A Florida circuit court judge has issued a temporary injunction against certain provisions of the state’s no-fault personal injury protection (PIP) law, ruling that it is no longer a “reasonable alternative” to a tort system because of recent changes to it. The injunction temporarily blocks further implementation of several limits on benefits and the exclusion of some medical professionals from the list of approved healthcare providers.

Second Judicial Circuit Court Judge Terry Lewis in the case [Myers v. McCarty Case No. 2013 CA 73] issued the temporary injunction, targeting a number of changes enacted in 2012.

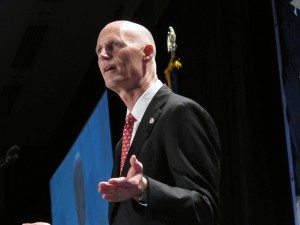

In a statement after the ruling, Gov. Rick Scott vowed to “continue to fight” to keep the changes that he said have saved motorists money. He said the changes to PIP have resulted in more than 70 percent of insurance rates approved by the state insurance commissioner either decreasing or holding steady.

The insurance industry also criticized the ruling.

The case came about after a group of acupuncturists, massage therapists and chiropractors sued the state because the law changes prohibit them from being able to receive PIP payments.

The law states that unless an individual injured in an accident seeks medical attention within 14 days they are no longer eligible for medical benefits. Further, the law for the first time differentiates between “emergency” injuries where the accident victim receives the full $10,000 in PIP benefits and “non-emergency” injuries where PIP benefits are restricted to $2,500.

Another law change excluded massage therapists and acupuncturists from the list of approved PIP medical providers.

Lewis based his ruling on an analysis of the state’s no-fault law dating back to 1974, when the Florida Supreme Court in a landmark case [Lasky v. State Farm Insurance Co. 296 So.2d 9 1974] upheld the state’s no-fault auto law as a “reasonable alternative” to a purely tort system on the basis that it benefited consumers.

“Proponents argued that the tradeoff was a ‘good deal’ because it would provide speedy payment of medical costs, lost wages, of any accident victim regardless of fault and would avoid the alleged uncertainties and inequalities of the tort system,” wrote Lewis.

However, Lewis said, the recent changes in the law had essentially ended the court’s line of reasoning in Lasky and the restrictions on medical benefits and medical providers made the state’s no-fault law an inadequate alternative to a tort system.

“Is the no-fault law still a good deal?” opined Lewis. “The answer to those questions is probably like beauty, in the eye of the beholder, and reasonable people may disagree. From my perspective, however, the revisions to the law make it no longer the ‘reasonable alternative’ that the Supreme Court found in Lasky.”

Based on that line of reasoning, Lewis granted the temporary injunction, saying that the law as currently written unfairly prevented the medical providers from accessing the courts and having their grievances heard.

The Office of Insurance Regulation (OIR) said it plans to appeal the ruling.

“The OIR has notified Florida auto insurers about it and does intend to file an appeal,” said OIR spokesperson Amy Bogner. She said the appeal would stay the order but only until the First District Court of Appeals rules on this issue.

Insurance representatives vowed to take any necessary action to overturn the ruling.

Donovan Brown, Florida counsel for state relations for Property Casualty Insurers Association, said the association is currently assessing the legal, regulatory and possible legislative steps to combat Lewis’ ruling.

“We are highly disappointed with this injunction, which temporarily invalidates the crux of the reform and thereby reopens the door to the fraud and abuse that the law was designed to counteract,” said Brown.

The Coalition of Insurance Fraud likewise expressed disappointment over the ruling, which it said ignores the harm done by fraudulent medical providers that led to the law changes to begin with.

“Curbing crooked medical providers in this manner is a reasonable way to reduce runaway fraud,” said Dennis Jay, executive director of the coalition. “Its constitutional validity has a strong basis.”

Lewis’ ruling comes just months after a federal court judge refused to approve a similar motion brought forward by the same group of health care providers.

U.S. District Court Judge Richard Lazzara in that case [Myers et al v. McCarty Case No. 8:12] denied the medical providers request for an injunction, saying they failed to show how they would be irreparable harmed under the new law or how an injunction would serve the public interest.

As such, Lazzara said, he was denying the providers’ motion on the grounds that it would ultimately fail in the courts.

“The plaintiffs have not met their burden of establishing the essential element necessary for the issuance of a preliminary injunction–a substantial likelihood they will prevail on the merits,” wrote Lazzara.

(Reported by Michael Adams. This article was originally published on Insurance Journal. Michael Adams is the Southeast editor of Insurance Journal.)

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash