener pastures, they are still working 8+ hours a day, committing the greatest part of their waking hours (and their most productive hours) to help their company compete and succeed. While at that company, most have a sense of loyalty.[i] They will do their best to make sure that their employer does well, at the same time recognizing that their positive efforts will likely yield them a pay bump or a bonus.

While they are loyal, working hard and identifying themselves with the company, they also are looking for “what the company can do for them” – including what benefits are offered to them. The crazier life gets, the busier employees become, and as they adapt to life changes, the more interested they are in benefits that will provide them what they want and need, save them time and not take too much time to research or purchase. What they want are benefits that make sense for them and can be purchased in ways that make sense. And that gives group and voluntary insurers a whole new challenge. Create relevant products that make sense on every level. Offer products that fit each unique life, then offer them where life happens — at work.

It sounds incredibly easy. Is there a catch?

Last week Celent released a Majesco-commissioned report, Next-Gen Platforms in Group and Voluntary: Exploiting New Opportunities Across the Worksite Ecosystem. At the same time, Majesco started a series of articles and conversations that are yielding some truly fascinating insights, not only about why insurers should consider entering the Group & Voluntary market, but why Group & Voluntary current market opportunities may be a sufficient motivator for insurers to adopt a next-gen platform approach to technology. Once we have examined the research, I think you’ll agree with me that there has truly never been a more opportune time to develop a Group & Voluntary strategy and an accompanying platform strategy.

Timing and approach and data

In a recent article, we listed out a number of reasons that Group and Voluntary Benefits are like the new “Wild West” of insurance. We are at a place in time where it seems like anything and anyone can get involved because the territory is opening up. A market shift, generational shift and technological advancements have changed how an insurer can develop and market their products through the worksite channel. Let’s look at a traditional example for comparison.

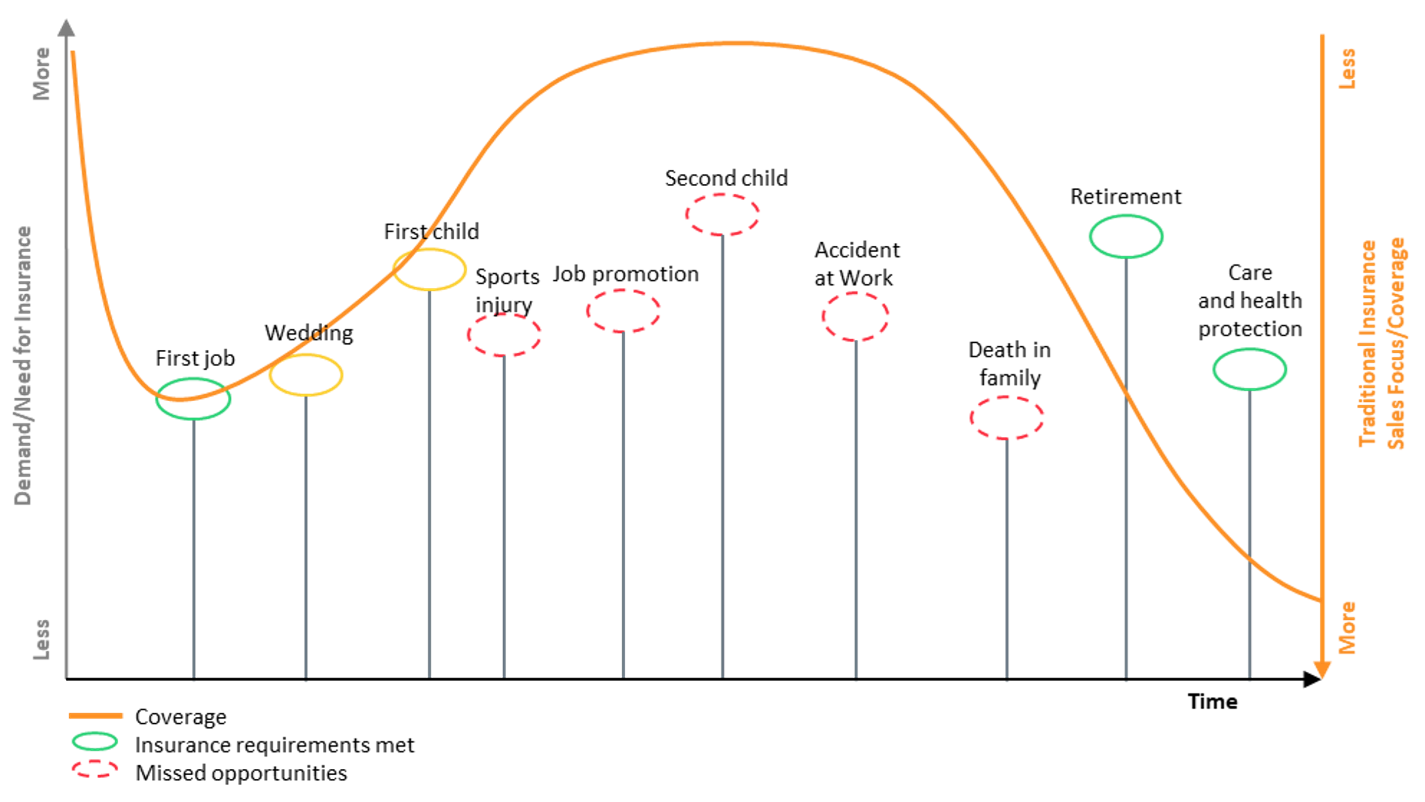

Celent’s report discusses traditional “life-event” marketing. (See Figure 1)

“…many of the life events that ought to trigger an opportunity to engage, such as a promotion or the birth of a child, often get missed when using traditional methods. Employer systems, when coupled with other data, can be a great source to identify and then tailor a solution that meets the exact need at a point that counts.”[ii]

Figure 1

Source, Celent, Oliver Wyman

So, where traditional insurers rely upon agent fact-finding or upon less-detailed data from market lists, employers know the facts and, in many cases, they are already using those facts to establish patterns of wellbeing for the employee. In fact, it’s in the wellbeing area that Group & Voluntary Benefits insurers may find their best product opportunities.

The wellbeing at the end of the rainbow.

If there was ever a pot of gold at the end of the rainbow, you wouldn’t really have to search for it. You would just have to follow the rainbow to get to it. In some respects, this is where insurers must begin. Instead of just asking the important question, “What do customers want,” the more relevant question in Group & Voluntary Benefits is, “What kinds of wellbeing are companies promoting these days?” Insurers need to follow the wellbeing rainbow to figure out just what sorts of products and hybrid services employees might find useful as they pursue wellbeing across physical, mental, financial and lifestyle.

As Celent points out, this search for wellbeing fits most employer benefit portfolios.

“Today, most employee plans extend beyond insurance to provide more holistic wealth, health and protection services. Increasingly, these services promote wellbeing, reward loyalty (through retail store discounts etc.), and serve to increase the employees purchase power (such as leveraging government tax efficient plans in some territories to purchase healthy living equipment, such as ‘bikes for work’).”[iii]

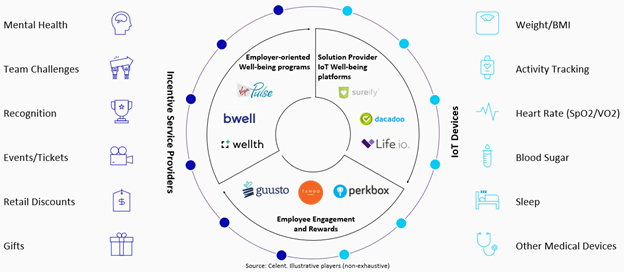

By looking at the benefits portfolio, in line with employee wellbeing and a new source of excellent data for life event-driven marketing, Group & Voluntary Benefits insurers should consider the types of innovative products that will be demanded. Many times this product looks less like a simple standalone product and more like a hybrid product that may include multiple coverages, multiple partners, incentives, data-linked pricing and some element of lifestyle wellness. Celent calls this a diversified play.

“Increasingly it involves not just a converged product set tailored to meet a specific customer need, but also a mechanism to drive regular engagement (via an associated rewards program) or active wellbeing with the associated risk mitigation benefits (such as an incentive program driven by IoT-based devices designed to drive active lifestyles or nudge financial prudence, such as IRA top-ups).”[iv]

Which way is the door to entry?

Once an organization has established that it has a product concept that might fit the employee benefits landscape, it’s then time to understand the distribution landscape. In most cases these are the doors to entry. According to Celent,

“Group & Voluntary players have the opportunity to extend their reach through either staking out a position in distribution or partnering with these players in addition to broadening their relevance through diversified plays.”[v]

The Celent report illustrates several partnership models that range from partnering with adjacent group and benefits providers and connecting through API integrations through becoming the center of a voluntary benefits ecosystem, with various options in between. Insurers need to consider what role they will play as they consider an array of partnerships that will deliver the products demanded by customers. It all boils down to strategy. Where can a Group & Voluntary Benefits insurer positively contribute to and succeed in the overall benefits scheme?

A very long engagement — the opportunity to keep the customer

In traditional Group & Voluntary Benefits products, portability wasn’t much in demand. As I pointed out in my last article, people stayed at their jobs longer – often their entire career – and if they didn’t, most insurers and systems weren’t prepared to turn a group or voluntary product into an individual product with the flip of a switch. Today, if a benefit works for an employee, they may wish to keep their coverage when they leave – or if they operate as a gig worker for the company. This is pushing Group & Voluntary Benefits players to figure out how to engage employees and then help them make seamless transitions between jobs or gigs.

This is where the idea of partnership becomes a vital element to capturing Group & Voluntary Benefits opportunities. In many or most cases, insurers that are looking to create products in the well-being space may find their best partnership opportunities within the realm of InsurTechs and well-being platform startups. [See Fig. 2] Celent states that,

“Partnering is a rational alternative response to deliver a more rounded customer proposition fast, and is the dominant strategy being adopted by firms active in the employee benefits market.”[vi]

Figure 2

This kind of partnering requires cloud-based, real-time services, facilitated through API integrations and normally in touch with both the worksite plan orchestrators (Benefits Plan Administrators) and the InsurTech wellbeing and engagement players. This is a real hurdle! According to Celent,

“For Group & Voluntary insurers operating in this market, operating models are often hampered by legacy infrastructures where different underlying systems service different products are then glued together at the front-end, resulting in an inconsistent customer experience depending on the product sold…Longer-term investment in technology and the adoption of an open ecosystem mind-set are essential to really take advantage.”

The Next-Gen ecosystem — an opportunity enabler

The timing is right. The opportunity to partner with benefits distribution players is better than ever. The ability to engage customers with better data and then keep them with portability is a real opportunity that will continue to grow through innovation. The whole premise hinges, however, on one decision. Are insurers ready and willing to adopt a Next-Gen ecosystem approach and prepare their organization with the platform architecture and cloud-supported strategy that is necessary to move ahead?

If you haven’t had a chance, be sure to download the Celent report and view our recent conversation with Seth Rachlin, Executive VP, Global Insurance Industry Leader, Capgemini and Jamie Macgregor, CEO, Celent, Untapped Market Opportunities for Group and Voluntary Benefits with Diversified Plays, Open Ecosystems and Next-Gen Platforms.

By Denise Garth, Chief Strategy Officer, Majesco. Denise Garth is widely regarded InsurTech and industry thought leader and recognized InsurTech Top 50 Influencer and Top 50 Women Leaders in SaaS, Denise Garth is the Chief Strategy Officer at Majesco. Majesco is a global leader of cloud insurance software solutions with products that empower insurers to modernize, innovate, and connect their business at speed and scale. Garth began working at Majesco in 2015 as a Senior Vice President in Strategic Marketing, Industry Relations, and Innovation. Garth leads the company’s strategy, marketing, industry relations, and innovation in support of Majesco’s client-centric strategy. With both P&C and L&A insurance experience, Garth has also authored research and articles grappling with the key issues and opportunities facing the insurance industry.

[i] Stuart, David and Todd Nordstrom, The Truth About Employee Loyalty, and 5 Things Every Leader Should Know, Forbes, January 10, 2019

[ii] Macgregor, Jamie and Dan McCoach, Next Gen Platforms in Group & Voluntary: Exploiting new opportunities across the worksite ecosystem, p. xx, Celent, August 26, 2021

[iii] Ibid.

[iv] Ibid. p.9

[v] Ibid. p. 11

[vi] Ibid. p.13

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb