The Kentucky Derby and Rich Strike – what an amazing combo! Even if you don’t follow horse racing, it would be difficult to miss the come-from-behind story of Rich Strike, the against-all-odds (literally 85 to 1 odds) horse that won the 2022 Kentucky Derby last weekend. Rich Strike was a long-shot in more ways than one. He was entered at the last minute by an owner, Richard Dawson, who had thought he was out of horse racing, and trained by a trainer, Eric Reed, who had lost 23 horses in a devastating stable fire. His rider, Sonny Leon, was highly-acclaimed but never ran in such a high-profile race. It was the kind of story that will someday make another great horse racing movie like Seabiscuit and Secretariat, but for now…it’s just the story of hard-working people with a great horse, making success happen through a vision, plan, perseverance and teamwork.

How does this relate to anything about insurance? It is about our customers, business owners who are making a comeback and changing the game for their business success and demanding those who support them, like insurers, do so as well.

Two years of business disruption, supply chain issues, and now fight for labor and talent have made their mark on the economy. But the silver lining for businesses is that it forced organizations to change their minds about preparing and running in a different kind of race. It requires a new mindset to adapt to continuous changes. For Small to Medium Businesses (SMB), it means re-evaluating their business risk and insurer relationships that will meet their new needs, demands and enable their business resilience.

SMBs were hit hard by the pandemic. Many did not survive. Those that did rapidly changed their business models, products and services and employment focus. As SMBs continue to adapt to a new digital economy, their ownership is also in the midst of change. We are now seeing the shift in Millennials and Gen Z taking the helm of new or existing businesses, using digital technologies in their personal and business lives that require new risk products, services and experiences.

Majesco’s annual SMB trends report, SMB Customers: Growth Opportunities Grounded in Grit and Resilience tells the story of SMBs’ determination and comeback and insurance’s opportunity if it adapts to meet SMBs’ new needs and expectations. Like a valuable trainer to a prize-chasing horse, insurance has the ability to coach, encourage and foster SMBs in their race to innovate and win. The growth of SMBs, combined with changes due to COVID and a host of new SMB risk needs are making insurers more relevant than ever.

How can insurers use the “Rich Strike” come-from-behind mindset to leap forward in the SMB market?

Our research looked closely at the SMB market with an eye toward opportunity. We looked at:

- The rapidly-changing SMB landscape

- Real insurance risk and purchase trends among SMBs

- The impact and opportunities for insurers

SMBs — Innovating to Stay in the Race

There is no going back. SMBs must and are adapting to a rapidly changing market landscape.

In April of 2020, the U.S. Census Bureau began a weekly survey of SMBs to track the impact of the COVID-19 pandemic on small businesses. In the first survey, over 51% of U.S. SMBs said the pandemic had a significant negative impact on their business, with another 43% saying the effect was moderately negative as reflected in Figure 1.

SMBs who adapted through the rapid changes and challenges the last two years, found that at the beginning of 2022 these conditions improved. Just 22% now say the pandemic has had a large negative impact, although 43% still say it has had a moderate negative effect; 30% reported a revenue decrease.

Figure 1: Impacts of the pandemic on SMBs

SMBs are continuing to recover more than two years later. As the world shifts to a new normal, understanding how insurers can help SMBs find their footing and accelerate growth in a vastly changed risk world is more important than ever. When we look at SMB trends, it is apparent that SMBs are ready to move ahead through innovation and change … creating new opportunities for insurers who likewise are prepared to innovate and change.

SMB Business Trends

SMBs are creating their own new normal. They are looking to strengthen their business and build in resilience by embracing new technologies. They are establishing a greater digital presence and improving customer engagement. They are redefining work environments and taking advantage of new partnerships and ecosystems. They are modifying and adding products at the same time they are modifying their supply chain and procurement management.

These SMB business trends are creating new risk needs that must be addressed with updated or new innovative products that meet their changing business models. Likewise, from a risk management perspective, SMBs are seeking guidance on reducing or eliminating risk to help manage their overall costs. The ability for insurers to provide risk assessments that can be used to guide SMBs in risk management approaches creates a value-added service to drive loyalty and retention, beyond only reducing losses.

Business Shifts Driven by COVID

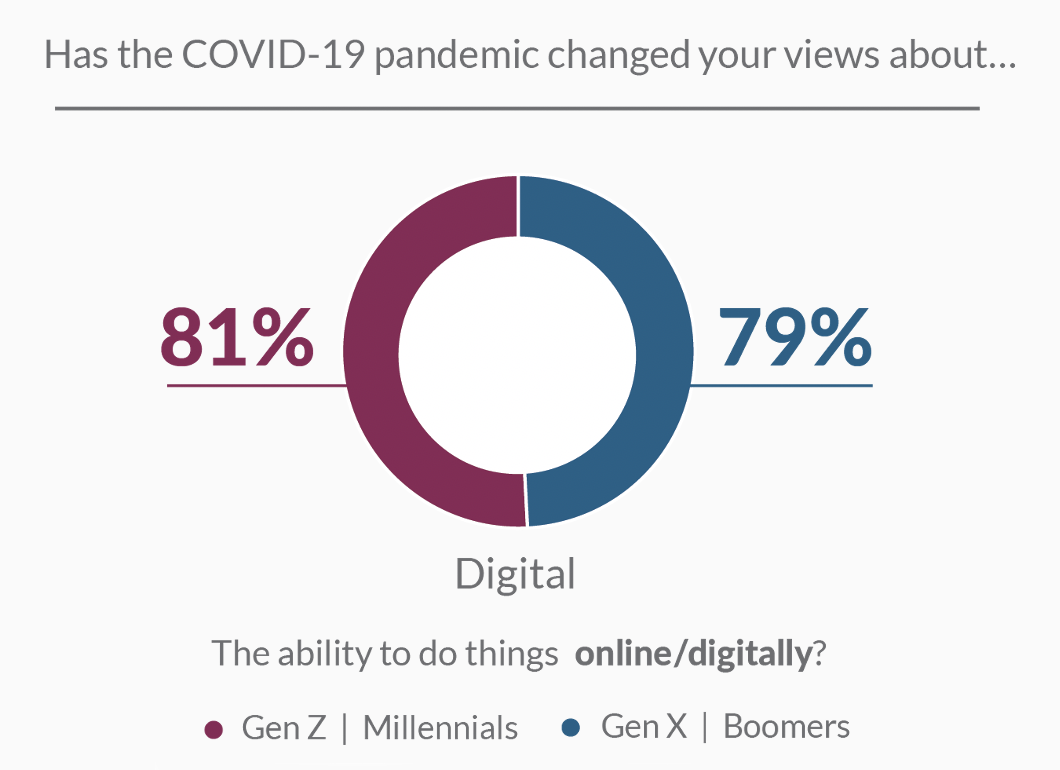

Adopting or expanding the use of digital technologies is one of the most critical shifts SMBs have made, regardless of age demographic, with 81% of Gen Z/Millennials and 79% of Gen X/Boomers changing their views about online/digital business models (see Figure 2).

Figure 2: COVID’s impact on the importance of digital capabilities

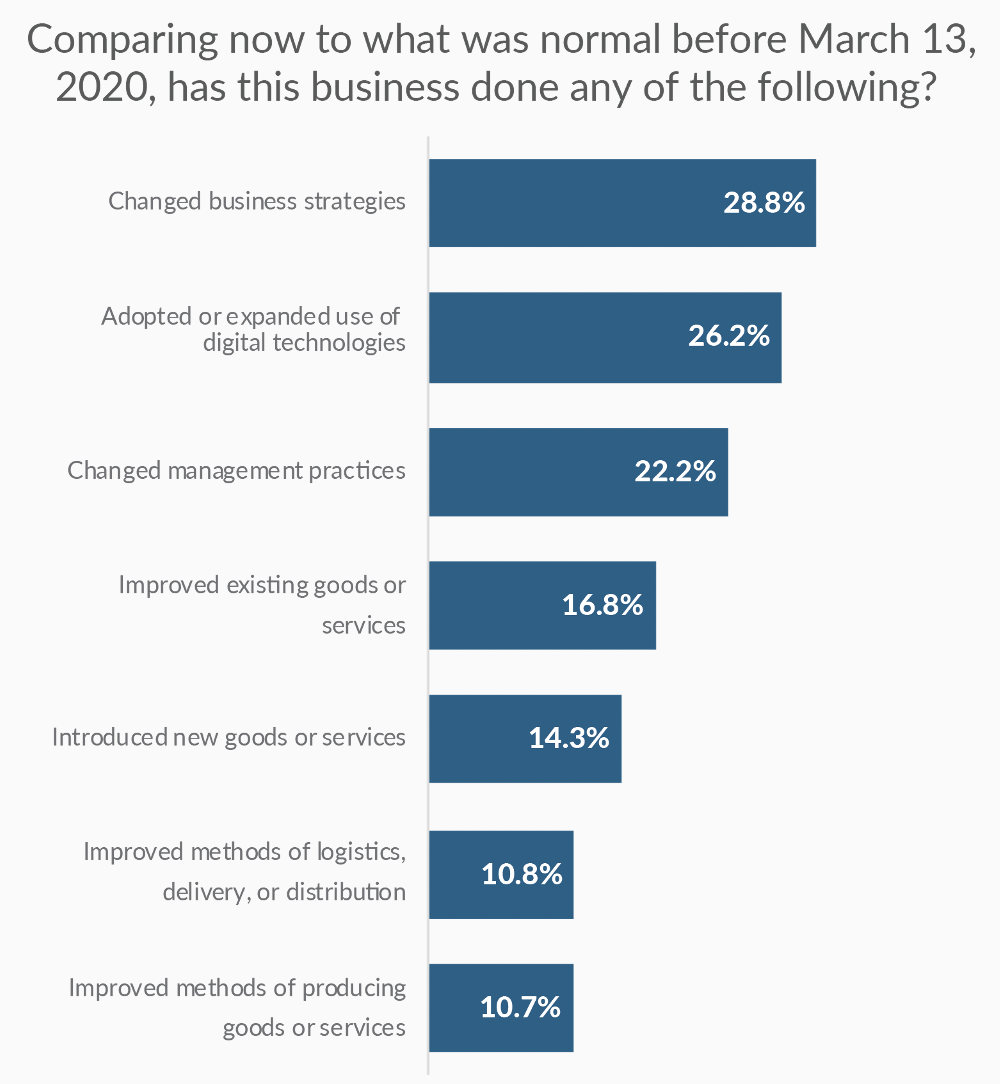

Key to this focus was how SMBs looked at their business differently. Nearly 29% of SMBs responded that they have changed their business strategies, 26% have adopted or expanded the use of digital technologies, and 22% changed their management practices. (See Figure 3.) Add to this, nearly 17% enhanced their goods and services, 14% offered new goods and services, 11% improved delivery / distribution and 11% improved how they produced their goods and services.

Together these numbers reflect that over 75% of SMBs have fundamentally changed their business models, products, and services over the last two years. There is a crucial need to proactively reassess SMB customers’ risk to protect their business – because the risk profile and products they bought likely no longer meet their needs. This offers insurers and their distribution partners a unique opportunity to proactively provide value as renewals come up.

Figure 3: Pandemic-influenced business changes by SMBs

The Great Resignation and The Burgeoning SMB Market

Both employers and employees have been greatly impacted by the pandemic with scaled back hours and workforce reductions. The annual number of establishments losing jobs accelerated in 2020, reaching its highest level since the Great Recession.

However, 2021 began the recovery with businesses reopening, new businesses starting or businesses expanding as reflected in strong unemployment numbers and a growing fight for talent with “The Great Resignation.” It appears that many who either lost their jobs or quit their jobs during the Great Resignation decided to take control of their own futures by launching their own small businesses.

“The pandemic has unleashed a historic burst in entrepreneurship and self-employment. Hundreds of thousands of Americans are striking out on their own as consultants, retailers and small-business owners.”[i] — The Wall Street Journal

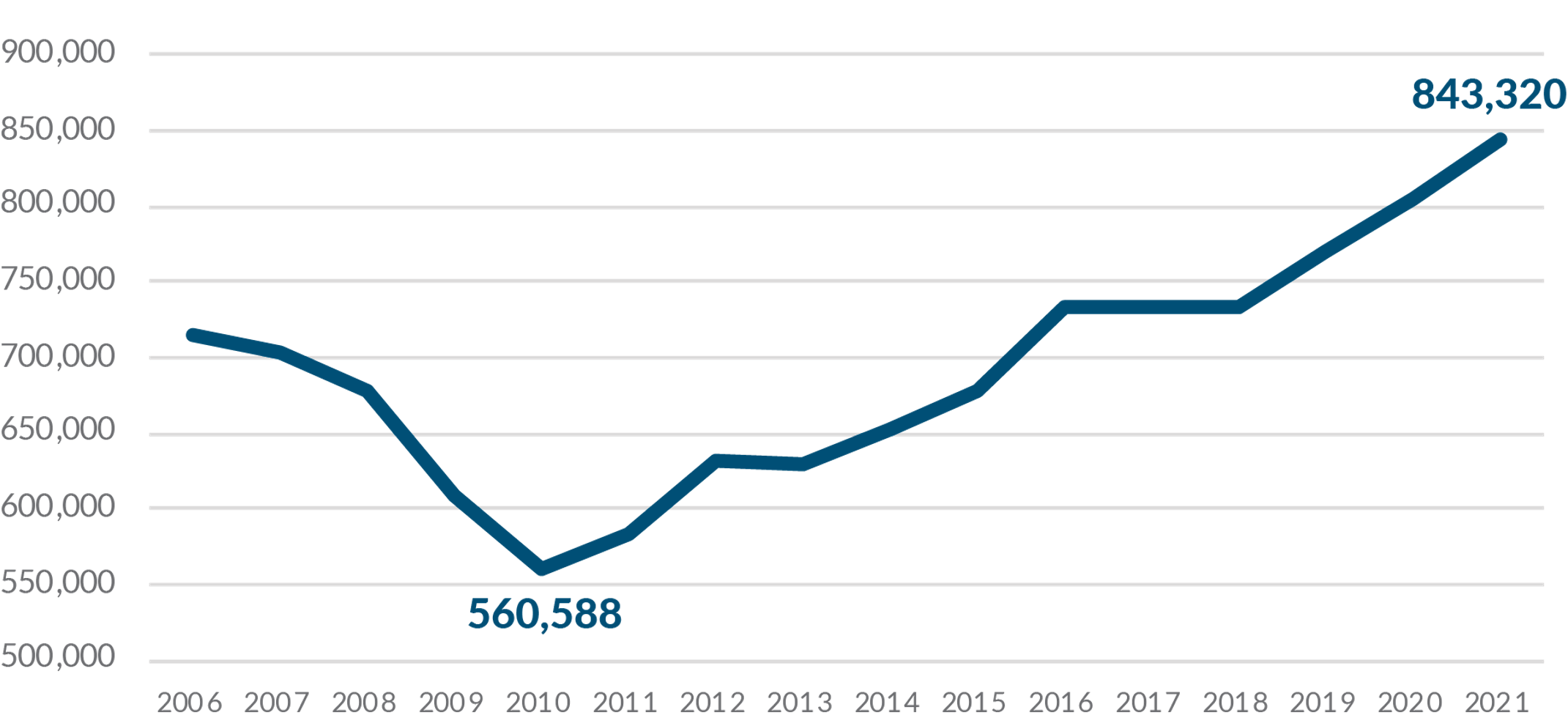

Statistics from the Bureau of Labor Statistics reflect this rapid entrepreneurial growth as the annual number of businesses less than a year old has accelerated greatly since 2019, highlighting the increase in people starting their own independent business – either from being laid off or as part of the Great Resignation (see Figure 4).[ii]

Figure 4: Businesses less than a year old

During 2020, 42% of Americans worked from home, nearly double the rate from 2019.[iii] In our 2022 Consumer Research report, Gen Z & Millennials reported higher rates of gig work as both independent contractors and rideshare drivers, reinforcing the trend to Gig economy work. More importantly, they anticipate a steady continuation of independent contractor work even as rideshare returns to pre-pandemic levels, highlighting the demand for business, cyber, workers compensation and employee benefit product changes to meet this continuing trend.

Figure 5: Gig Economy work trends

Employment Shifts in the Next Three Years

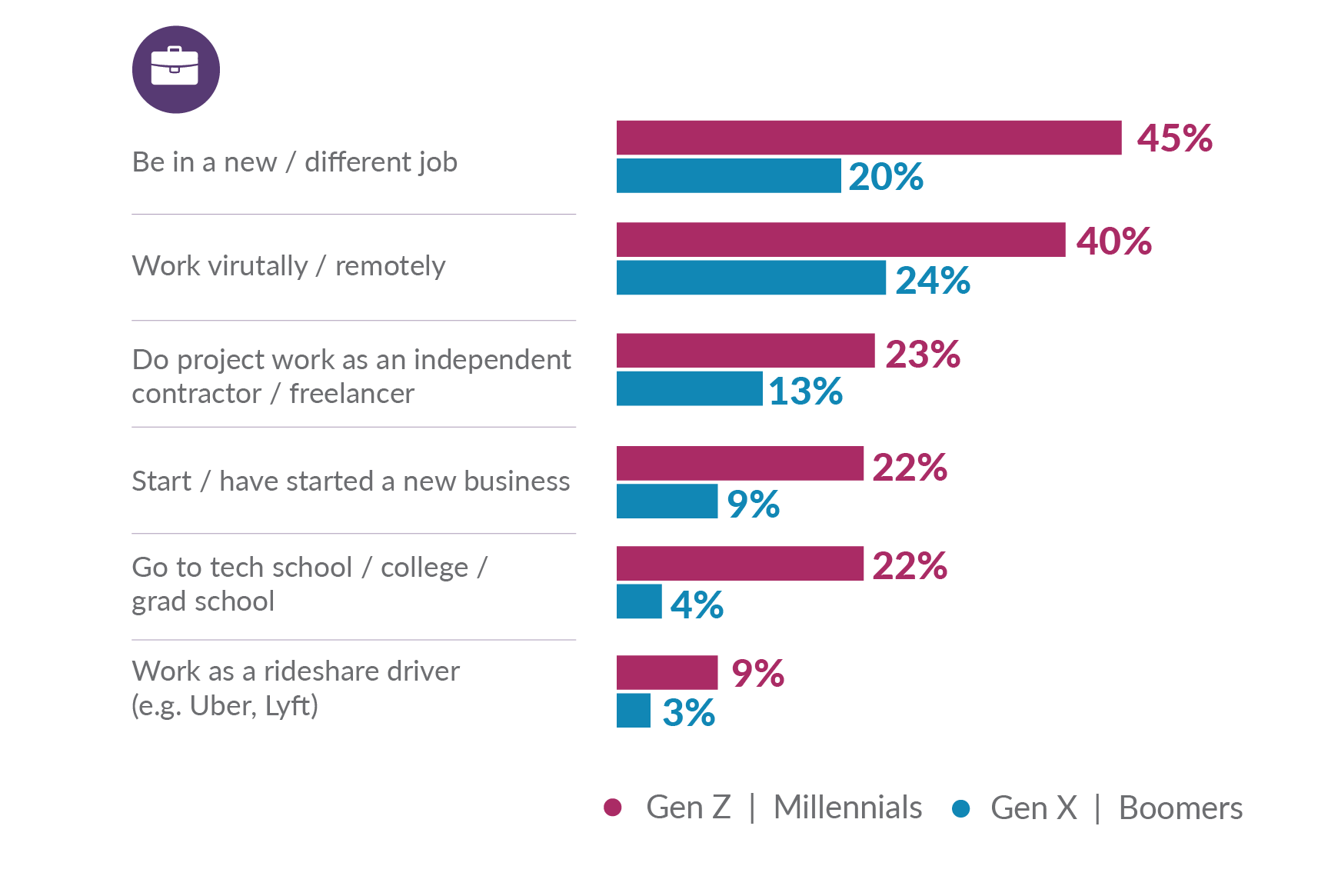

Adding to this trend, our 2022 Consumer Research found that a larger percentage of Gen Z & Millennials expect to be in different jobs (45%), working remotely (40%), and starting a new business (25%) over the next 3 years, continuing the transient aspects of this generation, and reflecting the growing demand for innovative insurance offerings for SMBs.

Figure 6: Expected changes in work in the next 3 years

These trends reflect market growth opportunities for insurers to rethink the products and services they offer to business owners and their employees. From on-demand benefits for gig/independent contractor work to work from home setups – employee and employer needs are dramatically changing. Innovative options like Nationwide’s Work From Home Insurance, which bundles home/renters, usage-based auto, and identity theft insurance[iv] is an example at the forefront of this change.

The Growing SMB Risk and Insurer Response

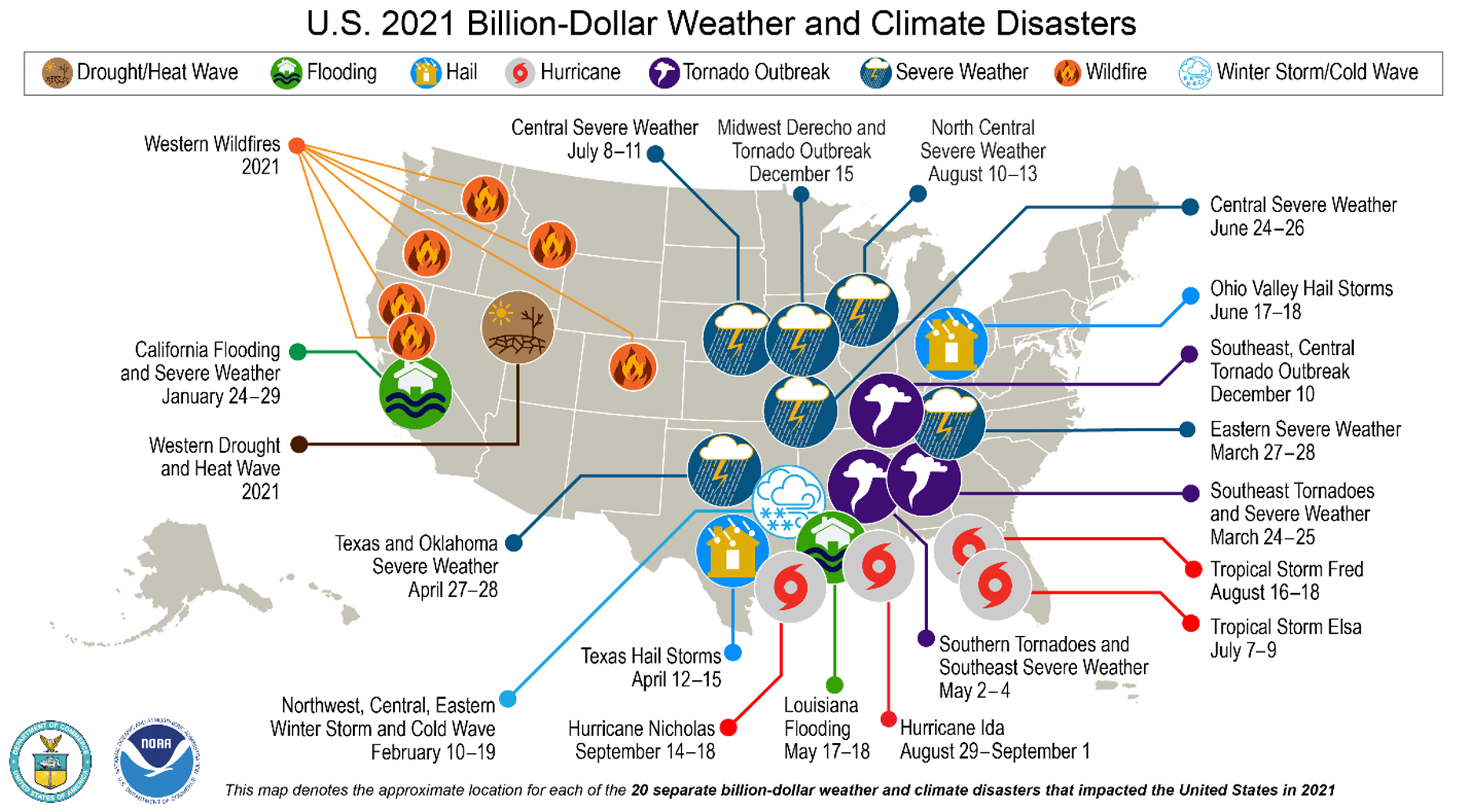

We are seeing increasing environmental, societal and technology risks that have the potential to intersect and significantly disrupt people and businesses negatively. Increased extreme weather events and natural disasters are having an unprecedented and increasingly large impact. According to the National Oceanic and Atmospheric Administration, the U.S. experienced 20 separate billion-dollar weather and climate disasters in 2021. This placed the year second to 2020 in terms of number of disasters, 20 versus 22, and third in total costs of $145 billion, behind 2017 and 2005.[v] The agency noted that the variety of the type of disasters made 2021 unique as represented in Figure 7.

Figure 7: U.S. 2021 Billion-Dollar Weather and Climate Disasters

Digital shift is expanding digital risk

As businesses shifted their models digitally, there was also a marked increase in cyberattacks. As a result, insurers noticed a rise in cyber insurance demand in 2020 and 2021 as compared to previous years. These new and increasing risks are creating opportunities to provide new coverages and services to help mitigate these threats. For insurers, this means both covering SMB risk and preparing to keep their own systems and customer data secure. Read more about this topic in one of our latest blogs, API Gateways Secure the Enterprise.

Managing risk is changing

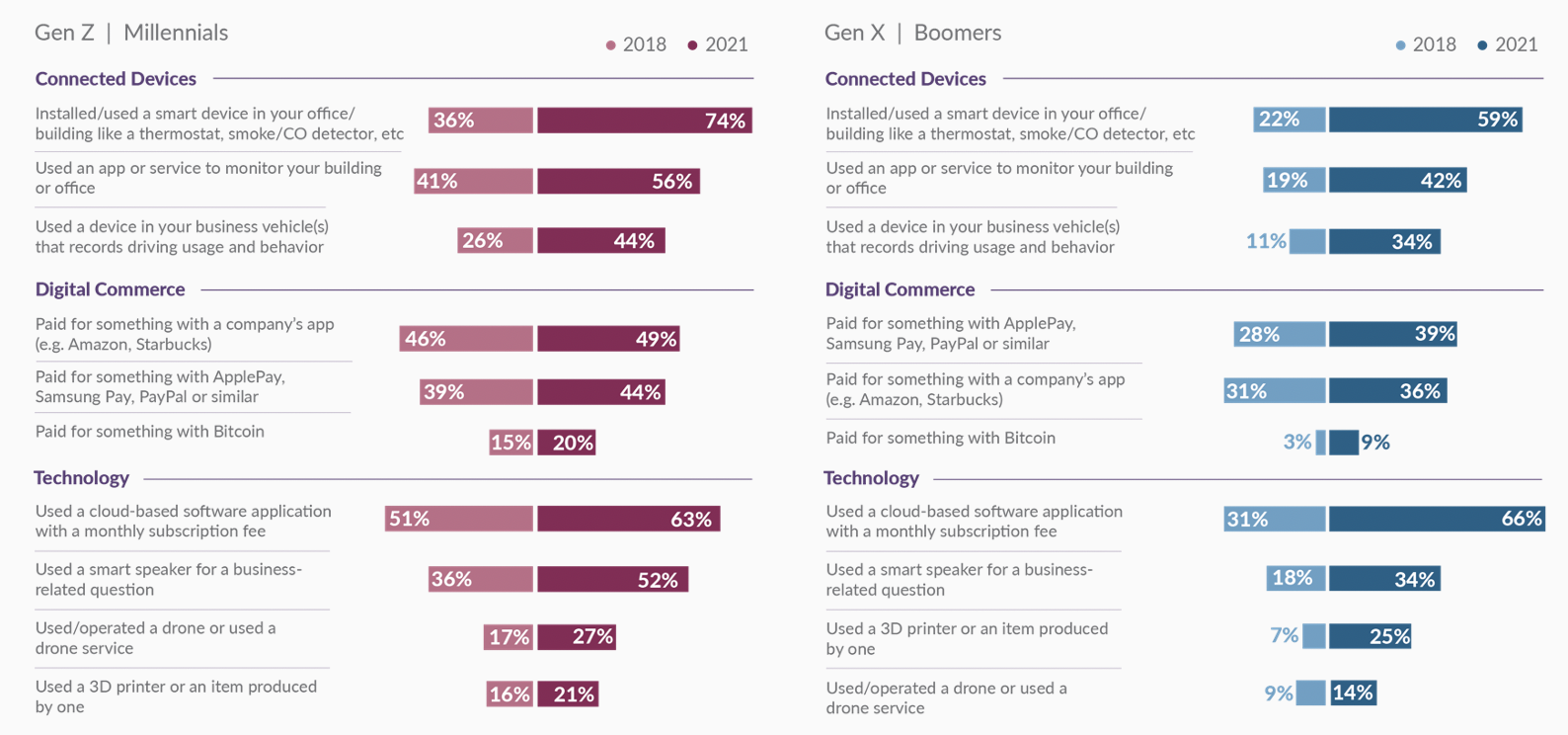

Both SMBs and insurers are growing in their acceptance and promotion of anything that will lower risk. Connected devices top the list. Use of smart devices with a building/office monitoring app reported the highest levels of usage. However, the largest increase in smart devices were for driving, recording usage and behavior at nearly 3 times the rate of use in 2018.

This isn’t a surprise, but it signals a move from trend to common practice. Various insurers are now requiring the use of OBD sensors in business vehicles, providing alerts when driving behavior is outside of predefined parameters. This is a case of insurers both offering protective analytic feedback to business owners and also using telematic data to protect themselves against undue risk.

Interestingly, both generational groups we surveyed saw significant increases in connected devices, with Gen X / Boomers’ average usage in 2021 at 2.5 times higher than 2018, compared to 1.7 times higher for Gen Z / Millennials. These increases reflect the demand and growth opportunities for new, innovative products such as usage-based insurance.

Figure 8: Business activities before and during COVID

Opportunities for Insurers — Additional Indicators of Future Insurance Needs

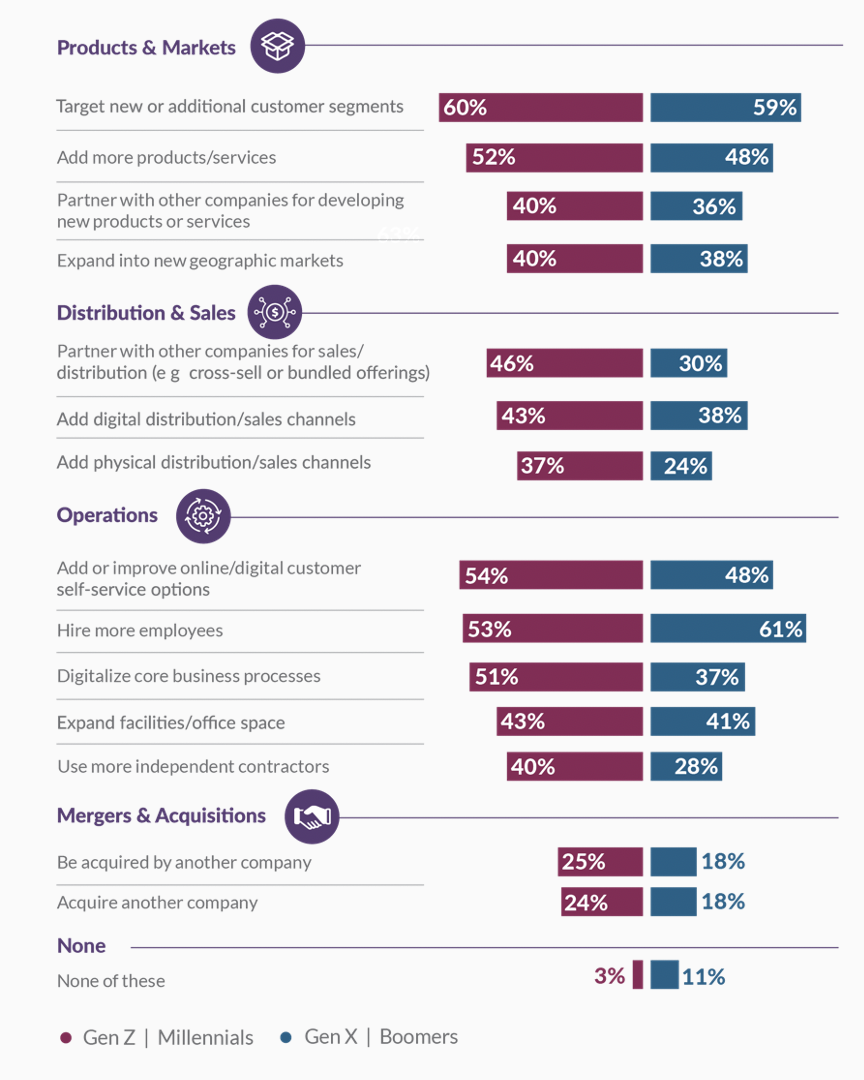

Optimism abounds for both SMB generational segments with plans for expansion of products and markets over the next three years, and partnerships play a key role. As seen in Figure 9, both segments have similarly high expectations for partnering with other companies to develop new products. They expect digital channels to be their primary means of sales/distribution expansion, further indicated with the lower addition of physical channels in the next three years.

Figure 9: Business activities expected in the next 3 years

Both generations have high expectations for hiring employees and expanding facilities/office space, providing strong indicators of an optimistic outlook and growth. Their expected expansion offers growth opportunities for insurers to protect property and provide benefits to ensure SMBs’ growth plans can be fulfilled effectively and profitably.

Looking ahead

The pandemic accelerated the pace of technology investment by insurance companies as it exposed the acute need to digitize their business. Some insurers were well on their way while others recalibrated their priorities to meet a changed world. Insurance leaders seeking relevance and growth in the SMB market likewise must adapt and step up to provide new risk products, value-added services, and customer experiences … digitally.

Is your organization ready to capture the new wave of SMB customers as they begin, grow and thrive in the Post-COVID business environment? Can you “Strike Rich” and win in new digital economy? Learn more by reading SMB Customers: Growth Opportunities Grounded in Grit and Resilience, or contact Majesco to find out how you can help SMBs come from behind in their race to win new markets, helping you win in the race to a new era of insurance leaders.

By: Denise Garth, Chief Strategy Officer at Majesco

[i] Mitchell, Josh, Dill, Kathryn, “Workers Quit Jobs in Droves to Become Their Own Bosses,” Wall Street Journal, November 29, 2021, https://www.wsj.com/articles/workers-quit-jobs-in-droves-to-become-their-own-bosses-11638199199

[ii] “Businesses less than a year old,” USA Facts, https://usafacts.org/data/topics/economy/economic-indicators/business-vitality/businesses-less-than-a-year-old/

[iii] “American Time Use Survey Summary,” U.S. Bureau of Labor Statistics, July 22, 2021, https://www.bls.gov/news.release/atus.nr0.htm

[iv] “Working from home? New insurance bundle is built for you and could save you money!” Nationwide Newsroom, June 24, 2021, https://news.nationwide.com/working-from-home-insurance-bundle-is-built-for-you/

[v] Smith, Adam, “2021 U.S. billion-dollar weather and climate disasters in historical context,” NOAA Climate.gov, January 24, 2022, https://www.climate.gov/news-features/blogs/beyond-data/2021-us-billion-dollar-weather-and-climate-disasters-historical

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality