The recent bombing at the Boston Marathon serves as a reminder that mass violence remains a critical threat for organizations, say experts at insurance brokerage Marsh, which just issued its latest report on sales of terrorism insurance.

Congress is heading into a period of debate about whether to reauthorize the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA). If TRIPRA is allowed to expire—or is extended but substantially modified—there may be fewer insurers offering terrorism insurance and prices potentially could increase, according to Marsh’s 2013 Terrorism Risk Insurance Report.

The number of companies purchasing property terrorism coverage has remained fairly constant, in the low 60 percent range, since 2009 as insurers underwrite the risk backed by TRIPRA, according to Marsh’s benchmarking data.

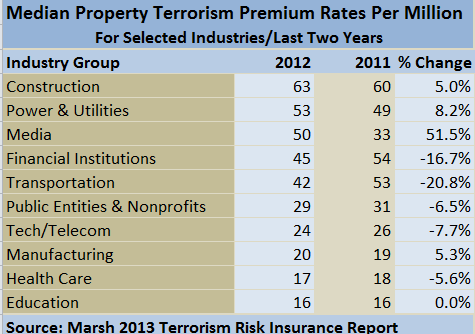

Premium rates also have remained generally steady for terrorism coverage, the report found. Companies with total insured value (TIV) of less than $100 million paid a median of $49 per million of TIV in 2012, the same as in 2011, while the median rate paid by companies with more than $1 billion in TIV was $19 per $1 million TIV in 2012, down from $21 in 2011.

Media companies are the most likely buyers, while construction firms generally pay the highest rates.

More companies in the Northeast—77 percent—buy the coverage than in any other region. The West had the lowest take-up rate in 2012, at 53 percent.

Other findings from Marsh’s report include:

- Larger companies are more likely to purchase property terrorism insurance, and also to see the lowest cost as a percentage of overall property premiums.

- Media clients purchased property terrorism insurance at a higher rate—81 percent—than did those in any other industry segment in 2012. Companies in the health care, financial institutions, education and public entity sectors had the next highest take-up rates among the 17 industry segments surveyed, all above 70 percent.

- Construction companies paid the most of any sector for terrorism insurance, with a median rate of $63 per million of TIV in 2012, up from $54 per million in 2010. Companies in the food and beverage, health care, and education sectors paid the least for coverage, with median rates less than $20 per million.

- Companies in the Midwest paid the lowest rates on average for property terrorism insurance in 2012, followed closely by companies in the West.

“Clearly the demand for terrorism risk insurance remains strong and the existence of the federal program plays a major part in the availability and affordability of the coverage,” said Dan Glaser, president and CEO of Marsh & McLennan Companies (MMC), who spoke today at an event sponsored by MMC and the Coalition to Insure Against Terrorism in Washington D.C. The event was held to release findings from Marsh’s report and to draw the attention of Congress to the federal program, which is set to expire at the end of 2014.

Effect on Workers Comp

The government program has been extended twice since originally enacted in November 2002 as a response to the attacks of Sept. 11, 2001. If it is allowed to expire or is substantially changed, terrorism insurance capacity may be difficult to acquire at reasonable costs for insureds, especially those with significant exposures in a central business district or major city, Marsh’s report said.

If Congress declines to renew or substantially modifies TRIPRA, the state-regulated workers compensation market could be affected, especially in the areas of pricing and capacity, according to the report. Workers compensation insurers are not permitted to exclude terrorism from their policies, and insurers generally are concerned about potential aggregation of risk, which may impact the availability of workers compensation insurance should TRIPRA materially change or expire. Where these insurers are also offering other lines of insurance, such as property, the combined aggregate exposure likely will further limit their ability or willingness to offer substantial property limits.

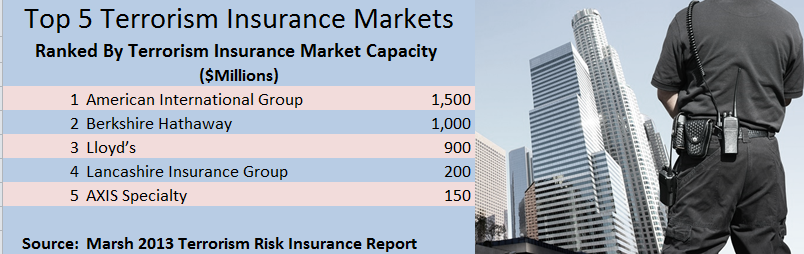

Capacity in the standalone terrorism insurance market has increased significantly over the years, serving as an important alternative or supplement to coverage made available through TRIPRA. Up to $2 billion per risk in standalone capacity is available to companies that do not have sizable exposures in locations where standalone insurers are approaching their aggregates. In higher risk areas, the estimated maximum market capacity is approximately $850 million per risk.

Marsh said it surveyed nearly 2,600 companies. This is the third edition of the report.

While the Boston event has not yet been classified as an act of terrorism under federal law, experts note that there are a number of issues involved in determining whether the Boston bombings tragedy would be considered a terrorist act for insurance purposes such as determining the applicability of terrorism exclusions and terrorism coverage.

Source: Marsh

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  The Future of HR Is AI

The Future of HR Is AI