Total reconstruction costs, including materials and retail labor, increased 6.8% from January 2022 to January 2023. This slight drop follows the 9.3% increase from October 2021 to October 2022.

Reconstruction cost increases have started to slow down and steady

Lumber, a key driver in reconstruction cost peaks in recent years, has decreased nine months in a row. This quarter, the composite is the only negative category, declining 5.1%. However, costs remain 61% higher than in pre-COVID times.

Interior trim increased the most among material composites, rising 22.1% from January 2022 to January 2023 due to the specialized skills used to manufacture pieces.

The cost of fuel used to transport and manufacture goods is decreasing for the first time since February 1, 2021.

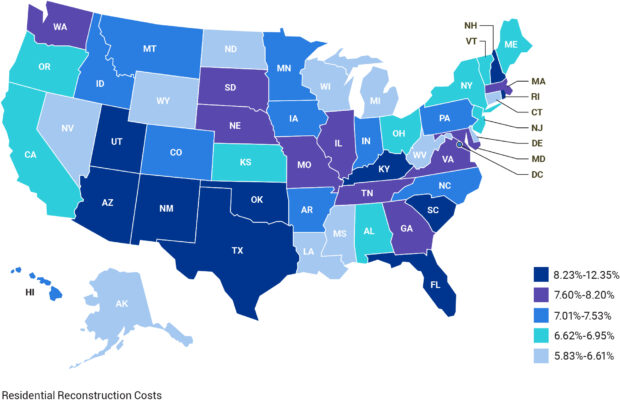

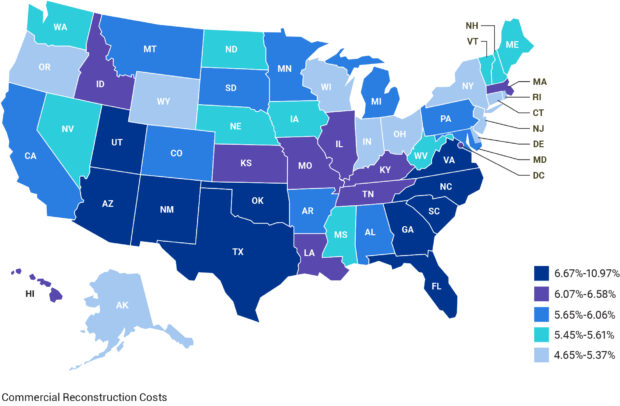

States see increases in reconstruction costs

Residential costs in total increased 7.5% from January 2022 to January 2023 and 0.4% from October 2022 to January 2023. For residential reconstruction costs, Florida had the largest increase at 12.4%, followed by South Carolina (11.0%) and New Mexico (10.7%).

Commercial costs in total increased 6.1% from January 2022 to January 2023 and 1.3% from October 2022 to January 2023. Florida had the largest increase in commercial reconstruction costs at 11.0%, followed by Utah (9.5%) and New Mexico (9.4%).

Explore our latest 360Value® Quarterly Reconstruction Cost Analysis, which offers an overview of current reconstruction cost trends at the national and state levels for the United States.

Trish Hopkinson: Trish Hopkinson is Head of 360Value for Verisk.

Joel Teemant: Joel Teemant is product director, 360Value commercial lines, for Verisk.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages