Usage-based insurance (UBI) finally has come of age in the U.S. insurance sector. Insurers have spent the last 20 years exploring the potential of telematics with alternating curiosity, commitment and disillusionment. Last year, 8.2 million U.S. auto policyholders shared their driving data with an insurer, based on the research of the IoT Insurance Observatory, a global think tank that has aggregated more than 100 players, including Allstate, which has been a member since 2018.

Executive Summary

Active customer engagement complete with service offerings and incentives to promote safer driving are hallmarks of Allstate’s Drivewise and Milewise telematics programs, which ultimately benefit society overall and the insurer as well. Here, Allstate VP David MacInnis and CM Guest Editor Matteo Carbone describe Allstate’s journey to build an auto insurer of the future and highlight a key driver that makes or breaks acceptance of telematics technology and data-driven services: value sharing with customers.Photo from Allstate

Allstate is a leader in adopting telematics, according to IoT Insurance Observatory data indicating that the company has over 2 million continuous connections across all programs, representing almost 10 percent of cars currently connected with an auto insurer at a global level.

Getting to this point started with a vision and a core belief that data and analytics will drive the future of transportation. Allstate’s goal is to protect customers, and the company has invested in telematics to adapt to customer needs, delivering value by redesigning products to be less complicated, more accessible and affordable.

Allstate’s approach to telematics has been to use driver behavior data responsibly. Current products—Drivewise and Milewise—aim to make roads safer by helping customers identify and understand safe driving habits while also giving customers more control and transparency over auto insurance rates.

This vision has guided a 10-year journey of progressively developing Allstate’s telematics competency:

- Back in 2010, Allstate launched its first device-based telematics program, Drivewise.

- In 2014, the insurance group already had more than half-a-million continuously connected customers.

- In 2014-2015, Allstate was first in the market to launch a smartphone-based program.

- In 2016, Allstate created Arity, a subsidiary fully dedicated to the telematics technology.

- More recently, Allstate developed features that gave reasons for policyholders to connect with their insurance carrier beyond a discount: integrated car health with engine alerts in 2016; gamification and rewards feature of Allstate Rewards, also in 2016; crash detection in 2020.

- In 2016, Allstate launched a pilot pay-per-mile program, with rapid state launches starting in 2018.

As of May 2021, more than 20 percent of Allstate auto policyholders are enrolled and connected into a telematics program in states and companies where they are available, and 40 percent of new business customers are opting-in and taking a trip in states where Drivewise and Milewise products are offered.

Today, Drivewise is one of the three largest continuous connection programs in the entire world, and Allstate has the largest pay-per-mile program in the market with Milewise.

The group has developed unique intellectual property based on more than 540 billion miles of driving data, adding 30 billion more miles every month.

As the program has matured, Allstate continues to sharpen its mastery of telematics data, innovating across multiple use cases to simultaneously maintain continuous connections with customers and to refine price segmentation, appropriately matching rate to risk.

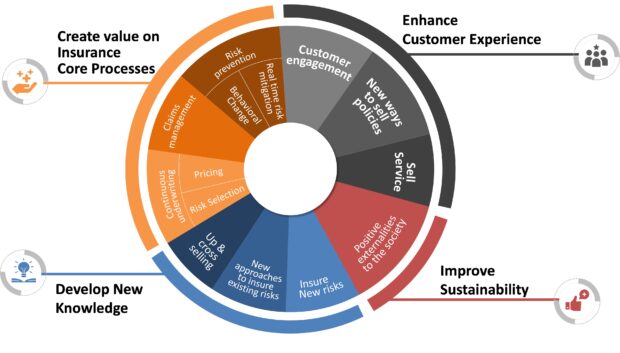

Map of the Insurance IoT Use Cases

Source: IoT Insurance Observatory and The Geneva Association

Behavior Change

A commitment to creating safer roads has inspired the entire evolution of Allstate’s telematics programs. Through continuous connections, the insurer is able to provide real-time tips on how driving behaviors can influence an individual customer’s costs with insight on how to drive more safely and save.

Allstate’s behavioral change approach has two main anchor points: identifying behaviors that are predictive of crashes and the ability to explain desired behavior changes to the customer. The app shares feedback on speeding, hard braking, phone usage and time of day driving. This allows the carrier to address two of the main pillars necessary for promoting safer behaviors: awareness and suggested behaviors. However, as identified by the research “From Risk Transfer to Risk Prevention” by The Geneva Association and the IoT Insurance Observatory, also providing a tangible incentive is needed to encourage drivers toward long-term and lasting behavior changes to reduce accidents. (See related textbox, “Read More About Insurance IoT,” Reference 1.)

Allstate products are currently providing both rewards and impacts on the premium and have already achieved concrete results in promoting safer behaviors. Allstate has seen that the policyholders who are most engaged with the app show lower claim frequency.

Instead of focusing on pricing sophistication only, Allstate guides drivers to develop safer driving habits with incentives and constant feedback. Customers enrolled in Milewise, for example, may see their per-mile rates change from week to week based on actual driving behaviors.

Milewise customers pay based on how much they drive (a daily rate and a per-mile rate). However, the per-mile rate can be increased or decreased on each week based on the customer’s prior four weeks of driving behaviors. Currently, about two-thirds of customers are seeing their pay-per-mile factors adjusted below 1.0 each week. (In other words, their premiums are being reduced for safe driving.) And the higher the engagement, the higher the change in behavior. Milewise policies that have weekly vs. quarterly interactions have a higher likelihood—75 percent vs. 55 percent—of the weekly pay-per-mile being adjusted below 1.0.

An additional element that incentivizes the change in behavior is a rewards program that provides customers and non-customers with points for safe driving by using Drivewise or Milewise. This is the first P/C insurance rewards program directly tied to telematics. With nationwide access (excluding N.Y.), Allstate gives points through a microtransaction system that rewards customers for their good driving, as well as many non-driving activities. (Non-driving activities include redeeming promo codes found in Allstate email communications; earning rewards for daily engagement with the program—literally logging in to Allstate Rewards earns points for customers; and completing periodic surveys. These all successfully drive increased engagement for the brand beyond safe driving.)

Points can be used on Allstaterewards.com to redeem and unlock savings on local offers, gift cards, merchandise, discounts on select Allstate products, donations to local charities in partnership with the Allstate Foundation and to win exciting sweepstakes and auctions. The Allstate Reward Program will incorporate new gamification features into the rewards experience in order to generate moments of interest and create a more frequent engagement with the brand.

(Editor’s Note: In mid-July, current sweepstakes included chances to win prizes ranging from $10-$15 gift cards for Starbucks, Old Navy, Apple, Sephora and Shell to $1,300 gaming packages, $1,500 cash or a $1,500 Carnival Cruise. Participants do not have to be Allstate policyholders, but they do have to download the Allstate app to earn points to enter the contests.)

Positive Externality to the Entire Society

Helping customers be better drivers improves their safety and reduces expected losses, but it also delivers a direct positive externality to the entire society, making roads safer. However, a short few months’ worth of feedback may not result in underlying driving changes for the driver. A feedback loop to the customer is required to build new habits and maximize the externality to the entirety of society. Drivers need feedback into their driving habits and incentives for them to react and change.

Customer Engagement

Allstate has redesigned policyholders’ experience through the use of telematics. Contrasting the experiences they have in the traditional disconnected physical world, Allstate is more present in policyholders’ daily lives, and policyholders’ experiences are enhanced through rewards and services by taking smarter actions. And positive customer experience results in more engagement.

Allstate products already have succeeded in boosting this engagement:

- Telematics users are at least 2.5 times more active in the mobile app with more than half of Milewise customers engaging with the mobile app on a monthly basis.

- 4 million customers participating in the rewards program visit nearly one million times each month.

We know that engaged consumers are more willing to recommend a brand with a good loyalty program, which also makes them more likely to continue doing business with that brand (textbox reference 3). Allstate gauges the impact through improved net promoter scores, up just under 10 percent for connected customers.

Services

Continuous connection has allowed Allstate to develop and advance these kinds of features for its policyholders. Drivewise policyholders all have access to the reward system and, since the end of 2020, the crash detection service, as well.

Crash Detection is a free safety feature available to Drivewise users within the Allstate Mobile app. When the app detects that a customer may have been in a serious car crash—either as a passenger or as a driver—they will be sent a notification through the Allstate Mobile app to offer help and quick access to emergency assistance, claims and Allstate Roadside. If a crash is detected, customers can call 911, call for roadside assistance, let Allstate know they are OK or even to start a claim.

Milewise policyholders, who receive an OBD2 dongle, instead have Car Health service included with their coverage. This service includes vehicle diagnostics and sends alerts if the engine light goes, with a description of the issue. This feature indicates the problem’s urgency and helps customers find repair shops, estimates repair costs and even schedules repair appointments. It also lets the customer know where their vehicle is parked.

Customer feedback collected by Allstate has found that these services provide peace of mind during potentially stress-inducing events and are great tools for people who may have older vehicles or cars with high odometer readings.

Continuous Underwriting

“The insurance sector depends upon risk analysis and functions in a domain of improbability,” according to a 2020 analysis of big data and actuarial science. Risks are dynamic, and a constant flow of digital data allows underwriting to be continuous and dynamic. A continuous underwriting approach allows insurers to improve risk selection and pricing, states another report from a group of actuaries. (Sources: “Big Data and Actuarial Science” by Hossein Hassani, Stephan Unger, Christina Beneki, 2020; “Smart device?” Inclusive Insurance Bulletin, pp. 13-14. Institute and Faculty of Actuaries, 2020)

- “From Risk Transfer to Risk Prevention – How the Internet of Things is reshaping business models in insurance,“ by Isabelle Flückiger and Matteo Carbone, Geneva Association Research, May 2021

- “The Past, Present, and Future of Telematics and UBI,“ by Harry Huberty and Matteo Carbone, June 2021

- “Black Boxes Could Yield Gold in Connected Insurance,” by Matteo Carbone, Henrik Naujoks and Sean O’Neill, Sept. 17, 2016

- “All the insurance players will be insurtech,” by Matteo Carbone and Andrea Silvello.

- “Attractive UBI Business Models for U.S. Consumers,” by Ryan McMahon and Matteo Carbone, Cambridge Mobile Telematics and IoT Insurance Observatory

- “Unveiling the full potential of telematics,” Swiss Re (2017)

- “Do You Think Insurers Are Not Innovative? Think Again,” by Matteo Carbone, Aug. 31, 2017

- “Let’s Make Insurers Great Again,” by Matteo Carbone, June 2021

Allstate’s intellectual property built over a decade has allowed it to be a frontrunner in this direction.

First of all, telematics offerings have a demonstrated “self-selection bias” that is favorable to insurers’ loss ratios (textbox reference 6). In other words, in each risk cluster, customers who enroll are less risky than those who do not enroll, allowing Allstate to offer an attractive upfront discount. Moreover, Allstate is today able to give its best drivers the best rates and give bad drivers appropriate rates. Traditionally, insurance has looked at your age, gender and marital status to predict how safely someone drives. Instead, telematics gives customers more control over, and transparency into, their auto insurance policy.

The current Allstate products offer both the option to have a defined price with cash back for safe driving (Drivewise) and a pay-per-mile pricing scheme (Milewise). Personalized pricing programs like Milewise allow customers to pay for each of the trips they’re taking based on how many miles they drive and, in some states, their recent driving behavior (as mentioned above). Allstate has seen this as an opportunity to meet customers’ needs and provide fairness and transparency over the pandemic period. In 2020, 25 percent of new business at Allstate was written into the Milewise product where it was available.

Different people have different preferences, and the mastery of telematics competencies allows insurers to evolve their insurance products to satisfy the evolution of the customer demand.

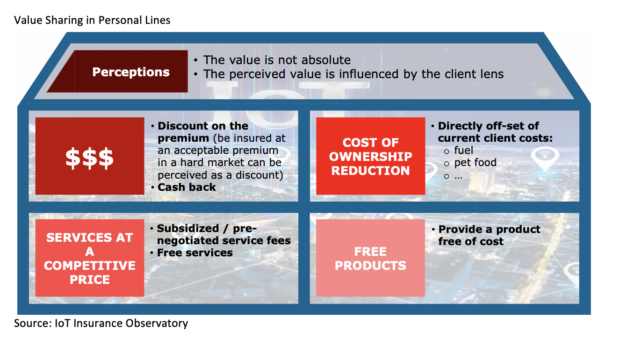

Research from the IoT insurance Observatory has revealed that each successful case history in using IoT in the insurance sector has been based on both the effective use of IoT data to create value for the insurer and a value-sharing scheme attractive for the customer. Sharing this value with customers has been proven to be the key driver that makes or breaks the acceptance of these new technologies and data-driven services (textbox reference 7).

As shown in the above figure, value sharing with the policyholder has various forms and structures in the IoT-based insurance offers. Benefits can reach high levels for the customers with safer behaviors. Safer customer behaviors also generate economic benefits to Allstate, and in this way, the company has financed telematics costs and provided benefits back to the customer. This value sharing is a single experience articulated on premium discounts, cash back, rewards and free telematics-based services.

Insure New Risks

Allstate has started to leverage the mastery in telematics in order to explore new sources of revenue. Specifically, Allstate has established a standalone IoT-based service, which is offered to users of the car-sharing service Avail, whether they are current Allstate policyholders or not. Avail is a car sharing service between travelers and neighbors active in some of the major U.S. cities. Telematics devices are installed in the shared cars, and the risks of this new business are insured by an Allstate policy.

In a future where insurance will be more connected, fair and personalized, policyholders will be engaged in risk prevention (textbox reference 8). Telematics is going to be a necessary capability for competing in the auto insurance and mobility arena, according to Tom Wilson, Allstate’s chief executive officer. “If you’re not leaning into telematics, you’re not going to be in business for very long, at least on a profitable basis,” he said at a recent Bank of America Securities virtual conference (reported by Inside P&C, “Companies Without Telematics Offerings ‘Won’t Be In Business Long,’ Allstate’s Wilson“).

This should give a sense of urgency to all the insurers because a competitor’s coverage product (rate filing based on traditional variables or policy form) can be replicated in a few months. But telematics capabilities require time to be built and internalized in the organization. A capability gap is going to require years to be closed.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  The Future of HR Is AI

The Future of HR Is AI  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best