Traditional insurance products focus on risk transfer. Insurers compete based on their ability to use historical loss information, data gathered during the submission process and other data from third-party data aggregators to predict the likelihood of future claims and price risk transfer products appropriately. With more and more data available in the current hyperconnected world, there are emerging opportunities for insurers to expand their product and service offerings.

Executive Summary

Learnings from early IoT experiments about customer adoption, roles and responsibilities, and conditions for generating ROI need to happen in every use case. And even though the answers may be different from one case to the next, the approach of The Hartford’s IoT Innovation Lab is highly repeatable, according to Dan Campany, the head of the Lab and CM Guest Editor Matteo Carbone.Here, they describe lessons learned from using water damage prevention technology for the insurer’s construction segment customers; the overall benefits of IoT in supporting real-time mitigation, behavioral change of insureds and enhanced underwriting for the insurer; and the ultimate goal of transforming commercial insurance products to incorporate IoT into fee-based services beyond core risk transfer.

In this respect, a key technology is the Internet of Things, which connects people and objects to the Internet, allowing remote transmission of information about people and things. IoT data is unique relative to the data insurers traditionally use to price risk. It is more granular and continuously refreshed, meaning individual assets and environmental conditions can be tracked in detail, in real time, all the time.

For an insurance company, that means that more data and information about clients’ and industries’ exposures, perils and incidents are available. Using this data makes it possible even to predict incidents and address risky situations proactively to avoid injuries, property damage or other types of claims scenarios.

In general, the average maturity of IoT adoption in the insurance industry is low and varies substantially by coverage line. While many insurers are experimenting with different IoT-based concepts, IoT has not yet been adopted on a scalable basis by the large majority of insurers. Personal auto and home are the most widespread IoT use cases in insurance, whereas commercial applications are largely still in experimentation and incubation. While many insurers clearly see the potential applications for IoT, they are still figuring out how to make the transition from “interesting technology” to “scalable ROI.”

One aspect that highlights the immaturity of the insurance approach to IoT is the lack of integration with the insurer processes. Indeed, several insurers have added an IoT gadget to a personal insurance coverage or launched IoT-based products and apps that are not linked to an insurance product. In these initiatives, the business value of the approach is not defined beyond “it is a marketing tool.” This approach misses one of the key lessons learned in the tech-driven innovation: a return on investment is more about having a strategy than about adopting a technology. (Source: “How to Overcome Challenges to Enterprise Implementation” by Brian Gilmore and George Westerman, MIT Sloan Review, Jan. 6, 2020)

However, in any insurance lines of businesses and across all geographies, the IoT Insurance Observatory’s research has found some successful IoT-based insurance stories. Cumulatively, an overview of the pioneers that succeeded in impacting their business through the usage of IoT data provide a map of the reasons for adopting IoT in the insurance sector. These concrete experiences confirm the relevancy of this InsurTech approach for the insurance sector and demonstrate the feasibility of this paradigm in any market.

There are some personal auto insurers with millions of UBI policies in their portfolios, and the leader in using IoT in health and life insurance has around 20 million connected users around the world. In commercial lines, the most recent developments are seen in the U.S., where many insurers have started to experiment with IoT usage.

One of the front runners is The Hartford. The company’s vision is to predict and prevent losses to minimize business interruption for their customers. This carrier wants to prevent bad things from happening.

The Hartford IoT Innovation Lab

The Hartford created its IoT Innovation Lab at the beginning of 2019 to predict and prevent customer losses and minimize business interruption. This allowed the company to create a more comprehensive, enterprise-wide strategy around IoT to accelerate experimentation and develop deep subject matter expertise.

For example, a specific business needed water damage prevention in the construction sector. Pilots of different solutions and business models by The Hartford’s IoT Innovation Lab allowed measurement of various technology solutions’ risk mitigation performances and the implementation of a sustainable approach. Anchored by their vision to predict and prevent losses, the IoT team created a deliberate plan to mature from experimentation to scalability.

Key things the team needed to learn before scaling included customer willingness to adopt under various conditions, as well as the viability and effectiveness of the technology solutions in preventing losses for different types of customer sites. In addition, the team had to absorb the roles and responsibilities within The Hartford risk engineering and underwriting organizations necessary to enable the new business model, as well as the conditions under which the loss prevention benefits exceeded the cost of the technology deployment.

The Hartford’s risk engineering and underwriting teams identify clients that should have water damage prevention technology based on their exposures. The opportunity is then referred to the professionals within the lab for a custom-built technology proposal. When the carrier has identified a loss mitigation solution adequate to provide the expected ROI, the carrier makes the investments. When the service is attractive for the client, but the resulting loss mitigation is insufficient to offset the cost of the investment, the customer may pay part of the costs.

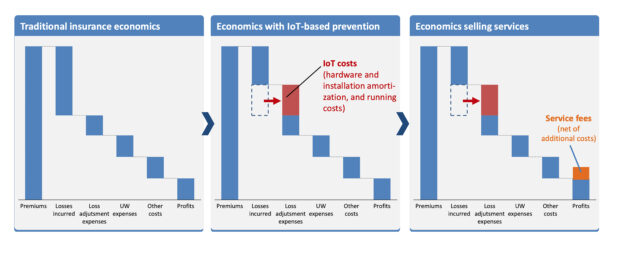

Risk Prevention Economics

Source: IoT Insurance Observatory

The lessons learned from the construction segment, though not directly portable to other types of property insurance, were a significant head start toward extending the water damage prevention efforts and resultant benefits to additional customer segments such as commercial real estate and small businesses, where The Hartford’s active experiments are also showing early signs of promise.

Real-Time Risk Mitigation

This IoT-based risk mitigation approach is based both on:

- Early detection of risky situations (for example, flow monitoring sensors for early detection of unusual flows indicative of a leak, temperature and humidity monitoring sensors for freeze condition detection).

- Detection of incidents to mitigate their consequences (sensors to detect escaped water).

The mitigation solutions are based on alert dispatch, including human intervention, and automation (such as automatic shut-off valves).

The lab has experimented with other real-time risk mitigation use cases over the last three years. The Hartford is currently expanding into additional technologies such as wearables and computer vision for real-time alerts—for example, monitoring whether workers wear hard hats and are lifting using proper ergonomic techniques for workers compensation. The goal is to understand the dynamics of risks in real-time—i.e., how a risky situation develops, and at what time point a real-time interaction is required to prevent an incident.

Intervention responses to these earlier-stage experiments can come in the form of immediate actions for a specific event (e.g., tell a forklift operator to stop speeding) or a more holistic review of the portfolio of behavioral trends over time that can be addressed with more systematic re-engineering of risk (e.g., redesign the forklift routes to optimize speed while minimizing proximity to human foot traffic).

Over time, The Hartford will even be able to assess changes to macro risk trends (e.g., number of incidents by category) and have an updated view of risk for a particular insured to support continuous underwriting based on more accurate risk selection and sophisticated pricing as customers respond and address—or do not—systemic risks in their operations.

Behavioral Change

An additional, indirect benefit of risk intervention is improving the risk engineering teams’ awareness about the current hazards, increasing their ability to recommend changes to improve insureds’ workplaces and make them safer. The Hartford’s IoT-based initiatives systematically enhance the activity of their risk engineering consultants by providing the insights generated by the technologies installed in the workplace.

- “This InsurTech Expert Says Mastering The IoT Paradigm Is An Achievable Target,” Forbes, July 2020

- “From Risk Transfer to Risk Prevention – How the Internet of Things is reshaping business models in insurance“ by Isabelle Flückiger and Matteo Carbone, Geneva Association Research, May 2021

All information from sensors and computer vision go to the risk engineering team as part of the risk advisory to the customers. For example, risk-related insights from ergonomic wearable devices can help the risk engineering team to identify systematic root cause issues in the customer’s operations and help them make new recommendations to improve safety, such as ergonomically correct workstations or mechanical lift assist equipment. Customers value the insights as well because it helps them prioritize and contextualize changes they can incorporate into their operations for both safety and efficiency.

Risk engineering consultants have to look at hundreds of things when they visit the customer site. As well, customer sites are often dynamic, with conditions changing substantially between risk engineering visits. Based on the IoT data, they get a customer-tailored list where issues are identified or where potential incidents could happen, including prescribed actions.

In the past, it was a “see and react” exercise. Now, problems are identified beforehand based on data analytics, allowing the risk engineering team to respond to conditions that they were not able to witness in the past as well as to be more targeted with prepared recommendations during their onsite visits. For example, data from wearable devices can help a risk engineering consultant to identify a particular job function that would benefit from a more in-depth, onsite assessment by a trained ergonomist.

Research about insurance risk prevention by The Geneva Association and the IoT Insurance Observatory has revealed that the same data necessary for the real-time risk prevention are used also for promoting safer behaviors, reinforcing the loss prevention impact on the insured risks and building more sustainable business cases around these prevention investments.

Developing Insurance IoT Capabilities

The Hartford believes it has only reached the tip of the iceberg on water damage prevention benefit captured through scaling across the enterprise property portfolio. At the same time, having a concrete success story early on with construction water damage prevention has made IoT benefits tangible for the broader organization, creating an influx of new ideas and demand from product and underwriting leaders.

The lab is repurposing its experimentation philosophy and approach to apply to other types of perils and technologies. Many of the same learnings need to happen during other experiments (e.g., customer adoption, roles and responsibilities, conditions for generating ROI). And, although the answers will be different for each use case, the approach is highly repeatable. The Hartford’s IoT Lab now has a series of active experiments in flight across various stages of maturity from opportunity framing to scaling.

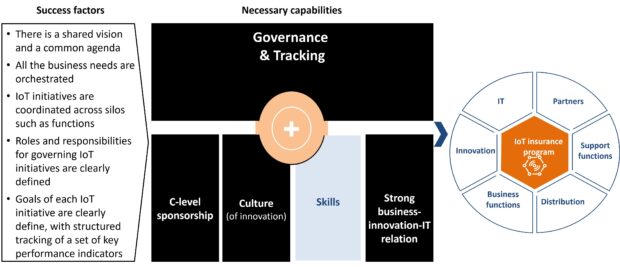

The Organizational Perspective for the Insurance IoT Adoption

Source: IoT Insurance Observatory

The goal for The Hartford’s IoT Innovation Lab is to keep the primary focus oriented on business model experimentation, developing insights by analyzing IoT data and supporting the business units’ ability to operationalize effectively at scale. Therefore, the team aspires to stay small and nimble. The preference is to avoid scaling the team to take over operational accountability of IoT at a transactional level once it has been fully implemented into the business units’ operating models. Still, the team remains deeply connected indefinitely as subject-matter experts and functions as a center of excellence.

As well, The Hartford leverages vendors’ capabilities whenever possible as opposed to creating proprietary hardware and software solutions in-house. Alerts go to the vendors, where they are analyzed and enable real-time actions. A backup goes to The Hartford’s IoT Innovation Lab team. The IoT Innovation Lab does capture all data from its IoT deployments for purposes of correlating with other proprietary data, conducting advanced analytics, measuring success, and developing net new actionable insights for underwriters and risk engineers over time (e.g., risk benchmarking and pricing models).

The Hartford’s Innovation Lab sees the evolution of IoT adoption in commercial lines over three phases:

- First, loss prevention as a way to deliver tangible ROI and develop the foundational capabilities and expertise.

- Second, enhanced underwriting execution through new data-driven insights from the deployment of IoT devices at scale. That includes incorporating the benefits of IoT data into risk segmentation and pricing models.

- Finally, transformation of products and services both in the form of proliferation of usage-based insurance as well as expansion of insurers’ role in the customer value chain to incorporate IoT into expanded, fee-based service offerings beyond core risk transfer.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage