When it comes to personal auto insurance, Progressive has been outpacing GEICO and State Farm in terms of growth and posting better loss ratios for years. But customer satisfaction scores are another matter.

The J.D. Power 2025 U.S. Auto Insurance Study, published last month, summarized satisfaction scores calculated from insights J.D. Power gathered from over 48,000 auto insurance customers surveyed across 11 geographic regions. Consistent with prior rankings, smaller insurers (writing across less than half the states, and some in just one state) tend to dominate the top spots in the 2025 listings.

Related article: Auto Insurance Satisfaction Rankings: High LTV Customers Most at Risk

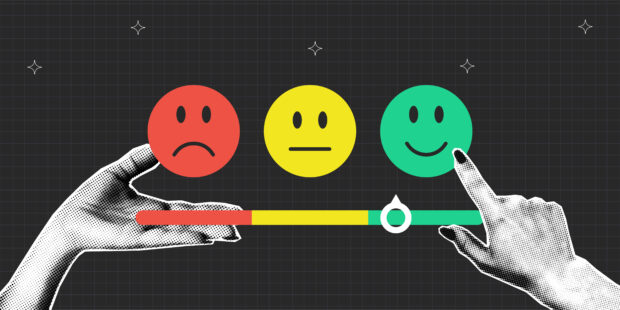

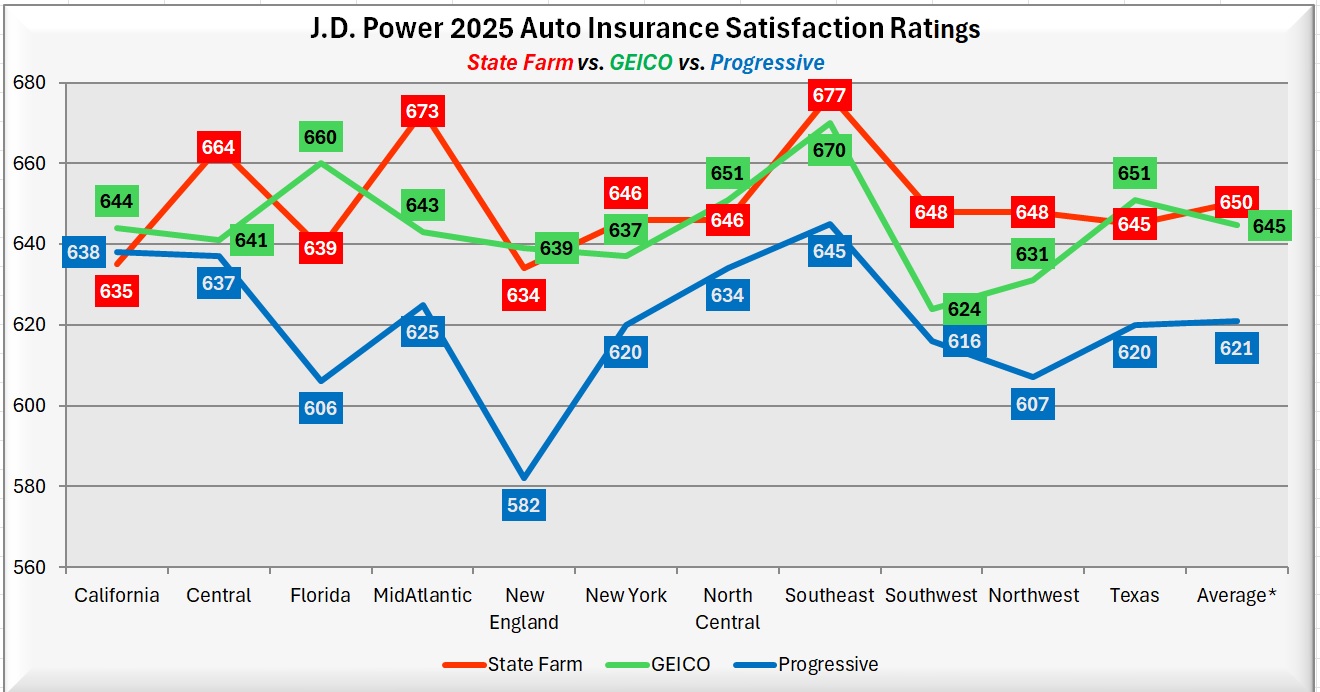

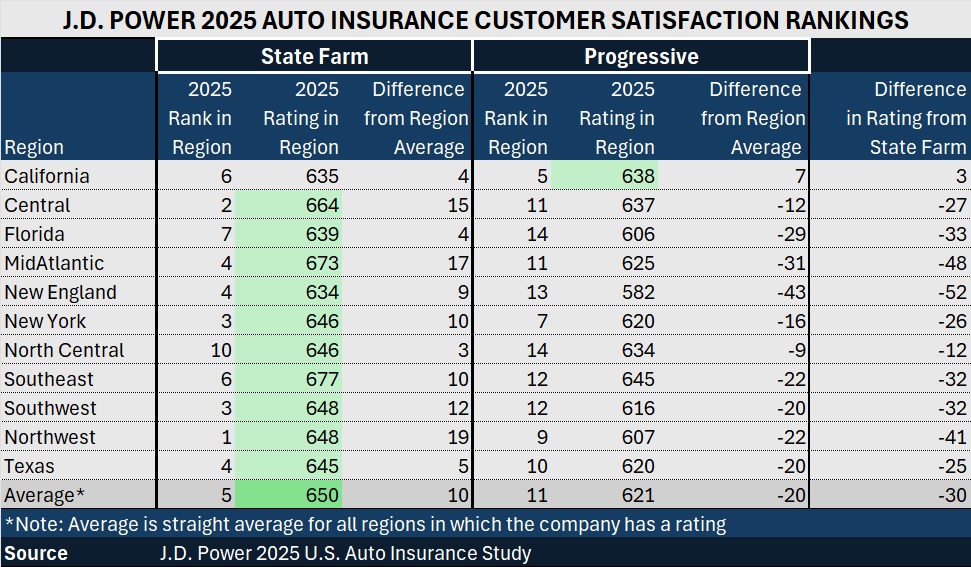

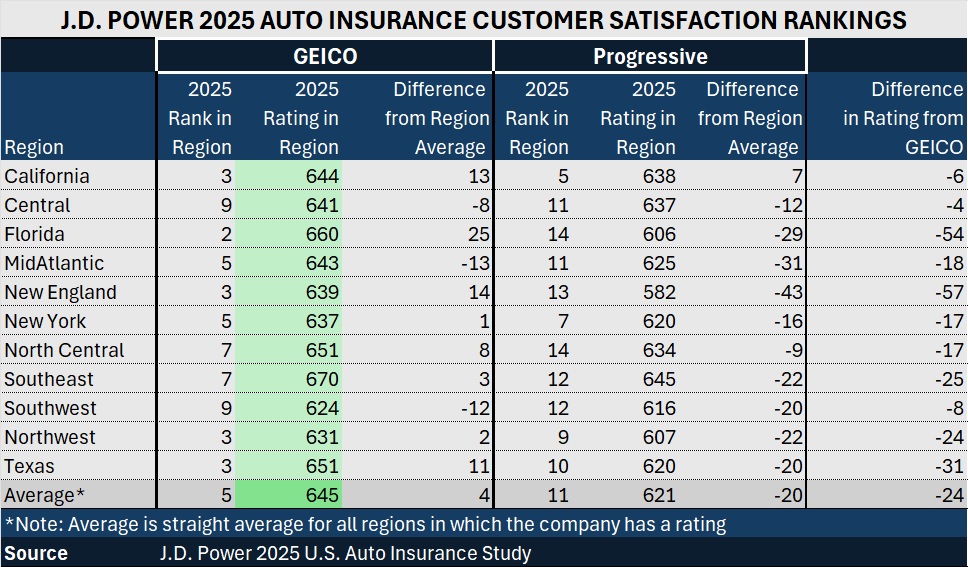

Turning to the largest national writers for which the J.D. Power report reveals satisfaction scores in all 11 regions, Progressive consistently ranks below State Farm, GEICO and Allstate in all regions. Progressive also ranks below the last insurer with 11 regional scores—Farmers—in eight of the 11 regions. (Farmers’ 2025 scores were worse than Progressive in California, New York and the North Central region.)

A comparison of 2024 scores reveals a similar picture, with Progressive’s scores falling below State Farm, GEICO and Allstate in almost all regions. The scores for Farmers were below Progressive’s in seven of the 11 regions in 2024, but Farmers scores improved by double digits in five regions in 2025. Progressive’s scores improved by double digits in only one region (Florida) in 2025, while dropping by double digits in two others.

Averaging all the region scores together, the (straight) average of Progressive’s regional scores is 621 (on a 1,000-point scale) for 2025—more than 20 points lower than either State Farm (650) or GEICO (645), 14 points below Allstate (635), and one point below Farmers (622). It’s also more than 20 points below the average for all companies (644).

Why is this the case?

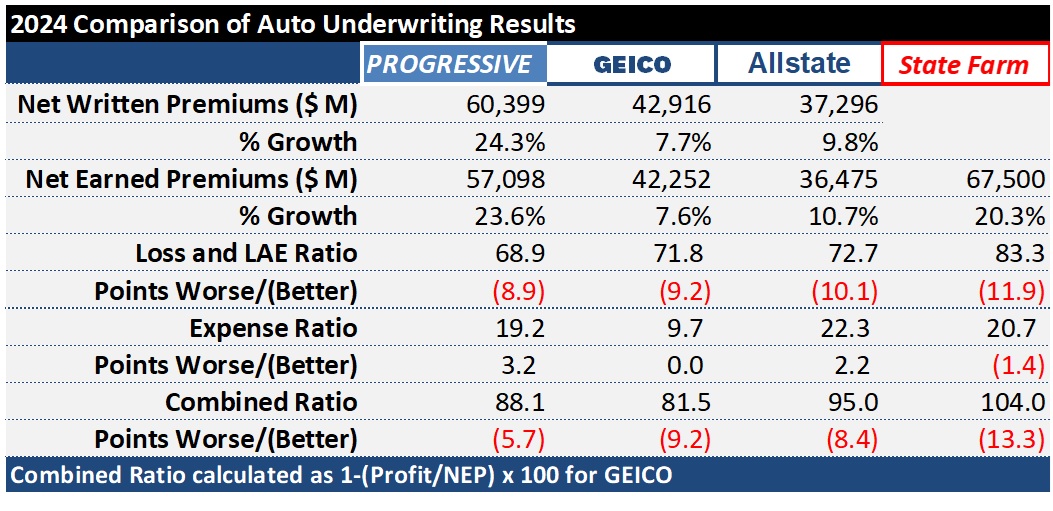

On financial metrics, Progressive continues to perform. According to a report on June results released just last week, Progressive grew personal auto policies in force by more than 19 percent in the last year, and the insurer recorded a loss ratio of 66.6 and a combined ratio of 85.9 for the first six months of 2025.

While first-half 2025 results aren’t in for competitors, Progressive excelled on most underwriting measures for full-year 2024. Progressive’s 68.9 loss ratio, for example, bested GEICO by nearly 3 points, Allstate by almost 4 points and State Farm by more than 14 points, while growing premiums more than 24 percent.

Drilling down to understand how business moves between carriers when customers decide to switch providers, a separate J.D. Power report, the quarterly loyalty indicator and shopping trends (LIST) report for fourth-quarter 2024, found that when any of these six top-10 carriers lost business—Allstate, American Family Insurance, Farmers Insurance, GEICO, Liberty Mutual Insurance or State Farm—they were most likely to lose their auto insurance customers to Progressive.

Investors and other financial stakeholders are surely satisfied with the results. But why is Progressive falling behind these peers on J.D. Power’s customer satisfaction metric? Is it because Progressive aggressively raised prices in recent years to achieve the superior underwriting results?

Stephen Crewdson, managing director of insurance business intelligence at J.D. Power, doesn’t think so. When Carrier Management posed the question via email, he noted that almost all auto insurers increased prices in recent years. “This is not unique to Progressive and doesn’t explain the gaps in scores.”

The U.S. Auto Insurance Study, now in its 26th year, measures customer satisfaction with auto insurers based on performance in seven core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance):

- Level of trust

- Price for coverage

- People

- Ease of doing business

- Product/coverage offerings

- Problem resolution

- Digital channels

According to Crewdson, Progressive falls farthest below the other carriers on the trust, problem resolution and people dimensions. “GEICO stands out from Progressive in trust and problem resolution, whereas State Farm stands out from Progressive in trust and people.”

Related article: Read more about how the scores are calculated in the 2024 article: Why J.D. Power Auto Insurance Satisfaction Scores Are Lower in 2024

A Matter of Trust or Price? A Look Back at 2024

Last year, J.D. Power changed its scoring model for auto insurance customer satisfaction rankings, ditching a five-factor model based on five transactional factors—claims interaction, price, policy offerings, billing process and policy information, and claims—to a model based on seven factors listed in the accompanying article.

Explaining the relative scores of Progressive, State Farm and GEICO this year, a J.D. Power representative said price was an issue for all carriers, but State Farm and GEICO had better trust scores than Progressive.

But it may be that trust and price aren’t mutually exclusive contributors to the scores.

During a webinar last year about the scoring model change, a J.D. Power representative described how attributes of the prior model influenced dimensions in the new model. She observed that price was “unsurprisingly” impactful on the new “trust” dimension.

Also impacting trust are things like courtesy extended to customers when they are assisted online or by agents, and insurance agents’ knowledge, she said. Not speaking about any carrier in particular, she also gave examples of low trust scores being given when an insurer’s customer service rep doesn’t have the customer’s information ready, or when they are left in the dark about why prices of their policies increased, what the policies cover, or time frames for claim resolution.

For the 2024 survey, customers who expected and understood why they were getting rate hikes scored their levels of trust on par with customers who saw their premiums actually decline.

(Source: CM’s June 25, 2024 article, “Why J.D. Power Auto Insurance Satisfaction Scores Are Lower in 2024)

GEICO Scores Improve; State Farm Worsens.

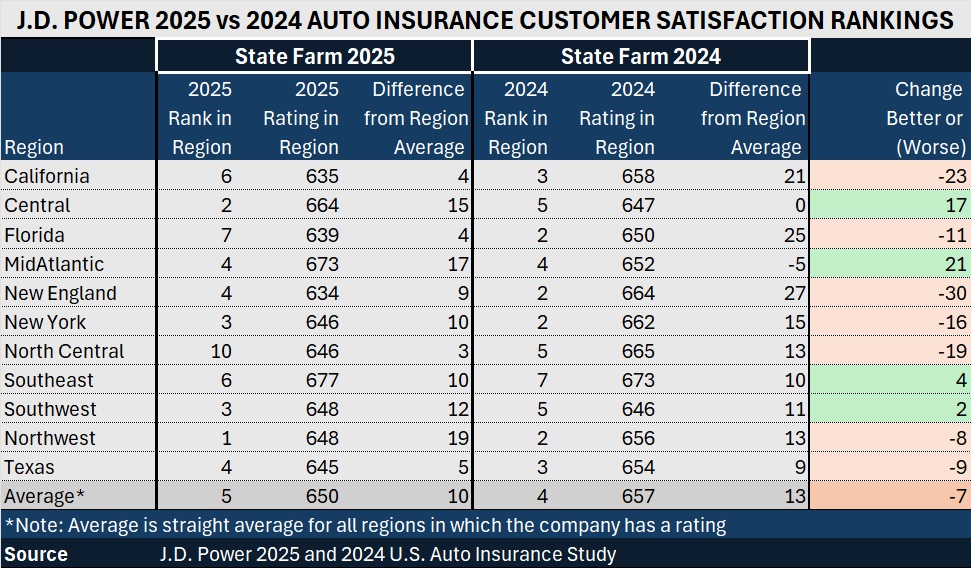

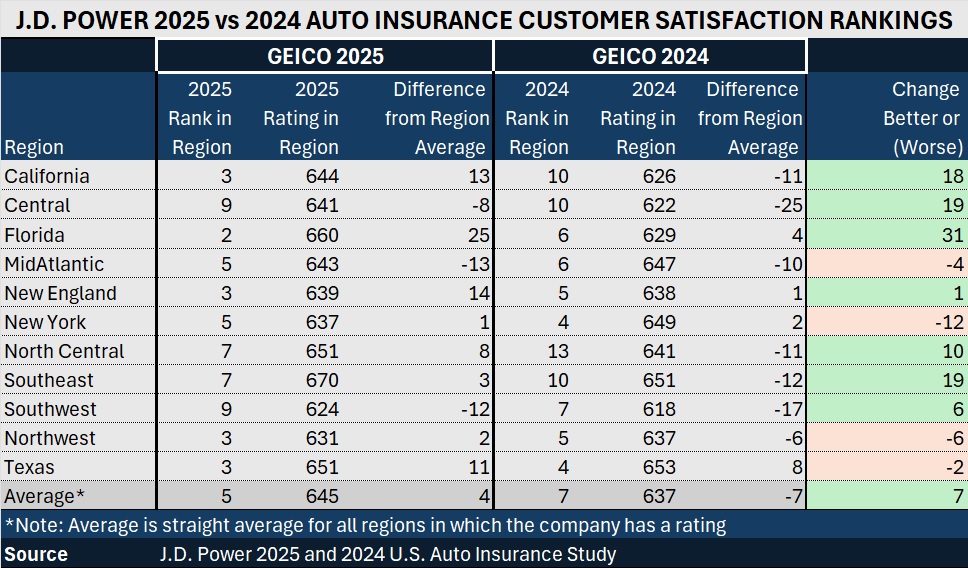

While the (straight) average of Progressive’s 11 regional scores didn’t change much in 2025 vs. 2024 (621 vs. 622), GEICO’s average score improved more than seven points (to nearly 645 from 637), while State Farm’s average score moved in the opposite direction (falling to 650 from 657 in 2024).

The charts below, compiled by Carrier Management, show the moves by region.

State Farm’s scores deteriorated in seven of the 11 regions, including California and New England. Seven was a luckier number for GEICO. GEICO’s scores improved in seven regions, including a more than 30-point jump in Florida.

Still, State Farm’s rankings remain generally higher than GEICO’s. With a first-place ranking in the Northwest, and taking second place in the Central region, State Farm’s median ranking was fourth in 2025 across the 11 regions, down from third in 2024. GEICO’s median ranking rose to fifth in 2025 from sixth in 2024.

Explaining GEICO’s improvements with reference to scoring dimensions, Crewdson told CM via email that GEICO’s largest increases, year-over-year, came in the price for coverage and people categories.

State Farm’s largest year-over-year decreases were in price for coverage and trust, he said.

Region by Region

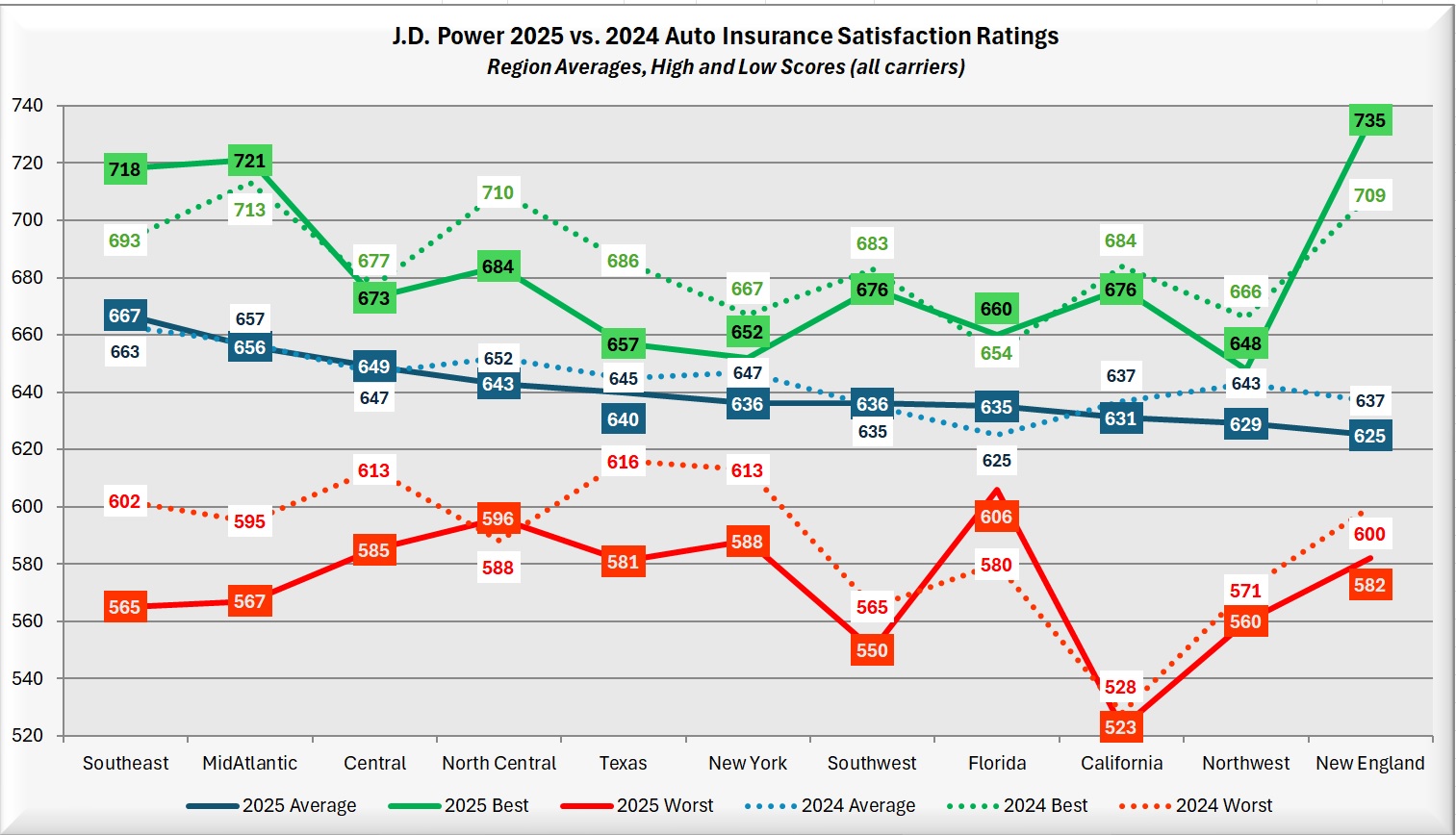

State Farm’s customer satisfaction score dropped more in New England than in any other region—and based on average region rankings across carriers, New England’s customers were generally the toughest to please in 2025.

The average customer score (for all carriers) calculated by J.D. Power in the New England region was 625, the lowest average among the 11 regions included in the J.D. Power report for 2025.

A year ago, in 2024, Florida had the worst average score—also 625. But the average score from Florida customers was 10 points higher—635—in the 2025 analysis.

In general, across regions, the lowest scores got lower in 2025 compared to 2024. Florida was the most notable exception.

In both years, the range of scores from best to worst was tightest in three individual states included in the studies—Florida, New York and Texas. In the other single-state region included in the J.D. Power study—California—the range remained above 150 points and scores were generally worse than last year across the board.

Kemper recorded the lowest score in both study years, 523 in 2025 and 528 in 2024—both coming in the state of California.

Who were the highest scoring insurers in each region? See CM’s earlier article about J.D. Power’s 2025 Auto Insurance Satisfaction Study for the list: “Auto Insurance Satisfaction Rankings: High LTV Customers Most at Risk“

The list includes several insurers with scores above 700, which were included in J.D. Power’s regional rankings.

Note: One insurer, USAA, is not included in the regional rankings but scores are provided in the study. USAA’s regional scores are consistently above 700, and roughly 90 points above the carriers ranked, on average. USAA does not meet the study award criteria because of the closed nature of the carrier’s membership, according to J.D. Power.

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits