Berkshire Hathaway Chair Warren Buffett and Vice Chair Ajit Jain admit that GEICO ranks behind Progressive in its ability “match rate to risk,” but both competitors will soon surpass State Farm and Allstate in business volume, Buffett says.

Executive Summary

Warren Buffett and Ajit Jain disagree on whether it makes sense to write insurance on a unique deal that would have Elon Musk’s Tesla paying the premium but both agree that GEICO has some ground to make up to catch Progressive on pricing auto insurance and that the insurance cost of the pandemic to Berkshire and the industry is likely to go up. Here, Carrier Management captures the insurance-related highlights of Berkshire Hathaway’s four-hour annual meeting last Saturday and provides the numbers to track the race between GEICO and Progressive to the top of premium growth and profit leaderboards.Speaking during the Berkshire annual meeting last Saturday, Buffett repeated a forecast he made two years ago when he said that either Progressive or GEICO would rise to the top of auto insurance premium rankings within five or 10 years.

“I will predict that five years from now, it’s very likely the top two will be GEICO and Progressive. In which order, we’ll see,” Buffett said at this year’s event, revising the ascension timeline.

Both Buffett and Jain said that GEICO has some ground to make up when it comes to pricing accuracy, as the two men responded to a shareholder question about why GEICO operates at a lower profit margin than Progressive.

“Progressive has had the best operation in recent years terms of matching rate to risk. And that’s what insurance is all about,” said Buffett, adding: “If you think that 90 year-olds and 20 year-olds have an equal chance of dying, you’re going to be out of business very quickly in the life insurance business. You will get all the 90 year-old risks, and the other guy will get all the 20 year-old risks.

“The same thing applies in auto insurance. There is a huge difference between 16-year-old males, and how they drive, and 40 year-old married, employed people,” he said.

“The companies that do the best job of actually having the appropriate rate on every one of their policyholders are going to do very well—and Progressive has done a very good job on that. We’re doing a much better job on that already,” he said, highlighting the appointment of Todd Combs, one of Berkshire’s investment managers as chief executive officer of GEICO early last year as a factor contributing to the improvement.

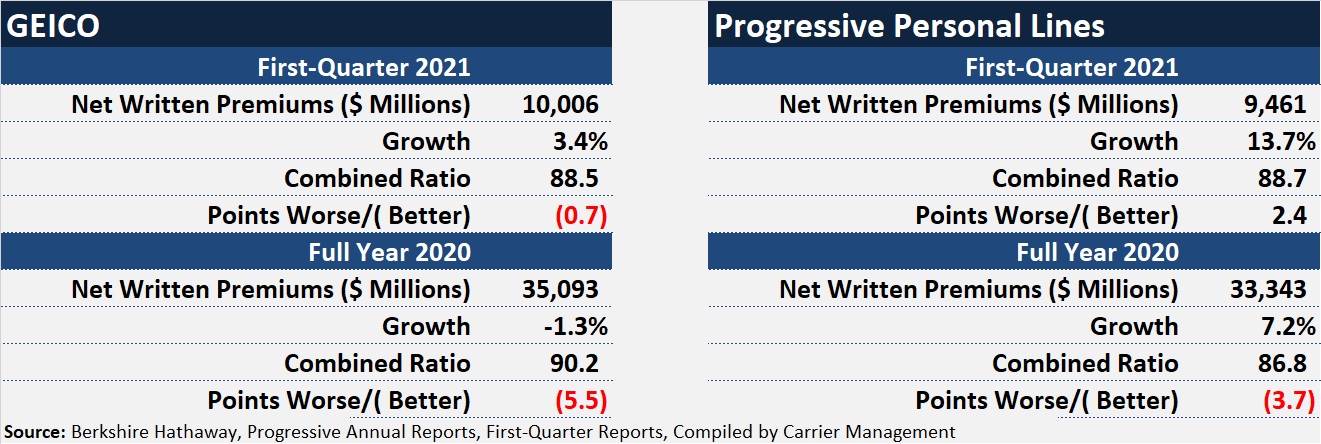

“If you look at the results as of now, Progressive is still crushing it in terms of growth relative to GEICO but GEICO has certainly caught up with Progressive in terms of margins, and hopefully that gap will be nonexistent in the future.”

“If you look at the results as of now, Progressive is still crushing it in terms of growth relative to GEICO but GEICO has certainly caught up with Progressive in terms of margins, and hopefully that gap will be nonexistent in the future.”

Ajit Jain, Berkshire

(Bloomberg Photo: Daniel Acker)

Said Jain: “There’s no question, Progressive is a machine. They are very good at what they do, whether it’s underwriting…, or whether it’s handling claims. Having said that, I think GEICO is catching up with Progressive. More than a year ago, Progressive had margins that were almost twice as much as GEICO—and growth rates that were almost twice as much as GEICO.”

“If you look at the results as of now, Progressive is still crushing it in terms of growth relative to GEICO but GEICO has certainly caught up with Progressive in terms of margins, and hopefully that gap will be nonexistent in the future.”

Later, Jain noted that while Progressive has certainly done better on matching rate to risk, when it comes to branding, GEICO is “miles ahead of Progressive. And in terms of managing expenses, GEICO does a much better job than anyone else in the industry,” he said.

Running After The Telematics Bus

Articulating what he views as GEICO’s competitive disadvantages relative to competitors like Progressive, Jain said that “GEICO had clearly missed the bus, and was late in terms of appreciating the value of telematics,” adding that GEICO has now “woken up” to the fact that telematics has a big role to play in matching rate to risk. He expressed the hope that GEICO’s telematics initiatives “will see the light of day before not too long,” allowing Berkshire’s auto insurer to catch up with all its competitors in assessing risk and pricing it appropriately.

Buffett concluded his remarks on the subject noting that auto insurance is a tough slog for even the most formidable competitors. “Both Progressive and GEICO were started in the 1930s….We’ve had the better product for a long long time in terms of cost. And here we are 85 years later, in our case, and we have about 13 percent of the market, and Progressive has a slight bit less.”

“The two of us have 25 percent, roughly, of this huge market,” after 80-plus years, he observed. “So, it’s a very slow changing competitive situation.”

Days after the Berkshire meeting, during a first-quarter investor call for Progressive on Wednesday, CEO Tricia Griffith addressed a question from an analyst about Jain and Buffett’s comments—specifically whether she had concerns about GEICO’s foray into telematics or about a market share lead that GEICO has over Progressive in some big states, like California and New York, where the use of credit scores for rating is banned or limited.

“They’re a formidable competitor and we like the competition because it makes us better and it’s better for customers,” Griffith said. In terms of rate-to-risk segmentation using credit scores, she said, “We’ve had an edge on a lot of our competitors for many, many years now, and we’re not going to stop. We believe rate-to-risk has a lot to do with many different variables—insurance credit scores being one of them, usage based insurance being one of them. But there are a lot of other variables. We will comply with the regulators.”

“We believe they help to match rate-to-risk and they’re correlated to ultimate losses, which is really important for all consumers to keep the rates competitive,” she said as she discussed credit scores and telematics. Noting that she is not surprised that GEICO plans to spend more money on telematics, she said, “We also will be spending more money on continuation of our many, many billion miles of Snapshot data.”

“I think going head-to-head on all those things is a good thing,” she said, adding Progressive’s continued spending on promoting its brand to the list of competitive activities (up 25 percent in the first quarter). “I’ve always been competitive and we like that….It makes sure that you don’t just rest on your laurels. We will react to whatever we need to, and continue to invest in segmentation, especially in usage-based insurance but [also] other segmentation variables, as well as our brand, our broad coverage and the people and culture at Progressive. We think all those together are really a winning formula.”

“Ten years ago, I might not have said this, but now we have head-to-head brands.”

Tricia Griffith, Progressive

Answering several questions about the secret sauce behind Progressive’s continued growth—with policies in force for personal auto up 13 percent for the first quarter—Griffith managed to counter Jain’s assertion that GEICO is the brand leader. “Ten years ago, I might not have said this, but now we have head-to-head brands,” Griffith said. “You may like her or you may not but you know who Flo is,” she said, also referencing a host of other Progressive characters. “It’s about awareness and people know who Progressive is. It’s a solid brand. It’s a reputable brand,” she said.

“Awareness gets you on the short list, and then when you’re on the short list and you shop, our competitive prices and our broad coverage gets you in the door.”

Progressive CFO John Sauerland said that a “massive portion” of the company’s advertising spend is in digital media. He also highlighted the “analytical powers that are inherent in Progressive people,” which he believes extend to Progressive’s digital media group—analytics that help them navigate digital auctions for search engine display ads.

Sauerland added that once a prospective customer is in the front door, the next step is getting them to the quoting stage. “That is not as simple as you might assume. There are multiple avenues where customers can decide to quit quoting process. And we optimize continuously to make that funnel… as efficient as possible to get them a quote, and then obviously to translate that quote to a buy,” he said, again noting that people with analytical skills and massive data sets are keys to the process.

Willing To Lose $10B In One Event

After Buffett and Jain took up familiar themes about competitive positioning among auto insurers back at the Berkshire annual meeting, they also weighed in with some comments about Elon Musk’s Tesla as they did in past years. Both men also talked about the impacts of social inflation and COVID-19 on the insurance industry. And Buffett addressed Berkshire’s opposition to blanket climate change disclosures across its diverse businesses—a topic that he first addressed during the annual meeting five years ago.

Buffett, who during a prior annual meeting rejected the idea that any auto maker, Tesla included, could make major strides in the auto insurance game, said he would consider insuring Musk’s mission to Mars—coverage that could involve insuring a SpaceX rocket, payload or human capital involved in the trip and subsequent planned colonization of the red planet.

“It would depend on the premium,” Buffett said, echoing a statement he made about the prospect of insuring pandemics during the 2020 annual meeting.

Buffett’s answer to a shareholder question, read by CNBC’s Becky Quick and directed initially to Jain, was the opposite of Jain’s. “This is an easy one. No thank you. I’ll pass,” Jain said, later adding, “In general, I would be very concerned about writing an insurance policy where Elon Musk is on the other side.”

But Buffett’s take was similar to his view on all unusual risks—price rules the decision. He added, however that he “would probably have a somewhat different rate if Elon was on board or not on board.” Berkshire’s chair added, “It makes a difference,” explaining the risk-sharing idea of having “skin in the game.”

In general, “we are willing to lose $10 billion in a single event,” he said earlier in the meeting, responding to a totally different question about the prospect of severe unexpected underwriting losses hitting Berkshire’s books in the future.

“We want to be paid appropriately for that. We’ve got the resources to do it, but we don’t want to loss $10 billion on something where we only thought we could lose $50 million,” Buffett said.

“I would probably have a somewhat different rate if Elon was on board or not on board. It makes a difference.”

Warren Buffett, Berkshire

(AP Photo/Nati Harnik)

The gist of the question was actually whether Berkshire should change its strategy to focus on more “plain vanilla risks” like those which GEICO takes on, forgoing the long-tail liability exposures that the company can accept today because of Buffett and Jain are around to assess them. Neither Jain nor Buffett gave a direct answer to the part of the question that referred to what Berkshire’s insurance portfolio should look like when the two risk experts are gone, instead focusing on a concern expressed about the “opaqueness and risk” of some insurance lines.

Jain responded, “Clearly contract certainty is an issue for us in the insurance industry,” he said, suggesting that it’s an issue in both short and long-tail lines, giving the recent example of business interruption coverage interpretation. “It is a risk every time we issue a contract that either because of sloppiness, in terms of how that contract is written, or because of the regulatory environment we all have to live in, that the words in the contract may be tortured,” Jain said. “And normally when they are tortured, they ended up going against the insurance industry, not in their favor, he said, suggesting that it’s prudent to “throw in something for the unknown unknowns” when pricing risks.

“We are willing to lose $10 billion in a single event….but we don’t want to loss $10 billion on something where we only thought we could lose $50 million,” Buffett said.

“We are willing to lose $10 billion in a single event….but we don’t want to loss $10 billion on something where we only thought we could lose $50 million,” Buffett said.

“Most of the surprises in insurance, practically all of them, are unpleasant,” Buffett agreed. Going on to talk about insurance claims from sexual abuse lawsuits against the Boy Scouts of America, which Jain reported have ballooned from 2,000 to a number closer to 100,000 as statutes of limitations were extended in some states, Buffett noted that the cases date back to the 1950s and 60s. “You’ve got people advertising for claims,” he said, referring to plaintiffs lawyers. “I’m sure a lot of the claims are valid. I’m sure a lot of them are invalid. And how in the world do you pick out the difference?”

Chubb CEO Evan Greenberg was more blunt during his company’s first-quarter earnings call conference last month. “We’re very sympathetic to those—and it breaks your heart where you see the circumstances of children abused by adults sexually and where they’re for real. Then on the other side of the coin, the trial bar is a money-making machine…That combined with new technologies and social media and litigation funding, they see it as another dog bowl they eat out of,” Greenberg said, after discussing a beneficial deceleration of notice of circumstance reports in jurisdictions where reviver statutes have been open for a longer period of time. Still, “there is also a lot of suspect and specious behavior that is involved here,” he said. “Our job is to tease out what’s real and defend against anything that that we suspect is just for ill-gotten gain.”

Pandemic Lessons

Back at the Berkshire meeting, Jain was asked about industry takeaways from dealing with COVID-related insurance losses in 2020. He pointed to both pricing and risk aggregation problems. “In the insurance business, we often think about pandemic risk as one of the risk factors that we need to cope with in our business….While we were aware of the fact that pandemic risk is a risk factor, it was totally, totally underpriced by all of us in the industry.

“Several of us thought it’s an event that will happen at most, once in a hundred years—and even then those odds were pretty high,” he said, concluding that insurers and reinsurers need to first “recalibrate and rethink about what the return time is for something like a pandemic risk. And separately, we haven’t yet done a good enough job as an industry in terms of correlating the risk and aggregating the risk, and making sure we can deal with the aggregate numbers.”

“Several of us thought it’s an event that will happen at most, once in a hundred years—and even then those odds were pretty high,” he said, concluding that insurers and reinsurers need to first “recalibrate and rethink about what the return time is for something like a pandemic risk. And separately, we haven’t yet done a good enough job as an industry in terms of correlating the risk and aggregating the risk, and making sure we can deal with the aggregate numbers.”

Jain specifically pointed to industrywide errors in pricing event cancellation or contingency policies on event like the Olympics being canceled and NBC buying insurance for their rights to cover the event, “which might suddenly be not worth much.” Said Jain: “When pricing something like that, we would think in terms of earthquake risk and more recently terrorism, but we would never factor something like what portion of the price should come from the pandemic exposure.”

Buffett, after describing how much more favorable U.S. courts have been in deciding pandemic-related business interruption coverage cases than in the UK, said that those losses haven’t been a huge factor at Berkshire, whose operating companies are not big players in commercial multiple peril packages. Still, Berkshire has put up $1.6 billion in reserves across all impacted lines, according to Jain, who also said he expects the number to rise. “The industry as a whole is reserved about $25-$30 billion for COVID-19. As of now, if you believe the pundits in the industry, they will tell you that number is probably going to be closer to $100 billion. So there’s another about $70-75 billion of COVID-19 losses that need to flow through insurance industry’s balance sheets and income statements. Our number, therefore, of 1.6 that we have as of now is going to be a lot, lot higher. But it’s not something that we cannot manage completely,” he confirmed.

Buffett wasn’t totally in agreement. “It’s one of the great human catastrophes of all time, but it was not that big in insurance,” the chairman said, going on to reject the practice of “feeding in losses” over time. “If the insurance industry thinks they’re going to lose a hundred billion dollars, the hundred billion ought to be up on their books.… You’ve got a liability. Our goal is to put up the liability when we think it’s happened. We should not be at a-billion-six, if we really think we’re going to have some proportional share of a hundred billion,” he said.

Later in the meeting, a shareholder, referring to a statement from Buffett suggesting that Berkshire’s ability to quickly assess and insure enormous risks is a less valuable asset than it used to be, asked the chairman to explain the thinking behind that. Buffett answered quickly. “The demand is less, basically on that,” he said, also recalling that while Berkshire was the only insurer that could take on the enormous risks of insuring buildings like the Sears Tower in the wake of the 9/11 attacks, two decades later, buyers aren’t showing up with requests for big limits.

“In addition to the demand side, the supply side has become a lot more competitive as well,” Jain said. There are a lot of people who can put up big limits, “not as much as we do, but they can syndicate a program and put up a billion dollars very easily. So that competitive advantage we had, we still have, but it’s no longer as big a deal as it used to be,” he agreed.

Berkshire Culture—Jain and Abel

The billion-dollar question for some analysts and shareholders—unasked at this year’s annual meeting—was answered by accident: Will Jain replace Buffett at some point in the future?

(AP Photo/Nati Harnik)

“Greg will keep the culture,” Vice Chair Charlie Munger said at one point, referring to Greg Abel, who oversees the non-insurance business units of Berkshire. Munger was expanding on an idea presented by Buffett about the success of a decentralized strategy at Berkshire, in which Buffett and Munger allow individual business leaders autonomy in directing their operations.

“Decentralization won’t work unless you have the right kind of culture accompanying it,” Buffett said, responding to a question about whether the conglomerate would ever become too big and complex to manage—leading Munger to make his statement about Abel maintaining that culture.

Buffett paused. Then he added, “If we had a culture of people who were trying to make a lot of money for themselves …. it would not have worked,” Buffett said. A day later, Buffett addressed the question about his successor, confirming on CNBC that Abel is the board’s choice if something should happen to Buffett overnight, and also stating that the board’s thinking was based on age.

Before that all transpired, Abel and Jain confirmed that they support one another, exchange ideas and work together on the cultural elements of the business on a regular basis.

While the unique relationship that Buffett and Munger have cannot be duplicated, Jain said, “We’ve known each other for a very long time. I certainly have a lot of respect, both on a professional level and a personal level, in terms of what Greg’s abilities are. We do not interact with each other as often as Warren and Charlie do, but every quarter we will talk [and] update each other about our respective businesses.”

The two men don’t have any formal meetings scheduled, “but every time a question comes up, which is related to insurance, Greg will pick up the phone and call me. By the same token, if there’s any question that comes up relating to any of the non-insurance operations…., like we had recently where a client of mine was trying to find a buyer, and I picked up the phone and talked to Greg and we talked about how best to proceed.”

“That happens during the course of the quarter. Every quarter we exchange notes, and we have a perfectly well-functioning relationship between the two of us,” Jain said.

(AP Photo/Nati Harnik)

Confirming all the same points, Abel highlighted his personal respect for Jain and his insurance smarts—”there’s no one better at it”—adding that in addition to a regular dialogue, they proactively reach out to one another if one hears anything unusual that the other should know. “But it goes beyond that. Ajit has a great understanding of the Berkshire culture. I strongly believe I do too. And anytime we see anything unusual in one of our businesses, it’s Ajit who I’m going to call and say, ‘Are you comfortable that we’re taking this approach? Is it going to be consistent with how you think about it? How you think about it in insurance?’

He concluded: “It goes beyond just discussing the businesses, but maintaining the exceptional culture we have at Berkshire and building upon that.”

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash