There wasn’t a lot of talk about auto insurance at this year’s annual meeting of Berkshire Hathaway, but when the subject came up, Warren Buffett acknowledged the continued dominance of one competitor—a mutual insurer.

“The largest auto insurance company in the United States was started over in Illinois by a guy who didn’t know anything about insurance particularly. And it’s a mutual company. It’s not supposed to succeed in capitalism,” said Berkshire Hathaway’s chair and chief executive officer, referring to State Farm.

Saturday’s six-hour event wasn’t the first one that featured Buffett referring to State Farm’s dominance when asked to comment on the competition between Berkshire’s GEICO and Progressive Insurance. “We will see five years from now or 10 years from now which one of us passes State Farm first,” he said as recently as the 2019 annual meeting. (Related article, “‘I Worry Much More About Progressive’ Than Tesla, Buffett Says“)

This time around, however, when CNBC Journalist Becky Quick read a question from a shareholder who wanted to know why GEICO is lagging Progressive in terms of top-line growth and underwriting profitability, Buffett did not talk about ever moving ahead of State Farm. To his mind, the auto insurance industry and the success of State Farm should be studied in business schools.

“If you go to business school, they teach you that only because you have incentives and compensation, all kinds of things, can companies succeed. [But] nobody’s really gotten rich off State Farm. They’ve sat there, and they are the largest insurance company,” he asserted. “When Leo Goodwin started GEICO 80 some years ago, he probably wanted to get rich,” he said, referring to GEICO’s founder. “And probably at Progressive, I know people wanted to get rich. And at Travelers and Aetna. You can name them off, dozens and dozens of companies.” (See related article, “Scoop, There It Is: GEICO Drives Up Berkshire 2020 Underwriting Profit” for more about Goodwin.)

“And who wins? A mutual company,” Buffett concluded.

“In terms of presence, of size, they still are the largest company. If you leave out Berkshire, they have the largest net worth by far. They’ve got $140 billion or something like that in net worth,” Buffett said, speculating that Progressive’s net worth is roughly one-sixth of State Farm’s.

“We spend $2 billion a year telling people the same thing we’ve been telling them for 70 or 80 years.” But when all is said and done, “State Farm is still doing more business than anybody, and it shouldn’t exist under capitalism.”

“If you [had] a plan to start a State Farm today and had to compete with Progressive, who would put up the capital [for] a mutual company that you’re not going get the profits from? It doesn’t make any sense at all,” he said.

Progressive Still Crushing It

Ajit Jain, who chairs Berkshire’s insurance operations, spoke before Buffett to give a direct response to the original question of Progressive’s outperformance of GEICO, conceding as he did at last year’s meeting that GEICO needs to catch up to Progressive on telematics. (Related article: “Progressive ‘Crushing It’ on Profit: Berkshire’s Jain and Buffett,” May 6, 2021)

“There’s no question that personal automobile insurance business is very competitive business. Having said that, both GEICO and Progressive are two very successful competitors. Each one of them have their pluses and minuses,” Jain said.

“There’s no question that more recently, Progressive has done a much better job than GEICO…in terms of margin and in terms of growth rate. There are a number of causes for that, but I think the biggest culprit as far as GEICO is concerned…is telematics.

“Progressive has been on the telematics bandwagon for, I don’t know, more than 10 years, 20 years. GEICO until recently wasn’t involved in telematics. It’s been only the last two years that we made a very serious effort in terms of using telematics for segmentation and trying to match rate and risk.”

“It’s a long journey, but the journey has started, and the initial results are promising. It will take a while, but my hope and expectation is that hopefully in the next year or two, GEICO will be in a position to catch up with Progressive in terms of telematics, and hopefully that will then translate into both growth rate and margin,” Jain said, drawing applause from shareholders who attended the Omaha meeting in person.

A Blind Spot?

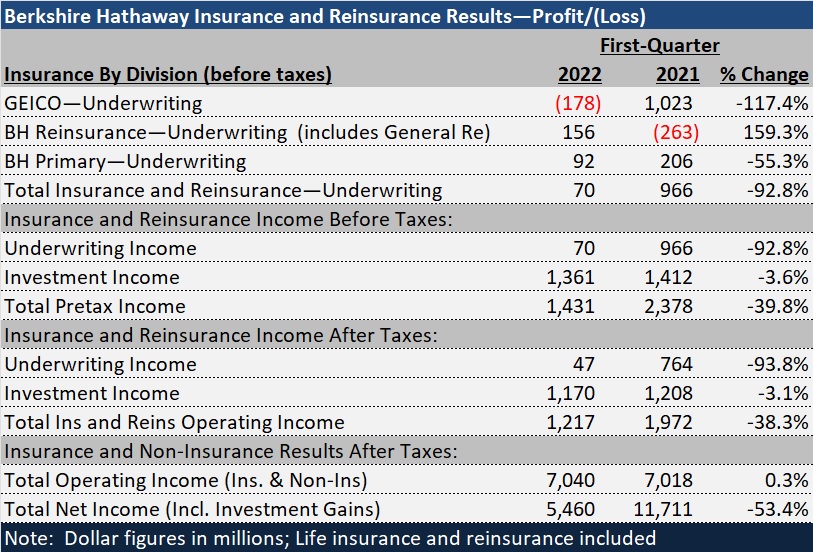

At an early point in the meeting, Buffett briefly reviewed first-quarter 2022 results for all of Berkshire’s operations, noting that $7.0 billion in operating income was essentially unchanged from first-quarter 2021. Net income, which includes the impact of unrealized losses on investment holdings and realized losses on sales of investments, fell to $5.5 billion compared to $11.7 billion for the comparable quarter in 2021.

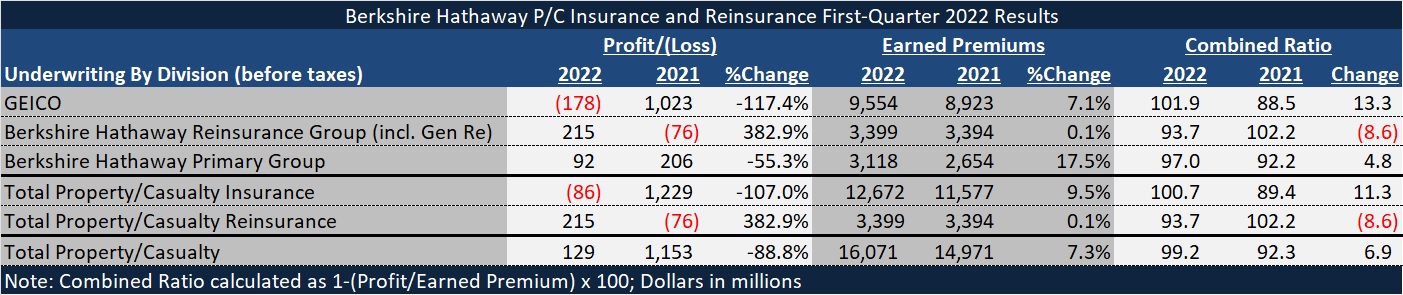

For just the insurance and reinsurance operations, after-tax operating income fell 38.3 percent to $1.2 billion. While investment income dropped less than 4 percent to $1.4 billion, Berkshire Hathaway’s primary insurance operations suffered on the underwriting side.

Underwriting profit fell 55 percent to $92 million for the commercial primary insurance operations. GEICO did worse, reporting $178 million in pretax underwriting losses, translating into a 101.9 combined ratio.

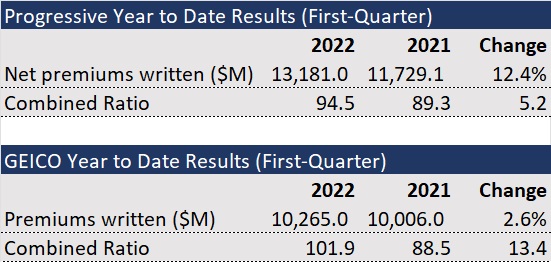

Progressive again outdistanced GEICO on growth and profitability measures in the first quarter. While Progressive reported a 12 percent jump in written premiums and a combined ratio of 94.5—up 5.2 points from first-quarter 2021—GEICO’s combined ratio deteriorated more than 13 points with premiums growing less than 3 percent.

“They are very, very, very disciplined in underwriting,” Buffett said of Progressive, following Jain’s assessment of the auto insurance competitor. “Of course, on the investment side, their net worth dropped in the first quarter because they own a lot of bonds,” he added, suggesting that Progressive and “probably everybody in the insurance business would say that well, we own bonds because that’s what people do.”

“There’s half of the business where you do what people do, and the other half of the business you spend all kinds of time trying to analyze in every county and every single way [how] you can segregate, properly rate business and all of that,” Buffett said.

Progressive, which reports earnings publicly each month, reported March and first-quarter 2022 results on April 14. The figures shown in that report include $388.6 million of losses on securities held and $54.5 million of realized losses on sales, which fueled a 79 percent drop in net income to $313.9 million compared to nearly $1.5 billion in first-quarter 2021.

The earnings statement did not provide any commentary on the drivers of income changes. An Investor Relations call is scheduled for Tuesday, May 3.

Said Buffett, “Ajit is responsible for adding more value to Berkshire than the total net worth of Progressive. That’s not to knock Progressive. I’m just saying, [it’s] one guy,” he said, drawing applause from the crowd in attendance.

At Progressive, shareholders equity stood at $17.1 billion at the end of the quarter, according to Progressive’s March 31, 2022 balance sheet, and $18.2 billion at year-end 2021.

Shareholders equity for the conglomerate of insurance and non-insurance businesses of Berkshire Hathaway exceeds $500 billion, according to the annual report.

Buffett spent a few minutes of his remarks recalling his first meeting 40 years ago with Peter Lewis, one of the legendary past CEOs of Progressive. “He was smart as hell, and you knew this guy was clearly going to be a major competitor of Berkshire’s. He knew insurance backwards and forwards—very bright and everything. But he just ignored the investment side and that was as important the underwriting side.”

Also praising subsequent leaders of Progressive for their underwriting skills, Buffett remarked, “It is interesting how organizations function and then have what I would say are to some extent blind spots. Charlie and I know we’ve got all kinds of blind spots ourselves,” he said, referring to Vice Chair Charlie Munger. “So, we have to be kind of careful criticizing other people for having them,” he said.

At a later point in the meeting, just before the lunch break, after Buffett offered some philosophical thoughts about “apperceptive masses” and life lessons about how the human brain can suddenly perceive something it’s been looking at for years in a different way (like an optical illusion), he mused with Munger about the pair’s own blind spots throughout the years.

“Part of the trick is to get so you correct your own mistakes, and we’ve done a lot of that—frequently way too late,” Munger said, without offering specific examples.

“Is it wise to criticize people at all?” Buffett asked.

“Probably not. But I can’t help it,” Munger said, having offered several biting comments during the meeting about bitcoin investors and the Robinhood trading platform.

While neither Elon Musk nor Tesla Insurance came up for criticism at this year’s meeting—in contrast to years past—Buffett did offer some general criticism of technology companies operating as insurance companies during his own discussion of bitcoin.

Right after he explained that U.S. dollars are the only real currency in the United States in his own discussion of the problems of cryptocurrency, Buffett observed that people attach “magic to lots of things” on Wall Street.

“We are not an insurance company. We’re a tech company,” he said, seemingly paraphrasing the remarks of an unnamed InsurTech executive. “Well, they’re an insurance company…A dozen people or so have raised a lot of money. They just don’t pay any attention to the fact that [they] sell insurance… In the end, they wrote insurance and overwhelmingly lost a lot of money since then,” he said.

More highlights captured by Carrier Management from the Berkshire annual meeting, including details for Berkshire’s $11.6B deal for Alleghany, Buffett and Jain’s thoughts on nuclear war risk and Buffett’s comments on tribalism, will be included in the related article, “Dealmaking 101: When Opportunity Comes, You Move, Buffett Says,” publishing tomorrow.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec