Nothing satisfies an insurance customer more than having a positive personal-interaction experience with any company – even their insurer. All it takes is to meet their expectations of a personalized, smooth experience for a claim, a purchase, or a routine contact such as billing and payments. It is about creating the “Amazon experience” for insurance.

Of course, when these interactions are disparate, frustrating, complex, redundant, the opposite is true. Customers become disillusioned and unsatisfied with the insurer.

It would be encouraging to report that all insurers are making great strides in their efforts to enhance customer-experience capabilities through new digital tools, data and processes. But, while some insurers are getting better at digitizing customer-engagement capabilities the candid reality is that, for the most part, most are lagging.

The challenges are well known: Customers do not want to go to different portals or apps for servicing, billing or claims. They don’t want to be stuck at a web landing page, staring at a screen and wondering what key they need to press to get to the next step. Or, if they do navigate to the right page, they are miffed when they must input personal information multiple times when they need to switch from screen to another. They want a holistic, personalized experience. In Majesco’s 2020 customer research, we found that insurers needed to reimagine the scope of what they offer to customers, moving from a transaction to an experience that included the risk product, value added services and a compelling, holistic customer experience.

Majesco, in conjunction with the KPMG LLP Insurance practice, is offering a new solution to achieve a Customer 360-Degree experience built on Majesco Digital1st® Insurance platform that allows customers to easily, holistically connect with their insurer.

Behind the customer view, this innovative solution is as impressive as it is powerful. The solution is a customer-experience engagement platform that provides a 360-degree capability for commercial property and casualty (P&C) customers to seamlessly connect with an insurers’ front-, middle-, and back-office systems as well as with value added services without the customer actually realizing it. They don’t have to, nor should they need to, care about the details that go on behind the scenes…they just need to get their information or task done quickly and painlessly.

Majesco leveraged the KPMG Connected Enterprise function, a modular and agile delivery method, created to help insurers define and align customer experience ambitions, set strategy, customize solutions for targeted organizations, and move rapidly for the benefit of customers and insurers.

If nothing else has become clear in the past year, we all have learned that customers of all ages have – perhaps by necessity – become better informed about how digital technology is fundamental to today’s commercial landscape. All of us, it seems, want to be better connected with businesses, and we’ve become better-educated about how to use technology that we might have avoided using just a short time ago. We’re ordering much more online, scanning and sending documents with a tap on a smartphone, using chat bots to communicate our needs, and we’re increasingly impatient with businesses that do not have digital capabilities.

The new 360 Degree Customer Experience solution is designed to offer customer experiences that place great emphasis on choice, speed, convenience, transparency and clarity. Those demands are the reason why insurance chief executive officers across the globe continue to accelerate operational digitization efforts.

The newly released 2021 KPMG Global CEO Survey shows that 45 percent of the respondents said their insurance company has “sharply accelerated” their digitization-upgrade efforts since the onset of the COVID pandemic, putting their organization “years in advance of where we expected to be.” Another 55 percent said digitization progress “has accelerated by a matter of months.”

These drivers are expected to intensify. Forrester reports that digital customer-service interactions will increase by another 40 percent in 2021.[1] Further, Gartner reports that business customers are developing a strong preference for business-to-business self-service, with 44 percent of Millennials preferring no human interaction.[2]

The Majesco Digital1st®, 360-Degree Customer Experience initiative, coupled with the KPMG Connected Enterprise program, offers a next generation user-friendly experience solution including:

- A cloud-native, multi-tenant, low code / no code digital platform that hosts a plug and play ecosystem, supported by a breadth of content.

- An EcoExchange insurance marketplace that serves as a partner ecosystem hub. It uses third-party services with a standard semantic layer that allows for easy integration and a true “plug and play” environment for traditional and InsurTech partners. The Eco-Exchange provides a wide range of partner apps (such as Lexis Nexis Risk Solutions, Verisk, Twilio, Splice, and Chase, among others) that can perform myriad functions.

- A capability for fast data ingestion with pre-population of forms that leverage outstanding claims reserve capabilities, machine learning, deep learning, and natural language processing.

This next-generation digital experience for customers represents a critical response to the need that insurers increasingly find themselves in right now: An existential requirement to stand out in a crowded, and increasingly more-agile, highly competitive industry. We believe that success requires an array of solutions built around the customer.

In our view, customers will be drawn to insurers that excel at post-purchase tasks, complex-service tasks, easily managing payments, and managing claims. Insurers that struggle in these areas because of legacy information technology (IT) reasons may be facing serious challenges in a very short time.

For those reasons, we believe that a 360-degree view of the customer provides a way to recognize and manage customer needs in a single place. The idea behind the 360-degree view is to allow insurers to deliver exceptional and consistent experiences across the value chain.

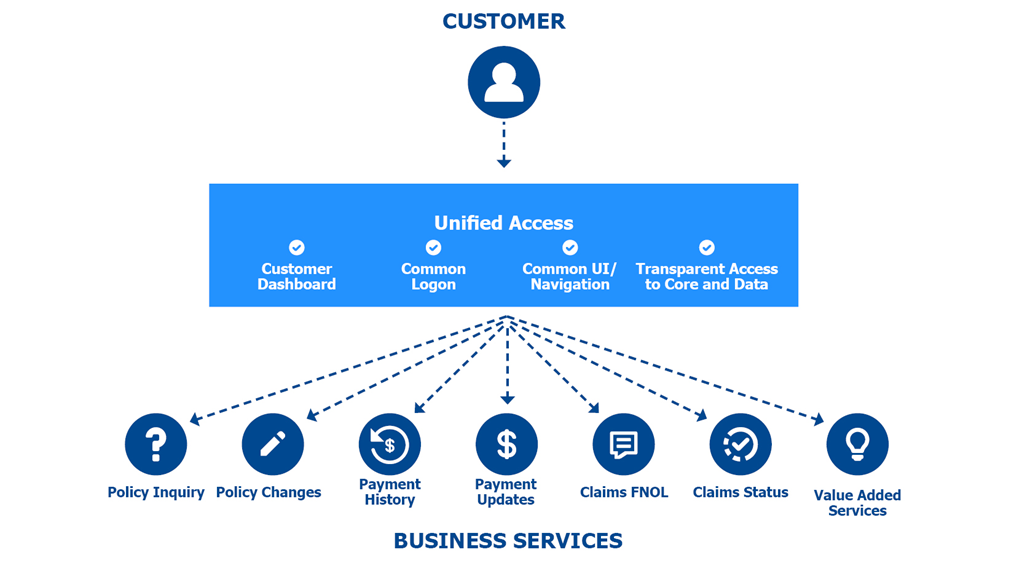

Instead of offering disparate apps, portals, and interfaces for sales, billing, payments, claims, and policy service, the Majesco Digital1st® solution offers access to all these capabilities (and more through partners) from a single customer engagement platform. The platform is meant to enable connectivity with the array of backend systems to service multiple needs, which is the foundation of a holistic, optimal customer-facing experience.

Using the Customer-360 capability, customers engage a dashboard that links them to services they need at any time, and it provides them with a holistic, end-to-end view for the management of their policies. The digital platform approach simplifies the interactions for the user and can be visualized as follows:[3]

Use Case With a Customer 360 View

Knowing customers’ desires, insurers would be well served by thinking like a customer, and then executing a thorough examination of current ways they interact with customers throughout the policy lifecycle. Where do pinch-points and gaps appear? Insurers must perform a clear-eyed inspection of their IT capabilities, paying particular attention to how the IT components do or do not support customer interactions. Insurance-company leaders must decide now if they will invest in digital platform technologies that enable the Customer 360 view. If not, they must understand if that decision will put the business on a path where growth through better customer experience will be improbable.

As we enter this new decade, the future of insurance is rapidly unfolding with robust digital business models. As the industry emerges from the COVID era, Majesco and KPMG are committed to assist insurers keep their customers satisfied through next-generation user-experience technologies. With the belief that the retention of customers is dependent on customers’ perceptions of insurers, the time has come for insurers to invest in capabilities and tools that create enhanced customer experiences and help enable growth in this competitive environment.

By:

Michael Adler, Global Insurance Operations Lead, KPMG. Michael has significant experience working with leading insurance companies to drive transformation leveraging digital, data, analytics, technology and best operational practices. Michael has a proven track record of delivering business value on large, complex transformation programs leveraging leading and innovative technology capabilities in conjunction with an insurers existing capabilities. He has worked with both domestic and global insurers in the areas of non-life, life, reinsurance and brokerage. He created and led the industry’s first and leading practice around cognitive technology focused on financial services and insurance.

Denise Garth, Chief Strategy Officer, Majesco. Denise Garth is widely regarded InsurTech and industry thought leader and recognized InsurTech Top 50 Influencer and Top 50 Women Leaders in SaaS, Denise Garth is the Chief Strategy Officer at Majesco. Majesco is a global leader of cloud insurance software solutions with products that empower insurers to modernize, innovate, and connect their business at speed and scale. Garth began working at Majesco in 2015 as a Senior Vice President in Strategic Marketing, Industry Relations, and Innovation. Garth leads the company’s strategy, marketing, industry relations, and innovation in support of Majesco’s client-centric strategy. With both P&C and L&A insurance experience, Garth has also authored research and articles grappling with the key issues and opportunities facing the insurance industry.

[1] Predictions 2021: It’s All About Empathy, Digital, And Virtualizing Customer Care, Ian Jacobs, Forrester, Oct. 2020.

[2] Future of Sales 2025: Deliver the Digital Options B2B Buyers Demand, Rama Ramaswami, Gartner Group, Dec. 2020.

[3] Customer Experience in Action: An Approach to Customer Service in the Digital Age, Karen Furtado and Mark Breading, Strategy Meets Action, April 2021

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Preparing for an AI Native Future

Preparing for an AI Native Future  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation