Content from Denise Johnson

Denise Johnson is a freelance journalist based in Arizona. She is also the former editor of Claims Journal. Reach her at denisehjohnson@yahoo.com.

Bumps Ahead as Disruption Drives Changes in Auto Insurance

There is no doubt the auto insurance industry is in a state of flux. Rising repair costs, poor driving behavior and advancing auto technology has disrupted the market, ...

Report: Advanced Tech Leads Carrier Innovation in 2024

Leveraging data for increased underwriting accuracy, customized policies and streamlining business operations are some of the top trends for property/casualty insurers in 2024, according to a report ...

Why Totaled Auto Losses Are Hard to Pin Down This Year

Depending on what report you have read, totaled auto losses are up, down or relatively stable.

Ever since the personal auto segment ...

Report: Drop in Auto Premiums, Rise in Motorists Deaths Linked to Reduced Traffic Enforcement

Several new driving trends have been recorded since the onset of the pandemic, according to a new report released by TransUnion. While traffic violations have declined nationally by 13 percent, the ...

Fitch: Hardening Commercial Lines Market to Continue Through 2023

This year will mark the fourth year of a hardening market for commercial lines underwriting cycle, according to the latest U.S Commercial Lines Market Update released by Fitch Ratings.. The Council ...

Digital Personal Lines Claims Portals at High Risk of Identity Fraud

Identity-related fraud is putting personal lines insurers to the test. Nearly all offering digital claims portals reported, in a newly released survey, that identity fraud has a negative impact on ...

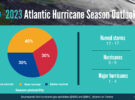

NOAA: Average Hurricane Season Predicted for the Atlantic

During a press conference today, the National Oceanic and Atmospheric Administration (NOAA) announced its forecast for the 2023 Atlantic Hurricane season. The 20th anniversary of Hurricane Isabel, a ...

Insurers Latest Target of U.S. AGs ESG Antitrust Concerns

This week, insurers and reinsurers who are members of the Net-Zero Insurance Alliance (NZIA), received a letter from 23 attorneys general raising potential legal concerns that might arise from their ...