“You can’t cut yourself to greatness.”

Simon Wilson, chief executive officer of Markel Insurance, made the simple statement at a Markel Group Brunch meeting for investors in Omaha on May 4 to convey the idea the hard work of reducing underperforming insurance business has been largely done in recent years. Markel Insurance is now intent on growing its “bread-and-butter” excess and surplus lines insurance business, written through wholesale brokers.

While Markel has been busy correcting underwriting mistakes, like cutting back on U.S. construction business, the E&S market has experienced industrywide growth of 20 percent for the last five years, said Wilson, the former head of the international insurance business of Markel Group, who ascended to the role of CEO of all the insurance business in March.

The Sunday brunch meeting took place a day after Berkshire Hathaway’s annual meeting in Omaha, with Markel Group CEO Tom Gayner referencing the wisdom of Berkshire Chair Warren Buffett and former Vice Chair Charlie Munger more than once. Markel Group is sometimes referred to as “Baby Berkshire” by investment analysts because of its similar setup as a holding company for insurance and non-insurance operations—insurance being the most important.

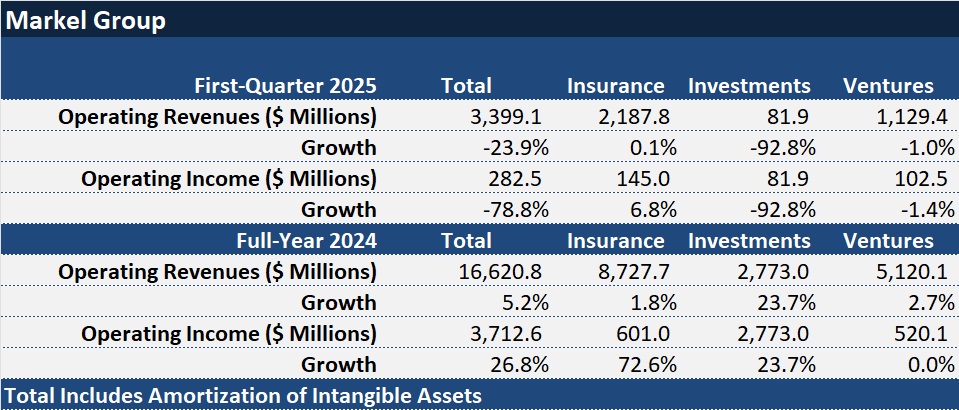

Gayner and Michael Heaton, chief operating officer of Markel Group, preceded Wilson with separate presentations during the Markel meeting, first describing the three profit-producing engines of the group: Insurance, Investments (returns from equity and fixed maturity investment of insurance float) and Ventures (a division made up of 21 noninsurance businesses). Heaton said the holding company is “a home” for the diversified operations designed to “relentlessly compound” shareholder capital over decades, and referenced the group’s values codified as the “The Markel Style.” One Style point—”to seek to be a market leader in each of our pursuits,” Heaton said, noting Markel Insurance’s No. 4 position in the U.S. surplus lines market (based on direct written premiums) and referring to Markel Insurance as the “biggest diamond” in Markel Group.

Still, both executives, choosing different words, expressed disappointment in the results of the “crown jewel” insurance engine in recent years, and alluded to corrective actions Wilson is putting in place now.

“Our core insurance business has not reached its full potential. And to deliver on our promise to you, it absolutely must,” Heaton told shareholders. “Speaking candidly, we had to begin by mopping up a few messes in the aisleways” several years ago, he said.

“While we have not been top quartile in recent years, make no mistake, we aim to return to the front ranks,” Gayner said, referring to the specialty insurance businesses that include admitted and nonadmitted programs written through managing general agents in addition to E&S wholesale.

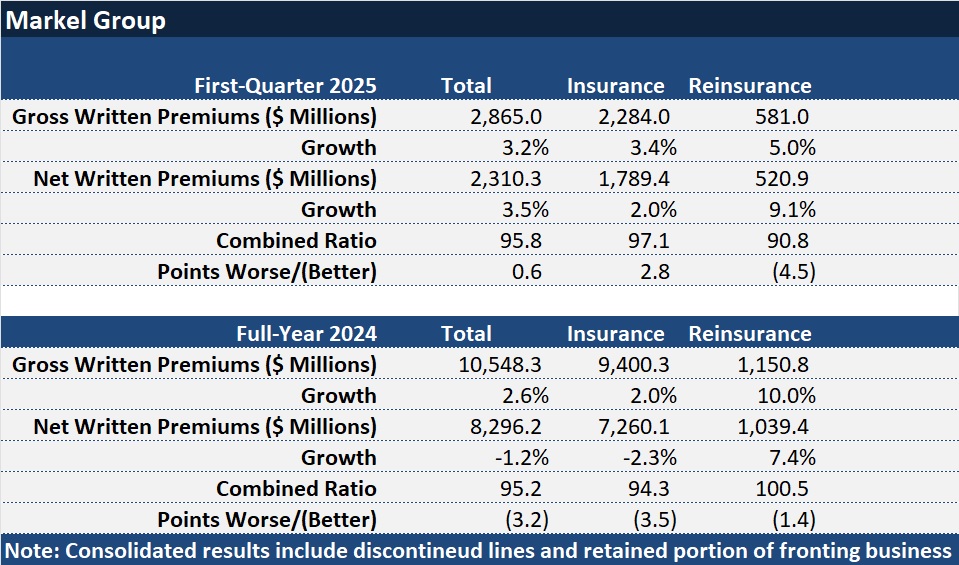

Wilson referenced combined ratios of competitors—Kinsale, averaging 78.7 over the last five years, and RLI, averaging 87.2. Markel’s average combined ratio was 94.7 over the same period, he said, setting out profit aspirations that will accompany renewed growth in E&S wholesale business, as well as moves to grow workers compensation and surety programs.

“That’s almost astonishing,” Wilson said, referring to Kinsale’s sub-80s combined ratios. “We heard yesterday at the Berkshire meeting that they were celebrating an 80-something combined ratio at GEICO. These Kinsale guys have been doing that over and over again for a long period of time” in specialty, he said.

Related article: Staff Cuts Help Fuel GEICO Profit; Not ‘Pouring Money’ Into AI: Jain

As for RLI, on the day that Markel announced that Wilson would take the reins of the insurance engine, the holding company also announced that RLI’s former Chair, CEO and President Jon Michael would fill a spot on the board of directors vacated by former Vice Chair Tony Markel, who is retiring. “We’re going to learn a lot from him as to how they produce,” Wilson said.

Related article: Wilson Promoted to CEO of Markel Insurance; Vice Chair Markel to Retire

Focusing in on the relative combined ratios, Wilson noted RLI’s mid-80s performance over the same five-year time frame in which Markel’s combined ratios hovered in the mid-90s. “We’ve got to be honest about that, right? If we’re doing 95 combined ratio on $10 billion of earned premium and our competition is 10 percentage points margin better than us, that’s a billion dollars in that year of lost profit against the best in the marketplace,” he stated.

Markel Insurance’s underperformance against its peers is one of the issues that sparked a board-level review of all the businesses, which Markel Group announced in February. “Our foremost focus will be the performance of our market-leading specialty insurance business. Insurance is at the heart of what we do,” a statement about the review said.

Related article: Markel’s Board Commencing Review of Go-Forward Business Structure

Assisted by external consultants and advisors, Markel also described the review as “an opportunity to….ensure our goals and direction align with our shareholders’ priorities,” revealing that the viewpoints of an activist shareholder, JANA Partners, had also prompted the period of broad self-reflection.

On the Agenda: Simplify and Empower

At the brunch meeting, Gayner said the board-led review would look at every aspect of the Markel Group, including its structure, operations, marketplace, perceptions and results. “That doesn’t mean that our work serving you to the best of our ability ever stops. We’ll continue to work and improve as the board review continues apace,” he said, later introducing Wilson to discuss the work that has started on fixing Insurance, independent of the board’s review.

The February media statement from Markel Group about a board-led review of Markel’s structure did not address whether the company is considering splitting off or selling any of its engines of profit. The statement did note, however, that the initial impetus for the review came at the suggestion of investor, the firm JANA Partners.

A Bloomberg article published late last year reported that JANA recommended the separation or sale of Markel’s private investment business and also believed that Markel could be an “attractive” target for larger insurers seeking acquisitions. (“Activist Jana Pushes Insurer Markel to Separate Venture Unit – Bloomberg by Crystal Tse, Dec 10, 2024, subscription required)

During the May 4 Markel Brunch meeting, the only “separation” executives spoke about involved restructuring inside the insurance engine—splitting Markel Specialty into a U.S. Wholesale and Specialty division and a Programs and Services division.

After presenting examples of the types of risks that Markel underwriters had tackled in the last week—a container vessel voyaging in the Red Sea, the builder of a floating wind farm near the coast of South Korea, and the owner of 10 gas stations in Richmond, Va. seeking pollution liability cover—Wilson outlined his plan to refocus on this type of core specialty insurance expertise by simplifying the organizational structure and empowering business unit leaders. He also provided some specifics on what ill-performing accounts that are no longer part of the Markel Insurance portfolio.

Jokingly suggesting that the school nickname “Simple Simon” may have gotten him his new job, Wilson introduced the new simplified structure of Markel Specialty, which will now be divided into two core business units—U.S. Wholesale and Specialty led by Wendy Houser, and Programs and Services led by Alex Martin. Houser’s division is responsible for all U.S. specialty insurance business that flows through the company’s core wholesale and retail channels, and Martin’s encompasses a collection of businesses that include personal lines, Bermuda, surety, workers compensation, small commercial general package, programs and InsurTech.

The restructuring serves to clearly align core businesses with the buying behavior of customers and distribution partners, Wilson suggested.

He also said that Markel Insurance will ditch a shared service model, progressively shifting services like IT away from the corporate center and into frontline underwriting divisions.

Within the two broad specialty divisions, encompassing some 50 or 60 individual specialty businesses, not only will there be stronger alignment between underwriting and technology, but underwriting business leaders, each responsible for “a clear set of accounts,” will also have full accountability for their individual profit and loss statement, he said.

“When you give someone a clear task to go and get done, and the tools to go and do it, if they’re good enough, nine times out of 10 they will get the job done. And that’s what we’re going to be doing here,” he said.

Strategic Missteps

Before expanding on the need for these key changes designed to empower leaders of individual specialty business units, Wilson spent a few minutes recounting the underwriting mistakes of the past.

“We are overweight in construction business in the U.S., [and] that was a misstep that caused us a problem when…the law courts in the U.S. started handing out enormous jury verdicts to people who have been injured in the course of work,” he said, also pointing to risk-managed D&O and E&O, and an intellectual property collateral protection insurance product line as performance hot spots.

Chief Financial Officer Brian Costanzo provided details on the corrective actions that started in early 2024 during a first-quarter earnings conference call, including exits of primary casualty retail businessowners policies, risk-managed excess construction, risk-managed architects and engineers and CPI. “We meaningfully reduced the construction mix in our casualty portfolio,” he added, noting that specific actions included changing terms and conditions to eliminate certain exposures to subcontractors, reducing limits on excess lines, implementing premium caps in challenging states, achieving double-digit rate increases across the casualty portfolio and walking away from risks that were not adequately priced.

More recently, “in our most challenged class U.S. public D&O, we moved to a single access point for public D&O and large financial institutions coverage based out of our Bermuda platform,” Constanzo added.

Related article: Markel Reorg Announced: U.S. Public D&O, FI Moves to Bermuda Platform

“These collective actions comprised a reduction of $350 million in 2024 gross written premium, but were accretive to our 2024 combined ratio results. …They will be further accretive to our 2025 results, but will also continue to put pressure on top-line premiums, which in the first quarter of 2025, reflected a reduction of $33 million in premiums related to these exited lines,” the CFO said during the earnings call.

“It’s one thing cleaning a mess up. You can’t cut yourself to greatness,” Wilson said days later at the Markel brunch meeting. “We’ve got to start really pushing growth into this business again.”

“Core strategy is something that we need to think about,” he stated.

“Because our strategy has become a little bit confused,… the ability for our entrepreneurial business leaders to get things done and make decisions has waned.”

Simon Wilson, Markel Group

“We’ve got this fabulous business at the center,” he said, referring to U.S. E&S Wholesale and Specialty as the biggest diamond within the Insurance business. “We’ve almost taken it for granted that will just continue to win in that area. We’ve gone after other bits of the market saying, ‘Oh, there’s lots of premium over here, there’s lots of premium over there. And meanwhile, Kinsale has gone right into that wholesaling specialty E&S market and started making money at a 70-something combined ratio.”

“We’ve taken our eye off the ball of our bread and butter business….We’ve had a little bit of a grass is greener strategy for a few years.”

Wilson also said that as Markel Insurance grew, it’s structure became overly complex. “We’ve fallen into that corporate trap of saying let’s do a matrix structure [with] a head of a product and a head of a distribution channel and a head of geography—and all those people report into slightly different bits of the organization.” When something goes wrong, no one is clearly accountable. And the complex structure slows decision making,” he said, offering a similar assessment of the problem of centralized services.

“Because our strategy has become a little bit confused,… the ability for our entrepreneurial business leaders to get things done and make decisions has waned,” he said. “As a result, people have lost a little bit of confidence to get things done and drive these businesses forward.”

Wilson promises “absolute clarity” going forward.

“We are a specialty insurer and we’re going to put the [task] of driving the strategy in the [hands of] leaders who are closer to the customer and understand how their businesses are run. We’re going to empower those people to get it done.”

Displaying a slide that showed the U.S. Wholesale with just under $3 billion in premiums, and the Programs and Solutions portfolio with about $3.7 billion, along with International and Reinsurance adding another $3.7 billion, Wilson focused on the potential to grow Wholesale and Programs.

The U.S E&S market is “where we made our reputation, and this is where we are perceived by brokers to have the greatest strength….That market since 2019 has grown a compound annual growth rate of 20 percent. Markel has not,” he said, going on to offer “structural reasons” why market growth will continue.

The U.S E&S market is “where we made our reputation, and this is where we are perceived by brokers to have the greatest strength….That market since 2019 has grown a compound annual growth rate of 20 percent. Markel has not,” he said, going on to offer “structural reasons” why market growth will continue.

“Customers who are buying these kind of special insurance products much prefer to get a tailored product that exists outside of the admitted market where you have to rate and file. They prefer that, and once they’ve used it, they carry on using it,” he said. The need in the U.S. to get tailored insurance solutions “is going up and up and up and up.”

Wilson also pointed to the increasing sophistication of the largest wholesalers—Amwins, CRC and RT Specialty. “Business is gravitating towards them and they’re putting more and more investment into that space,” he said.

Turning to the Programs and Services area, Wilson focused on the potential to grow in the workers compensation and surety segments.

“Workers comp is a massive, massive area of the U.S. specialty marketplace, and when you look at a lot of our competitors, it’s actually where they’ve made their profit. They’ve been able to release reserves from that workers comp space often to subsidize the casualty reserves that they’ve been having to put up.”

Markel’s worker comp business is also profitable—”but it needs to be bigger.”

“Do we need a bigger product? Do we need a broader appetite? Do we need a new technology system? Do we need some more people? Probably a little bit of all of those things, but we will develop a strategy to grow that business way beyond $480 million [gross written premium level] that it’s at now,” he said.

“I’d hope for that to be more like a billion in the not too distant future.”

Similarly, highlighting 70-80 combined ratios for surety, Wilson said Markel has more than doubled an acquired business, SureTec, from a $70 million business to $190 million in gross premium. “There’s no reason why that shouldn’t be $500 million in a few years.”

Wilson also discussed the profitability and growth potential in International business, and underscored the need to federate shared services. “If we believe in empowering business leaders—and we do, and we want them to run a tight P&L, then we’ve got to get back to basics. We’ve got to start pushing businesses and ownership down towards the customer.”

In addition to talking about how the decentralization of technology and other shared services will restore a culture of trust and entrepreneurship internally, Wilson offered external trust in Markel and market-leading specialty insurance expertise as a competitive advantages to build upon early in his presentation.

“In an industry which is completely based on trust, our customers and our broker distribution partners believe us to be an organization that consistently does the right things whether that’s on a claims payment, in the way we trade, in giving advice.

“When we when we give advice, they trust advice.

“That is huge. It cannot be replicated by other people overnight,” he said.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Preparing for an AI Native Future

Preparing for an AI Native Future