While the leader of Berkshire Hathaway’s insurance operations described Jan. 1 property-catastrophe reinsurance pricing as disappointing, the “day in the sun” came at April 1, allowing Berkshire to write almost as much as it can.

Ajit Jain also said the potential downside of deploying all that capacity is a potential $15 billion loss if a hurricane hits Florida this year.

Speaking during the annual meeting on Saturday, Jain addressed the question of why Berkshire has been sitting on the sidelines of the property-cat reinsurance market, and described the market conditions he witnessed at year-end 2022.

“The last 15 years has been a difficult time. Prices have not been attractive and even though we have had some presence in the property-cat business in the last 15 years, it really has been minimal,” he affirmed.

“This December 31st, which is a big renewal date for cat reinsurance, we were hoping that we would get a few days in the sun, and [that] we’d be able to deploy our capital and be able to write some fairly attractive business.” Jain said he had designs on putting “several billion dollars on the books,” until the market got crowded.

“In the last 10 days of December, unfortunately, a lot of capacity came out of the woodwork. Pricing that we were expecting to realize didn’t come [up to] meet our pricing requirements.”

As a result, “January 1 was a big disappointment,” but that meant that Berkshire’s reinsurance operations had “a lot of powder dry” for the next big renewal date—April 1. “And we were lucky that we kept the powder dry because at April 1 suddenly prices zoomed up” over Jan. 1 prices to much more attractive levels. “So, now we have a portfolio that is very heavily exposed to property-catastrophe. To put that in perspective, our exposure today is almost 50 percent more than what it was five or six months ago,” he reported.

“I think we have written as much as our capacity will allow us to write. We are very happy with what we’ve written. The margins have been healthy,” he said, adding, however, that Berkshire also has “a very unbalanced portfolio.”

“What that means is if there’s a big hurricane in Florida, we will have a very substantial loss….If we have a very big loss anywhere other than Florida relative to our competition, we will have a much smaller loss.”

Concluded Jain: “Net net, I’m very happy with the portfolio. It is a lot better than what it’s been in the past. I don’t know how long it will last. And if a hurricane happens in Florida, we could lose across all the units, we could lose as much as $15 billion. If there isn’t a loss, we’ll make several billion dollars as profit.”

Exposing 5 percent of Berkshire’s $300 billion of capital involved Jain making a phone call to Berkshire Chair Warren Buffett. “It was less than a 30 second phone call. Warren said yes without even listening to what the numbers were,” he reported.

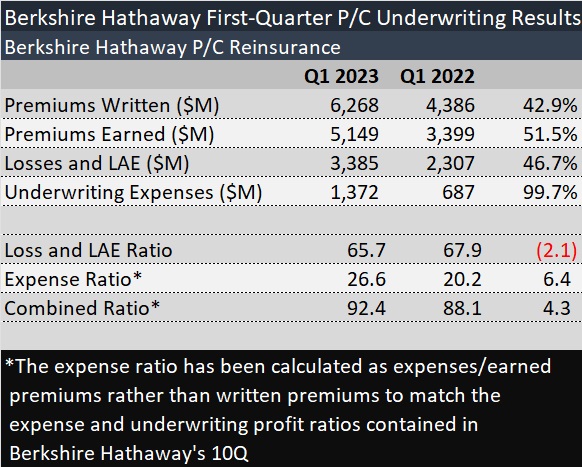

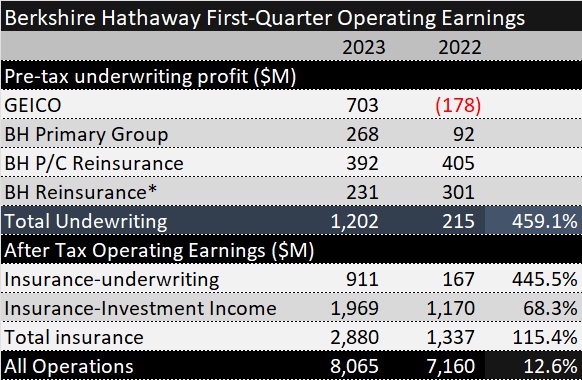

Buffett led off the annual meeting with a review of overall operating earnings for Berkshire Hathaway, which came in $8.1 billion for the first-quarter, with insurance and reinsurance operations contributing $2.9 billion after taxes. While Buffett advised that declines in U.S. business activity would mean earnings for non-insurance operations will likely be lower for full-year 2023 than 2022, he predicted that insurance operations and investment income would lift overall operating earnings higher. “Insurance underwriting does not correlate with business activity. It depends on things like hurricanes and earthquakes and other events. So on a prospective basis, on a probability basis, we’re likely to have a better year this year in insurance underwriting than we had last year.”

“It just isn’t affected by what you might call ‘the business cycle'” that applies in industries like retail.

“One massive earthquake or one hurricane that came in at just the wrong place can affect that prediction, but on a probabilistic basis, our insurance looks better this year,” he said, following a detailed discussion of the drivers of investment income across all operations—some $125 billion in short-term investments now earning higher yields. In dollars, Buffett said the $125 billion, which produced investment income of $50 million annually in recent years, would now yield roughly $5 billion a year.

Insurance and investment income are the two “main elements of earnings that look like they will swing in our direction. I would expect, but I can’t promise, that our operating earnings will be greater than last year,” he said.

For the first quarter, insurance operating income, after taxes, came in at more than twice the level of first-quarter 2022, with a boost an underwriting profit at GEICO fueling a five-fold increase in overall underwriting profit and a 68 percent jump in insurance investment income pushing insurance operating income up higher.

At another point in the meeting, Jain predicted that full-year results for Berkshire’s personal auto insurer, GEICO, will produce a combined ratio just below breakeven—an improvement from last year’s full-year result of nearly 105 but below a target of 96, adding that it would take two years to shore up the auto insurer. Related article: “Berkshire’s Jain on GEICO Profit: ‘Don’t Take It to the Bank’; Tech Needs Rebuild“)

During Buffett’s opening remarks, he also highlighted another benefit of Berkshire’s insurance and reinsurance operations—the accumulation of float. Referring to float as “a very valuable asset that shows up as a liability,” Buffett said, “Ajit is responsible for building up this treasure,” which currently totals $165 billion.

Float “is money that represents unpaid losses….You get paid in advance in insurance. So what shows up is a net liability on our balance sheet gives us funds to exercise with an amount of discretion that no other insurance company that I know of in the world enjoys just because we have so much net worth,” he said, extolling the benefits as he has at past meetings with a slightly different explanation that compared insurance float to bank deposits.

“Float is money is left in our hands somewhat akin, but very importantly different, from a bank deposit. You have to pay interest to get a bank deposit. And you have to pay more interest these days….”

Having float is “like having a bank with no employees, no interest and no ability to withdraw the money in a hurry that we have working for us,” Buffett said.

On the subject of bank deposits, Buffett discussed recent bank failures during the afternoon session of the annual meeting. Related article, “Berkshire’s Buffett Blames Politicians, Regulators, Press for Bank Failures.”

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report