Insurance claims adjusters have something in common with postal clerks, cashiers, administrative assistants and graphic designers. These jobs all rank among those in the greatest decline over the next five years, a new report says.

The ranking, included in the “Future of Jobs Report 2025” published by the World Economic Forum early this month, doesn’t say specifically why the job grouping “claims adjusters, examiners, and investigators” landed 12th among jobs that will experience the fastest net percentage decline by 2030, and 15th among those that will have the biggest decrease in real terms over the same period.

In general, however, the report, drawing information from a survey of over 1,000 executives in 22 industries and 55 economies representing more than 14.1 million employees, points to technological advancements, economic pressures, demographic shifts and geoeconomic tensions as key factors reshaping industries and professions worldwide.

As a result of the technological and other macrotrends, the Future of Jobs 2025 report estimates that “labor market churn”—new job creation and job displacement combined—will amount to 22 percent of formal jobs existing today. More specifically, by combining respondents’ job growth and decline expectations with hard data on global employment collected by the International Labor Organization, the report reveals that there will be 170 million new jobs across the studied industries and geographies, equivalent to 14 percent of today’s total employment figure of 1.2 billion formal jobs.

As a result of the technological and other macrotrends, the Future of Jobs 2025 report estimates that “labor market churn”—new job creation and job displacement combined—will amount to 22 percent of formal jobs existing today. More specifically, by combining respondents’ job growth and decline expectations with hard data on global employment collected by the International Labor Organization, the report reveals that there will be 170 million new jobs across the studied industries and geographies, equivalent to 14 percent of today’s total employment figure of 1.2 billion formal jobs.

Fast-growing jobs include “big data specialists,” “fintech engineer” and “AI and machine learning specialists.”

Overall job growth is expected to be offset by the displacement of 92 million current jobs, or 8 percent of total employment across industries and countries.

For the insurance industry, the market churn figure is similar to the overall figure—19 percent—according to a two-page summary of survey and analysis information specific to the “insurance and pensions management” industry.

Aside from claims adjusters, other insurance industry jobs listed as declining in the report included “statistical, financial and insurance clerks,” ranking 19th among fastest declining by 2030, and “insurance underwriters, valuers and loss assessors,” which came in 23rd.

Closely associated with insurance, “risk management professionals” ranked among the careers for which jobs created will exceed jobs displaced. A job category titled “sales agents and brokers” is also listed among those that will experience growth (in the single digits) over the next five years.

Although not specific to insurance, some tech-related job titles held by insurance industry professionals—”data analysts and scientists” and “Internet of Things specialists”—are among the 15 fastest growing, according to the WEF report.

Key Trends Driving Workforce Changes

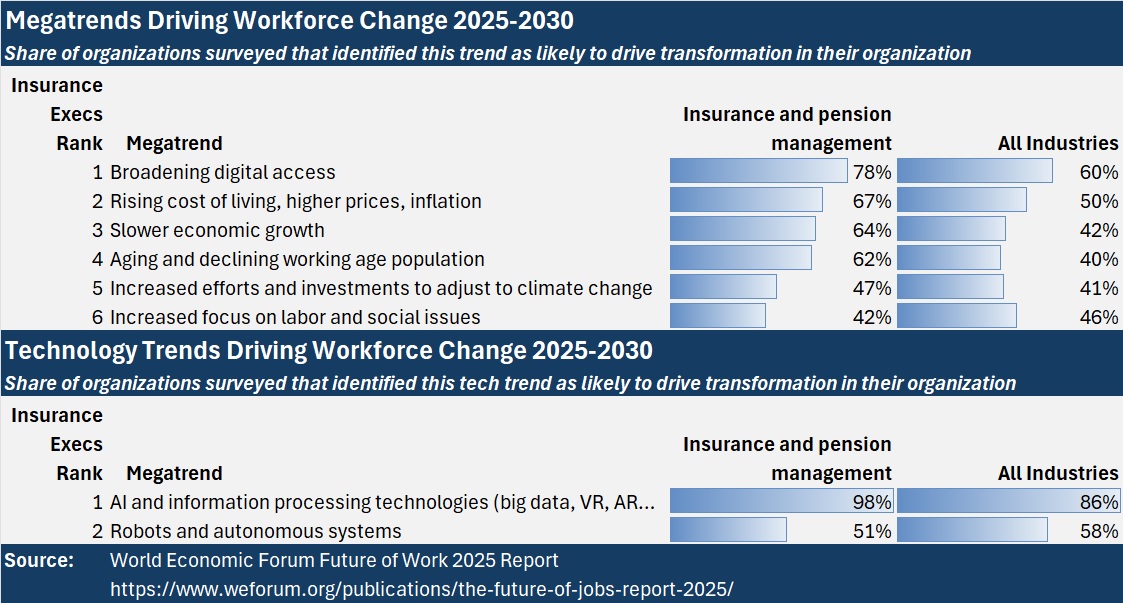

Across industries, surveyed executives—chief executive officers, chief strategy officers, chief people officers and chief learning officers of leading global firms—expect “broadening digital access” to be the most transformative trend for their organizations, with 60 percent expecting it to alter their workforces by 2030.

For the “insurance and pensions management” industry, the percentage is higher, with 73 percent also selecting the macrotrend “broadening digital access” as one that will transform their business.

(Editor’s Note: Analysis for just insurance apart from pension management, or for just property/casualty, is not available in the WEF report. The next closest industry segment is “financial services and capital markets,” for which survey results about macrotrends identified as drivers of job disruption are similar. For brevity, throughout this article, CM will refer to the “insurance and pensions” industry as “insurance.”)

While the “digital access” trend is the top trend selected by executives in insurance and other industries, insurers ranked two economic trends—inflation and slower economic growth—as the second- and third-most transformative trends impacting their workforces. While the rising cost of living was also the second-ranked trend for other industries, only half of all executives saw it as a main driver of change, while two-thirds of insurance executives did.

Drilling down on the perceived labor force impact of nine specific technologies, executives across industries said that artificial intelligence (AI) and information processing technologies will likely have the biggest impact, with 86 percent of respondents expecting these to transform their business by 2030.

Insurance executives likewise rank AI as the top technology set to disrupt their workforces. In fact, the expectation that AI will be transformational is nearly unanimous within the insurance industry, with 98 percent identifying AI. The only industries with higher percentages of employers saying AI will drive internal transformation were technology services (99 percent) and telecommunications (100 percent).

Comparing results for the insurance industry to those of other industries throughout the report, it is evident that the insurance executives surveyed have been leaning into technology to a greater degree—and they expect to continue to do so in the future.

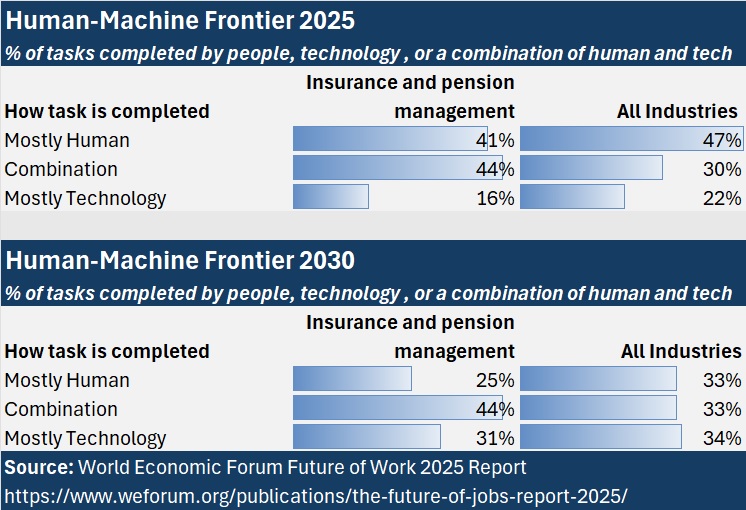

In contrast to other industries, 44 percent of work tasks in the insurance industry today are performed by humans working together with technology. Across all industries, people combine with technology to perform just 30 percent of work tasks.

Going forward, while all sectors are expected to see a reduction in the proportion of work tasks performed by humans alone by 2030, they differ in the share of this reduction projected to be driven by automation vs. augmentation.

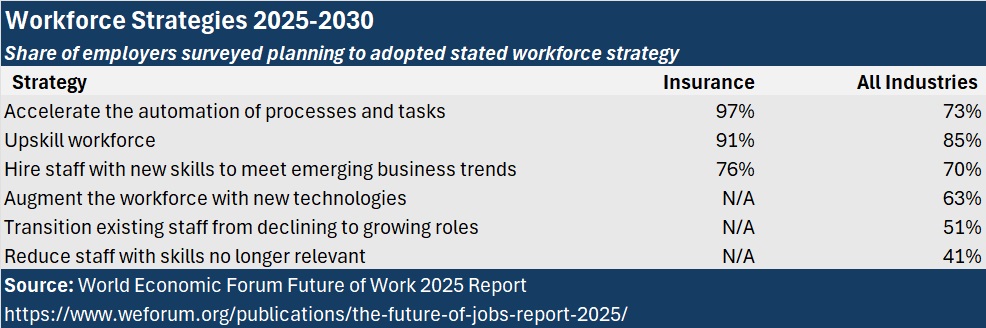

Insurance leads the automation trend, with 97 percent of insurance industry employers planning to accelerate automation of processes and tasks, compared to 82 percent across all industries.

By 2030, humans will still collaborate with technology to handle 44 percent of work tasks in the insurance industry. But tasks performed by technology alone will nearly double—to 31 percent in 2030 from 16 percent in 2025, driving a corresponding drop in tasks accomplished by humans alone, which will fall to one-quarter of industry tasks.

Top Skills: Today and 2030

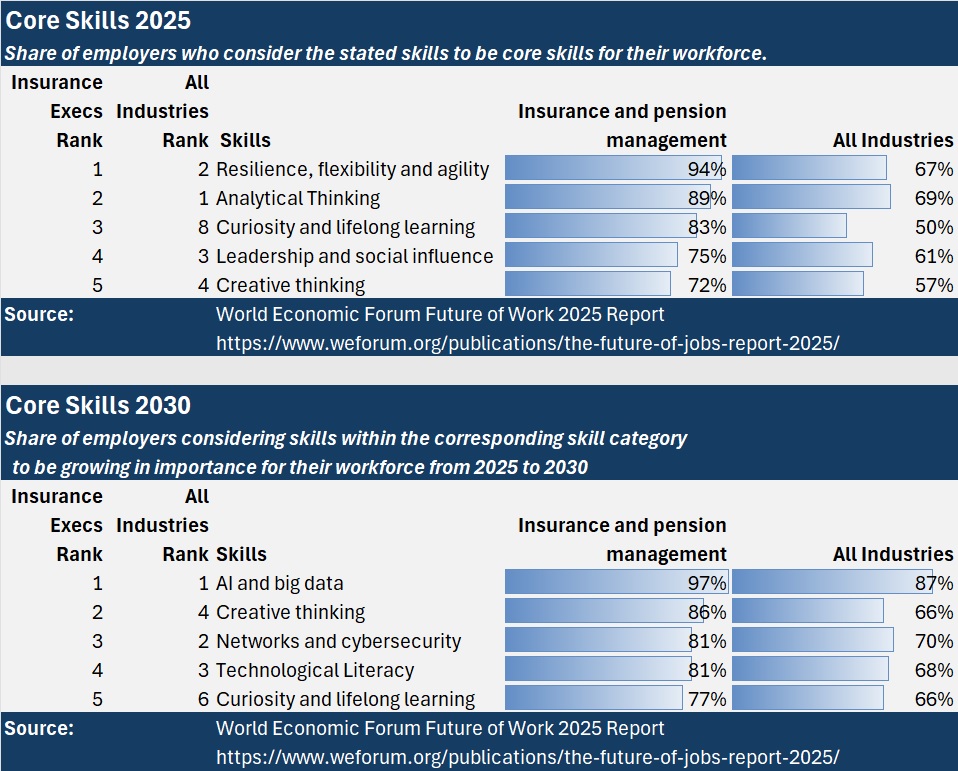

The insurance industry also stands apart from other industries in terms of what its leaders view as core skills for their workforces today and what will be important five years from now.

Currently, human attitudes and cognitive skills—attributes such as resilience and adaptability, analytical thinking, curiosity, leadership and creative thinking—are viewed as the most important by insurance industry executives.

Related articles: ‘Critical Thinkers’ Needed for AI-Powered P/C Insurers; Meet Your New Employee: Advanced AI

Resilience tops the core skills inventory for insurers, with 94 percent of executives viewing this as core—27 percent more than other industries. The percentages of insurers identifying another self-efficiency trait, curiosity, and the other cognitive and management skills as core skills are all 20-30 percentage higher than other industries.

With tech-related skills—AI, technological literacy and network security—moving up the insurance industry skills inventory for 2030, analytical thinking and resilience move off the list of top 5 core skills. But creative thinking rises up to become the second-most cited future core skill, with 86 percent of insurance employers believing that creativity will remain a core industry skill in the future. (Resilience ranks sixth, selected by 72 percent for 2030.)

Upskill or Replace

On average, workers across all industries can expect that two-fifths (39 percent) of their existing skill sets will be transformed or become outdated over the 2025-2030 period, an online digest of the nearly 300-page report says.

“Skill instability,” however, has slowed compared to previous editions of the Future of Work report, from 44 percent in 2023 and a high point of 57 percent in 2020 in the wake of the pandemic. “This finding could potentially be due to an increasing share of workers (50 percent) having completed training, reskilling or upskilling measures, compared to 41 percent in the report’s 2023 edition,” the report states.

Still, “skill gaps are categorically considered the biggest barrier to business transformation by Future of Jobs Survey respondents, with 63 percent of employers identifying them as a major barrier over the 2025-2030 period.” Reacting to the problem, 85 percent of employers surveyed across all industries plan to prioritize upskilling their workforces, with 70 percent of employers expecting to hire staff with new skills.

While more than three-quarters of insurance industry employers likewise plan to hire to gain new skills, insurers are leaning into upskilling and automation more than employers in other industries in order to react to megatrends.

Within the insurance industry, “while 42 percent of employers predict talent availability at the point of hiring to worsen, the industry is strongly focused on upskilling and reskilling: 91 percent of employers plan to upskill their workforce to adapt to evolving needs,” the report says. As a result, 82 percent of executives in the insurance industry expect talent development to improve in the next five years, the report says.

With respect to specific skills needed to embrace AI-related opportunities, however, insurance companies anticipate hiring individuals with skills to work with AI much more than other industries. While 62 percent of executives across industries identified hiring as an AI-ready strategy, 91 percent of insurance industry executives did.

Reskilling and upskilling existing talent to work more effectively with AI is the most anticipated strategy across industries—identified as a strategy by 77 percent of all executives. That’s the second-most popular strategy for insurance industry organizations, identified by 85 percent of insurance industry executives.

(Editor’s Note: In addition to survey responses, research collaborations and data partnerships with ADP, Coursera, Indeed and LinkedIn resulted in data and analysis that complemented the survey findings, the report says.)

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash