There was a moment in first-quarter 2021 when InsurTech Root met a long-desired loss ratio target, sending a promising signal that the cash-burning startup was squarely on the road to personal auto insurance underwriting profits.

Executive Summary

A few days after Root’s first-ever quarterly operating profit and first-quarter combined ratio under 100, CTO Matt Bonakdarpour and CFO Megan Binkley reflected on how the company arrived that point and what’s next in an interview with Carrier Management.“We’ve got it. We figured it out,” said Matt Bonakdarpour, president and chief technology officer, recalling the collective sentiments of the team during its first quarter as a public company.

According to company financial statements, Root delivered a calendar-quarter gross loss and loss adjustment ratio of 80.7 in that three-month period, some 40 points better than a corresponding loss and LAE ratio of 120.5—a measure that looked more like a combined ratio—for the same quarter in 2019. (Editor’s Note: Results were better across the auto insurance industry in 2020 when COVID shutdowns kept drivers off the roads.)

Investments in a tech stack and quantitative methods were paying off, thought Bonakdarpour, then serving in the role of vice president of data science.

But the eureka moment was fleeting.

The inflationary environment of 2021 erupted, impacting Root and every other writer of personal auto insurance—whether they were technology-driven companies or not. By second-quarter 2021, the gross calendar period loss and LAE ratio was up over 100 again, and for all of 2021 it was 96.5.

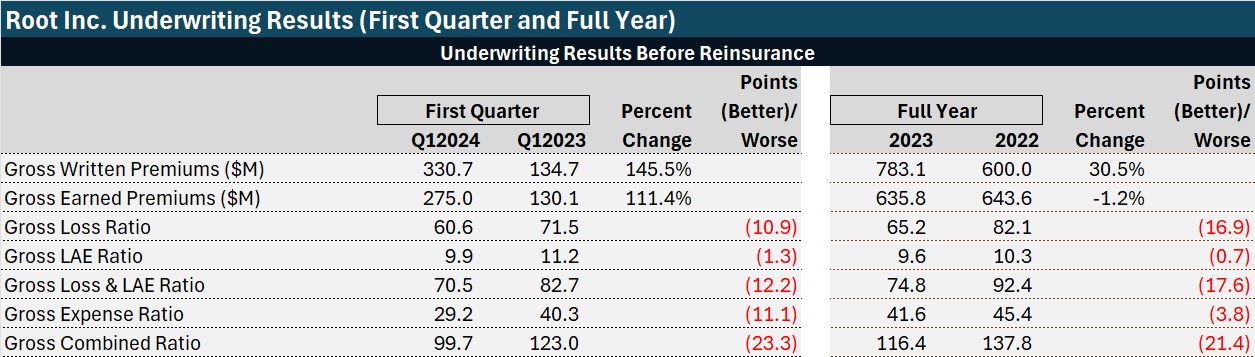

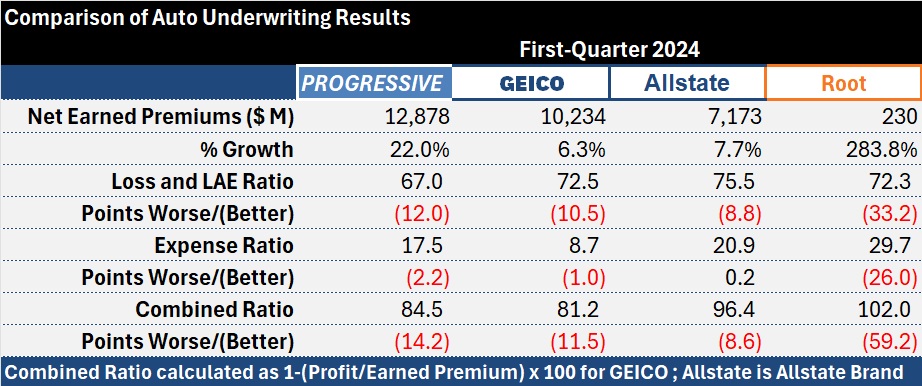

Three years later, Root is in a very different spot. For full-year 2023, Root’s gross loss and LAE ratio shrunk back down to 74.5. And in the first quarter of 2024, it was 70.5. Adding in other underwriting expenses, Root reported its first-ever gross combined ratio below 100, while more than doubling gross written premiums and policies in force.

Looking back, Bonakdarpour describes the inflationary bump on the path to underwriting profit as a blessing and a curse.

“A curse is for obvious reasons—enormous pressure on profitability and therefore growth. But a blessing because we got a macro example to illustrate the power of [a core] strategic pillar,” he said, referring to Root’s goal to “be the best in the world at pricing and automation.”

“It’s one of the reasons I was attracted to the company when I started here back in 2018…From Day 1 of the company’s inception, we’ve been investing in our tech stack and our quantitative methods” to support day-to-day decisions. “We thought that that could lead to more effective risk management as an insurance company, which would then result in lower prices and a more delightful customer experience.”

The benefits of having modern technology and methods grounded in data science, however, were most apparent on a “micro level,” Bonakdarpour said. “It’s a little bit faster than it would be otherwise to either make a decision or to take action on a decision—to get it into production and actually improve the customer experience. But it’s really hard to point to one thing to say, ‘Hey, look, this is the value of technology.’ They are very micro transactions that are being improved,” he said. “In aggregate, when you add up all of those decisions and actions, it is very valuable. But it’s hard to illustrate it outside the walls of the company.”

Explaining his favorable view of inflationary loss cost trends, Bonakdarpour said that cost inflation essentially inflated those micro actions to macro results, demonstrating the power of a strategy rooted in technology and data science. “The investment in the modern technology allowed us to identify trends very early, understand where they were coming from, understand conclusively that [this] wasn’t a moment-in-time event—it was something that was going to last for a while—and then adapt to it very quickly by using our pricing and underwriting technology to react.”

“That’s the blessing. Outside the walls of the company we were able to show with one big, dramatic event that won’t happen very often, that being able to identify [trends] and then respond very quickly is valuable. And that’s really what the technology allows us to do.”

“We were able to showcase the power of the technology.”

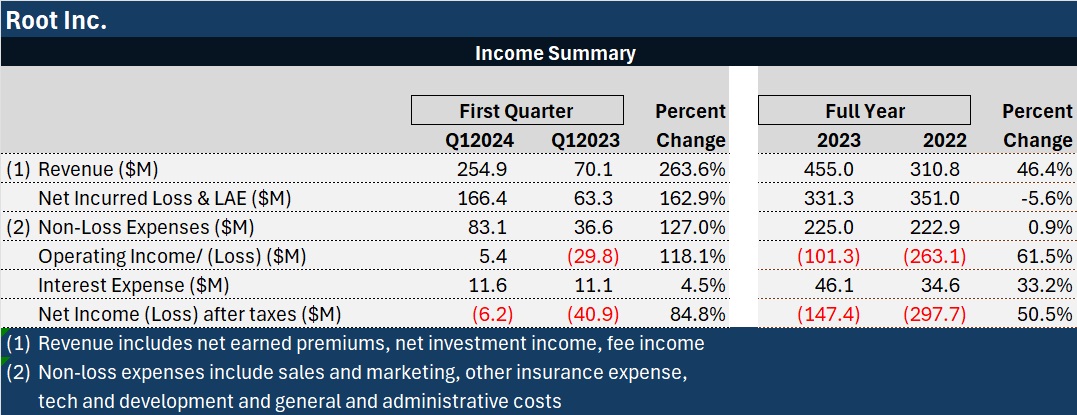

Bonakdarpour and Root’s Chief Financial Officer Megan Binkley spoke to Carrier Management a few days after Root reported that first-ever gross underwriting profit and its first operating profit also, along with a much lower bottom-line net loss than ever before.

“We have stated over the past few years, starting at the end of 2022, [that] our goal is to reach profitability with the existing capital base. When we set that initially, it felt like a very lofty goal to a lot of the folks outside of the organization,” Binkley said. But inside the company, it seems just within reach, she added.

“As we sit here today, Q1 was a major milestone for us. Our net loss was $6 million—an 85 percent improvement year over year. So, we are closer to that goal than ever, and I have a lot of confidence in the vision of leadership for the future. I think that we’ll be able to realize that goal of GAAP net income profitability with existing capital in the near future,” she said.

Together, Binkley and Bonakdarpour spoke with CM about the challenges of the past few years, the technology Root aims to build upon, including a platform to facilitate embedded insurance partnerships like one struck with Carvana in 2021, and the leadership vision for Root’s future.

Q: Root’s loss ratios today are in line with some much bigger competitors, which like Root have telematics programs and capabilities to match rate and risk. What’s different about Root in terms of technology and data science?

Bonakdarpour: Technology and data science is woven into the fabric of the company at every decision point [for] the customer—whether it’s during the onboarding experience, to very plainly illustrate what coverages the customer is buying [or it’s] a very quick, less than 40-second quoting process. And then after bind—any moment when they’re making endorsements [or] interacting with claims and customer service, every single one of those events are instrumented in our platform to allow for more of a systematic way to make decisions…

It’s granular at the customer level. It takes the context of that individual customer into account when it can make decisions…

This is the playbook of any type of machine learning-based company. First, you put a set of rules in that makes sense based on what you know. But then as you collect data, you can replace those rules with more sophisticated models that drive a better granular customer experience.

That kind of instrumentation across our platform is what drives the difference. It’s not just the fact that we have telematics. That’s one tool. We think we do telematics better than many, but it’s the fact that across the entire value chain for the customer, it’s instrumented with quantitative methods, and the technology platform allows us to identify issues and react to them faster.

Q: Before the inflationary period, Root’s loss ratios were higher than the competition. Was it just a matter of the models having to learn? You had to collect more data? Or did something have to be fixed?

Bonakdarpour: What we learned over time was [that] a lot of little things have to be right in order for us to succeed. You nailed one of them—collecting more data. It’s very challenging when you launch in a new market to know whether you’re rate adequate or not.

Across the entire company, the data science team is probably the only team that’s happy when we have more loss data because that allows us to react and set our prices more adequately. But there’s more than that, too.

Even if we were priced adequately, our loss ratios would’ve been higher because of the new business penalty. We were a growing company. Still are. But we were mixed shifting toward new business and therefore on a calendar year basis, our loss ratio would be high.

“That’s the blessing. Outside the walls of the company we were able to show with one big, dramatic event that won’t happen very often, that being able to identify and then respond very quickly is valuable. That’s really what the technology allows us to do.”

“That’s the blessing. Outside the walls of the company we were able to show with one big, dramatic event that won’t happen very often, that being able to identify and then respond very quickly is valuable. That’s really what the technology allows us to do.”

Matt Bonakdarpour, Root

Q: Let’s talk about technology that other competitors don’t have—Root’s automated marketing platform. I read terms like “optimize unit economics” in Root’s shareholder reports, describing marketing driven by data science, which aren’t words spoken by other insurance companies.

Bonakdarpour: We have a performance marketing team that’s focused on distribution channels like quote aggregators—we call those vertical search channels—[and] Google search engine marketing, other search engines. These are channels where we think we’ve got a right to win based on our expertise in data science…

They’re typically ad auctions where we are bidding as a participant in an ad based on information we have about a customer who’s about to view an ad. [Data science] gives us granular information on which to react and bid…

When we think about capital allocation in these channels, it’s all about unit economics. [The focus is] not the profit in a given calendar year but the lifetime profit of the customer, and whether this upfront investment will meet our returns given what…our estimate of lifetime profit is…

All the little pieces of information we have about the customer who may view the ad allows us to [develop an estimate] in a very granular way. And the dynamics play out in an analogous way to how they play out in pricing…You’re disproportionately going to attract the customers for which you’re bidding too high [and] everybody else is bidding lower. It’s the same [adverse selection] phenomenon.

So, the better you are at predicting unit economics in a granular way, the better you’ll perform. We invested in that heavily last year as we gained confidence in our loss ratio and scaled in those channels. It has paid off, and now we are reacting to the new competitive landscape we’re encountering with a lot of the tools we built last year through that investment.

“I have a lot of confidence in the vision of leadership for the future. I think that we’ll be able to realize that goal of GAAP net income profitability with existing capital in the near future.”

“I have a lot of confidence in the vision of leadership for the future. I think that we’ll be able to realize that goal of GAAP net income profitability with existing capital in the near future.”

Megan Binkley, Root

Q: When CM interviewed CEO Alex Timm in 2020, he spoke about underwriting out the worst customers with telematics and being able to provide the remaining best customers with lower prices. After Root and industry price increases of the last few years, where do you think Root is today in terms of winning the customer based on a pricing differential?

Bonakdarpour: We believe we’re rate adequate. We don’t think there’s a lot of rate that we need to take because we’re underpriced. I think any rate that we’re taking in the near future is to keep up with any type of regular trend that you may see with inflation.

We are keeping a very close eye on various internal key performance indicators as the competition comes back…We haven’t seen a lot of our metrics fall off a cliff with competitor re-entry, which would suggest we’re overpriced, for example…

Many carriers will overreact to an inflationary environment on the back of that environment. We are seeing that in some of the numbers where if you look at the year-to-date increase in insurance premiums, [it’s] something like 22 percent, which is well ahead of what the severity indices are saying are increasing.

So, the [industry] rate increases are outpacing inflation right now, and so we’re very focused on making sure we don’t do that—that we’re always adequately priced, that we’re not overpriced.

Time to Eat Our Own Cooking

Q: Looking at the individual line items of the income statement reveals big changes in the reinsurance costs and ceded reinsurance premiums. How has the reinsurance program changed?

Binkley: The results from a direct underwriting perspective have vastly improved over the last few years, [and] our reinsurance costs are really a derivative of the underlying direct results. As our direct business has gotten better, we’ve been able to really optimize the reinsurance structure—reduce costs in terms of the external quota shares that we’re using.

When we were early on, our loss ratio was a lot higher, and in terms of quota share reinsurance, we had a lot of structural features in the reinsurance contracts whereby we weren’t getting all of the benefit from utilizing the quota share. So, you saw a really high net loss ratio in the past. As the underwriting results have improved, we’re in a position where we want to eat our own cooking…and really retain that underwriting profit ourselves.

As we’ve implemented these changes, the delta between our direct loss and LAE ratio and our net loss in LAE ratio has really shrunk. In Q1 last year, the delta was around 23 points. In this quarter, it is less than two points.

Q: The financial statements also reveal a big reduction in general and administrative expenses. What are the drivers of expense savings there? Is it mostly people costs?

Binkley: It is a combination…In early 2021, when we really saw the first signs of inflation, we knew we needed to react not only on pricing and underwriting but also in terms of optimizing the fixed expense space as well. So, in early 2022, we paused. There were some very difficult decisions that we made on fixed expense. It was a combination of both headcount and non-headcount reductions.

We took a zero-based budget approach on the non-headcount side. [Instead of saying], “We spent X on this software last year. That’s a good basis [going forward],” you basically start from scratch and every external expense is justified.

We’ve been very diligent and disciplined in terms of how we look at our fixed expenses, and that’s just ingrained in the culture now. That’s why, year over year, the G&A expense has come down. We’re really a much leaner organization with more operating leverage as we sit here today.

Q: There were some layoffs, but the overall headcount is up since the last time CM profiled Root in 2020 [950 vs roughly 700]. How has the complexion of the workforce changed?

Binkley: One thing that we have done, at least over the last six months, is as we’ve turned the growth engines back on, we’ve also been investing modestly to support that growth, both on claims and customer service. And then we are investing very modestly in terms of headcount to support the product, optimize unit economics. There’s a very disciplined approach that we take just like any ROI as we’re investing additional dollars within the fixed expense base. It really needs to be justified and have an ROI associated with it.

Bonakdarpour: Speaking from my team’s perspective across engineering analytics, data science, state management and actuarial—those teams are all quite a bit smaller than they were pre-2022. So, from a mix perspective as a percentage of the whole, I think they are smaller but more productive, honestly.

In terms of the goals we’re setting, we’re more ambitious. We’re hitting more goals than we were before. So, there is an efficiency here that [was] probably unlocked through the years of investment in our technology platform. We don’t require as many folks to maintain these systems because they are automated. And then since they’re automated, it doesn’t take many to operate them either…

[In technology and development,] you can expect [hiring] to continue at the pace it’s been for the last six months or so. We’ve got open job postings on our careers website. These investments are very deliberate though. We don’t start with, ‘Hey, I think we can support another hundred engineers. Let’s go get a hundred engineers.’ We’ve got a backlog of very valuable projects that we believe will hit our return targets, and so we’re going to fund those new products that will serve customer needs very deliberately.

Q: Root’s overall mission is to be the No. 1 personal lines insurer in the U.S. rather than the No. 1 personal auto insurer. Talk about Root’s aspirations in terms of expanding product lines. Given where Root is now—the loss ratios are good—is expanding nationally a priority before product line?

Bonakdarpour: We’re actively engaging on state expansion right now. Just this year we’ve submitted rate filings to two new markets. We have a plan to get national over the coming years. A lot of that depends on appetite and discussions with regulators. [It’s] hard to predict timelines…

[And] we will be multi-product at some point in the future. It’s all about when… Over the last two years, it made no sense for us to focus on homeowners because we had a lot of foundational improvements that we had to make on auto—make sure we can create a best-in-class auto product, solve a lot of the problems that, at the time, were low-hanging fruit…We knew the steps we had to take to solve them. We just had to go and take those steps.

What we found over the last two years is that when we focus as an organization, we can deliver. And so, we want to be very careful not to put too many irons in the fire and lose that focus again because that could be disastrous.

However, we know that our customers have a need, a homeowners need…We can’t deliver on what they need with our current product. So, we must create that multiline product. We think that will also allow us to access other customer segments that we can’t serve today. We see them coming to us, quoting with us, but leaving because we can’t bundle homeowners in a way that’s delightful for them.

That will be a focus of ours in the coming years. It will not be this year.

Q: Throughout its history, Root has faced a lot of non-believers who talk about the publicly traded InsurTechs as a group and say, “They are not going to make money. They’re not going to disrupt.”

One detractor recently said that Root’s results aren’t better because of the technology or disruption. It’s because Root is much smaller and had bad results previously—and so when they went to the regulators, they got rates approved faster.

What would you say to the naysayers about what Root has accomplished and the overall vision?

Bonakdarpour: I just go back to the strategy that we’ve been outlining and sticking to—ever since I’ve been here, those three strategic pillars we think will create a delightful customer experience. The proof is in the pudding in a lot of this…We can continue to repeat our strategic vision, but it’s all about us executing.

So, I wouldn’t say anything to them. I would just say stay tuned. Watch us execute.

If you went back to the late 90s, and you could invest in an index of companies that were investing in Internet technology, you’d probably become very successful. It was really hard to choose which of the companies would be successful, but that approach to modernization through the Internet was a successful strategy…

I think we’re in the same space now with insurance, where if you invest in an index of insurance companies that are technology-first, culturally, from a prioritization perspective, when you look at what the leaderships are talking about—[companies] that are investing in modern technology and modern quantitative methods—I think the same is true. That index fund is going to do very well. That’s our opportunity to lose. And it’s all about execution to deliver what we’re promising. But I think it is a no-brainer to me that the top 10 companies in insurance a decade or two from now will be the ones investing in what is our top strategic priorities in technology and automation.

Q: What about the idea that regulators have been easier on Root?

Bonakdarpour: If you went and looked at the data, I think you’d see that we were quicker at filing, not quicker at receiving approvals…

But honestly, we’ve had a great experience working with regulators. I think they’re starting to see what our vision is and what the technology can demonstrate…It’s all been reasonable and supportive conversations with the regulators.

For those that are still skeptical, we need to earn the right and their trust through the results. We’ll do that and then we’ll show them the path.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes