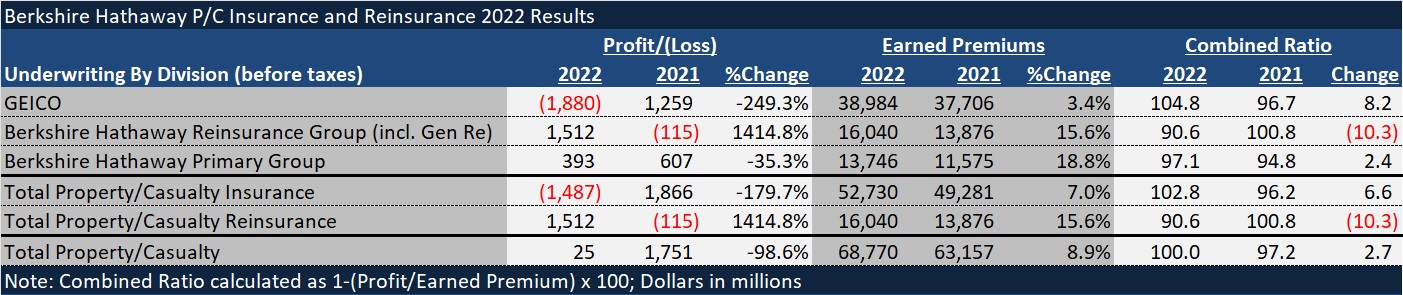

Berkshire Hathaway recorded its first full-year underwriting loss since 2017—but a small one—as strong profits from reinsurance operations were almost enough to counterbalance the deteriorating results from the conglomerate’s personal lines insurer GEICO.

In fact, while GEICO’s pretax underwriting loss was more than $1.9 billion, the biggest loss that the auto giant has booked in the decade for which Carrier Management has tracked its earnings, Berkshire’s property/casualty insurance and reinsurance operations together just broke even with a 100.0 combined ratio for 2022.

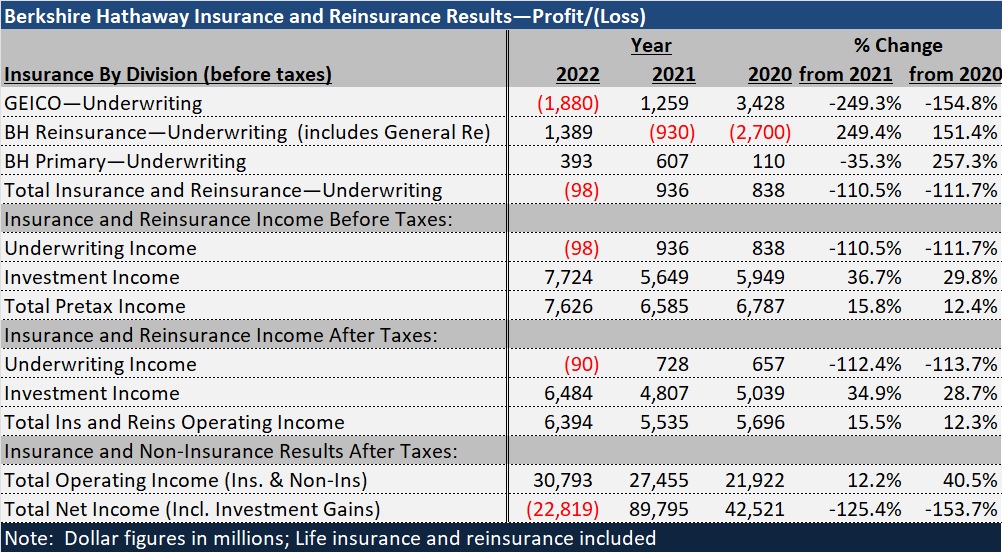

After taxes, and including results of life reinsurance operations as well, the insurance and reinsurance operations together wound up with a $90 million loss overall. With investment income from the insurance and reinsurance operations adding $6.5 billion to figures on the income statement, operating income for the insurance and reinsurance operations grew 15.5 percent after taxes.

Still, GEICO’s red negative number stands out on any presentation of results for insurance operations in recent years. A one-page appendix near the back of Berkshire’s 140-plus page annual report reveals that the property/casualty companies have operated at an underwriting profit in 18 of the last 20 years—with two decades of mostly gains totaling $29.2 billion.

GEICO’s 2022 combined ratio, landing at almost 105—more than 8 points higher than 2021—was also higher than its 2017 combined ratio of 101.1. Five years ago, however, a 116 combined ratio for the reinsurance operations, largely related to an adverse development cover placed by Berkshire’s National Indemnity for American International Group and to catastrophe losses from hurricanes Harvey, Irma and Maria, an earthquake in Mexico, a cyclone in Australia and wildfires in California—was the driving force of the negative result.

For 2022, GEICO’s catastrophes from Hurricane Ian, at roughly $400 million, were almost equal to GEICO’s Hurricane Ida losses ($375 million) in 2021. Still, GEICO’s losses and loss adjustment expense ratio rose 10.9 points to 93.1 in 2022, as higher claims frequencies and severities kicked in.

GEICO’s expense ratio, on the other hand, declined 2.8 points to 11.7, with the declined attributable to both the decrease in expenses as well as the increase in earned premiums.

According to the annual report, “GEICO has successfully obtained premium rate increase approvals from certain states in response to the significant claims costs increases it has experienced in recent years. As a result, we currently expect GEICO to generate an underwriting profit in 2023.”

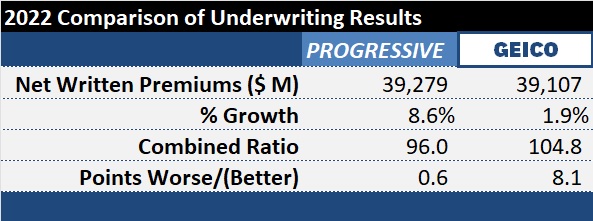

Premium growth, however, came in lower than competitors Progressive and Allstate, with GEICO’s net written premiums rising just 1.9 percent and net earned premiums, 3.4 percent. The Berkshire annual report said that while rate hikes translated into jumps in average premiums per auto policy, those were substantially offset by a decrease in policies-in-force. In particular, while average premiums per voluntary auto policy rose 11.3 percent, voluntary auto policies in-force declined 8.9 percent in 2022.

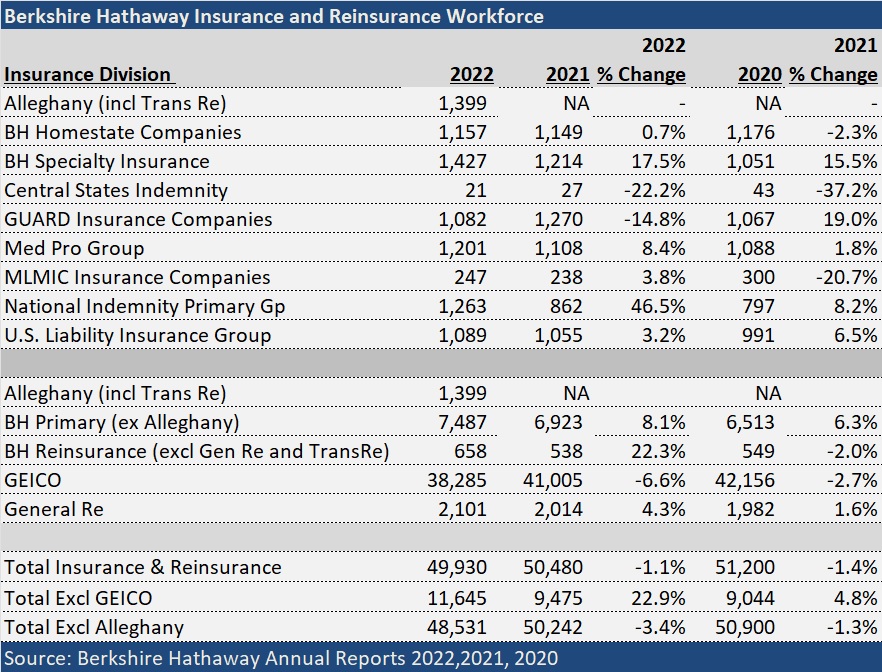

For the second straight year, GEICO also had a drop in staffing, with the number of employees dropping 6.6 percent to a level lower than Berkshire reported in 2017.

On the other hand, the reinsurance companies, which lifted Berkshire’s P/C operations to a profit overall, also saw employee counts rise in 2022, even without considering the addition of Transatlantic Re—a part of Alleghany Corporation, which Berkshire acquired early last year.

In terms of underwriting results, even though Hurricane Ian added $1.6 billion to P/C reinsurance losses, total catastrophe reinsurance losses of $2.0 billion were similar to the 2021’s total of $2.1 billion.

With higher rates, new property business and $986 million of TransRe Group premiums boosting total P/C reinsurance written premiums (other than retroactive reinsurance premiums) by 19.9 percent to $2.8 billion in 2022, the P/C reinsurance combined ratio landed at 86.4—nearly 10 points lower than 2021 (95.1).

Buffett and Munger

The always much-anticipated Chairman’s letter from Warren Buffett did not have too many specific references to insurance or reinsurance other than to flag the purchase of Alleghany Corporation as the second positive development for the year.

“Alleghany delivers special value to us because Berkshire’s unmatched financial strength allows its insurance subsidiaries to follow valuable and enduring investment strategies unavailable to virtually all competitors. Aided by Alleghany, our insurance float increased during 2022 from $147 billion to $164 billion,” Buffett wrote.

As is the case in prior annual reports, this year’s report included a running total of float over the decades, and Buffett noted that since 1967, which Berkshire first entered the insurance business, Berkshire’s float has increased 8,000-fold through acquisitions, operations and innovations. Though not recognized in our financial statements, this float has been an extraordinary asset for Berkshire.

Other highlights of Berkshire’s letter included a defense of share repurchases, several references to the “American tailwind” that propels Berkshire forward, a reference to the fact that Berkshire “will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses,” and section titled, “Some Surprising Facts About Federal Taxes,” and a page devoted to the wit and wisdom of Vice Chair Charlie Munger.

Referring the cash holdings, Buffett wrote, “We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses. Our CEO will always be the Chief Risk Officer—a task it is irresponsible to delegate.

Giving some incredible visualizations of Berkshire’s $32 billion contribution via the corporate income tax to the $32 trillion revenue collected by the U.S. Treasury over the past decade, Buffett said that the pile of $100 bills that would total Berkshire’s decade of tax payments would stack up 21 miles high, “about three times the level at which commercial airplanes usually cruise.”

On the American Tailwind, he wrote, “America’s dynamism has made a huge contribution to whatever success Berkshire has achieved….We count on the American Tailwind and, though it has been becalmed from time to time, its propelling force has always returned.”

“I have been investing for 80 years—more than one-third of our country’s lifetime. Despite our citizens’ penchant—almost enthusiasm—for self-criticism and self-doubt, I have yet to see a time when it made sense to make a long-term bet against America.”

The quotes from Munger, include these:

- “Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.”

- “A great company keeps working after you are not; a mediocre company won’t do that.”

- “There is no such thing as a 100 percent sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.”

- “You have to keep learning if you want to become a great investor. When the world changes, you must change.”

Buffett referred to the Alleghany deal as the second positive development for Berkshire Hathaway in 2022. The first positive development was booking record operating earnings across all of Berkshire’s operations—insurance and non-insurance of $30.8 billion.

Buffett referred to the Alleghany deal as the second positive development for Berkshire Hathaway in 2022. The first positive development was booking record operating earnings across all of Berkshire’s operations—insurance and non-insurance of $30.8 billion. Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers