Since 2022, the landscape of coverage litigation in U.S. district courts has shifted significantly, signaling new challenges and opportunities for property/casualty insurers.

Recent findings from Lex Machina, the LexisNexis Legal Analytics platform, reveal that lawsuits involving homeowners policy coverage disputes unrelated to hurricanes have surged to historic highs.

It’s not just personal lines: Lawsuits concerning coverage under commercial liability policies have also become more frequent than ever in federal district courts.

Meanwhile, business interruption lawsuits remain a consistent feature of the coverage litigation environment, even years after mandated business closures during the early stages of the COVID-19 pandemic, with newer cases increasingly tied to climate-related losses.

Homeowners Policy Disputes Rising Beyond Hurricanes

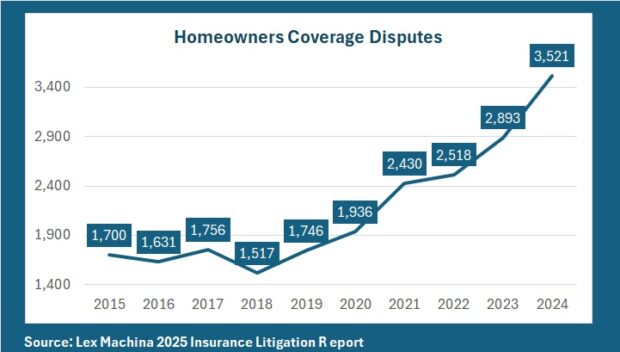

Independent of hurricane-related losses, more and more homeowners policy coverage lawsuits have been launched in federal courts each year since 2018. In 2024, more than 3,500 lawsuits were filed in federal district courts or removed from state courts to federal courts, the highest number in over a decade.

Notably, although these cases do not explicitly allege hurricane-related losses, an increasing proportion nonetheless refer to weather-driven losses such as damage from wind, storm and flood events.

Data from Lex Machina through October 2025 shows that the upward trend is continuing through this year.

For carriers, this shift highlights the increasing exposure to non-catastrophic weather events and the need to reassess underwriting strategies and claims management practices accordingly.

Escalating Business Liability Coverage Disputes

Business liability coverage litigation has followed a similar upward trajectory, with steady increases each year since 2022. Federal courts saw more than 3,000 new commercial liability coverage disputes in 2024, and preliminary 2025 data shows accelerating growth.

According to industry observers, several factors are driving this rise, including inflationary pressures, carriers’ evolving postures toward coverage decisions (more assertive stances on denials), and the emergence of novel liability scenarios tied to technology and environmental risks (cybersecurity, ESG-related liability and artificial intelligence, for example).

Continued Activity in Business Interruption Coverage

Despite the decline of pandemic-related claims, business interruption lawsuits remain active and are increasingly driven by climate-related disruptions. In 2024, more than 650 such lawsuits were filed in federal courts, a figure more than 50 percent higher than any pre-pandemic year in the prior decade.

Most 2025 filings stem from losses resulting from hail, storms, floods and other weather events.

Strategic Implications for Carriers

The data suggests that insurers must adapt to a “new normal” of litigation driven by diverse and evolving forces. Beyond headline-making catastrophes, social inflation, technological risks and climate variability are redefining exposure patterns.

For property and casualty carriers, leveraging litigation analytics can provide critical insights into emerging patterns, helping to refine underwriting, adjust claims strategies and anticipate future areas of contention. Understanding these shifts is essential for navigating the next phase of coverage litigation and managing risk in an increasingly complex claims landscape.

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered