Telematics has been on personal insurers’ radar for many years, and it has recently reached a tipping point. Nowadays, it is recognized as a necessary capability for the future success of any auto insurer in the U.S. market.

Executive Summary

Allstate’s David MacInnis and the IoT Insurance Observatory’s Matteo Carbone wrote an article for the third-most popular feature published on Carrier Management last year—The Journey to Build the Auto Insurer of the Future—detailing features like active customer engagement, service offerings and incentives to promote safer driving that are built into Allstate’s Drivewise and Milewise telematics programs. Still, some insurance professionals are skeptical that telematics is gaining traction.Here, MacInnis and Carbone follow up with hard evidence on take-up rates and double down on their efforts to explain the benefits of telematics for society and for insurers as well.

Photos from Allstate

Last year we analyzed Allstate’s journey toward developing this capability in our article “The Journey to Build the Auto Insurer of the Future.” That piece analyzed how Allstate has continued for a decade to sharpen its mastery of telematics data by innovating across multiple use cases. We explored Allstate usage of telematics data for:

- Changing behaviors by identifying behaviors that are predictive of crashes and the ability to explain desired behavior changes to the customer.

- Generating positive externalities to the society due to the promotion of safer driving behaviors.

- Offering positive and engaging experiences to the policyholders.

- Providing useful services, such as crash detection, for the policyholders.

- Better matching rate to risks through continuous underwriting.

- Addressing changing risks.

These contents have been extremely well received and have generated an interesting debate around the necessary capabilities for auto insurers of the future.

However, the sector must deliver results each quarter. It is not unusual to hear questions about the real impact generated by the usage of telematics data or reference to “not-yet-so-relevant” levels of UBI adoption in discussions between insurance executives. This is one of the reasons that have motivated us to write this second essay. Our direct experience provides some answers to these concerns, and we want to reinforce further our call to action for a better and informed usage of telematics data in the insurance sector.

Allstate has applied the telematics capabilities to develop telematics programs not only for the Allstate brand—with its flagship Drivewise product and the fast-growing mileage-based product Milewise—but also among all the companies within the Allstate Group (Esurance DriveSense program, National General/Direct Auto telematics program, Encompass telematics program, and Allstate Canada Drivewise and My_Bridge programs). The Allstate Group has over 2.5 million telematics policies among all programs and companies at of the end of 2021. Focusing on the Allstate branded telematics programs, this represents already a penetration above 20 percent on portfolios in the states where at least one telematics program is offered. This penetration on the portfolio has grown by 15 percent over the past two years mainly driven by increased new business penetration.

The IoT Insurance Observatory—an insurance think tank focused on promoting a profitable usage of IoT data in the insurance sector that has aggregated more than 70 players between Europe and North America—has mapped already five large U.S. insurers with a UBI penetration of at least 30 percent on their new business. Allstate is leading the pack.

Looking to the new business, the current penetration sits at 30 percent in states that have only one telematics program offered and reaches 40 percent in states where both Drivewise and Milewise are available. In these states, this penetration ranges from 30 percent in the exclusive agent channel to 40 percent for the business sold through the call center and over 50 percent for the online business. This variance in channel telematics take-up rate is driven by the channel and not by age as these variances are independent of the age bucket.

COVID Boosted the Interest in Telematics

Since first-quarter 2020, Allstate personal lines telematics programs have grown significantly. New business adoption of these telematics programs has increased 100 percent relative to pre-COVID levels. This doubling of the telematics penetration at new business was found across all states and by channels.

Allstate expected some increases as it has deepened the Drivewise enrollment discount and took rate investment (reductions) in Milewise product. But simple new business elasticities wouldn’t have forecast anywhere near the observed increase.

One can conclude that consumers have always had the opportunity for savings with these programs but may have had an aversion to allowing themselves to exact those savings. Watching their vehicle be unused for days or months on end may have unlocked their willingness to take part in Allstate telematics programs and reap the financial benefits.

Due to these dynamics, Allstate’s personal line Drivewise mobile program—the biggest telematics portfolio for the group—grew by 57 percent from first-quarter 2020 to fourth-quarter 2021. Moreover, Milewise book of business grew by 725 percent over this same time period even as the average mileage increased during 2021 and surpassed overall mileage from 2019. Demand for Milewise product has increased two- to five-times (varying by state) in fourth-quarter 2021 relative to the rate at which it was being sold prior to first-quarter 2020.

At a market level, it is undeniable that management focus, program design and the go-to-market plan have been focused on using telematics to address the new business with the proposal of UBI offers to customers who were switching from another carrier. However, the developed capabilities make it foreseeable to have telematics SDKs (software development kits) integrated in the core insurance app to provide claims assistance, rewards for safe driving and advice to the policyholders in the near future.

Reasons for Adopting Telematics

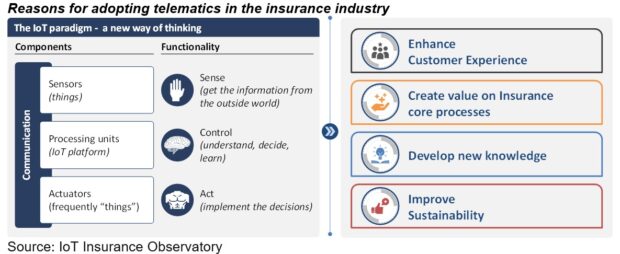

Telematics represent a new way of thinking about auto insurance. This IoT paradigm allows insurers to take smarter action than in the traditional disconnected physical world. Over its six editions—engaging almost 150 leading organizations—the IoT Insurance Observatory has developed a framework about the reasons for adopting telematics in the insurance industry. These reasons are:

- Enhancing the customer experience.

- Improving of core insurance processes.

- Developing of new business opportunities based on usage of telematics data

- Providing positive externalities to society.

In many sectors, the companies that excel in the customer experience are the ones that design iconic experiences and build (and iterate) solutions customers crave. Moreover, many studies on Net Promoter Scores (NPS) have shown a correlation between satisfaction and retention. Some insurers have started to leverage the usage of telematics for doing exactly the same, and their ecosystem services deliver even a better customer experience than services from other providers. Some are even working on the transformation of the buying experience by using this data.

From the MIT studies on data monetization, process improvement is the most broadly adopted approach and accounts for the greatest proportion of financial returns. Similarly, the usage of telematics data around the world has demonstrated a concrete return in improving the key insurance processes: risk selection and pricing, loss prevention (through the promotion of less risky behaviors), and claim management.

Telematics usage allows insurers to connect with clients and their risks, with a frequency and a richness of contents unimaginable in the last century. These connections and the consequent knowledge of customer needs are extremely valuable. To realize the potential of this knowledge, insurers must become “customer obsessed,” define the next generation of products and become better at selling peace of mind to them (cross- and up-selling). Based on the IoT Insurance Observatory research at an international level, this third area is less mature than the previous two. The creation of this knowledge is a complex task that requires an additional evolution of the sector telematics mastery, such as the usage of “insurance digital twin,” and represents the innovation frontier currently explored by some forward-looking players.

Telematics adoption contributes to making the insurance business more sustainable for both the customers and society at large, as well as for the company itself and its shareholders. The insurance telematics-based initiatives contribute to this impact on the sustainable development goals (SDGs) at all levels: the biosphere, society and economy.

The vision that has characterized Allstate’s telematics journey resonates with these four areas. A vision centered on improving road safety has inspired this 10-year journey. The usage of emerging technologies has been the way to achieve this purpose.

The value propositions to the policyholder have been characterized by the soft nudging for a safer driving behavior (through transparency into driving habits, recommendations and incentives), the maximization of customer control over the insurance prices, and the delivery of value far beyond price (as we described in our previous article).

Allstate has accumulated relevant competences and gone through a successful telematics journey. This has already allowed the insurer to obtain concrete results both on making customers happier and obtaining better economics results.

Happier Policyholders

Allstate connected auto policyholders have a significantly higher monthly mobile engagement number than non-connected ones. Thirty percent of the Drivewise customers use and engage with the app monthly, and the percentage grows to over 50 percent for the Milewise portfolio.

Customers who are more engaged show a higher Net Promoter Score and are more likely to refer as well. Drivewise customers have a 3-4 percentage points better NPS than traditional customers, and the NPS is even 6-7 points better in the Milewise customer base.

Customers who are more engaged show a higher Net Promoter Score and are more likely to refer as well. Drivewise customers have a 3-4 percentage points better NPS than traditional customers, and the NPS is even 6-7 points better in the Milewise customer base.

All these aspects are the foundation for a superior retention in the telematics programs. Customers who connect and sign up for a telematics program tend to have anywhere between 5-15 percentage points higher retention rates relative to those who have chosen to not enroll into a program.

Better Economic Results

Telematics is helping Allstate to stay at its auto margin target combined ratio. This is mainly linked to the more accurate pricing and the ability to influence driving behavior. Moreover, the mobile-based telematics adoption is also supporting operational improvements through its support in promoting self-service functionalities by the policyholders.

- More accurate pricing is due to the increased accuracy of loss prediction. Nowadays, telematics represents the most predictive variables a company can have for determining loss cost between the best and worst drivers. A driving score developed by braking events alone can have the same predictive spread found for a credit variable, according to an Allstate analysis. Like speeding and time of day, all other variables one could rate just add to increased spread for telematics vs. this base variable. Even using the telematics driving score as a correction factor applied to an existing risk model could have spread that is a multiple of the variable of credit. When a model is built with all the variables—including the driving score—estimated simultaneously, there is ever-increasing predictive power for driving behavior, and the spread of traditional variables is reduced.

- Promotion of safer behavior. Allstate wants people to understand their driving habits, which will help drive change within those habits.

When contemplating all benefits that telematics can bring, Allstate’s Arity found there is a four-times difference in the lifetime valuebetween the top-quartile best drivers and the bottom-quartile worst drivers. This is why the journey of the Allstate telematics approach has always been based on continuous monitoring, and the Drivewise program rewards safe driving habits with a cashback per trip and an additional reward program (that Allstate refers to as Allstate Rewards). Higher engagement also results in improving the transparency into ones driving habits, which Allstate believes results in customers’ greater control over their insurance prices. Once aware, they can act on it, and if they do, they will help lower their premium based on their improved driving habits.

Surveys of Allstate policyholders have revealed that 65 percent believe they have changed their driving habits after enrolling in the telematics program.

For Milewise customers—in states where the rate per mile changes weekly based on a four-week moving average of their driving behavior—we have found that those who are engaged with the experience are more likely have to a reduction in the rate vs. those who rarely visit the mobile app.

Programs like Allstate Rewards create positive microtransactional moments for the users. Allstate has leveraged this reward program as a means to reward customers for their good driving behaviors (such as receiving points for three days without a hard braking event or 10 days without a speeding event). Customers can use these points to redeem and unlock savings on local offers, gift cards, merchandise, discounts on select Allstate products, donations to local charities in partnership with the Allstate Foundation, and to win exciting sweepstakes and auctions. Customers who are active within the Allstate rewards program tend to have both retention and loss ratio benefits in the range of 1 to 2 percentage points. These customers also have 26 percent higher likelihood to recommend Allstate.

Moreover, the knowledge developed about drivers and their risks—by analyzing the telematics portfolio—also allows Allstate to obtain positive impacts on the entire auto book. As shared in one earning call by Allstate top management last year, evidence about the dynamic of the miles driven in rural areas or by commuters—measured in the telematics portfolios—have allowed a better understanding of the frequency picture. This has led to an adjustment of the traditional auto price at a granular level, which has also generated a better close rate than competitors.

The Allstate case history described above shows the real impact already generated by using telematics data and the progressive development of the foundations for the next steps of this multiyear journey. This journey in applying the telematics paradigm to the auto business continues to be focused on four development directions:

- Simple experience to create an effortless experience for the customer by integrating telematics into the core auto product experience.

- Affordable/empowered product to fit rapidly changing lifestyles with pricing sophistication that maximizes control and transparency.

- Safety promotion by providing a personalized and engaging continuous experience with a value-added feature that coaches drivers to be safer on the road.

- Continuous innovation based on consciousness of the need for a recurring loop of using the data, learning, iterating and innovating in order to progressively build the necessary capabilities. These capabilities allow Allstate to master telematics and shape the future of connected auto solutions.

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid