Even though Berkshire Hathaway’s GEICO achieved a 93 first-quarter combined ratio, an enviable result measured against industry peers, the leader of Berkshire’s insurance operations said the figure is not a true indication of where the business is today.

Answering a question posed by a shareholder for the second year in a row at Saturday’s annual meeting about GEICO’s ability to catch up with competitors who had leapt out ahead of the personal auto insurer in leveraging telematics for pricing and risk selection, Ajit Jain, chair of Berkshire’s insurance operations, initially gave a positive assessment for GEICO on that score.

In fact, GEICO “has certainly taken the bull by the horns and has made rapid strides in terms of trying to bridge the gap” that existed previously, he said, noting that close to 90 percent of new business “has a telematics input” into the pricing decision.

“Unfortunately, less than half of that is being taken up by the policyholders,” he added.

He went on to say that even though GEICO is moving ahead on telematics, “we still haven’t started to realize the true benefit—and the real culprit, or the bottleneck, is technology. GEICO’s technology needs a lot more work than I thought it did,” Jain said, noting that the company has “more than 600 legacy systems that don’t really talk to each other.”

He continued: “We’re trying to compress them to no more than 15, 16 systems that all talk to each other. That’s a monumental challenge, and because of that, even though we have made improvements in telematics, we still have a long way to go because of technology.”

“Because of that, and because of the whole issue more broadly in terms of matching rate to risk, GEICO is still a work in progress,” he said, turning his attention to an explanation of the first-quarter combined ratio.

“GEICO is still a work in progress,” Ajit Jain said.

“Even though that’s very good, it’s not something we can take to the bank,” he said, highlighting two unusual items that contributed to the improved first-quarter combined ratio: prior-year reserve releases and the fact that “the first quarter tends to be a seasonally good quarter for auto insurance.”

“My guess is at the end of the year, GEICO will end up with a combined ratio just south of 100 as opposed to the target they’re shooting for—96.”

“I hope they reach the target of 96 by the end of next year. But instead of getting too excited about it, I think it’s important to realize that even if we reached 96, it will come at the expense of having lost policyholders. There is a trade-off between profitability and growth. And clearly we’re going to emphasize profitability and not growth…”

“So, it will not be until two years from now that we’ll be back on track fighting the battles on both the profitability and the growth front,” he said.

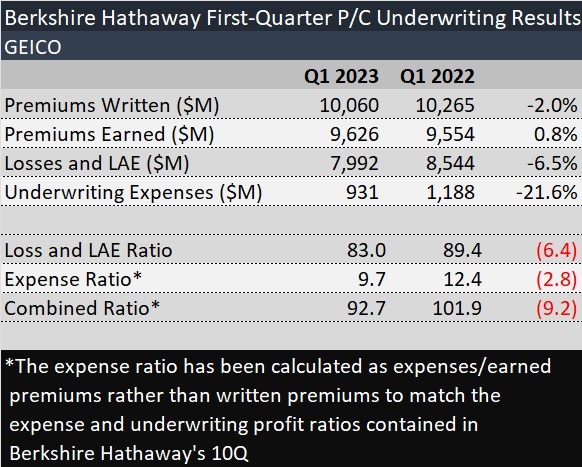

The text of the 10Q published over the weekend disclosed the actual amount of the prior-year reserve release—$338 million—which shaved 3.5 points off of GEICO’s first-quarter loss ratio. The report narrative also references the impact of higher average premiums charged per policy, a reduction in policies-in-force and lower claims frequencies as other factors behind an overall loss ratio decline of 6.5 points compared to first-quarter 2022.

GEICO’s combined ratio improved more than 9 points to 92.7 compared to 101.9 in first-quarter 2022. Beyond the loss ratio improvement, the nearly 3 points of combined ratio improvement came from a 21.6 percent drop in underwriting expenses. The decreases were driven by a reduction in advertising expenses, the report said.

In spite of advertising expense cuts, a huge gecko was visible in scenes from the annual meeting shopping area broadcast on CNBC, along with Squishmallow likenesses of Berkshire’s chair and vice chair, Warren Buffett and Charlie Munger. CNBC hosts explained that the Squishmallows are products of Jazwares, a U.S. toymaker that is one of the non-financial businesses owned by Alleghany Corp., better known to Carrier Management’s audience for its TransRe, RSUI and CapSpecialty operations.

While Jain commented on GEICO’s need for a tech overhaul, Buffett, in human form, took the opportunity to pick up on Jain’s remarks by taking a swipe at InsurTech startups. He compared their lack of success to the “overwhelming success” of Berkshire’s now 10-year-old startup, Berkshire Hathaway Specialty Insurance.

“There have been a lot of public companies created in the last decade, or thereabouts, in insurance, and there’s none of them that we would like to own,” Buffett said. “They always started out in their prospectus saying, ‘This is a tech company, not an insurance company.'”

“Of course they’re a tech company,” Buffett continued. Every type of company, insurance or non-insurance, uses technology. “But you still have to properly match rate to risk. And they invariably have reported the huge losses. They’ve eaten up capital,” he said, contrasting BHSI as the only insurance company that he knows of that has started in the last years that has been successful.

Now with $12 billion of float, the specialty insurance company that Jain and four other people set out to develop a decade ago has roughly 1,500 people around the world. “We took on the whole industry, and we brought some unique talent, [and] we brought capital, and we brought capabilities that really only Berkshire could supply.”

“It was the combination of brains and talent and energy and money,” he declared recalling that when Chief Executive Officer Peter Eastwood, a former AIG executive, started to build the company, there were “many people in this space who didn’t like us coming” into the specialty insurance space. “We did it without it costing us a dime of entry,” he said, referring to lack of underwriting losses. “And it’s been unmatched by any of the companies that went public,” Buffett said.

In addition to singling out Eastwood, Buffett offered praise for Todd Combs, an investment manager who Buffett and Jain chose to lead GEICO a few months before a global pandemic changed the auto insurance landscape. “He’s not all the way home” in terms of shoring up GEICO, he said, agreeing with Jain, but added that Combs has changed GEICO in multiple ways—”a remarkable accomplishment under difficult circumstances.”

(See related article, “Jain Talks Reinsurance; Berkshire Could Lose $15B in Florida,” for a discussion of Berkshire’s reinsurance operations and how insurance and reinsurance contribute to overall operating earnings for the conglomerate)

EV Makers ‘Hot to Trot’

Auto insurance came up once again when an investor wanted to know what GEICO was going to do to compete against electric vehicles makers getting into insurance, specifically referring to insurance of EVs available from Tesla and GM.

Jain disclosed that GEICO is talking to a number of original equipment manufacturers to see if the auto insurer can work with auto makers to offer coverage at the point of sale, too. “We are hopeful, too, that we will strike a deal with some of them before not too long,” he said.

“There haven’t been very many success stories as yet. So, we’ll wait and see,” he said, referring to the competition that’s already out there. Although this is “a very convenient way to sell auto insurance,” he noted that “there’s a fair amount of data that needs to be collected on the driver, not just the car. And that makes it a little more complicated.”

Referring to the fact that Tesla and GM have talked a lot about this in the press, and specifically referring to a projection of $3 billion of premium he heard from GM, Jain said, “It’s hard to imagine where it will come from. But they’re all hot to trot. I think somebody will find the secret sauce before not too long, and we ourselves are in that race.”

Buffett went on to note, as he has done at past meetings, that selling insurance with cars is not a new idea. “General Motors had Motors Insurance for decades,” he said. Buffett went on to reference losses on a book of business that Uber laid off on James River Insurance some years back.

“It’s not a new idea. It’s not magic in the least…It is hard to come up with something that is better than matching risk to price than a bunch of very smart people that are doing it at Progressive, and a bunch of very smart people who are doing it to a greater extent at GEICO,” he said.

Buffett’s reference to GEICO’s smarter group this year was a subtle departure from commentary at past events during which Jain and Buffett put Progressive ahead of GEICO in the skill of matching rate to risk.

Jain concluded the discussion this year noting that the margins on writing auto insurance, at 4 percent, are very small. “Once there are more people that are trying to take a bite of the apple, it just becomes very, very difficult to keep all the mouths fed in a profitable manner,” he said.

The subject of Tesla—or more precisely, Tesla’s leader Elon Musk, came up later in the meeting when an investor asked Munger about a past remark he made about Musk overestimating himself. Still true?

“Yes, I think he overestimates himself, but he is very talented. So, he’s overestimating somebody who doesn’t need to overestimate to be very talented,” he said initially. Buffett and Munger then went on to highlight Musk’s ability to take on big risks.

“He dreams about things, and his dreams have got a foundation,” Buffett said.

“He would not have achieved what he has in life if he hadn’t tried for unreasonably extreme objectives. He likes taking on the impossible job and doing it. We’re different. Warren and I are looking for the easy job that we can identify,” Munger said.

“We don’t want to compete with Elon in a lot of things,” Buffett said.

“We don’t want that much failure,” Munger continued.

“It takes over your life in a way that just doesn’t fit us…They are going to be, well, there have been important things done by Elon already, and it requires—fanaticism isn’t the word…”

“Yeah, it is the word,” said Munger.

“Well, it isn’t quite the word, but it’s a dedication to solving the impossible. And every now and then he’ll do it,” countered Buffett. “It would be torturous to me and Charlie,” he said, concluded that neither he or Musk would enjoy being in the other’s shoes.

‘Old-Fashioned Intelligence’ and Atom Bombs

In addition to insurance, reinsurance, and Musk’s different approach to life, Berkshire executives addressed other hot topics, including one of Musk’s other interests—artificial intelligence. Specifically, one questioner asked whether Buffett and Munger believed that AI and robotics would have a positive and the negative impact on society. (Read about Berkshire’s reinsurance operations in the related article, “.Jain Talks Reinsurance; Berkshire Could Lose $15B in Florida“)

“If you went into BYD’s factories in China, you would see robotics going at an unbelievable rate,” said Munger, referring to a Chinese EV maker and Tesla rival in which Berkshire has invested. “We’re going to see a lot more robotics in the world.”

“I am personally skeptical of some of the hype that has gone into artificial intelligence,” Munger continued. “I think old-fashioned intelligence works pretty well.”

“There won’t be anything in AI that replaces Ajit,” Buffett said.

“It can do amazing things, [but] it can’t tell jokes,” he added, noting that Bill Gates had introduced him to a recent version of AI. (Editor’s Note: This was possibly OpenAI’s GPT, which Gates has recently written about in an item on his Gates Notes blog titled “The Age of AI had begun.”)

Still, Buffett referred to remarkable tasks the AI could take on, such as “checking all the legal opinions since the beginning of time…”

“It can do all kinds of things. But when something can do all kinds of things, I get a little bit worried…because I know we won’t be able to uninvent it. And you know, we did invent—for very, very good reasons—the atom bomb in World War II. It was enormously important that we did so. But is it good for the next 200 years of the world that the ability to do so has been unleashed?” he asked.

Paraphrasing an insight from Albert Einstein, Buffett said that both the atom bomb and AI could “change everything in the world except how men think.”

Top photo: Ajit Jain, Vice Chairman of Insurance Operations for Berkshire Hathaway, Sunday, May 6, 2018. . (AP Photo/Nati Harnik)

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation